In the sphere of international relations, statements made by global leaders can often ripple across industries and affect economic landscapes far beyond their borders. Recently, Canada's Prime Minister made a bold declaration to former U.S. President Donald Trump, asserting that "Canada won't be for sale, ever." This remark not only signifies Canada's stance on national sovereignty but also raises important questions about economic independence and foreign investment policies. For Australia, a nation with its own robust stance on economic sovereignty, this development presents an opportunity to reflect on its strategies and policies regarding foreign investment and national economic control.

How It Works: Understanding Economic Sovereignty

Economic sovereignty refers to a country's power to control its own economic policies, resources, and market conditions without undue influence from external entities. In the context of Canada and the United States, this idea is particularly relevant due to their close economic ties. Similarly, Australia faces its own set of challenges and opportunities regarding foreign investments, especially in key sectors like real estate and mining.

- Assessing Foreign Investment: Australia's Foreign Investment Review Board (FIRB) plays a crucial role in overseeing foreign investments. Ensuring that these investments align with national interests is key. According to the Australian Bureau of Statistics (ABS), foreign direct investment in Australia was valued at AUD 1.1 trillion in 2022, highlighting the significant role overseas investors play in the economy.

- Maintaining Economic Balance: While foreign investment brings capital and expertise, it's crucial to balance it with local interests. For instance, the Reserve Bank of Australia (RBA) monitors the potential impact of foreign investments on housing prices, a sector that saw an 8% increase in prices from 2022 to 2023.

- Strengthening Local Industries: By fostering innovation and supporting local businesses, Australia can reduce reliance on foreign capital. The government's investment in technology hubs, like the Sydney Tech Hub, aims to stimulate local entrepreneurship and innovation.

Pros and Cons Evaluation of Foreign Economic Policies

Pros:

- Increased Capital Flow: Foreign investments bring essential capital that can drive growth and development in various sectors.

- Global Expertise: International investors often bring expertise and technology that can enhance local industries.

- Job Creation: Investments can lead to job creation, reducing unemployment rates and boosting the economy.

Cons:

- Loss of Control: Excessive foreign control over key industries can lead to a loss of national economic autonomy.

- Inflated Market Prices: High levels of foreign investment can inflate prices, particularly in real estate.

- Economic Vulnerability: Overreliance on foreign investment can make the economy vulnerable to global market fluctuations.

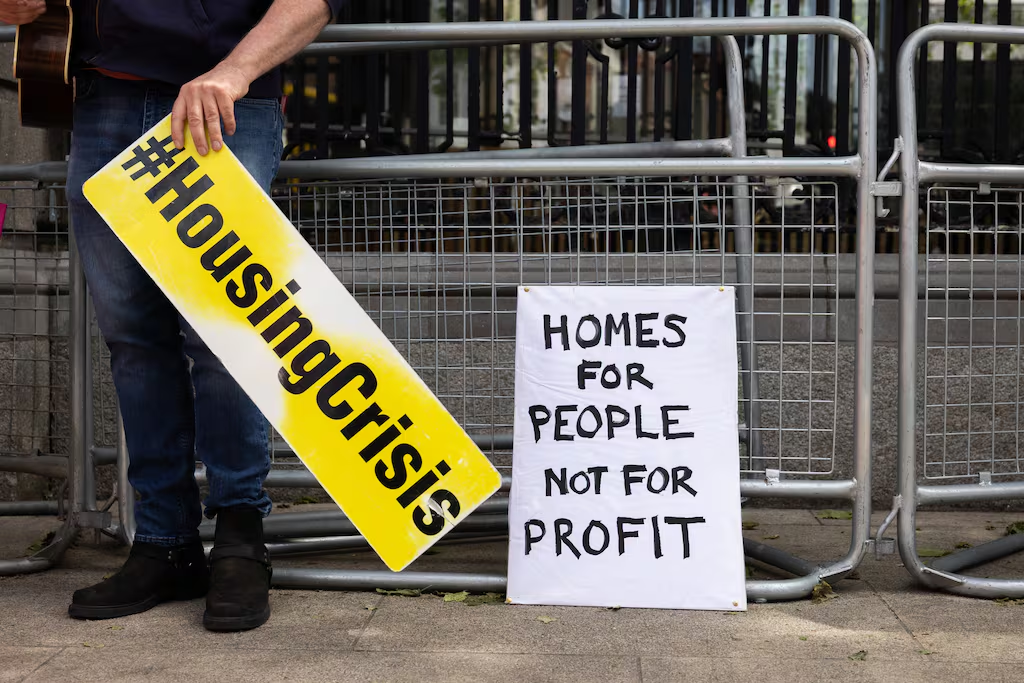

Case Study: Australia's Real Estate Sector

Problem: In recent years, Australia's real estate market has experienced substantial foreign investment, particularly from Chinese investors. This influx has led to concerns over housing affordability and market stability.

Action: In response, the Australian government introduced tighter regulations on foreign property purchases, including increased scrutiny by the FIRB and higher stamp duties for overseas buyers.

Result: These measures have slowed the rate of foreign purchases and helped stabilize housing prices, with a noted decrease in the annual growth rate from 12% in 2021 to 8% in 2023.

Takeaway: This case highlights the importance of regulatory frameworks in managing foreign investment to protect national interests while still encouraging beneficial economic contributions.

Common Myths & Mistakes in Economic Policy

Myth: "All foreign investment is beneficial."

Reality: While foreign investment can boost economic growth, unchecked investment can lead to market imbalances and loss of control over critical sectors.

Myth: "National economic policies should focus solely on attracting foreign capital."

Reality: A balanced approach that includes strengthening local industries is crucial for sustainable economic growth.

Future Trends & Predictions

The future of Australia's economic policy is likely to be shaped by a more strategic approach to foreign investment. According to a report by Deloitte, by 2028, Australia will see a shift towards more stringent investment screening processes to ensure alignment with national interests. Additionally, the focus will likely expand to fostering domestic innovation to reduce reliance on foreign capital.

Conclusion

Australia has the opportunity to learn from Canada's assertive stance on national sovereignty. By carefully balancing foreign investment with local economic interests, Australia can safeguard its economic future while still benefiting from global capital and expertise. To stay ahead in this evolving landscape, policymakers and industry leaders must prioritize a strategic and balanced approach to economic sovereignty.

What are your thoughts on how Australia should navigate its economic sovereignty? Share your insights below!

People Also Ask

- How does foreign investment impact Australia's economy? Foreign investment provides capital and expertise, boosting growth but also posing risks like market inflation.

- What are the biggest misconceptions about foreign economic policies? A common myth is that all foreign investment is beneficial, though it can lead to market imbalances.

- What are the best strategies for managing foreign investment? Implementing regulatory frameworks and fostering local industries are key strategies for balancing foreign investment.

Related Search Queries

- Australia foreign investment policy

- Economic sovereignty in Australia

- Impact of foreign investment on real estate

- Australia's economic independence

- Future trends in foreign investment