Did you know that New Zealand's economy, while resilient, is susceptible to global economic shocks? As the world becomes increasingly interconnected, the ripple effects of economic crises can reach even the most seemingly isolated markets. For New Zealand, a nation heavily reliant on exports, tourism, and international trade, preparing for future economic crises is not just prudent—it's essential. This article delves into how New Zealand can brace itself for future economic upheavals, drawing on expert insights, real-world case studies, and data-backed analyses.

Understanding New Zealand’s Economic Landscape

New Zealand's economy is unique, characterized by its reliance on agriculture, tourism, and a burgeoning tech sector. According to the Stats NZ, agriculture alone contributes approximately 7% to the GDP, with dairy products, meat, and wool among the top exports. However, this reliance also makes the economy vulnerable to global market fluctuations and climate change impacts.

In recent years, the tech industry has emerged as a promising driver of economic growth. The Ministry of Business, Innovation and Employment (MBIE) reports that the digital sector contributes more than $6.5 billion to the GDP, showcasing its potential as a buffer against economic downturns. Diversifying the economy by bolstering such industries could be pivotal in crisis preparation.

Case Study: Resilient Response to the 2008 Financial Crisis

Problem: During the 2008 global financial crisis, New Zealand faced a significant economic slowdown, with GDP growth plummeting and unemployment rising.

Action: The Reserve Bank of New Zealand implemented aggressive monetary policies, including slashing interest rates to record lows and providing liquidity support to banks.

Result: These measures stabilized the financial system, and by 2010, the economy was back on a growth trajectory, with GDP increasing by 3% annually.

Takeaway: Proactive monetary policies and strong financial institutions can mitigate the impacts of global crises, a lesson that remains relevant today as New Zealand prepares for future uncertainties.

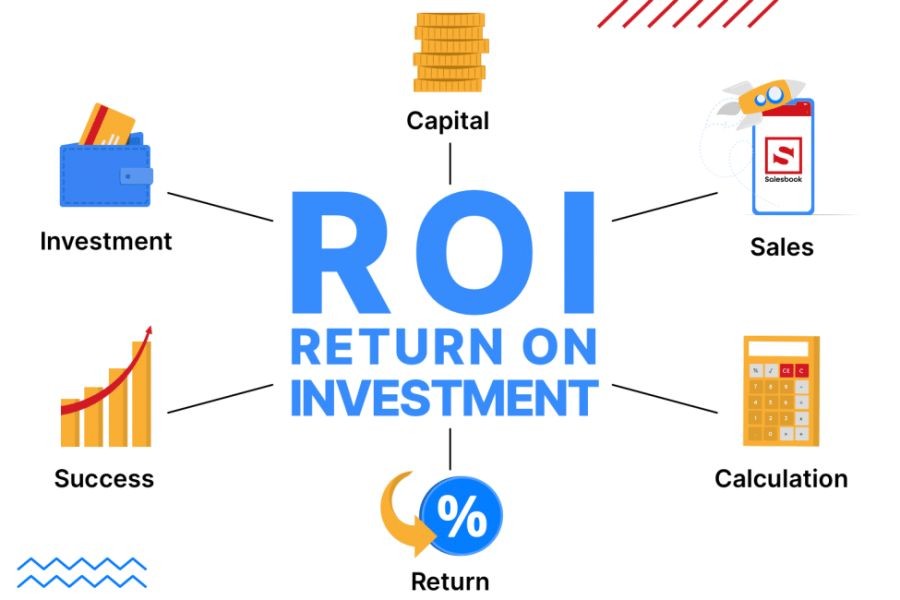

Pros and Cons of Economic Diversification

Economic diversification is often touted as a safeguard against economic crises. Here's a balanced look at its pros and cons:

- Pros:

- Reduced vulnerability to sector-specific downturns.

- Increased employment opportunities across various industries.

- Potential for innovation and growth in emerging sectors like technology and renewable energy.

- Cons:

- Initial investment costs in infrastructure and training.

- Potential for oversaturation in new markets.

- Challenges in policy alignment and regulatory changes.

Expert Insights: Preparing for Future Economic Crises

Dr. Jane Walters, an economist at the University of Auckland, emphasizes the importance of financial literacy and crisis simulations. "Understanding financial risks and having a well-rounded economic education can help individuals and businesses make informed decisions during crises," she notes. Furthermore, regular crisis simulations can prepare businesses for unexpected downturns, ensuring they have contingency plans in place.

Common Myths & Mistakes in Crisis Preparation

- Myth: "New Zealand is too small to be affected by global crises."

- Reality: New Zealand's economy is intricately linked to global markets, making it susceptible to external shocks.

- Myth: "Diversification is too complex and costly for small businesses."

- Reality: Even small steps towards diversification, such as exploring new markets or products, can provide significant resilience.

- Myth: "Government intervention is always the solution."

- Reality: While government support is crucial, businesses must also adopt proactive measures, such as building cash reserves and investing in technology.

Future Trends: Economic Resilience in the Next Decade

Looking ahead, several trends could shape New Zealand's economic resilience:

- Digital Transformation: As more businesses embrace digital tools, the economy could become more adaptable and less reliant on traditional sectors. According to Deloitte, digital transformation could add $46 billion to NZ's GDP by 2030.

- Renewable Energy: With global shifts towards sustainability, New Zealand's investment in renewable energy could not only meet domestic needs but also position the country as a leader in green technology.

- Trade Partnerships: Strengthening trade relations with diverse markets, particularly in Asia, could mitigate the risks associated with over-reliance on Western economies.

Conclusion: Final Takeaway & Call to Action

New Zealand's path to economic resilience lies in proactive measures, including diversification, digital transformation, and strategic trade partnerships. As a nation, embracing these strategies could safeguard against future economic crises. Are you prepared for the next economic challenge? Share your thoughts and strategies in the comments below!

People Also Ask

- How does economic diversification impact New Zealand's economy?

Diversification reduces reliance on specific sectors, leading to increased resilience and employment opportunities across industries, as reported by the MBIE.

- What are the biggest misconceptions about preparing for economic crises?

A common myth is that New Zealand is too small to be affected by global crises. However, its interconnected economy is susceptible to external shocks.

Related Search Queries

- New Zealand economic resilience strategies

- Impact of global crises on NZ economy

- Diversification benefits for New Zealand businesses

- Future economic trends in New Zealand

- Preparing for financial crises in New Zealand

- New Zealand trade partnerships and economic stability

- Digital transformation impact on NZ economy

- Sustainable energy and economic growth in NZ

- Expert insights on NZ economic resilience

- Common myths about economic crises in New Zealand

CamillePha

1 month ago