Introduction

Imagine you're a commercial real estate broker in New Zealand, navigating the complexities of property transactions. You’re already juggling market trends, client expectations, and financial forecasts. But lurking beneath the surface are hidden fees that can erode your profits if not managed properly. These fees often catch even seasoned investors off guard, leading to unexpected financial strain. In New Zealand, where real estate is a significant economic driver, understanding these hidden costs is crucial for maximizing returns.

As of 2023, the New Zealand real estate market has exhibited a mix of resilience and volatility. According to Stats NZ, property prices have seen a rapid rise of 27% since the pandemic's onset, making it crucial for brokers and investors to navigate the landscape with precision. Understanding the hidden fees involved in real estate transactions can mean the difference between profit and loss. This article delves into the nuanced world of hidden real estate fees, offering insights, strategies, and real-world examples specific to the Kiwi context.

Case Studies & Real-World Examples

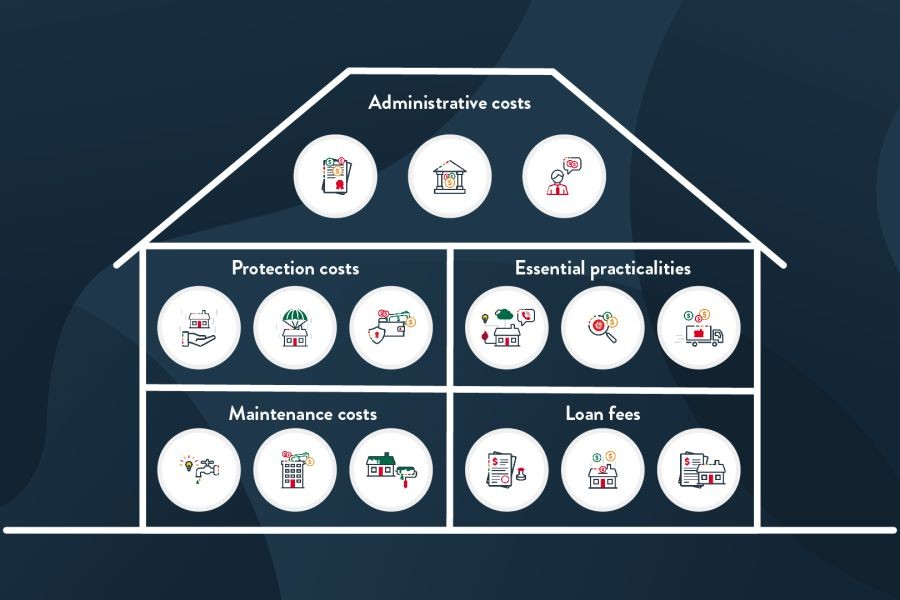

Understanding Common Hidden Fees

Before diving into case studies, it's essential to understand the common hidden fees that can impact real estate transactions in New Zealand:

- Legal Fees: Often underestimated, these can include costs for conveyancing, title searches, and document preparation.

- Valuation Fees: Required by lenders, these fees ensure the property’s value aligns with the loan amount.

- Land Information Memorandum (LIM) Reports: These reports provide critical information about the property’s legal status and history.

- Body Corporate Fees: For properties within a body corporate, these fees cover shared maintenance and administration costs.

- Compliance and Inspection Fees: Ensuring a property meets local regulations can incur additional costs.

Case Study: Wellington Commercial Property - The Impact of Legal Fees

Problem:

A Wellington-based investment firm faced unexpected hurdles due to underestimated legal fees. Their commercial property transaction, initially budgeted at NZD 1.5 million, saw an overrun of NZD 50,000 in legal costs. The firm had overlooked intricate legal requirements specific to the property’s zoning changes.

Action:

To address this, the firm engaged a specialized real estate lawyer to conduct a thorough review of all legal obligations. This included a detailed examination of zoning laws and potential legal disputes associated with the property.

Result:

Post-intervention, the firm not only mitigated excess costs but also identified opportunities to leverage the property’s zoning for higher returns. They realized a 15% increase in property value by converting parts of the space for mixed-use purposes, aligning with Wellington’s urban development policies.

