In the intricate web of global trade, New Zealand stands as a beacon of economic resilience and innovation, leveraging strategic trade partnerships to bolster its growth. As the world navigates the complexities of international commerce, New Zealand's trade alliances play a pivotal role in shaping its economic landscape. This article delves into ten key trade partnerships that are instrumental in driving New Zealand's growth, offering a comparative analysis and evaluating their pros and cons.

How Trade Fuels New Zealand’s Future

New Zealand is a nation that thrives on trade. With a small domestic market and a strong reliance on agriculture, tourism, and innovation, global trade partnerships are the lifeblood of the Kiwi economy.

But trade today isn’t just about goods and services—it’s about strategic relationships, resilience, digital exports, and sustainably growing influence in the Asia-Pacific and beyond.

This article breaks down the 10 most important trade partnerships that are helping New Zealand grow—economically, politically, and culturally.

1. China – NZ’s Largest Export Market

Why it matters:

China is New Zealand’s single largest trading partner, accounting for over 28% of total exports.

Key exports:

Dairy (milk powder, butter, cheese)

Meat (beef, lamb)

Logs and timber

Seafood and wine

Economic value:

Trade with China exceeds NZ$38 billion annually.

Opportunities:

Growing demand for premium, traceable food products.

Expansion of digital services, edtech, and clean energy technologies.

Belt and Road alignment for infrastructure cooperation.

Risks:

Political tensions can affect market access.

Heavy reliance makes NZ vulnerable to policy shifts in Beijing.

2. Australia – A Natural Trade Ally

Why it matters:

Australia is New Zealand’s second-largest trading partner, with trade flows worth over NZ$30 billion annually.

Key exports:

Manufactured goods

Food and beverage

Services (tourism, finance, construction)

Special advantage:

The Closer Economic Relations (CER) agreement is one of the most open and successful free trade agreements in the world, enabling seamless business operations across the Tasman.

Future growth areas:

Renewable energy technology

Construction partnerships

Joint ventures in the Indo-Pacific

3. United States – High Value, Innovation-Focused

Why it matters:

The US is NZ’s third-largest export destination, especially valuable for high-margin goods and services.

Key exports:

Wine and beef

Tech services (SaaS, film production)

Honey and pharmaceuticals

Innovation focus:

New Zealand tech companies like Xero, Pushpay, and Rocket Lab gain strong traction in US markets.

Growth potential:

Venture capital and joint tech hubs

Green energy collaboration

Defense and aerospace partnerships

4. Japan – Stability and Sustainability

Why it matters:

Japan offers economic stability, high consumer trust, and strong demand for high-quality products.

Key exports:

Meat (especially beef)

Dairy

Forestry products

Hydrogen energy collaborations

Recent developments:

Japan is working with NZ on green hydrogen exports.

Both are CPTPP members, easing trade integration.

Strategic synergy:

Shared values in rule-based order, sustainability, and tech innovation.

5. European Union – Premium Market Access

Why it matters:

The EU is a high-income, high-standard market, now more open than ever to New Zealand after the 2022 NZ-EU Free Trade Agreement.

Key sectors:

Wine, meat, and dairy

Sustainable goods

Intellectual property-driven exports (films, tech, design)

Benefits of the EU-NZ FTA:

Tariff elimination on 91% of NZ exports

Sustainability commitments as part of the agreement

Increased market visibility in 27 countries

6. United Kingdom – Post-Brexit Reboot

Why it matters:

Post-Brexit, NZ and the UK have forged a new free trade agreement, strengthening historical ties and opening new opportunities.

Key exports:

Wine, lamb, honey

Fintech and software services

Educational exchange and tourism

Why it’s growing again:

Simpler visa rules for young Kiwis

Cultural affinity

Strategic alignment on Pacific issues

7. South Korea – Advanced Tech Meets Quality Agri

Why it matters:

South Korea represents an advanced, tech-savvy market hungry for safe, high-quality food and collaborative tech development.

