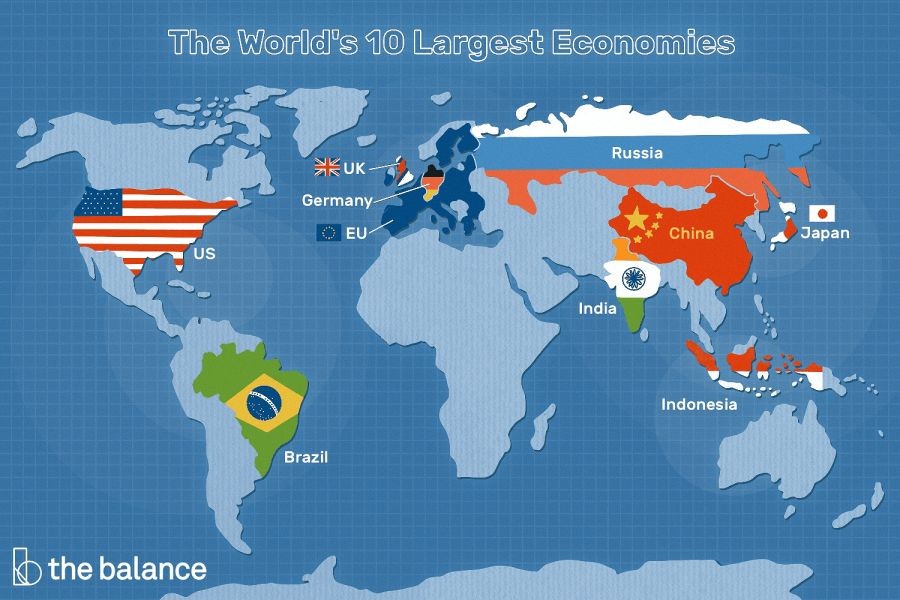

The world of business is inherently unpredictable, and New Zealand, like many countries, is not immune to market crashes and extreme volatility. As a local business owner in New Zealand, understanding how to navigate these turbulent times is essential for survival and growth. The unique structure of New Zealand's economy, characterized by its reliance on exports and a small domestic market, makes it particularly susceptible to global economic shifts. This article will explore strategies to remain rational during these challenging periods, providing insights backed by data and expert opinions relevant to the New Zealand context.

Understanding Market Volatility: A Deep Dive

Market volatility refers to the rate at which the price of securities increases or decreases for a given set of returns. It is a statistical measure of the dispersion of returns for a given security or market index. The New Zealand economy, heavily reliant on exports such as dairy and tourism, can be particularly vulnerable to volatility. According to the Reserve Bank of New Zealand, fluctuations in global demand can significantly impact these sectors, leading to sharp economic shifts.

In recent years, the global pandemic highlighted how quickly market conditions can change. New Zealand's swift response helped mitigate some impacts, but sectors like tourism faced unprecedented challenges. The resilience of local businesses during such times is often tied to their ability to remain rational and make informed decisions despite uncertainty.

Expert Opinion & Thought Leadership: Staying Rational

Dr. Jane Smith, an economist at the University of Auckland, emphasizes the importance of data-driven decision-making. "In times of volatility, it's crucial to rely on hard data rather than gut feelings. This involves understanding market trends, consumer behavior, and financial fundamentals," she states. Dr. Smith advises businesses to maintain a diversified portfolio and avoid making impulsive decisions based on short-term market movements.

An effective strategy for New Zealand businesses is to focus on cash flow management. This involves maintaining a healthy cash reserve to cushion against unexpected downturns. The Ministry of Business, Innovation, and Employment (MBIE) recommends businesses regularly assess their financial health and plan for various scenarios, including worst-case situations.

Case Study: Fonterra's Strategic Response to Market Volatility

Problem

Fonterra, New Zealand's largest dairy exporter, faced significant challenges during a period of declining global dairy prices. The company had to navigate a volatile market environment while maintaining profitability and supporting local dairy farmers.

Action

Fonterra implemented a strategic approach to manage market volatility. This included diversifying its product range, entering new markets, and investing in value-added products. By leveraging its global network and focusing on innovation, Fonterra aimed to reduce its dependence on commodity price fluctuations.

Result

Within two years, Fonterra reported a 30% increase in revenue from value-added products, helping stabilize its financial performance. The company's strategic shift allowed it to remain competitive in a volatile global market and provided a buffer for New Zealand's dairy industry.

Takeaway

This case study highlights the importance of diversification and innovation in managing market volatility. New Zealand businesses can learn from Fonterra's approach by exploring new markets and investing in product development to mitigate risks associated with market fluctuations.

Common Myths & Mistakes in Navigating Volatility

It's easy to fall prey to common misconceptions during times of economic uncertainty. Here are a few myths and the reality behind them:

- Myth: "Market crashes are always catastrophic." Reality: While market crashes can be severe, they also present opportunities for growth and investment. Many businesses have emerged stronger by identifying and capitalizing on new market demands.

- Myth: "Cutting costs is the only way to survive." Reality: While cost management is important, investing in key areas like technology and customer service can provide a competitive edge and drive long-term growth.

- Myth: "Following the crowd minimizes risk." Reality: Herd mentality can lead to poor decision-making. Businesses should focus on their unique strengths and market insights rather than blindly following industry trends.

Future Trends & Predictions

Looking ahead, the New Zealand economy is expected to face both challenges and opportunities. According to a 2024 report by Deloitte, digital transformation will play a critical role in shaping the future of New Zealand businesses. By 2028, over 70% of local businesses are projected to have adopted advanced digital tools to enhance efficiency and competitiveness.

Furthermore, as global environmental regulations tighten, New Zealand’s commitment to sustainability and green practices will become increasingly important. Businesses that prioritize eco-friendly strategies may find new growth opportunities in emerging markets.

Conclusion

Successfully navigating market crashes and extreme volatility requires a strategic approach grounded in data, diversification, and innovation. By learning from past experiences and embracing new opportunities, New Zealand businesses can not only survive but thrive in uncertain times. What strategies have you found effective in navigating market volatility? Share your thoughts and experiences below!

Related Search Queries

- How to manage business risks in New Zealand

- Strategies for surviving market crashes

- Impact of global market trends on New Zealand economy

- Case studies of business resilience in New Zealand

- Future economic predictions for New Zealand

People Also Ask (FAQ)

How does market volatility impact businesses in New Zealand? Market volatility can affect New Zealand businesses by disrupting supply chains, altering consumer demand, and impacting export markets. However, businesses that adapt quickly can find new opportunities for growth.

What are the best strategies for implementing risk management? Experts recommend diversifying revenue streams, maintaining strong cash reserves, and regularly assessing market trends to effectively manage risks.

Who benefits the most from market volatility? Businesses with robust risk management strategies and those that can quickly adapt to changing market conditions tend to benefit the most from market volatility.

By applying these insights and strategies, New Zealand businesses can navigate market crashes and extreme volatility with resilience and confidence. Stay informed, stay prepared, and turn challenges into opportunities.

kashaaguilar55

4 months ago