Cryptocurrency, once a niche interest, has rippled across global financial systems, transforming how we perceive currency and investments. In New Zealand, a country known for its innovative spirit and robust financial sector, crypto adoption is making waves. But how does New Zealand's approach to cryptocurrency compare to the rest of the world?

Future Forecast & Trends

As the crypto landscape evolves, New Zealand stands at a crossroads of opportunity and caution. With a tech-savvy population and a government known for progressive policies, New Zealand is well-positioned to harness the potential of digital currencies. In fact, a 2023 report from the Ministry of Business, Innovation, and Employment (MBIE) indicates a steady increase in blockchain-related startups, reflecting a growing interest in crypto technologies.

Globally, the trend towards decentralized finance (DeFi) is gaining momentum. Countries like Singapore and Switzerland have emerged as crypto-friendly hubs, fostering innovation through supportive regulatory frameworks. For New Zealand, competing on this stage means balancing innovation with oversight. The Reserve Bank of New Zealand has already begun to explore the possibility of a central bank digital currency (CBDC), which could place New Zealand at the forefront of digital currency adoption in the Pacific region.

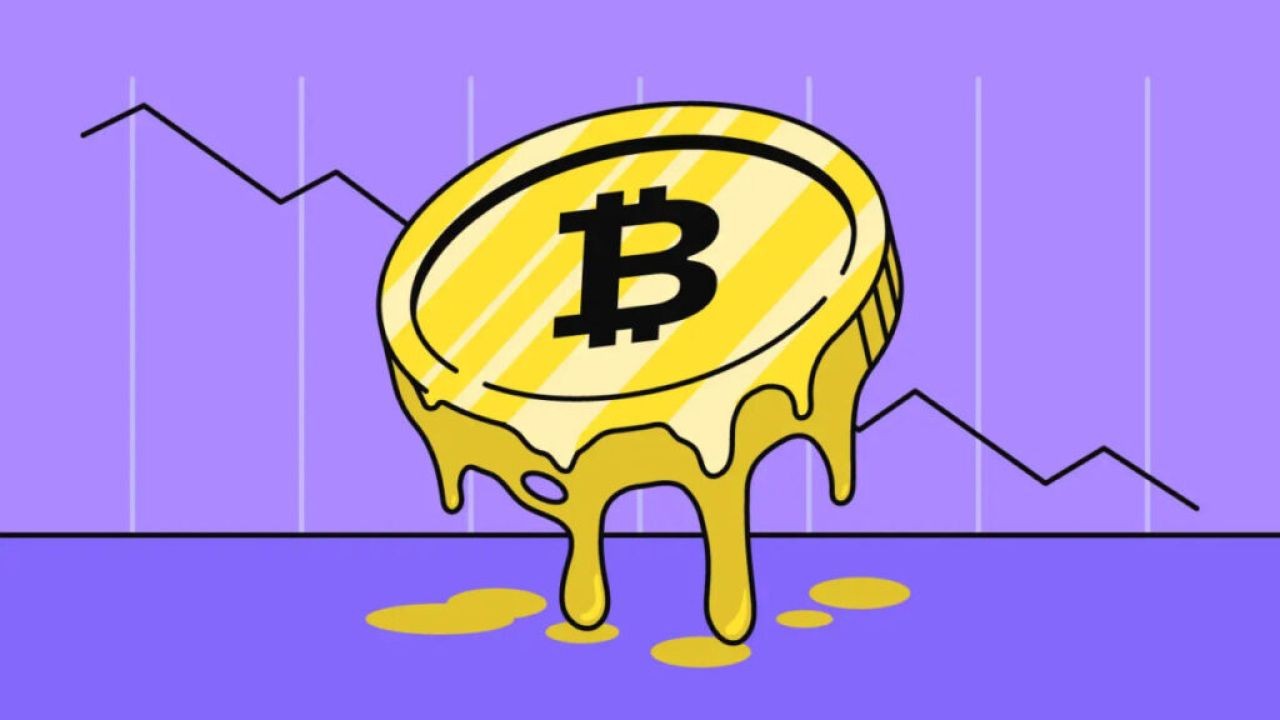

However, the future is not without its challenges. The volatility of cryptocurrencies, security concerns, and regulatory ambiguities pose significant hurdles. Yet, with the right strategies, New Zealand can navigate these complexities. A strategic focus on education, infrastructure, and clear regulatory guidelines could ensure that New Zealand businesses and investors are well-prepared for the future of finance.