Key areas of trade:

Kiwi fruit (Zespri is massive in Korea)

Dairy and meat

Edtech and clean energy

Bilateral FTA signed in 2015 has opened new doors for New Zealand exporters.

Emerging sectors:

Film and content co-production

Smart farming collaboration

Hydrogen fuel technologies

8. India – The Giant Still Warming Up

Why it matters:

While underdeveloped compared to others, India’s massive population and rising middle class make it a future powerhouse for Kiwi trade.

Current exports:

Logs and wood

Fruit and wool

Education services

Challenges:

No FTA yet

Complex import duties and regulatory delays

Why it’s important now:

India’s growing food security needs

Renewable energy projects

Potential for NZ universities to scale digital education exports

9. Vietnam – The Rising ASEAN Star

Why it matters:

Vietnam is one of NZ’s fastest-growing trade partners, with exports doubling over the last decade.

Key exports:

Dairy

Wood and logs

Fruit and cereals

Strategic edge:

Both countries are in CPTPP, ensuring smooth trade protocols.

Why it’s a future hub:

Vietnam is fast becoming a manufacturing alternative to China and a gateway into ASEAN for Kiwi exporters.

10. Indonesia – Big Market, Bigger Potential

Why it matters:

Indonesia is Southeast Asia’s largest economy and a member of RCEP, creating major opportunities for NZ’s agriculture and education sectors.

Current trade strengths:

Dairy, especially milk powder

Beef and sheep meat

University partnerships

What’s next:

NZ tech and agritech firms are finding clients in Indonesia’s booming urban centres.

Sustainable agriculture collaboration could define the next decade.

The Trans-Tasman Bond: New Zealand and Australia

The economic relationship between New Zealand and Australia is more than just geographical proximity; it's a dynamic partnership that has flourished over decades. The Closer Economic Relations (CER) agreement, established in 1983, eliminated trade barriers and has since facilitated a seamless flow of goods, services, and investments. According to Stats NZ, Australia accounted for 16% of New Zealand's total exports in 2022, underscoring the crucial role this partnership plays in New Zealand's economy.

Pros of the Trans-Tasman Partnership

- Market Access: New Zealand businesses enjoy unrestricted access to a large market, enhancing their competitive edge.

- Diverse Sectors: The partnership spans various sectors, from agriculture to technology, fostering innovation and diversification.

- Shared Regulatory Frameworks: Harmonized standards and regulations reduce compliance costs and facilitate smoother transactions.

Cons of the Trans-Tasman Partnership

- Economic Dependence: Heavy reliance on Australia can expose New Zealand to economic shocks originating from its neighbor.

- Competitive Pressures: New Zealand industries face stiff competition from Australian counterparts, particularly in manufacturing.

China: A Growing Economic Giant

China's emergence as a global economic powerhouse has significantly impacted New Zealand's trade dynamics. The New Zealand-China Free Trade Agreement (FTA), signed in 2008, marked a watershed moment, paving the way for increased exports of dairy, meat, and wood products. In 2022, China was New Zealand's largest trading partner, accounting for 29% of its total exports, as per the Ministry of Business, Innovation and Employment (MBIE).

Pros of the China Partnership

- Market Size: Access to China's vast market offers unparalleled growth opportunities for Kiwi businesses.

- Resource Demand: China's appetite for New Zealand's primary products drives demand and supports rural economies.

- Investment Opportunities: Chinese investments in sectors like infrastructure and technology fuel economic development.

Cons of the China Partnership

- Trade Imbalances: A significant trade surplus in China's favor can create economic vulnerabilities.

- Geopolitical Risks: Political tensions and trade disputes could disrupt business operations.

- Regulatory Challenges: Navigating China's complex regulatory environment poses challenges for exporters.

Japan: A Strategic Ally

Japan, as a high-tech industrial nation, offers New Zealand a strategic partnership that extends beyond trade into technological collaboration. The New Zealand-Japan Economic Partnership Agreement (EPA) enhances trade in goods and services, promoting sustainable economic growth. Japan ranks as New Zealand's fourth-largest export market, with a significant focus on agricultural products and innovative technologies.

