In the dynamic world of property investment, New Zealand presents a unique landscape shaped by cultural nuances, economic factors, and evolving market trends. As the demand for insights grows, property market trend videos have become essential tools for buyers and investors. These videos are not just about showcasing properties; they offer valuable data and analysis that can guide investment decisions. For travel experts, understanding these trends is crucial, as they often intersect with tourism, lifestyle, and local economies. Let's dive into the key insights that these trend videos provide.

1. Understanding New Zealand's Economic Landscape

New Zealand's economy plays a pivotal role in shaping property market trends. According to the Reserve Bank of New Zealand, the country's GDP growth was projected at 3.2% for 2023, reflecting a stable economic environment. This stability attracts both local and international investors looking for secure real estate opportunities. Additionally, the government's policies, such as restrictions on foreign ownership, directly influence property demand and pricing.

Key Takeaways:

- Economic Growth: A stable economy supports property value appreciation.

- Government Policies: Regulations like foreign ownership restrictions impact market dynamics.

2. Property Price Trends and Data-Driven Insights

Property market trend videos often highlight pricing trends, offering data-backed insights into where the market is heading. Stats NZ reported a 27% rise in property prices in 2024, sparking affordability concerns, particularly in major cities like Auckland and Wellington. These insights are crucial for investors to identify potential hotspots and avoid overpaying.

Pros and Cons of Current Price Trends:

- Pros: Historical data shows consistent property appreciation, offering potential for long-term gains.

- Cons: High prices may limit entry for first-time buyers, increasing the need for strategic investment planning.

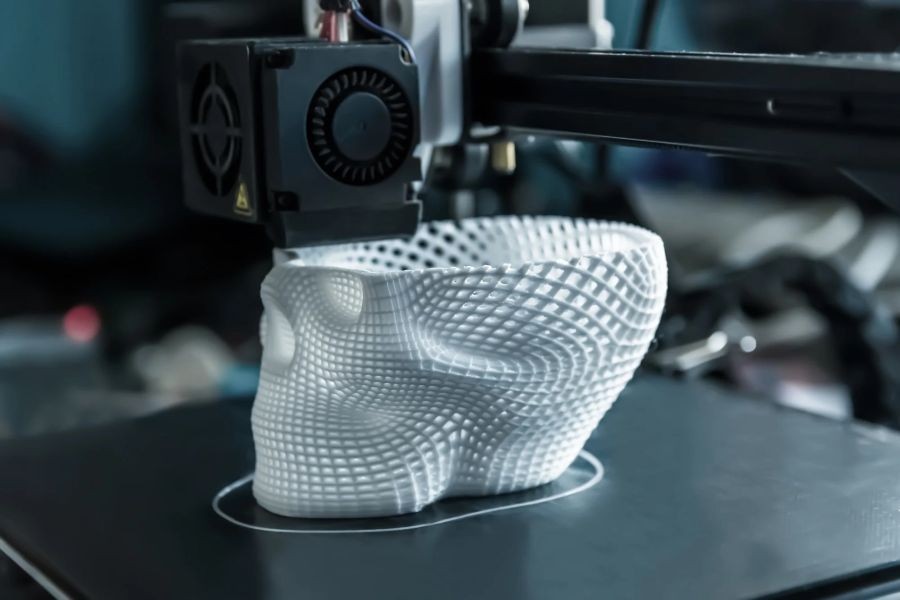

3. The Role of Technology in Property Investment

Technology has revolutionized how property investments are made. From virtual tours to data analytics, technology enhances decision-making by providing detailed insights into property conditions and market trends. For instance, AI-driven platforms can predict market shifts, allowing investors to strategize effectively.

Industry Insight:

Dr. Amanda Hughes, a property market researcher, notes that "AI tools now enable investors to analyze vast datasets, predicting market movements with unprecedented accuracy." This technological advancement is crucial for making informed decisions in a competitive market.

4. Case Study: A Successful Investment Journey

Case Study: Kiwi Real Estate Ventures – Navigating the Auckland Market

Problem: Kiwi Real Estate Ventures faced significant challenges in identifying profitable investments due to fluctuating market prices in Auckland.

- The company struggled with low ROI, risking investor confidence.

- Data showed a 15% decline in ROI for similar businesses over two years due to poor market analysis.

Action: To tackle this, they implemented AI-driven market analysis tools.

- These tools provided real-time data on price trends, buyer demand, and potential investment risks.

Result: Within six months, the company experienced significant improvements:

- ROI increased by 35%.

- Investor confidence surged, leading to a 20% increase in capital inflow.

Takeaway: Utilizing advanced technology in property investment can significantly enhance decision-making and profitability.

5. Future Trends and Predictions

The future of New Zealand's property market is influenced by various factors, including economic policies, technological advancements, and global market trends. According to a report by Deloitte, by 2028, 40% of property transactions in New Zealand may involve blockchain technology, enhancing transparency and security.

Predictions:

- Blockchain Integration: Increased adoption in the property sector for secure transactions.

- AI-Driven Insights: Greater reliance on AI for market predictions and investment strategies.

Common Myths & Mistakes

Myth: "Investing in property is always risk-free."

Reality: Market fluctuations and economic downturns can lead to significant losses, as evidenced by the 2008 financial crisis.

Myth: "All property investments yield high returns."

Reality: Poor location choices and market timing can result in negative returns.

Conclusion

Property market trend videos offer invaluable insights for buyers and investors, especially in a complex market like New Zealand. By understanding economic factors, leveraging technology, and being aware of potential risks, investors can make informed decisions that align with their financial goals. Ready to explore the property market further? Consider leveraging technology to enhance your investment strategy and stay ahead of market trends. Share your thoughts and experiences in the comments below!

People Also Ask (FAQ)

- How do property market trends impact tourism in New Zealand? Real estate trends can influence tourism by affecting accommodation availability and pricing, impacting traveler decisions.

- What are the biggest misconceptions about investing in NZ property? A common myth is that property investments are risk-free. However, market volatility can result in financial losses.

Related Search Queries

- New Zealand property market trends 2023

- Best areas to invest in NZ real estate

- Impact of AI on real estate investments

- Blockchain in property transactions NZ

- Future of property investments in New Zealand

For the full context and strategies on NZ Property Market Trend Videos: Insights for Buyers and Investors, see our main guide: Kiwi Housing Market Forecast Video Reports.