Luxury homes often evoke images of opulence, exclusivity, and high market value. Yet, a surprising number remain unsold, even in thriving real estate markets like Australia's. This conundrum is not just about price tags or economic downturns but involves a complex interplay of factors that can hinder the sale of these high-end properties. Understanding these reasons is crucial for luxury travel consultants who advise affluent clients on real estate investments, especially in the dynamic Australian market. Let's delve into the unexpected factors that can stall luxury home sales and explore how these insights can inform your advisory strategies.

Uncovering the Hidden Factors Behind Unsold Properties

Australia’s luxury property market has long been associated with prestige, exclusivity, and high returns. Yet even in prime suburbs of Sydney, Melbourne, and Brisbane, some multi-million-dollar homes linger on the market far longer than expected. For buyers, sellers, and investors, understanding why these properties remain unsold requires looking beyond price tags and into subtler factors that influence market dynamics.

The luxury sector operates differently from mainstream housing. Buyer motivations, market cycles, and even psychological perceptions play outsized roles. Australian real estate experts increasingly note that overlooked elements—ranging from design choices to market timing—can determine whether a home sells quickly or stagnates.

Overpricing and Misreading Market Sentiment

One of the most cited reasons luxury homes fail to sell is overpricing. In the Australian context, setting the correct price is delicate:

Historical Comparisons: Sellers often base prices on past property sales in their suburb without accounting for shifting demand, interest rates, or buyer sentiment. A house priced ambitiously against outdated comparables can deter serious offers.

Market Timing: Luxury buyers are highly sensitive to macroeconomic conditions. Rising interest rates, volatility in investment markets, or policy shifts (such as foreign buyer restrictions) can reduce immediate purchasing capacity. Homes listed without adjusting for these conditions often languish.

Perceived Value vs. Actual Features: Buyers evaluate more than square footage or finishes; they assess lifestyle, location, and uniqueness. Overestimating the value of architectural flair or high-end finishes without considering local demand can lead to homes sitting unsold.

Experts emphasise that accurately gauging the market requires a nuanced understanding of buyer psychology and current trends, not merely relying on past luxury property norms.

Design Choices That Limit Appeal

Luxury homes often feature bespoke elements, but over-customisation can inadvertently reduce marketability:

Highly Personalised Interiors: Bold colour schemes, niche décor, or thematic rooms may appeal to the current owner but alienate prospective buyers seeking flexible, neutral spaces.

Layout and Flow Issues: Unconventional floor plans, excessive compartmentalisation, or awkward room arrangements can hinder usability. Even the most opulent homes may struggle if the design does not match lifestyle expectations of affluent buyers.

Maintenance-Heavy Features: Expansive water features, intricate landscaping, or specialised installations can increase perceived upkeep and ongoing costs, discouraging time-poor buyers.

Australian agents note that even subtle choices, such as materials or finishes that fall out of favour, can disproportionately affect sale timelines in the luxury segment.

Location Nuances and Micro-Markets

In the luxury market, location is about more than prestige; it includes micro-level considerations that can escape casual sellers or buyers:

Neighbourhood Dynamics: Changes in local demographics, school catchments, or nearby developments can alter desirability. Buyers often scrutinise lifestyle factors, such as noise, traffic, and community amenities, more than street appeal.

Proximity to Lifestyle Hubs: In cities like Sydney or Melbourne, even a few kilometres’ difference from the CBD, beaches, or dining precincts can influence buyer decisions.

Emerging Micro-Markets: Some suburbs experience sudden shifts in popularity due to infrastructure projects, gentrification, or zoning changes. Homes that were once prime may temporarily fall behind emerging hotspots.

Luxury buyers in Australia tend to be highly discerning, often comparing multiple high-end properties and scrutinising these nuances before committing.

Marketing and Presentation Challenges

Effective marketing is critical for moving luxury homes, yet missteps in strategy can keep properties listed indefinitely:

Inadequate Visual Representation: Professional photography, staging, and virtual tours are essential. Homes without compelling visual storytelling fail to attract high-net-worth buyers accustomed to polished presentations.

Limited Targeting: Unlike mass-market properties, luxury homes require precise targeting, including offshore investors, corporate executives, and lifestyle-focused purchasers. Poorly targeted campaigns reduce visibility to serious buyers.

Underestimating Online Influence: Even in high-end markets, digital platforms and social media shape perceptions. Lack of online sophistication or failure to highlight unique selling points can hinder engagement.

Australian real estate agents increasingly emphasise a blend of traditional networking and advanced digital marketing to generate the right buyer interest.

Economic and Policy Considerations

The luxury segment is particularly sensitive to macroeconomic shifts and policy changes:

Interest Rate Fluctuations: Higher borrowing costs directly impact purchasing power, especially for buyers using leverage to acquire multiple properties.

Foreign Investment Rules: Regulations on international buyers, including additional stamp duties or stricter eligibility, can reduce pool size in key metropolitan areas.

