Australia's housing market, long considered a staple of wealth accumulation, is witnessing seismic shifts that could alter the landscape of homeownership over the next two decades. Historically, the Australian dream of owning a home has been deeply embedded in the national psyche. However, recent trends suggest that this dream might become increasingly elusive. Understanding this shift is crucial, especially for sustainability advocates who are interested in the broader implications of these changes on the environment, economy, and societal structures.

The Economic Landscape: Rising Costs and Stagnant Wages

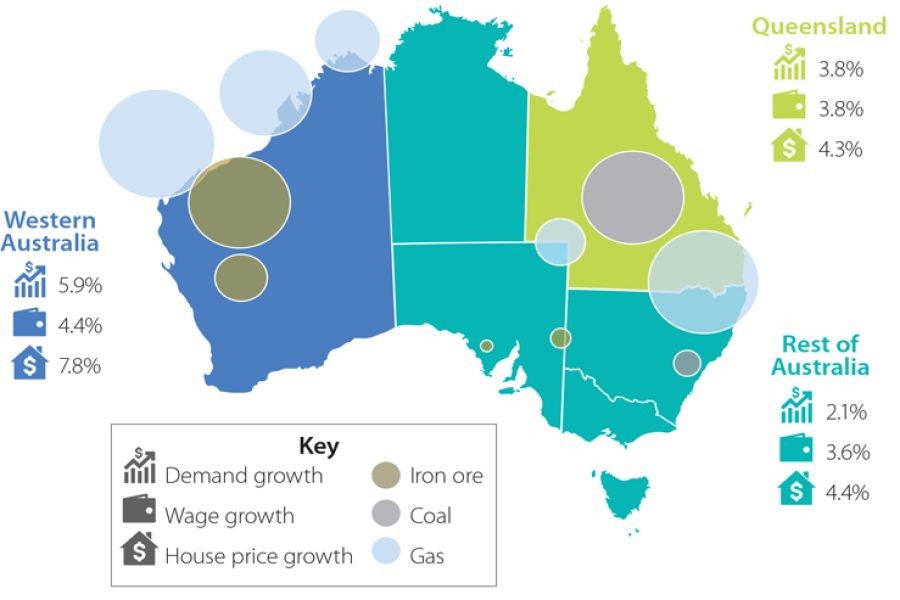

The relationship between income and property prices plays a critical role in homeownership trends. According to the Australian Bureau of Statistics (ABS), the median house price in major cities like Sydney and Melbourne has skyrocketed by over 50% in the past decade, while wage growth has remained stagnant, increasing by a mere 2-3% annually. This disparity makes it challenging for first-time buyers to enter the market, pushing homeownership further out of reach for many Australians.

The Role of Interest Rates

The Reserve Bank of Australia (RBA) has maintained historically low interest rates to stimulate economic growth, inadvertently inflating property prices. While low rates generally make borrowing more affordable, they also increase demand, driving up prices. As interest rates potentially rise to curb inflation, many Australians may find themselves unable to afford the higher mortgage repayments, thus deterring new buyers.

Urbanization and the Shift to Renting

Urbanization trends are also reshaping the housing market. As more Australians move to urban centers for better job opportunities and amenities, the demand for rental properties has surged. This shift is supported by data from the RBA, which indicates a significant increase in rental yields, making renting a more viable and flexible option for many, particularly younger Australians who value lifestyle over long-term property investment.

Case Study: The Melbourne Urban Sprawl

Melbourne's rapid urban expansion highlights this trend. The city's population growth has led to increased demand for housing, yet the supply has struggled to keep pace. As a result, rental prices have increased, and many residents are opting to rent rather than buy, valuing the mobility and flexibility that renting offers.

Environmental Considerations and Sustainable Living

For sustainability advocates, the decline in homeownership can present opportunities for promoting sustainable living practices. Smaller living spaces, such as apartments and shared housing, often have a lower environmental footprint compared to standalone homes. Additionally, the rise in rental properties offers a platform for implementing energy-efficient solutions that can be scaled across multiple units, contributing to Australia's carbon reduction goals.

Policy Implications: The Role of Government Initiatives

The Australian government has introduced various policies to address housing affordability, such as the First Home Loan Deposit Scheme. However, these measures have had limited success in bridging the affordability gap. As the government continues to focus on sustainability, future policies may increasingly promote rental properties that incorporate green technologies, aligning with global sustainability trends.

Technological Advancements and the Future of Housing

Technological innovations are poised to reshape housing in Australia. The rise of smart home technologies and modular construction methods can reduce costs and improve energy efficiency. These advancements may make homeownership more accessible, yet they also present challenges in terms of initial investment and adoption barriers.

Comparative Global Insights: Lessons from Singapore

Singapore's public housing model offers valuable insights for Australia. Despite limited land resources, Singapore has achieved high homeownership rates through government intervention and innovative housing solutions. By adopting similar strategies, Australia can address its housing challenges while promoting sustainable urban development.

Pros and Cons of Declining Homeownership

Understanding the potential benefits and drawbacks of declining homeownership is essential for developing effective strategies.

Pros:

- Increased Mobility: Renting offers flexibility, allowing residents to move in response to job opportunities and lifestyle changes.

- Environmental Benefits: Smaller living spaces often require fewer resources and offer opportunities for energy-efficient upgrades.

- Financial Flexibility: Renting eliminates the burden of property maintenance costs and allows individuals to allocate funds elsewhere.

Cons:

- Wealth Accumulation: Owning property remains a significant means of wealth accumulation, and renting may limit this opportunity.

- Rental Instability: Renters face the potential for frequent relocations and rent increases, impacting long-term stability.

- Lack of Control: Renters have limited ability to make changes to their living environment compared to homeowners.

Common Myths and Misconceptions

Several myths persist around homeownership in Australia, and dispelling these can help align expectations with reality.

Myth: "Owning a home is always cheaper than renting."

Reality: Given the current market conditions, renting can be more cost-effective, especially when considering maintenance and interest payments.

Myth: "Property values will always rise."

Reality: The property market is subject to fluctuations, and recent trends have shown that values can stagnate or decline, particularly in oversupplied areas.

Future Trends and Predictions

Looking forward, several trends are likely to shape the future of homeownership in Australia. The integration of smart technologies, continued urbanization, and evolving government policies will play pivotal roles. By 2035, it's predicted that over half of Australia's urban population will be renters, driven by affordability issues and lifestyle preferences. This shift will necessitate innovations in rental property management and sustainable practices.

Conclusion

The decline in homeownership in Australia over the next 20 years presents a complex interplay of economic, social, and environmental factors. For sustainability advocates, this shift offers opportunities to promote eco-friendly living, while also highlighting the need for innovative housing solutions. As Australia navigates these changes, the focus will likely be on balancing affordability, sustainability, and quality of life for all residents.

What’s your take on the future of homeownership in Australia? Share your thoughts and join the conversation below!

Related Search Queries

- Future of homeownership in Australia

- Australia housing market trends

- Impact of urbanization on housing

- Renting vs buying in Australia

- Sustainable living in Australian cities

People Also Ask

How does declining homeownership impact Australia's economy?

The decline in homeownership can affect wealth distribution and consumer spending patterns, as more income is directed toward rental payments rather than investments.

What are the biggest misconceptions about homeownership in Australia?

A common myth is that homeownership is always a better financial decision than renting, but current market dynamics show that renting can be more economical.

What strategies can help improve housing affordability in Australia?

Experts recommend increasing housing supply, revising zoning laws, and promoting affordable rental solutions to enhance housing affordability.