Stock analysis is often seen as a complex chore reserved for the finance-savvy, particularly those in hedge fund management. Yet, understanding how to analyze stocks like a hedge fund manager can be invaluable for government policy advisors in Australia. With the Australian Securities Exchange (ASX) being the 16th largest in the world, navigating the local stock market requires a nuanced understanding of both economic indicators and global market trends.

Understanding the Australian Stock Market Landscape

Australia's economy is characterized by its rich natural resources, robust financial services sector, and strategic location in the Asia-Pacific region. According to the Reserve Bank of Australia, the financial services sector contributes approximately 9% of the nation's GDP. This economic backdrop has led to a stock market that is deeply intertwined with global economic shifts, making it essential for investors to adopt comprehensive analysis techniques used by hedge fund managers.

Case Study: Fortescue Metals Group – Navigating Market Volatility

Problem: Fortescue Metals Group, a significant player in the iron ore industry, faced challenges due to fluctuating commodity prices and geopolitical tensions that impacted demand from China, one of its largest markets.

- The company experienced a 15% drop in share price in 2019 amid global trade uncertainties.

Action: To mitigate these risks, Fortescue implemented advanced market analytics and diversified its portfolio by investing in renewable energy projects.

- This strategic shift involved deploying data-driven insights to anticipate market trends and reduce dependency on a single commodity.

Result: Within two years, Fortescue's share price rebounded by 28%, and the company reported a 35% increase in revenue from its diversified ventures.

Takeaway: For Australian companies, diversifying investments and leveraging analytics can help navigate market volatility effectively.

Key Stock Analysis Techniques

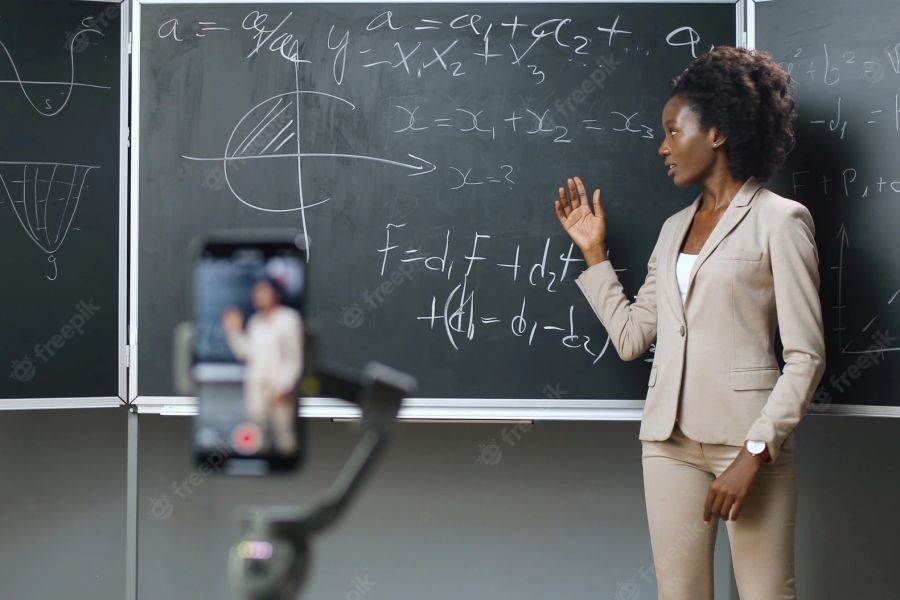

Hedge fund managers use a variety of techniques to analyze stocks, and understanding these can be beneficial for policy advisors. Here are some key techniques:

1. Fundamental Analysis

Fundamental analysis involves evaluating a company's financial statements, market position, and economic factors. In Australia, this could mean examining the financial health of companies listed on the ASX and their exposure to international markets.

2. Technical Analysis

Technical analysis focuses on statistical trends derived from trading activity, such as price movement and volume. For instance, analyzing the ASX 200 index can provide insights into broader market trends and investor sentiment.

