Australia’s adventure sports scene is a thrilling landscape of adrenaline-pumping activities that draw both locals and tourists alike. However, beneath the surface of this exhilarating environment lies a darker side—insurance scams that plague the industry. These scams not only jeopardize the financial stability of businesses but also pose significant risks to participants and the wider economy. Understanding and addressing these scams is crucial for ensuring the safety and sustainability of adventure sports in Australia.

Introduction: The Hidden Threat in Australia's Adventure Sports

In recent years, Australia has seen a surge in the popularity of adventure sports, from surfing the iconic waves of Bondi Beach to rock climbing in the Blue Mountains. Yet, as the industry grows, so do the opportunities for fraud. According to the Australian Bureau of Statistics (ABS), the adventure sports industry contributes significantly to the economy, making it a lucrative target for scammers. This article delves into the intricate world of insurance scams affecting this vibrant sector, offering insights into how they operate and how businesses can protect themselves.

Why insurance has become the quiet crisis in Australia’s adventure economy

Australia has one of the most active adventure sports cultures in the world. From surfing and kiteboarding to rock climbing, skydiving, trail riding, and white-water rafting, outdoor risk is not a fringe pursuit. It is embedded in national identity, regional tourism, and local economies.

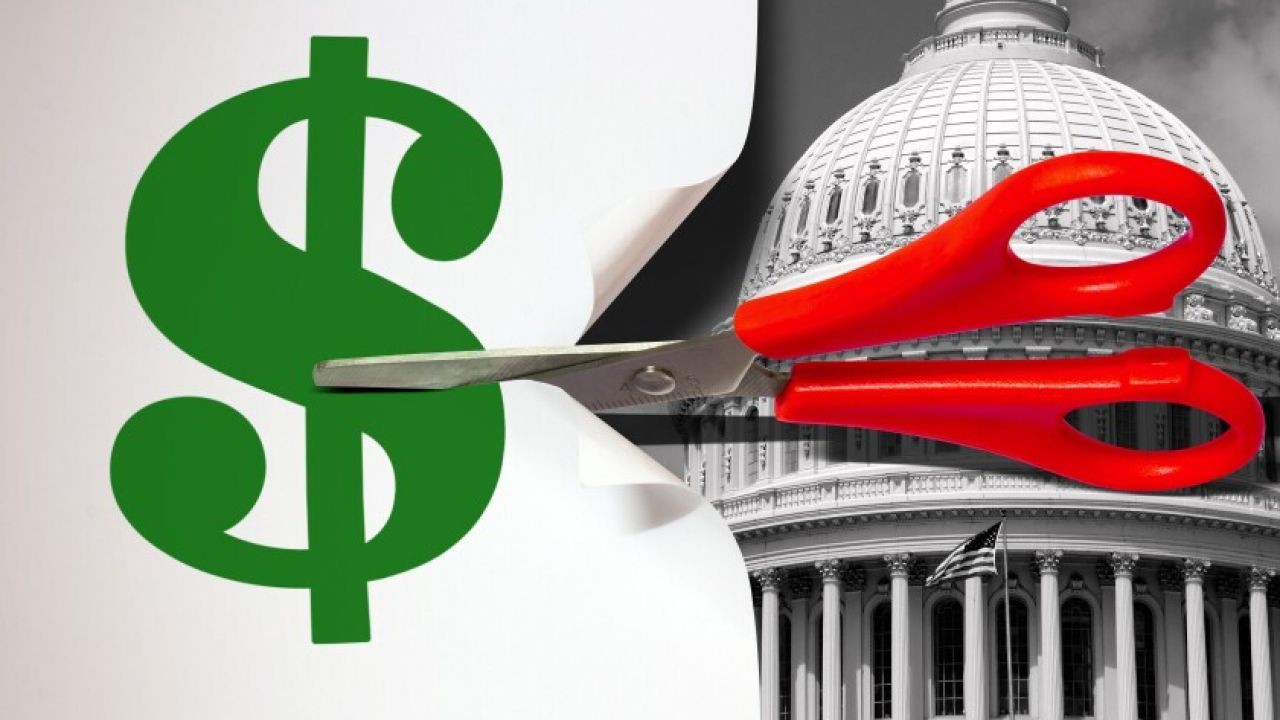

Yet behind the growth of adventure participation sits a largely invisible problem: insurance fraud and exploitation that is quietly destabilising the sector. Operators are facing soaring premiums, exclusions that make coverage nearly meaningless, and claims processes shaped more by defensive legal strategy than real-world risk.

