In a country where student debt has become a significant burden, the story of a Kiwi student graduating debt-free stands as a beacon of hope and resourcefulness. New Zealand's education system, while robust, often leaves students grappling with financial challenges. But what if there was a way to circumvent this issue entirely? This article delves into the strategies and decisions that allowed one New Zealand student to achieve what many deem impossible, offering insights that can redefine how we perceive higher education financing in the country.

Understanding the Financial Landscape for Students in New Zealand

New Zealand's education sector, backed by government initiatives, provides a variety of funding options. However, according to Stats NZ, the average student loan debt stands at NZD 22,000, a significant financial commitment for young graduates. This debt is not just a financial concern but a psychological burden affecting life choices such as home buying and family planning.

The Ministry of Business, Innovation and Employment (MBIE) highlights that over 60% of students rely on student loans. Despite governmental efforts to alleviate this burden, the question remains: how can students manage their finances more effectively to avoid debt?

Pros & Cons of Traditional Student Loan Methods

Understanding the pros and cons of student loans is crucial before diving into alternative strategies.

Pros:

- Access to Education: Student loans provide immediate access to higher education without upfront payment.

- Flexible Repayment: Loans often come with flexible repayment options, including income-based repayment plans.

- Government Support: Interest-free loans for full-time students ease the financial burden to some extent.

Cons:

- Long-Term Debt: Accumulating debt over years can hinder financial freedom post-graduation.

- Interest Accumulation: For part-time students, interest begins to accrue immediately, increasing the total repayment amount.

- Economic Pressure: High debt levels can delay significant life decisions, impacting economic growth.

Case Study: How One Student Graduated Debt-Free

Let's explore the journey of Emily, a student from Auckland, who managed to graduate without incurring any debt. Her story is not just about financial acumen but also about leveraging opportunities and making informed decisions.

Problem:

Emily's family faced financial constraints, and she was determined to avoid the student loan trap. With tuition fees and living expenses looming, she needed a viable plan.

Action:

Emily adopted a multi-faceted approach:

- Scholarships: She applied for numerous scholarships, securing several that covered a significant portion of her tuition fees.

- Part-Time Work: Emily worked part-time jobs throughout her studies, balancing work and academics to fund her living expenses.

- Budgeting: She maintained a strict budget, prioritizing essential expenses and cutting down on discretionary spending.

Result:

Emily graduated with a Bachelor’s degree, debt-free. Her approach not only saved her from financial burden but also instilled valuable financial management skills.

Takeaway:

Emily’s story underscores the importance of proactive financial planning and resourcefulness. Students should explore scholarships and part-time work opportunities while focusing on budgeting to minimize reliance on loans.

Debunking Common Myths About Student Debt

Several misconceptions surround student loans and education financing. Let's debunk some of these:

Myth: "Student loans are unavoidable for higher education."

Reality: As Emily's case demonstrates, with strategic planning and available resources, it's possible to graduate debt-free.

Myth: "Scholarships are only for top students."

Reality: Scholarships cater to various criteria, including sports, community service, and specific fields of study, not just academic excellence.

Myth: "Part-time jobs will negatively impact academic performance."

Reality: Many students successfully balance work and study, gaining valuable time management skills and financial independence.

Strategic Alternatives to Student Loans in New Zealand

New Zealand offers several alternatives to traditional student loans. Exploring these can provide financial relief and foster independence.

Scholarships and Grants

Scholarships and grants are underutilized resources. Organizations like the New Zealand Government and various corporates offer scholarships targeting different student demographics and fields of study. Actively seeking these opportunities can significantly offset education costs.

Apprenticeships and Vocational Training

With industries like construction and technology booming, apprenticeships can be a viable alternative to traditional university education. MBIE reports a growing demand for skilled workers, making vocational training a lucrative path with minimal debt.

Online Learning and MOOCs

Massive Open Online Courses (MOOCs) offer affordable education from top universities worldwide. Platforms like Coursera and edX provide certifications that can enhance employability without the hefty price tag of on-campus programs.