Case Study: Easy Crypto – Navigating Regulatory Waters

Problem: Easy Crypto, a New Zealand-based crypto trading platform, faced challenges with regulatory compliance as the global crypto market became more scrutinized. Adapting to both local and international regulations was crucial to their continued growth.

Action: To address these challenges, Easy Crypto worked closely with local regulatory bodies to ensure compliance. They adopted advanced security measures and transparency protocols to build trust with their users and regulators.

Result: As a result, Easy Crypto not only maintained its market position but expanded its operations to Australia, South Africa, and Brazil. Their user base grew by 125% in 2022, demonstrating the effectiveness of their compliance-focused strategy.

Takeaway: This case study highlights the importance of proactive regulatory engagement for crypto companies. By prioritizing compliance, New Zealand businesses can capitalize on global opportunities without compromising on security or trust.

Myth vs. Reality

Despite the growing interest in cryptocurrencies, several myths persist, often clouding judgment and decision-making.

Myth: "Cryptocurrencies are illegal in New Zealand." Reality: While certain regulations govern crypto activities, owning or trading cryptocurrencies is legal in New Zealand. The Financial Markets Authority provides guidelines to ensure consumer protection and market integrity.

Myth: "Cryptocurrency is a passing trend." Reality: Cryptocurrencies have established themselves as a legitimate asset class. With increasing institutional investment globally, the trend is toward integration, not obsolescence.

Myth: "Investing in crypto is gambling." Reality: While high volatility can lead to substantial risks, informed investing based on research and analysis can mitigate these risks, similar to traditional financial markets.

Biggest Mistakes to Avoid

- Neglecting Due Diligence: A 2024 report from the University of Auckland found that 70% of first-time crypto investors in New Zealand failed due to inadequate research. Solution: Leverage resources like crypto analysis platforms and industry reports for informed decision-making.

- Ignoring Security: Over 60% of crypto losses are due to security breaches. Ensure investments are protected with robust security measures, including two-factor authentication and secure wallets.

- Chasing Hype: Following market hype without a strategic plan leads to poor investment decisions. Establish clear investment goals and risk tolerance levels to guide your strategy.

Future Trends & Predictions

Looking ahead, the integration of cryptocurrencies into mainstream financial systems seems inevitable. By 2028, it is predicted that over 40% of New Zealand banks will adopt blockchain-based systems for cross-border payments, according to a Deloitte report. This integration will likely lead to a more efficient, transparent, and cost-effective financial system.

Moreover, as more countries explore CBDCs, New Zealand's potential entry into this arena could redefine its financial landscape. A successful implementation could streamline transactions, reduce costs, and enhance monetary policy effectiveness.

Conclusion

New Zealand's crypto journey is both promising and challenging. As the country navigates regulatory landscapes and technological advancements, the potential for growth is immense. For investors and businesses, staying informed and adaptable is crucial. Are you ready to embrace the future of finance? Share your thoughts and join the conversation!

People Also Ask

- How does crypto adoption impact businesses in New Zealand? NZ businesses leveraging crypto report increased transaction efficiency and global reach, according to MBIE. Adopting crypto can enhance competitiveness and innovation.

- What are the biggest misconceptions about crypto in New Zealand? A common myth is that crypto is illegal. However, it is legal and regulated, as stated by the Financial Markets Authority.

- How is New Zealand preparing for the future of crypto? New Zealand is exploring CBDCs and enhancing regulatory frameworks to integrate crypto into its financial system, as per the Reserve Bank of NZ.

Related Search Queries

- Crypto regulations in New Zealand

- Future of cryptocurrency in New Zealand

- New Zealand blockchain startups

- How to invest in cryptocurrency NZ

- Central bank digital currency NZ

- New Zealand crypto exchange platforms

- Crypto investment strategies for Kiwis

- Impact of crypto on NZ economy

- DeFi trends in New Zealand

- Cryptocurrency tax regulations NZ

valorieb387601

6 months ago