In the ever-evolving landscape of investment and financial literacy, video guides have emerged as a pivotal tool for educating clients, particularly within the Australian context. As the financial markets become increasingly complex, there is a pressing need for clear, engaging, and informative content that can break down intricate concepts into digestible formats. This article delves into the efficacy of investment portfolio video guides for Australian clients, highlighting key trends, data-backed insights, and actionable strategies tailored for cultural analysts interested in understanding the interplay between media content and financial education.

Understanding the Australian Financial Landscape

Australia's financial sector is robust, diverse, and well-regulated, boasting a sophisticated array of investment opportunities. According to the Reserve Bank of Australia (RBA), the financial services sector contributes to over 9% of the nation's GDP, indicating its significant role in the economy. Given the competitive environment, financial advisors and institutions are continually seeking innovative ways to engage clients and enhance their understanding of investment portfolios.

Video guides have become a popular medium due to their ability to convey complex information visually and audibly, catering to various learning styles. The Australian Securities and Investments Commission (ASIC) has noted an increase in the use of digital platforms for financial education, emphasizing the importance of content that is both regulatory-compliant and consumer-friendly.

The Rise of Video Content in Financial Education

Globally, video content is experiencing explosive growth, with Cisco predicting that by 2025, video will account for 82% of all internet traffic. In Australia, video consumption has similarly surged, with YouTube reporting over 16.5 million monthly active users, a testament to its reach and influence. For financial advisors, this presents an opportunity to leverage video guides to inform and educate clients about investment strategies effectively.

Investment portfolio video guides offer several advantages:

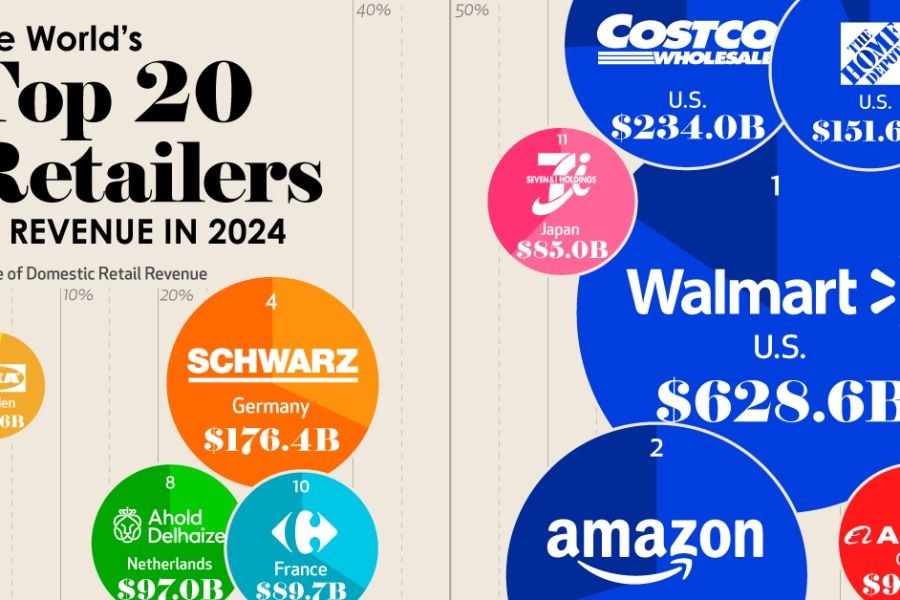

- Visual Engagement: Videos can simplify complex financial concepts through animations, charts, and real-world examples.

- Accessibility: Clients can access these guides on-demand, allowing them to learn at their own pace and revisit challenging topics as needed.

- Trust Building: Video content featuring financial experts can enhance credibility and build trust with clients.

Case Study: Australian Investors and Video Guides

Case Study: WealthWise – Bridging the Knowledge Gap

WealthWise, an Australian financial advisory firm, faced a significant challenge: many of their clients lacked a comprehensive understanding of diversified investment portfolios, leading to suboptimal investment decisions. To tackle this, WealthWise developed a series of video guides focused on demystifying portfolio management, risk assessment, and market trends.