Pros of the Japan Partnership

- Technological Collaboration: Access to Japan's advanced technologies fosters innovation in New Zealand industries.

- High-Value Markets: Japan's demand for premium agricultural products aligns with New Zealand's export strengths.

- Stable Economic Environment: Japan's stable economic policies provide a reliable trade framework.

Cons of the Japan Partnership

- Market Saturation: Japan's mature market can limit growth opportunities for new entrants.

- Cultural Barriers: Differences in business practices and cultural norms require adaptation and understanding.

The United States: Opportunities and Challenges

The United States remains a vital trading partner, offering New Zealand access to one of the world's largest consumer markets. While there is no formal FTA, the Trade and Investment Framework Agreement (TIFA) facilitates bilateral trade and investment. The United States is New Zealand's third-largest export market, with significant exports in dairy, meat, and wine.

Pros of the United States Partnership

- Consumer Market: Access to a vast and affluent consumer base drives revenue growth for New Zealand exporters.

- Innovation Hub: Collaborations in technology and research enhance New Zealand's innovation capabilities.

- Investment Flow: The United States is a major source of foreign direct investment (FDI) in New Zealand.

Cons of the United States Partnership

- Trade Barriers: Tariffs and regulatory hurdles can impede market access for Kiwi products.

- Political Volatility: Policy shifts and trade tensions may create uncertainty for exporters.

India: An Emerging Frontier

India represents an emerging frontier for New Zealand's trade ambitions. While trade volumes are modest compared to other partners, the potential for growth is substantial. New Zealand's primary exports to India include logs, apples, and dairy products. The ongoing negotiations for a bilateral FTA aim to unlock new opportunities.

Pros of the India Partnership

- Growing Middle Class: India's expanding middle class presents a lucrative market for consumer goods.

- Diverse Sectors: Opportunities exist in education, technology, and agribusiness sectors.

- Strategic Location: India's strategic location enhances trade connectivity with Asia and the Middle East.

Cons of the India Partnership

- Bureaucratic Hurdles: Complex regulations and procedural delays can hinder business operations.

- Market Access Challenges: Tariffs and non-tariff barriers limit export potential.

Case Study: Fonterra's Global Success

Fonterra, New Zealand's dairy giant, exemplifies the success of leveraging global trade partnerships. With operations spanning over 100 countries, Fonterra capitalizes on New Zealand's trade agreements to export dairy products worldwide. A strategic focus on China and Southeast Asia has driven revenue growth, with China alone accounting for 30% of Fonterra's total exports. By adapting to diverse market demands and investing in innovation, Fonterra demonstrates the potential for New Zealand businesses to thrive in international markets.

Lessons Learned

- Market Diversification: Expanding into multiple markets mitigates risks associated with economic downturns in a single region.

- Innovation and Adaptation: Investing in research and development ensures products meet evolving consumer preferences.

- Strategic Partnerships: Collaborating with local partners enhances market entry and distribution capabilities.