This is not a marginal issue. For many adventure businesses, insurance is now the single largest fixed cost, often exceeding rent, equipment, or staff wages. As scams and exaggerated claims increase, insurers retreat or price themselves out of reach. The result is a fragile ecosystem where legitimate operators struggle to survive, while opportunistic behaviour goes largely unchecked.

At the same time, this pressure has created an opening. Australian startups, particularly in insurtech, risk analytics, and compliance technology, are beginning to turn this dysfunction into opportunity.

What insurance scams actually look like in adventure sports

Contrary to popular belief, most insurance abuse in adventure sports does not involve elaborate staged accidents. It is more subtle, and therefore harder to police.

One common pattern involves participants exaggerating injuries after incidents that were inherent, disclosed risks of the activity. In adventure sports, the line between accident and assumption of risk is narrow. Some claimants, often encouraged by third-party legal operators, frame normal outcomes as negligence.

Another pattern involves misrepresentation. This can occur when participants fail to disclose pre-existing injuries, intoxication, or breach of safety instructions, only for these details to emerge after a claim is lodged. In other cases, small operators misclassify activities to access cheaper cover, inadvertently voiding policies when claims arise.

Australia’s legal environment, where liability frameworks vary by state and waivers are not always decisive, creates fertile ground for these disputes. Insurers respond by increasing premiums across entire categories, rather than isolating bad actors.

Why adventure sports are uniquely exposed

Adventure sports sit at the intersection of physical risk, tourism, and consumer expectation. Participants often want both thrill and protection, even when those goals conflict.

In Australia, there is a strong cultural assumption that someone else should bear responsibility when things go wrong. This is reinforced by advertising language, social media narratives, and uneven understanding of personal risk.

For insurers, adventure sports represent a low-volume, high-uncertainty category. Claims may be infrequent, but when they occur, they can be expensive and reputationally sensitive. Faced with poor data and inconsistent reporting, insurers often respond conservatively.

The result is a blunt system. Good operators subsidise bad behaviour. Transparent businesses pay for opaque ones. Over time, this drives experienced providers out of the market, leaving fewer, larger players or informal operators who operate under the radar.

The downstream impact on operators and regions

Rising insurance costs do not just affect businesses. They shape who can access adventure sports at all.

Smaller regional operators, particularly in areas reliant on tourism, are often the first casualties. When insurance becomes unaffordable, activities are reduced or cancelled entirely. This has flow-on effects for accommodation, hospitality, and local employment.

In some parts of Australia, land managers and councils respond by tightening access or imposing blanket bans, further reducing opportunity. Ironically, this can push participation into unregulated spaces where risk is higher and insurance nonexistent.

The system becomes self-reinforcing. Higher risk leads to higher premiums, which lead to less oversight, which leads to more risk.

Where startups see opportunity, not just failure

This dysfunction has caught the attention of Australian entrepreneurs who see insurance not as a static product, but as a data and trust problem.

A growing number of startups are building tools that help adventure operators demonstrate real-world safety rather than rely on generic classifications. These platforms track participant briefings, equipment checks, environmental conditions, and incident reporting in ways insurers can actually use.

Others focus on dynamic risk assessment. Instead of annual policies based on broad assumptions, these models price risk per session, per participant, or per condition. A calm day on flat water is not priced the same as extreme conditions, even within the same sport.

There is also movement toward verifiable waivers and informed consent systems. Rather than treating waivers as legal theatre, startups are designing processes that prove participants understood risks at the time of engagement. This does not remove liability, but it reduces ambiguity.

Why Australia is fertile ground for this shift

Australia’s adventure sports scene is large enough to generate meaningful data, but small enough to allow experimentation. Operators often know each other, share problems, and are open to pragmatic solutions rather than ideological ones.

The country also has a strong base of founders with lived experience in adventure sports, insurance, or both. This matters. Solutions built without understanding how these activities actually operate tend to fail quickly.

Regulators, while cautious, are increasingly aware that the status quo is unsustainable. There is growing recognition that blanket exclusions and rising premiums do not improve safety, they simply reduce transparency.

The trade-offs and unresolved tensions

This evolution is not without risk. Greater data collection raises privacy concerns. Smaller operators worry about administrative burden. Some fear that algorithmic pricing could penalise innovation or push risk tolerance too low.

There is also tension between personal responsibility and consumer protection. Australian society has not fully resolved where that line should sit in adventure contexts. Startups can improve clarity, but they cannot settle cultural debates on their own.

