Australia's renewable energy sector is booming, making it an attractive prospect for angel investors looking to capitalize on sustainable investments. This growth is driven by the country's abundant natural resources, progressive government policies, and a global shift towards cleaner energy solutions. But how can investors navigate this burgeoning market effectively? In this article, we'll delve into the nuances of investing in Australia's renewable energy sector, providing data-backed insights, real-world examples, and actionable strategies tailored for angel investors.

The Australian Renewable Energy Landscape

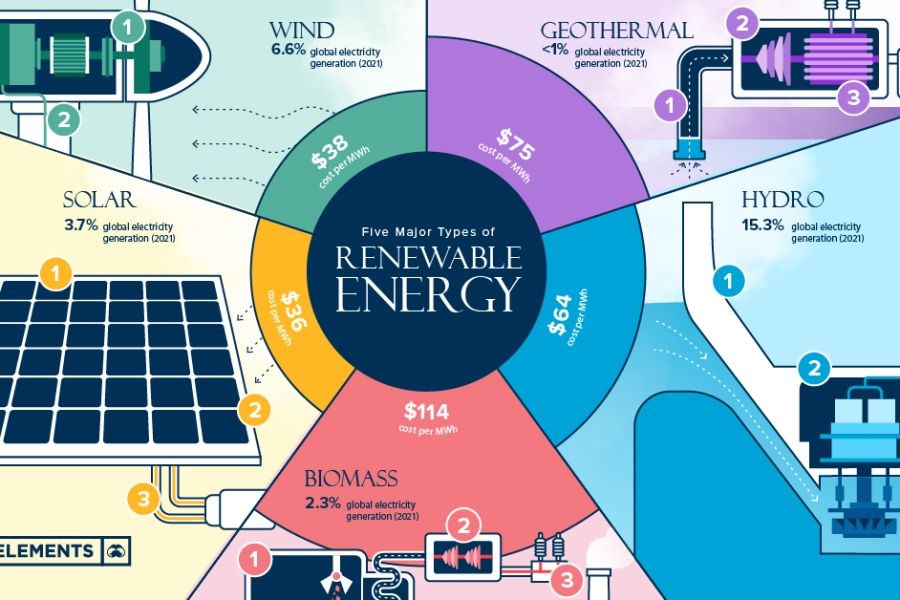

Australia is uniquely positioned to become a global leader in renewable energy. With vast open spaces, abundant sunlight, and strong coastal winds, the nation has the natural resources needed to generate significant renewable energy. According to the Clean Energy Council, as of 2023, renewables contributed over 30% of Australia’s total electricity generation, and this number is expected to rise as investments in solar, wind, and hydroelectric projects increase.

Government Policy Analysis

The Australian government has been a pivotal force in driving the renewable energy agenda. The Renewable Energy Target (RET) is a key policy that mandates a certain percentage of electricity must come from renewable sources by 2030. According to the Australian Bureau of Statistics, this policy has already attracted significant investments, resulting in over 21,000 megawatts of installed renewable capacity by 2022. Additionally, the government’s commitment to achieving net-zero emissions by 2050 further bolsters the sector's growth prospects.

Investment Opportunities in Solar Energy

Solar energy is arguably the most developed and promising segment within Australia’s renewable landscape. With over 2.7 million households equipped with solar panels, Australia leads the world in residential solar uptake. The International Energy Agency (IEA) highlights Australia’s potential to become a solar superpower due to its high solar irradiance. Investing in solar farms and associated technologies offers substantial ROI opportunities as the demand for clean energy solutions continues to rise.

Real-World Case Studies

Case Study: Sun Cable – A Visionary Approach to Solar Energy

Sun Cable, an Australian company, embarked on an ambitious project to develop the world’s largest solar farm, the Australia-ASEAN Power Link (AAPL). The project aims to export solar energy from Australia's Northern Territory to Singapore through undersea cables.

Problem: Sun Cable aimed to address the challenge of energy exportation and storage on a massive scale. The company faced hurdles regarding technological feasibility and regulatory approvals.

Action: Sun Cable partnered with industry leaders to innovate in high-voltage direct current (HVDC) technology, securing governmental support and international investment.

Result: The project is expected to generate 10 gigawatts of solar power with a capacity to store 30 gigawatt-hours of energy, significantly reducing carbon emissions in Singapore.

Takeaway: Sun Cable’s success illustrates the potential of large-scale solar projects and the importance of strategic partnerships and government collaboration in overcoming regulatory and technological barriers.

Wind Energy: A Growing Frontier

Wind energy projects have gained significant traction, with Australia harnessing its extensive coastal and inland wind resources. According to the Global Wind Energy Council, Australia installed over 2,000 megawatts of new wind capacity in 2023, making it one of the fastest-growing markets globally. Angel investors have a prime opportunity to invest in wind farm development and related technologies, which promise strong returns as the market expands.

Pros and Cons of Investing in Renewable Energy

- Pros:

- High ROI potential due to decreasing technology costs and increasing energy demand.

- Supportive government policies and incentives.

- Alignment with global sustainability trends and ESG criteria.

- Cons:

- Regulatory and technological challenges in scaling projects.

- Market volatility and dependence on policy support.

- High initial capital expenditure for infrastructure development.

Key Regulatory Insights

Investors must navigate the complex regulatory landscape, which varies across states. The Australian Competition & Consumer Commission (ACCC) oversees competitive practices, ensuring fair market conditions. Additionally, the Australian Energy Regulator (AER) regulates energy markets and networks. Understanding these regulatory bodies and compliance requirements is crucial for mitigating risks and maximizing investment returns.

Common Myths & Mistakes

- Myth: Renewable energy investments are too risky. Reality: While there are risks, the sector's growth and government backing provide significant opportunities for stable returns.

- Myth: Only large corporations can benefit from renewable energy projects. Reality: Small to medium-sized enterprises and individual investors can also participate through partnerships and community energy projects.

Future Trends & Predictions

Looking ahead, the future of renewable energy in Australia is promising. By 2030, the Commonwealth Scientific and Industrial Research Organisation (CSIRO) projects that 50% of Australia’s energy could be generated from renewable sources. Emerging technologies such as energy storage and hydrogen fuel are expected to revolutionize the industry, offering new investment avenues.

Conclusion

Australia’s renewable energy sector presents a compelling opportunity for angel investors seeking to combine financial returns with sustainable impact. By understanding the landscape, leveraging government policies, and staying abreast of technological advancements, investors can effectively capitalize on this dynamic market. As the sector continues to evolve, the potential for significant returns and contributions to a sustainable future is greater than ever. What strategies will you employ to harness this opportunity? Join the conversation and share your insights below!

People Also Ask

- How does investing in renewable energy impact Australia's economy?

Investing in renewable energy boosts job creation, reduces carbon emissions, and enhances energy security, contributing positively to Australia's GDP.

- What are the biggest misconceptions about renewable energy investment?

A common myth is that renewable energy investments are too risky. However, with supportive policies and technological advancements, the sector offers stable and lucrative opportunities.

- What are the best strategies for investing in Australia's renewable energy sector?

Experts recommend diversifying investments across different renewable technologies, understanding regulatory requirements, and forming strategic partnerships for long-term success.

Related Search Queries

- Renewable energy investment opportunities in Australia

- Australian government policies on renewable energy

- Solar energy projects in Australia

- Wind farm investments in Australia

- Future of renewable energy in Australia

- Risks of investing in renewable energy

- Energy storage technologies in Australia

- Hydrogen fuel investment opportunities

- Australian renewable energy market trends

Shrek Shirt

22 days ago