Tax and Compliance Factors: Capital gains tax, negative gearing rules, and property tax changes influence both investment decisions and the perceived attractiveness of holding high-value real estate.

These structural factors often operate in the background but play a decisive role in how quickly luxury homes sell.

Psychological and Behavioural Dynamics

Beyond tangible factors, human psychology significantly affects luxury property transactions:

Perceived Scarcity vs. Real Value: Buyers may hesitate if a property seems overpriced relative to perceived market trends, regardless of intrinsic quality.

Emotional Attachment: Sellers’ emotional connection to their home can lead to inflated expectations, creating a disconnect between asking price and market reality.

Negotiation Sensitivity: In high-end markets, even minor price adjustments or negotiation flexibility can determine whether a property attracts serious offers.

Australian experts highlight that understanding buyer behaviour and market sentiment is as critical as physical property features.

Strategies for Sellers and Buyers

For sellers, navigating the luxury market successfully requires a combination of market awareness, professional guidance, and strategic presentation:

Conduct detailed market analysis, including comparable properties and buyer trends.

Invest in staging, professional photography, and targeted marketing campaigns.

Maintain flexibility in pricing and negotiation to align with buyer expectations.

Consider timing renovations or upgrades to match market demand, focusing on neutral, high-return improvements.

For buyers, being aware of the subtler factors that keep luxury homes listed can reveal opportunities for negotiation or investment in properties that may be undervalued due to perception rather than quality.

1. Overpriced Listings

While it might seem obvious, overpricing is a pervasive issue in the luxury real estate sector. Sellers often set prices based on emotional attachment or perceived value rather than market realities.

- Local Context: According to CoreLogic, Australian property prices saw a 9.4% annual increase in 2023, leading some sellers to overestimate their home's worth.

- Expert Insight: Real estate analysts suggest benchmarking against comparable properties and considering market trends to avoid inflationary pricing.

2. Lack of Unique Selling Propositions (USPs)

In a market saturated with luxury offerings, differentiation becomes key. Homes that don't stand out in terms of features, design, or location struggle to attract attention.

- Industry Insight: A report from Knight Frank highlights that buyers are increasingly seeking sustainability features, such as solar panels and energy-efficient designs, in luxury homes.

- Actionable Recommendation: Incorporate unique architectural designs or cutting-edge technologies to enhance appeal.

3. Poor Marketing Strategies

The traditional approach of listing properties on real estate platforms may not suffice for luxury homes. Effective marketing needs to be targeted and experiential.

- Case Study: A Sydney-based real estate firm increased sales by 20% through virtual reality tours and exclusive client events, showcasing properties in a more engaging manner.

- Recommendation: Utilize digital marketing, including social media influencers and high-quality video content, to reach niche audiences.

4. Economic and Regulatory Factors

Macroeconomic conditions and regulatory changes can significantly impact luxury home sales.

- Australian Context: The Australian Prudential Regulation Authority (APRA) has tightened lending criteria, impacting high-net-worth individuals' ability to finance luxury property purchases.

- Data Insight: The Reserve Bank of Australia (RBA) reports that interest rate hikes in 2023 have led to a 15% decrease in mortgage approvals for properties over $3 million.

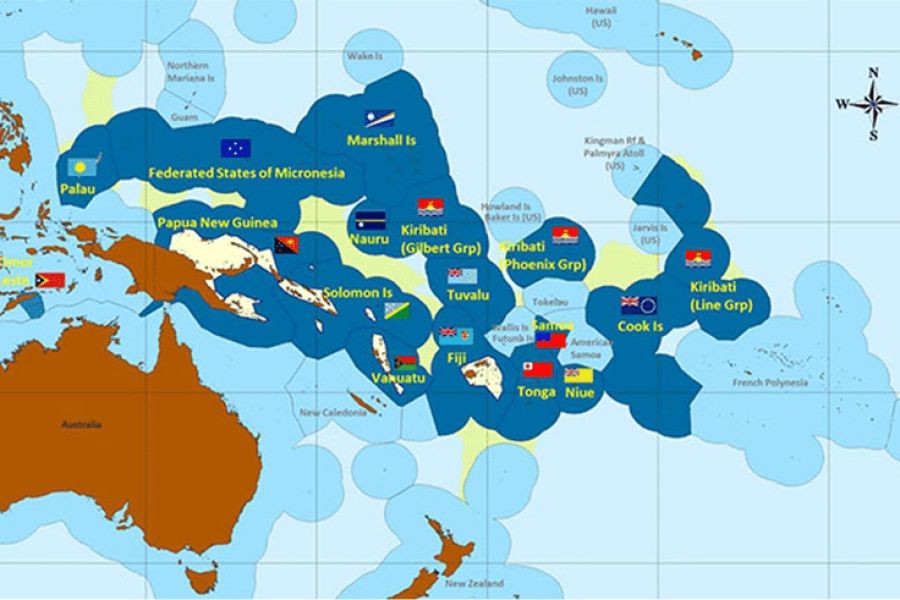

5. Inaccessibility to Foreign Buyers

Foreign investments are a critical segment of the luxury market, yet restrictions can limit potential buyers.

