Millennials face unique financial challenges in a rapidly changing economic landscape. Balancing student loans, housing costs, and the gig economy can be daunting. However, achieving financial freedom is possible through smart budgeting. In this article, we'll explore practical budgeting strategies tailored to millennials, helping them take control of their finances and work towards financial freedom.

Understanding Millennial Finances

Millennials, born between 1981 and 1996, have experienced economic shifts that have shaped their financial outlook. Many millennials carry student loan debt, face rising housing costs, and navigate the gig economy. Despite these challenges, they share common financial goals, including homeownership, retirement planning, and financial independence.

The Fundamentals of Smart Budgeting

Smart budgeting starts with understanding the basics. It involves tracking income, categorizing expenses, and setting aside savings. Creating a budget allows you to allocate your money purposefully, helping you avoid overspending and plan for your financial goals.

Building a Millennial-Friendly Budget

A millennial-friendly budget considers the unique aspects of this generation's financial situation. It involves setting realistic goals, prioritizing expenses, and finding the right balance between spending and saving. Consider using budgeting apps and tools to streamline the process and stay on track.

Embracing Technology for Financial Management

Technology can be a millennial's best friend when it comes to managing finances. Budgeting apps, online banking, and digital tools make it easier than ever to track expenses, set financial goals, and monitor progress. These tools empower you to take control of your financial life.

Tackling Debt and Student Loans

Student loans and credit card debt can weigh heavily on millennials' finances. Create a plan to manage and reduce debt. Prioritize high-interest debt while making minimum payments on others. Explore consolidation options and consider refinancing student loans to secure better interest rates.

Saving for the Future

Savings are the foundation of financial security. Allocate a portion of your income to savings, including an emergency fund, retirement accounts, and other future goals. Take advantage of employer-sponsored retirement plans and consider investing in diversified portfolios to grow your wealth.

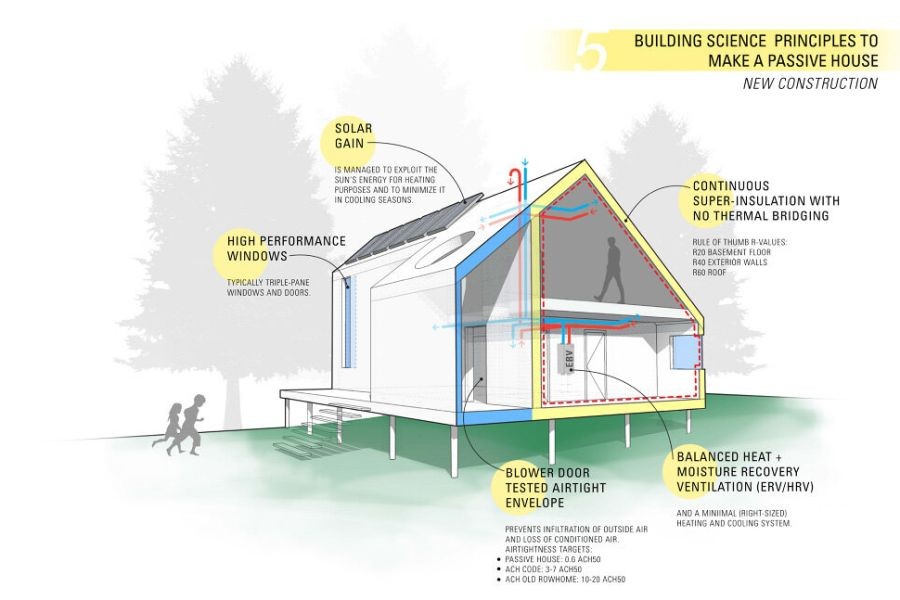

Navigating Housing and Rental Costs

Housing costs can consume a significant portion of a millennial's income. Explore creative housing solutions, such as co-living or renting with roommates. When considering homeownership, weigh the costs and benefits carefully.

Side Hustles and Additional Income Streams

The gig economy offers millennials opportunities for additional income. Explore side hustles that align with your skills and interests. However, remember to balance your side hustle with your main job, and allocate the extra income wisely in your budget.

Preparing for Financial Emergencies

Life is unpredictable, and financial setbacks can occur. Establishing an emergency fund provides a safety net in times of need. Aim to save three to six months' worth of living expenses in your emergency fund to ensure you're prepared for unexpected challenges.

Conclusion

In conclusion, smart budgeting is the key to achieving financial freedom in today's changing economy. By understanding your financial situation, setting clear goals, embracing technology, and managing debt wisely, you can take control of your finances and work towards a brighter financial future. Remember that financial freedom is not an overnight achievement but a journey that begins with smart budgeting.

FAQs

How can I create a budget when my income varies each month due to gig work? Budgeting with irregular income requires flexibility. Start by tracking your average monthly income over several months and build a budget around the lowest months to ensure you can cover your expenses.

Is it wise to invest in the stock market as a millennial, and how do I get started? Investing in the stock market can be a smart long-term strategy. Start by educating yourself about investment options, consider low-cost index funds or exchange-traded funds (ETFs), and consult with a financial advisor if needed.

What are some practical ways to cut down on discretionary spending without sacrificing quality of life? Identify areas where you can cut back, such as dining out less, canceling unused subscriptions, and shopping mindfully. Look for free or low-cost alternatives for entertainment and leisure activities.

How can I balance saving for retirement with more immediate financial goals like buying a home or paying off debt? Prioritize high-interest debt repayment, build an emergency fund, and then allocate a portion of your income towards retirement savings. Striking a balance between short-term and long-term goals may require adjustments as your financial situation evolves.

What steps should I take if I find myself in financial trouble and unable to meet my budgeting goals? Don't hesitate to seek help if you're facing financial challenges. Reach out to a financial counselor or advisor for guidance. They can help you create a plan to manage debt, reduce expenses, and get back on track toward your financial goals.

DeenaSpink

3 months ago