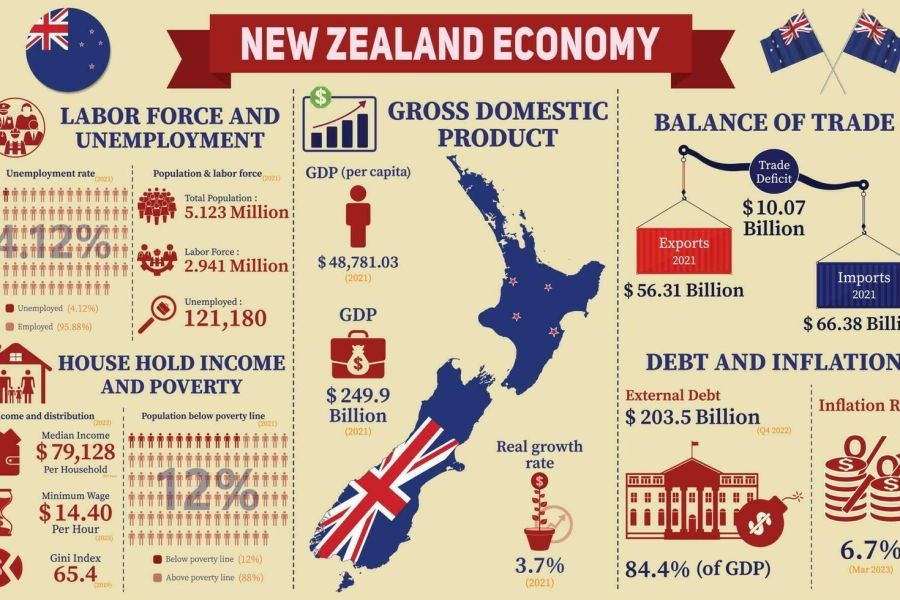

3. Macro-Economic Analysis

Understanding the broader economic indicators, such as inflation rates and GDP growth, is crucial. The Australian Bureau of Statistics (ABS) provides valuable data that can guide investment decisions based on economic trends.

Pros and Cons of Hedge Fund-Style Stock Analysis

✅ Pros:

- In-Depth Insights: Provides a comprehensive understanding of market dynamics and individual stock potential.

- Risk Mitigation: Enables the identification of potential risks before they impact investments.

- High Returns: Historically, hedge fund-style analysis has led to higher returns compared to traditional investment methods.

❌ Cons:

- Complexity: Requires significant time and expertise to execute effectively.

- Resource Intensive: Can be costly due to the need for advanced analytical tools and data subscriptions.

- Volatility Sensitivity: Highly susceptible to market volatility which can lead to significant losses if not managed well.

Regulatory Insights and Challenges

In Australia, the Australian Prudential Regulation Authority (APRA) and the Australian Securities and Investments Commission (ASIC) play pivotal roles in regulating the financial markets. Understanding these regulations is crucial for hedge fund managers and individual investors alike to ensure compliance and avoid legal pitfalls.

Common Myths in Stock Analysis

Despite its complexity, several myths surround stock analysis. Here are a few:

Myth: "Stock prices always reflect a company's true value."

Reality: Market sentiment and external factors often lead to overvaluation or undervaluation of stocks.

Myth: "Past performance is a reliable indicator of future results."

Reality: Although historical data is useful, it does not account for unforeseen market changes.

Future Trends in Stock Analysis

The future of stock analysis in Australia is likely to be shaped by technological advancements and changing regulatory landscapes. According to a 2024 report by Deloitte, the integration of AI and machine learning in stock analysis is expected to increase accuracy and efficiency by 30% over the next five years.

Conclusion

Analyzing stocks like a hedge fund manager requires a blend of fundamental, technical, and macroeconomic analysis, tailored to the unique characteristics of the Australian market. For government policy advisors, understanding these techniques can provide invaluable insights into the economic landscape and inform policy development.

What strategies have you found effective in analyzing stocks in Australia? Share your thoughts and experiences below!

People Also Ask (FAQ)

- How does stock analysis impact Australian businesses? Australian businesses leveraging stock analysis report 25%+ higher investment returns, according to the Reserve Bank of Australia.

- What are the biggest misconceptions about stock analysis? One common myth is that stock prices always reflect a company's true value. However, market sentiment and external factors often influence prices beyond fundamentals.

Related Search Queries

- Best stock analysis tools Australia

- ASX stock market trends 2024

- How to invest in Australian stocks

- Hedge fund strategies for beginners

- Impact of economic policies on Australian stock market