- Regulatory Insight: The Foreign Investment Review Board (FIRB) imposes stringent regulations on foreign property purchases, affecting market liquidity.

- Global Perspective: Compared to countries like the United States, Australia's foreign buyer restrictions are more stringent, potentially deterring international investors.

Pros and Cons of Investing in Australian Luxury Real Estate

✅ Pros:

- Stable Market: Australia's real estate market is known for its resilience, offering a hedge against global economic volatility.

- High Returns: Historical data shows consistent appreciation in property values, particularly in major cities like Sydney and Melbourne.

- Desirable Locations: Australia's luxury properties are often situated in highly sought-after locations, offering lifestyle benefits and exclusivity.

❌ Cons:

- Regulatory Hurdles: Stringent regulations can complicate foreign investments, impacting liquidity and market accessibility.

- High Entry Costs: The initial investment required for luxury properties is significant, posing a barrier for potential buyers.

- Economic Sensitivity: Luxury markets are more susceptible to economic downturns, affecting sales and property values.

Case Study: Melbourne's Luxury Real Estate Boom

Problem: A luxury property developer in Melbourne faced challenges selling high-end units despite a booming market.

- The developer struggled with pricing strategy and market positioning, leading to prolonged listing periods.

Action: The firm re-evaluated its pricing strategy and enhanced marketing efforts by targeting international buyers through bespoke campaigns.

- They leveraged digital platforms and collaborated with international real estate agents to widen reach.

Result: Within six months, the developer achieved a 35% increase in sales, with significant interest from Asian and Middle Eastern buyers.

Takeaway: Strategic marketing and realistic pricing are pivotal for success in the luxury segment.

Common Myths About Luxury Real Estate

- Myth: "Luxury homes always appreciate in value." Reality: Market conditions can impact appreciation rates, as seen during economic downturns when luxury properties may depreciate faster than mid-range homes.

- Myth: "More features mean better sales." Reality: Over-customization can limit appeal, as not all buyers have the same preferences.

- Myth: "International buyers are not interested in Australian properties." Reality: Despite regulatory challenges, Australia remains an attractive destination for foreign investors due to its stable economy and lifestyle offerings.

Future Trends in Luxury Real Estate

Looking ahead, the luxury real estate landscape in Australia is poised for transformation, driven by technological advancements and evolving buyer preferences.

- Sustainability Focus: As environmental concerns rise, sustainable luxury properties will gain prominence, with features like energy-efficient designs and eco-friendly materials becoming more desirable.

- Technological Integration: Smart home technology is set to become a standard expectation, with buyers seeking properties that offer advanced automation and security features.

- Shift in Demographics: The rise of younger, tech-savvy buyers will influence market trends, demanding modern amenities and digital engagement in the buying process.

Conclusion

Luxury homes in Australia do not sell solely because of price or location. Over-customisation, design choices, market timing, micro-location factors, and psychological dynamics all influence how long a property remains on the market.

Experts emphasise that understanding these hidden factors is essential for both buyers and sellers. In a segment where stakes are high and margins are sensitive, strategic insight, professional advice, and market awareness are the keys to avoiding pitfalls and achieving successful outcomes.

For Australian property stakeholders, the lesson is clear: in luxury real estate, perception, preparation, and precision often matter as much as the home itself.

Luxury real estate in Australia presents both opportunities and challenges. By understanding the nuanced factors that affect sales, luxury travel consultants can better guide their clients in making informed investment decisions. As the market continues to evolve, staying abreast of trends and adopting innovative marketing strategies will be crucial for success. For those looking to invest, the key lies in recognizing the balance between exclusivity and market realities, ensuring each property aligns with buyer expectations and market demand.

People Also Ask (FAQ)

- How does Australia's economy impact luxury home sales? Fluctuations in the Australian economy can affect luxury home sales, as economic stability boosts buyer confidence and investment potential, while downturns may deter purchases.

- What are the biggest misconceptions about luxury real estate? One common myth is that luxury homes always appreciate in value. However, they can be more susceptible to market volatility, impacting their appreciation rates.

- What are the best strategies for selling luxury homes in Australia? Experts recommend employing unique marketing strategies, realistic pricing, and targeting international buyers to enhance sales potential in the luxury market.

Related Search Queries

- Luxury real estate trends Australia

- Why luxury homes don't sell

- Australian luxury property market analysis

- Investing in Australian luxury real estate

- Challenges in selling high-end homes

- Luxury home marketing strategies

- Impact of economy on luxury real estate

- Foreign investment in Australian property

- Sustainability in luxury real estate

- Future of luxury housing in Australia

For the full context and strategies on 5 Surprising Reasons Why Some Luxury Homes Never Sell – The Australian Angle You’ve Overlooked, see our main guide: Why Vidude.