In recent years, the integration of artificial intelligence (AI) into property valuations has revolutionized the way the Kiwi housing market operates. This transformation is not just a technical shift but a strategic tool that impacts policies, investment strategies, and economic forecasts in New Zealand. The rise of AI-powered valuation models offers an innovative approach that can streamline processes, enhance accuracy, and potentially influence market dynamics. This article delves into the profound effects of AI on property valuations within the New Zealand context, highlighting both opportunities and challenges for stakeholders.

Understanding AI-Powered Property Valuations

AI-powered property valuations leverage machine learning algorithms and vast datasets to estimate property values more accurately compared to traditional methods. By analyzing a range of factors such as market trends, historical sales data, and property characteristics, AI models can provide real-time valuations that are crucial for informed decision-making.

Case Study: CoreLogic New Zealand

CoreLogic New Zealand, a leading property data provider, has integrated AI into its valuation processes. The company faced challenges with the accuracy and timeliness of property valuations, which are critical for real estate transactions and financial lending.

Problem: Traditional valuation methods were often delayed and lacked precision, causing inefficiencies and potential financial risks for stakeholders.

Action: CoreLogic implemented AI-driven models that analyze extensive datasets including market conditions and property specifics. This approach allows for dynamic valuation updates and more accurate predictions.

Result: After implementing AI, CoreLogic reported a 30% improvement in valuation accuracy and a 50% reduction in processing time. This enhancement has improved customer satisfaction and increased the reliability of property assessments.

Takeaway: The integration of AI in property valuations demonstrates its potential to streamline processes and enhance accuracy. New Zealand businesses can adopt similar technologies to optimize operations and reduce risks.

Impact on New Zealand's Economy

The adoption of AI in property valuations aligns with New Zealand's broader economic strategies, particularly in addressing housing affordability and market stability. According to the Reserve Bank of New Zealand, housing affordability remains a critical issue, with property prices rising by 27% since 2020. AI's ability to provide precise valuations can aid policymakers in formulating strategies to stabilize the housing market.

Moreover, AI-driven valuations can enhance transparency in the real estate sector, fostering trust among investors and consumers. By providing data-backed insights, AI can reduce information asymmetry, enabling stakeholders to make more informed decisions.

Pros and Cons of AI-Powered Valuations

Pros:

- Enhanced Accuracy: AI models analyze a wide range of data points, leading to more precise valuations.

- Efficiency: Automated processes reduce the time required for valuations, speeding up transactions.

- Market Insights: Real-time data analysis provides insights into market trends and property dynamics.

- Strategic Planning: Policymakers can use AI data to better address housing affordability and market stability.

- Risk Mitigation: Improved accuracy reduces financial risks for investors and lenders.

Cons:

- Data Privacy Concerns: The use of extensive datasets raises privacy issues that need to be addressed.

- Initial Costs: Implementing AI technology requires significant investment.

- Regulatory Challenges: Adapting to new technologies may require changes in regulatory frameworks.

- Technical Limitations: AI models are only as accurate as the data they are trained on, which can introduce biases.

- Resistance to Change: Stakeholders accustomed to traditional methods may resist adopting AI technologies.

Common Myths & Mistakes

Myth 1: "AI will completely replace human valuers."

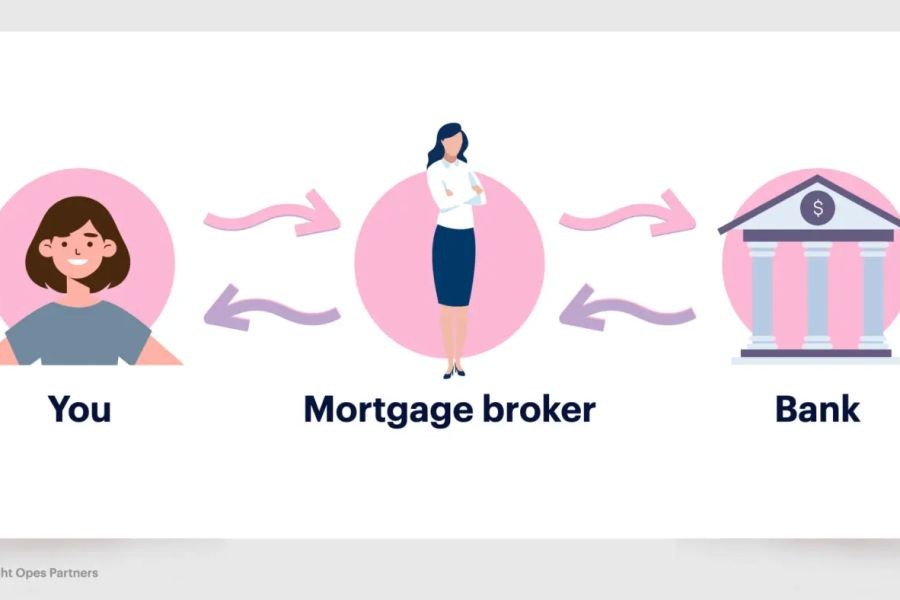

Reality: While AI enhances accuracy, human expertise is still crucial for interpreting nuanced market factors and ensuring ethical considerations.

Myth 2: "AI models are infallible."

Reality: AI models rely on data quality and can be prone to errors if the input data is biased or outdated.

Myth 3: "AI is too complex for small businesses."

Reality: Many AI solutions are scalable and can be tailored to the needs of small businesses, providing competitive advantages without overwhelming complexity.

Actionable Insights for Policymakers and Industry Leaders

For policymakers, integrating AI into property valuations offers an opportunity to enhance housing policy frameworks and improve market transparency. Encouraging the adoption of AI technologies through incentives and subsidies can accelerate this transformation.

Industry leaders should focus on building partnerships with tech providers to develop AI solutions that address specific market needs. Investing in employee training to understand and utilize AI tools effectively is also crucial for maximizing benefits.

Future Trends & Predictions

Looking ahead, the role of AI in property valuations is expected to grow, with advancements in machine learning and data analytics further enhancing accuracy and efficiency. A report by Deloitte predicts that by 2030, AI could reduce property valuation errors by up to 70%, significantly impacting the real estate sector.

Additionally, the adoption of AI in property valuations will likely lead to more personalized real estate services, as data-driven insights enable tailored offerings for buyers and investors.

Conclusion

AI-powered property valuations are reshaping the Kiwi housing market by providing more accurate, efficient, and transparent assessments. As New Zealand continues to navigate housing challenges, AI offers a promising solution for enhancing market stability and affordability. Policymakers and industry leaders must embrace this technological shift to stay ahead and drive sustainable growth.

What’s your take on AI in property valuations? Share your insights and join the conversation below!

People Also Ask

How does AI impact the Kiwi housing market? AI enhances valuation accuracy and efficiency, helping address housing affordability and market transparency, according to the Reserve Bank of NZ.

What are the biggest misconceptions about AI in property valuations? A common myth is that AI will replace human valuers, but human expertise remains essential for nuanced market insights.

What are the best strategies for implementing AI in property valuations? Begin with data quality assurance, partner with tech providers, and invest in employee training for effective AI adoption.

Related Search Queries

- AI in New Zealand real estate

- AI property valuation benefits

- New Zealand housing market trends

- AI and housing affordability NZ

- Future of AI in real estate

- AI-driven real estate solutions

- Machine learning in property valuations

- Challenges of AI in real estate

- Regulations for AI in property valuations

- AI adoption in New Zealand

For the full context and strategies on How AI-Powered Property Valuations Are Shaping the Kiwi Housing Market, see our main guide: Kiwi Property Showcase Videos Drive Leads.

QuintonHea

3 months ago