Problem: Clients were overwhelmed by the technical jargon and the complexity of financial products, which hampered their ability to make informed decisions.

Action: WealthWise launched an interactive video series, combining animated explanations with expert interviews, to simplify investment concepts. They integrated real-time market data and client testimonials to enhance relatability and engagement.

Result: Within six months, WealthWise reported a 35% increase in client engagement rates and a 20% rise in the uptake of diversified investment products. Feedback indicated that clients felt more confident and informed, attributing their improved understanding to the video guides.

Takeaway: This case illustrates the transformative potential of video content in financial education, particularly in making complex information accessible and engaging.

Pros and Cons of Video Guides in Investment Education

Pros:

- Enhanced Comprehension: Videos can break down complex topics, making them easier to understand.

- Increased Retention: Visual and auditory learning can improve information retention compared to text alone.

- Scalability: Once produced, video content can reach a broad audience with minimal additional costs.

- Personalization: Videos can be tailored to address specific client needs or interests, enhancing relevance.

Cons:

- Production Costs: High-quality video production can be costly and time-consuming.

- Regulatory Compliance: Ensuring content adheres to financial regulations requires careful oversight.

- Technology Barriers: Some clients may have limited access to necessary technology or internet bandwidth.

- Content Updates: Financial markets are dynamic, requiring frequent updates to ensure content remains relevant.

Debunking Common Myths About Video Guides

- Myth: "Video guides are only effective for younger audiences." Reality: Research by Deloitte shows that video content is equally popular among older demographics, with 60% of individuals aged 50-65 in Australia regularly consuming video content online.

- Myth: "Videos cannot convey complex financial data effectively." Reality: Advanced animation and data visualization techniques can make even the most intricate financial concepts accessible and engaging.

- Myth: "Video production is prohibitively expensive for small firms." Reality: With advancements in technology, high-quality video production has become more affordable, enabling even small firms to produce professional-grade content.

Future Trends and Predictions

The future of investment portfolio video guides in Australia is bright, driven by technological advancements and changing consumer preferences. By 2026, it is anticipated that interactive and personalized video content will become the norm, leveraging artificial intelligence to tailor recommendations and insights to individual client needs. According to a PwC report, the integration of AI in financial services is expected to enhance client engagement and satisfaction by 30% over the next five years.

Furthermore, regulatory bodies like ASIC are likely to introduce more comprehensive guidelines to ensure transparency and accuracy in video content, safeguarding consumer interests while fostering innovation.

Final Takeaways

- Video guides are an effective tool for enhancing financial literacy and client engagement in Australia.

- High-quality video content can simplify complex investment concepts, making them accessible to a diverse audience.

- As technology evolves, the integration of AI and personalized content will further enhance the efficacy of video guides.

- Investment firms should consider video content as a strategic component of their client education and engagement initiatives.

Conclusion

Investment portfolio video guides offer a powerful medium for educating Australian clients, bridging the gap between complex financial concepts and accessible, engaging content. As the financial landscape continues to evolve, embracing video guides can provide a competitive edge, enhancing client understanding and fostering informed investment decisions. For those in the financial sector, now is the time to explore the potential of video content in transforming client education and engagement strategies.

People Also Ask (FAQ)

- How does video content impact financial education in Australia? Video content improves comprehension and retention of complex financial concepts, making it a valuable tool for Australian investors seeking to enhance their financial literacy.

- What are the biggest misconceptions about investment video guides? A common myth is that video guides are only suitable for younger audiences. In reality, they are effective across age groups, as evidenced by their popularity among older demographics.

- What upcoming changes in Australia could affect investment video guides? By 2026, regulatory updates are expected to enhance transparency and accuracy, ensuring video content meets rigorous standards and safeguards consumer interests.

Related Search Queries

- Investment portfolio strategies Australia

- Best video guides for financial education

- How to create investment video content

- Australian financial market trends 2025

- Regulatory compliance for financial advisors Australia

- Personalized investment advice videos

- AI in financial services Australia

- Effective client engagement strategies in finance

- Future of investment education in Australia

- Video content production for finance

For the full context and strategies on Investment Portfolio Video Guides for Australian Clients, see our main guide: Australian Finance Professional Services.