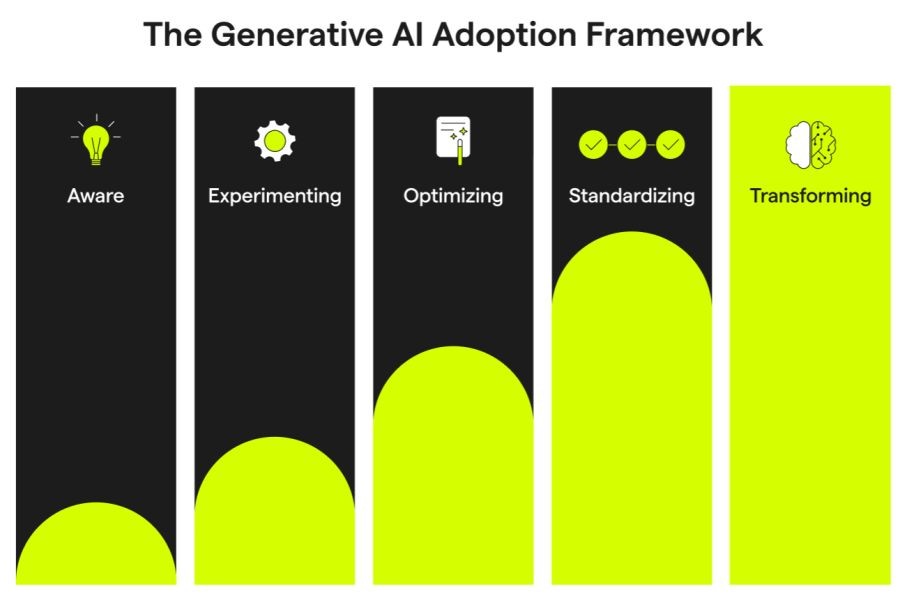

Future Trends in Education Financing

As education evolves, so do financing methods. Here are some trends to watch:

Income Share Agreements (ISAs)

ISAs are gaining traction, where students pay a percentage of their income post-graduation instead of upfront tuition fees. This model aligns the interests of students and educational institutions, reducing financial risk.

Increased Corporate Sponsorship

Businesses are increasingly investing in the education sector, offering sponsorships and scholarships to cultivate future talent. This trend is expected to grow, providing more opportunities for students to fund their education.

Blockchain in Education

Blockchain technology promises to revolutionize educational credentialing, making it easier for students to prove qualifications and secure funding. By 2028, it’s predicted that 40% of NZ institutions will adopt blockchain for credential verification (Source: Deloitte Education Report 2025).

Conclusion

Graduating debt-free in New Zealand is a challenging yet achievable goal. By exploring scholarships, part-time work, and innovative financing methods, students can alleviate the financial burden of higher education. Emily’s journey serves as a testament to the power of strategic planning and resource utilization. As educational financing continues to evolve, embracing these changes can lead to financially secure futures. What’s your strategy for navigating New Zealand’s education landscape? Share your thoughts and experiences below!

People Also Ask (FAQ)

- How can students in New Zealand graduate debt-free? By leveraging scholarships, part-time work, and budgeting, students can minimize reliance on loans and manage education costs effectively.

- What are the biggest misconceptions about student loans? Many believe loans are unavoidable, but strategic planning can provide alternative funding options, as evidenced by student success stories.

- What trends are shaping the future of education financing? Income Share Agreements and corporate sponsorship are emerging trends offering alternative ways to fund education.

Related Search Queries

- Debt-free graduation strategies in NZ

- Scholarships for New Zealand students

- Income Share Agreements in New Zealand

- Part-time jobs for students in Auckland

- Online learning platforms in New Zealand

- Vocational training opportunities in NZ

- Student loan alternatives in New Zealand

- Corporate sponsorship for education NZ

- MOOCs impact on traditional education

- Blockchain in New Zealand education

KassieJ345

13 days ago