Takeaway:

This case study underscores the importance of comprehensive legal due diligence in property transactions. For brokers in New Zealand, integrating legal insights early in the transaction process can prevent costly surprises and unlock additional value.

Data-Driven Analysis

To contextualize the financial impacts of hidden fees, consider these authoritative statistics:

- According to the Reserve Bank of New Zealand, the average cost of real estate transactions now includes an estimated 10% additional in unforeseen fees.

- MBIE reports that up to 30% of real estate transactions in New Zealand involve disputes over undisclosed fees, highlighting the need for transparency.

- The Property Council of New Zealand notes that legal and compliance fees have risen by 12% annually, reflecting increased regulatory scrutiny.

These figures highlight the critical need for brokers and investors to anticipate and manage these costs effectively to safeguard their investments.

Pros and Cons of Navigating Hidden Fees

While understanding hidden fees is essential, it comes with its own set of challenges and opportunities:

Pros:

- Enhanced Financial Planning: Anticipating fees allows for more accurate budgeting and cash flow management.

- Improved Client Trust: Transparency about potential costs enhances credibility and strengthens client relationships.

- Competitive Advantage: Brokers who provide detailed fee breakdowns can differentiate themselves in a competitive market.

Cons:

- Complexity: Understanding and explaining fees requires a deep knowledge of legal and financial nuances, which can be resource-intensive.

- Potential for Disputes: Miscommunication or oversight in fee disclosure can lead to client disputes and reputational damage.

- Regulatory Variability: Frequent changes in regulations can lead to unpredictable cost structures.

Common Myths and Mistakes

Misconceptions about hidden fees can lead to costly mistakes in real estate transactions. Let's debunk some common myths:

Myth: "All fees are included in the purchase price."

Reality: The purchase price often excludes additional fees such as legal costs, LIM reports, and compliance inspections, which can add up to 10% of the transaction value.

Myth: "Valuation fees are unnecessary if the property is well-priced."

Reality: Valuation fees are crucial for lenders to ensure the property's value supports the loan, impacting financing options.

Myth: "Body corporate fees are fixed and predictable."

Reality: These fees can fluctuate based on maintenance needs and changes in shared facilities, affecting long-term investment returns.

Future Trends and Predictions

As New Zealand's real estate market continues to evolve, several trends and predictions are worth noting:

- According to a Deloitte report, AI and blockchain technologies will streamline transaction processes, reducing the incidence of hidden fees through enhanced transparency and automation.

- By 2026, policy updates from MBIE are expected to mandate clearer disclosure of all transaction-related fees, aligning with international best practices.

- The integration of sustainable building practices and compliance with environmental regulations will introduce new fee structures, as predicted by NZTech’s sustainability report.

Conclusion

In the realm of commercial real estate in New Zealand, understanding hidden fees is more than just a financial necessity—it’s a strategic imperative. By anticipating and managing these costs, brokers can enhance client trust, optimize financial outcomes, and strengthen their market position. As the industry moves towards greater transparency and technological integration, staying informed about these hidden fees will be crucial for success.

What’s your experience with hidden fees in real estate transactions? Share your insights in the comments below!

People Also Ask (FAQ)

- How do hidden fees impact commercial real estate in New Zealand? Hidden fees can significantly affect the financial outcomes of property investments, often leading to unforeseen costs that can erode profits if not managed effectively.

- What are common hidden fees in New Zealand real estate? Common hidden fees include legal fees, valuation fees, LIM reports, body corporate fees, and compliance inspection costs.

- How can brokers manage hidden fees effectively? Brokers can manage hidden fees by conducting thorough due diligence, engaging specialized legal counsel, and maintaining transparent communication with clients.

Related Search Queries

- Hidden fees in New Zealand real estate

- Real estate transaction costs NZ

- Legal fees in property investment NZ

- Understanding LIM reports in NZ

- Body corporate fees New Zealand

- Compliance costs in NZ real estate

- Trends in NZ real estate market

- Sustainable building fees NZ

- AI in real estate transactions NZ

- Future of property investment in New Zealand

charlottecisne

10 months ago