Investing in high-value properties in Australia presents an opportunity to capitalize on the country’s stable economic environment and thriving real estate market. However, with potential high returns come significant risks and complexities, particularly in the realms of tax and compliance. This guide will delve into the intricacies of property investment, offering strategic insights and data-backed analysis to help investors navigate the Australian property landscape effectively.

Understanding the Australian property market

Australia's property market is characterized by its resilience and dynamic growth. In recent years, property prices have surged, with Sydney and Melbourne leading the charge. According to CoreLogic, Sydney property prices rose by 12% in 2024, outpacing wage growth. This upward trend has caught the attention of both domestic and international investors, seeking to leverage the potential returns. However, the Reserve Bank of Australia (RBA) warns of potential cooling due to interest rate adjustments, making it crucial for investors to stay informed and strategic in their approach.

Step 1: Conduct Comprehensive Market Research

Before diving into the property market, investors must conduct thorough research to understand current trends and future projections. This research involves analyzing economic indicators, property cycles, and demographic shifts. The Australian Bureau of Statistics (ABS) offers valuable insights into these areas. For instance, the ABS reports a significant population growth in urban areas, driving demand for residential properties.

Example: An investor considering a purchase in the Melbourne suburbs should examine local employment rates, infrastructure development plans, and historical price trends to gauge future demand and potential appreciation.

Step 2: Assess Financial Implications

Property investment requires a deep understanding of financial metrics such as return on investment (ROI), cash flow, and tax implications. The Australian Taxation Office (ATO) provides guidelines on tax deductions and obligations, which can significantly impact net returns. It's crucial to factor in costs like stamp duty, property management fees, and maintenance expenses.

Example: A property purchased at $800,000 with a rental yield of 4% may seem attractive. However, after accounting for taxes, maintenance, and financing costs, the net yield might be substantially lower, underscoring the importance of a detailed financial analysis.

Step 3: Understand Legal and Compliance Requirements

Investing in property involves navigating complex legal and compliance landscapes. The Australian Competition & Consumer Commission (ACCC) and the Australian Prudential Regulation Authority (APRA) set forth regulations to protect investors and maintain market integrity. Compliance with zoning laws, building codes, and tenancy regulations is imperative to avoid legal pitfalls.

Example: An investor planning to develop a residential complex must ensure that the land is zoned for residential use and that all building plans adhere to local council requirements.

Pros vs. Cons of High-Value Property Investment

Pros

- Potential for High Returns: Historical data shows high-value properties in prime locations often yield significant appreciation and rental income.

- Tangible Asset: Real estate is a physical asset that can provide long-term security and income diversification.

- Tax Benefits: Deductions on mortgage interest, depreciation, and other expenses can enhance net returns.

Cons

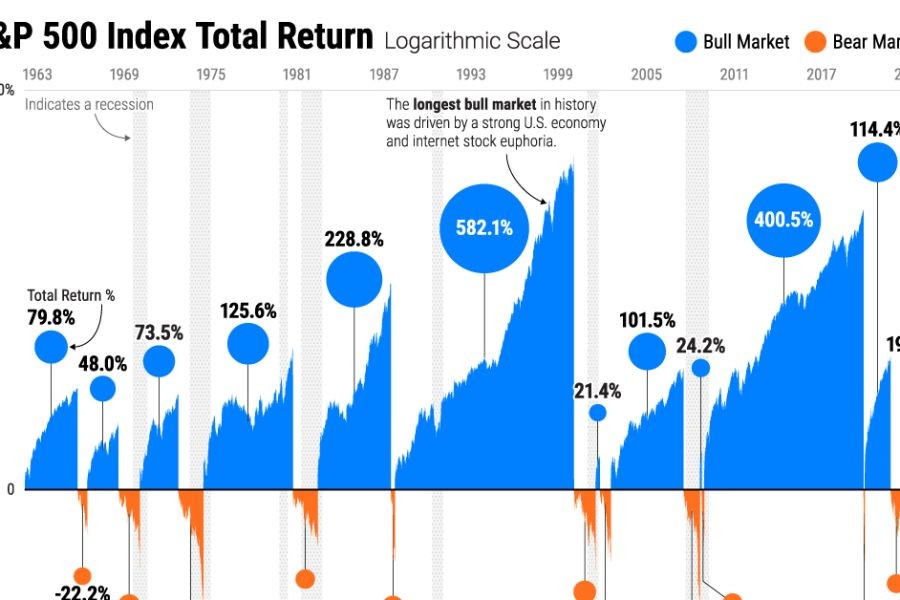

- Market Volatility: Property values can fluctuate due to economic changes, affecting investment returns.

- High Entry Costs: Significant capital is required for down payments and associated purchasing costs.

- Regulatory Risks: Changing laws and regulations can impact property values and rental yields.

Case Study: Successful Property Investment in Sydney

Problem: A local investor sought to capitalize on Sydney’s growing property market but faced challenges in identifying the right property and financing options.

Action: The investor utilized data analytics tools to assess market trends and engaged a financial advisor to explore tax-efficient financing structures.

Result: Within three years, the property appreciated by 20%, and strategic tax planning led to a 15% increase in net rental income.

Takeaway: Leveraging data and expert advice can significantly enhance investment outcomes in high-value property markets.

Common Myths & Mistakes in Property Investment

Myth vs. Reality

Myth: "Real estate always appreciates in value."

Reality: While long-term trends show appreciation, short-term market fluctuations can result in value depreciation. Investors must be prepared for potential downturns.

Myth: "Paying off the mortgage quickly is beneficial."

Reality: While reducing debt is generally positive, it may not always be the best financial strategy. Investors should consider the opportunity cost of redirecting funds from other potential investments.

Future Trends in Australian Property Investment

The future of property investment in Australia is poised for transformation, driven by technological advancements and sustainability trends. By 2028, 40% of Australian banks are expected to adopt blockchain for cross-border payments, potentially lowering transaction costs for investors (Source: Deloitte Banking Report 2024). Moreover, the push for sustainable living is likely to increase the demand for eco-friendly homes, impacting property values and tenant preferences.

Conclusion

Investing in high-value properties in Australia can offer substantial returns, but it requires a strategic approach informed by comprehensive research, financial acumen, and compliance awareness. By staying informed and leveraging expert insights, investors can navigate the complexities of the market and optimize their investment outcomes. As the landscape evolves, embracing technology and sustainable practices will be key to future success.

Ready to dive deeper into property investment strategies? Join our AU Property Investment Forum for exclusive insights and expert advice!

Related Search Queries

- Australian property investment strategies 2024

- How to invest in real estate in Australia

- Tax benefits of property investment in Australia

- Best cities for property investment in Australia

- Sydney vs. Melbourne property market trends

For the full context and strategies on High-Value Property Investment Guides for Australian Investors, see our main guide: Commercial Property Videos Australia.