Data-Driven Analysis

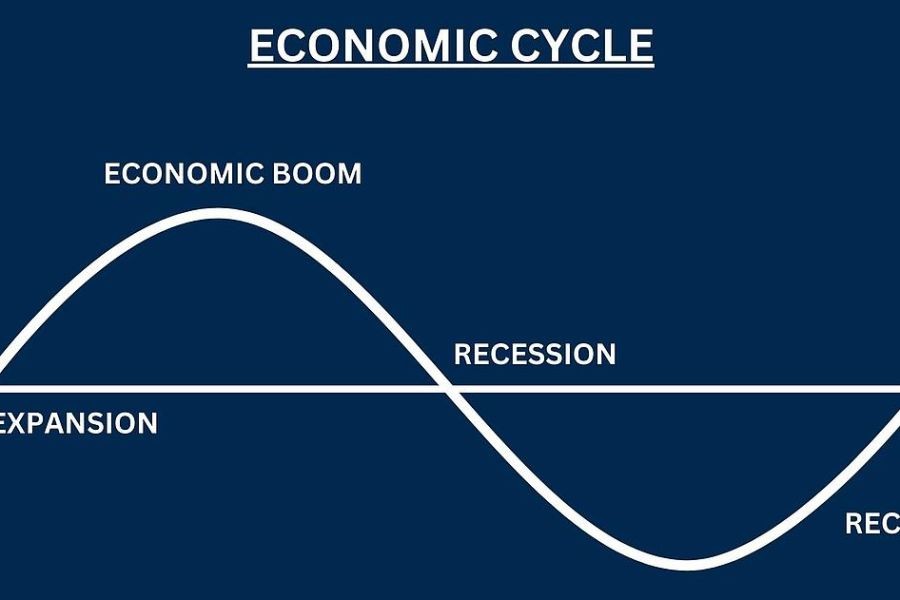

According to the Reserve Bank of New Zealand, the country's export sector is a key driver of GDP growth, contributing 30% to the national economy. The diversification of trade partnerships is crucial in mitigating risks associated with global economic fluctuations. By expanding its trade alliances, New Zealand ensures resilience in the face of global uncertainties.

Challenges and Opportunities

While New Zealand's trade partnerships offer significant advantages, challenges persist. Navigating geopolitical tensions, adapting to regulatory changes, and managing environmental impacts are critical considerations. However, opportunities abound in sectors like technology, renewable energy, and sustainable agriculture. By capitalizing on these opportunities, New Zealand can enhance its global competitiveness and achieve sustainable growth.

Avoiding the Mistakes Others Already Made

Hard Truth: Complacency in Key Markets Can Cost You

Many New Zealand exporters have historically over-relied on a handful of markets—particularly China and Australia. While these are strong relationships, they are also subject to geopolitical risk and demand fluctuations.

Real-world example:

In 2020, Australian wine exporters were hit hard by Chinese tariffs. NZ exporters took note—but those who diversified early gained resilience and avoided sudden revenue shocks.

Tactical lesson:

A smart export strategy must balance deep partnerships (like China, Australia) with emerging growth markets (Vietnam, India, Indonesia).

Future Trends and Predictions

Looking ahead, New Zealand's trade landscape is poised for transformation. The shift towards digital trade, the rise of regional trade agreements, and the emphasis on sustainability will shape future trade dynamics. By 2030, experts predict that New Zealand's export sector will increasingly rely on technology-driven solutions to enhance efficiency and competitiveness.

Conclusion

New Zealand's trade partnerships are integral to its economic growth, offering both opportunities and challenges. By fostering strategic alliances and embracing innovation, New Zealand can navigate the complexities of global trade and achieve sustainable prosperity. As businesses and policymakers collaborate to enhance trade relationships, the future holds promise for a resilient and thriving New Zealand economy.

People Also Ask (FAQ)

- How do trade partnerships impact New Zealand's economy? Trade partnerships enhance New Zealand's export capabilities, contributing significantly to GDP and supporting job creation.

- Which sectors benefit most from New Zealand's trade partnerships? Key sectors include agriculture, technology, and education, which leverage access to international markets for growth.

- What challenges do New Zealand businesses face in international trade? Challenges include navigating regulatory complexities, geopolitical tensions, and market access barriers.

- How can New Zealand businesses capitalize on trade opportunities? Businesses can focus on innovation, market diversification, and strategic partnerships to enhance competitiveness.

- What are the future trends in New Zealand's trade landscape? Future trends include digital trade, regional agreements, and sustainability, driving transformation in trade dynamics.

Related Search Queries

- New Zealand trade partnerships

- New Zealand exports and imports

- Impact of trade agreements on New Zealand

- New Zealand and China trade relations

- Future of New Zealand's trade

- Pros and cons of New Zealand trade agreements

- Economic impact of trade on New Zealand

- New Zealand trade statistics 2023

- Challenges in New Zealand's international trade

- New Zealand's top trading partners

LuellaWgo

6 months ago