New Zealand's startup ecosystem is burgeoning, with a particular interest in crowdfunded startups. This trend is not just a fleeting phenomenon; it's driven by a combination of innovation and the need for diversified investment options. Crowdfunding offers an alternative path for entrepreneurs to raise funds, bypassing traditional financial institutions. This article delves into the intricacies of investing in crowdfunded startups in New Zealand, highlighting local trends, challenges, and opportunities.

Understanding Crowdfunding in New Zealand

Crowdfunding in New Zealand has gained momentum, supported by favorable government policies and a strong entrepreneurial spirit. According to the Ministry of Business, Innovation and Employment (MBIE), the country has seen a steady increase in crowdfunding platforms, facilitating capital access for startups and SMEs. This shift aligns with global trends, but New Zealand's unique regulatory environment and market dynamics create specific opportunities and challenges for investors.

Key Benefits of Investing in Crowdfunded Startups

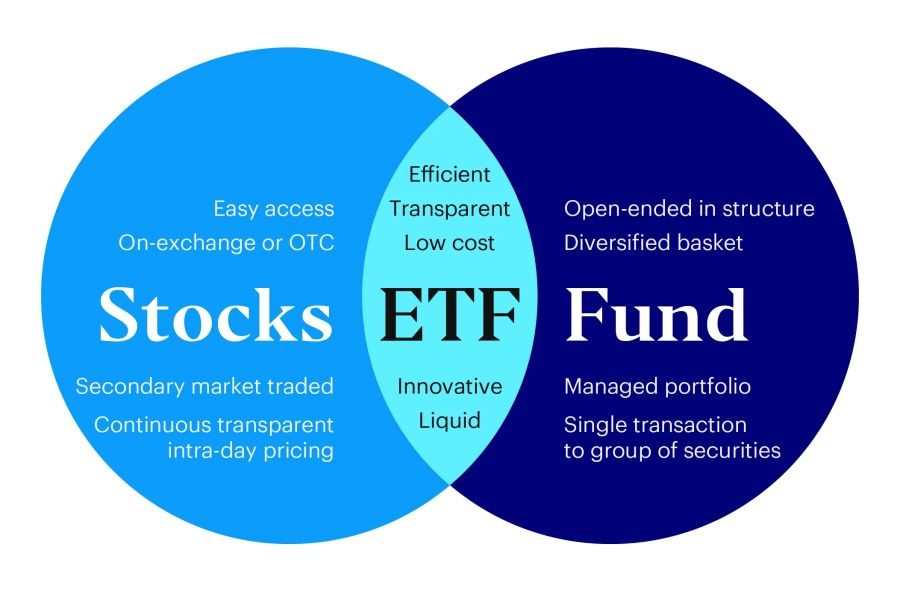

- Diversification: Crowdfunding allows investors to diversify their portfolios by investing in a variety of startups across different sectors.

- Support for Innovation: By investing in startups, investors can support innovative projects that may not receive funding through traditional channels.

- Community Engagement: Crowdfunding often involves a community of like-minded individuals, fostering a sense of belonging and shared interest in the startup's success.

Case Study: New Zealand's PledgeMe

Problem: PledgeMe, a New Zealand-based crowdfunding platform, faced the challenge of low investor engagement and limited project diversity.

Action: The platform introduced new features, including project updates and investor feedback loops, to enhance user experience. They also expanded their project categories to attract a broader range of investors.

Result: Within a year, PledgeMe saw a 30% increase in investor participation and a 40% growth in successfully funded projects.

Takeaway: Engaging the community and diversifying project offerings can significantly enhance platform success and investor satisfaction.

Pros and Cons of Investing in Crowdfunded Startups

✅ Pros:

- Potential High Returns: Successful startups can offer substantial returns on investment.

- Access to Early-Stage Opportunities: Investors can get in on the ground floor of innovative projects.

- Direct Communication: Crowdfunding platforms often facilitate direct communication between investors and startup founders.

❌ Cons:

- High Risk: Many startups fail, and investors can lose their entire investment.

- Lack of Liquidity: Crowdfunded investments are usually long-term and cannot be easily liquidated.

- Limited Information: Startups may not provide the same level of transparency as publicly traded companies.

Common Myths & Mistakes in Crowdfunding

Myth: "All startups have the same level of risk." Reality: Risk levels vary significantly based on the industry, market conditions, and the startup's business model. Investors should analyze each project individually.

Myth: "Crowdfunding is only for tech startups." Reality: While tech startups are prominent, crowdfunding spans various sectors, including food, fashion, and social enterprises.

Myth: "Investing small amounts isn't impactful." Reality: Even small investments can accumulate to significant funding for startups, and every contribution supports innovation.

Future Trends in Crowdfunding

By 2026, the crowdfunding landscape in New Zealand is expected to evolve with increased regulatory support and technological advancements. The Reserve Bank of New Zealand predicts an uptick in digital platforms facilitating secure and efficient transactions. Additionally, the integration of blockchain technology could provide enhanced transparency and security for investors.

Conclusion and Final Takeaways

- Investing in crowdfunded startups in New Zealand offers a chance to support innovation while potentially reaping high returns.

- The market is diverse, with platforms like PledgeMe leading the way in improving investor engagement and project diversity.

- Understanding the risks and conducting thorough due diligence are critical for successful investments.

As the crowdfunding landscape continues to evolve, staying informed and engaged with the latest trends and platforms will be essential for investors. Ready to explore the world of crowdfunded startups? Start by researching local platforms and assessing potential projects that align with your interests and risk appetite. Share your thoughts and experiences in the comments below!

People Also Ask (FAQ)

What are the biggest misconceptions about crowdfunded startups? One common myth is that all startups have the same risk level. However, each startup's risk can vary based on industry and business model.

How does crowdfunding impact the New Zealand economy? Crowdfunding boosts New Zealand's economy by supporting innovation and providing capital to startups, contributing to job creation and economic growth.

Related Search Queries

- How to invest in startups in New Zealand

- Best crowdfunding platforms NZ

- Risks of crowdfunding investments

- Crowdfunding regulations in New Zealand

- Successful NZ startups