What they can do is make risk visible rather than abstract. That alone changes behaviour.

What the next five years are likely to bring

If current trends continue, Australia’s adventure sports insurance landscape will fragment. Traditional insurers may retreat further, while specialist providers and tech-enabled underwriters step in.

Operators who adopt transparent, data-driven safety systems will likely access better coverage and pricing. Those who do not may struggle to operate at all. This will accelerate professionalisation across the sector.

For participants, the experience may become more explicit. Fewer illusions of zero-risk, more informed consent, and clearer boundaries between thrill and responsibility.

Understanding the Anatomy of Insurance Scams in Adventure Sports

Insurance scams in the adventure sports industry can take many forms, but they typically involve fraudulent claims for accidents that never occurred or exaggerated injury claims. These scams exploit the inherently risky nature of adventure sports, where injuries are not uncommon. Here’s how they generally unfold:

- False Claims: Individuals or groups orchestrate fake incidents, such as staged accidents, to file claims that result in undeserved payouts.

- Exaggerated Injuries: Real accidents are exaggerated to claim higher compensation, often involving collusion between participants and medical professionals.

- Ghost Policies: Fraudsters sell fake insurance policies to unsuspecting businesses or participants, leaving them unprotected in case of genuine incidents.

The Australian Competition & Consumer Commission (ACCC) highlights that these scams not only defraud insurance companies but also inflate premiums, impacting the entire industry.

Case Study: The Impact of Insurance Fraud on a Surfing School

Consider the case of a surfing school in Byron Bay, which faced a series of fraudulent claims that nearly led to its closure. The school experienced multiple claims for injuries supposedly sustained during lessons. Upon investigation, it was revealed that several claimants had never enrolled in any classes.

Through diligent record-keeping and collaboration with their insurer, the school was able to prove the fraudulent nature of these claims. However, the incident resulted in increased insurance premiums and temporary reputational damage. This case underscores the importance of robust record management and insurer partnerships in combating scams.

Steps to Combat Insurance Scams in Adventure Sports

Addressing insurance fraud requires a multi-faceted approach that involves businesses, insurers, and regulatory bodies. Here’s how businesses can protect themselves:

- Implement Rigorous Verification Processes: Ensure that all participants sign waivers and provide identification. This can deter fraudulent claims by establishing a clear participant record.

- Invest in Surveillance and Monitoring: Deploy cameras and other monitoring tools at activity sites to capture evidence of any incidents. This footage can be invaluable in refuting false claims.

- Regularly Audit Insurance Policies: Collaborate with insurance providers to review policies and claims history for any inconsistencies or red flags.

- Educate Staff and Participants: Train staff to recognize suspicious behavior and educate participants on the importance of honesty in claims.

By following these steps, businesses can significantly reduce the risk of falling victim to insurance scams, safeguarding their operations and reputation.

Regulatory Insights and the Role of APRA

The Australian Prudential Regulation Authority (APRA) plays a crucial role in overseeing the insurance sector, ensuring that it operates within a framework that minimizes fraud risk. APRA’s guidelines on risk management and fraud prevention provide a blueprint for insurers and businesses alike.

According to APRA, one of the key strategies is enhancing data analytics capabilities to detect anomalies in claims, which can indicate potential fraud. By leveraging technology, insurers can more effectively identify and investigate suspicious claims, reducing the incidence of fraud.

Myths and Misconceptions About Insurance Scams

- Myth: "All insurance claims are thoroughly investigated." Reality: Due to high volumes of claims, many are processed with minimal scrutiny, making them vulnerable to fraud.

- Myth: "Only large businesses are targeted by scammers." Reality: Small and medium enterprises are equally at risk, often due to less stringent risk management practices.

- Myth: "Insurance companies are solely responsible for preventing fraud." Reality: Fraud prevention is a shared responsibility between insurers, businesses, and regulatory bodies.

Future Trends and Predictions

Looking ahead, the integration of technology in fraud detection is expected to transform the insurance landscape. Artificial intelligence and machine learning are being increasingly employed to analyze vast amounts of data, identifying patterns that may indicate fraudulent activity. According to a report by Deloitte, the global investment in AI for fraud detection is projected to grow by 25% annually, with Australia being a significant contributor to this trend.

Moreover, as awareness of insurance fraud grows, there will likely be more stringent regulatory measures and collaboration between industry stakeholders to enhance fraud prevention strategies.

Conclusion: Safeguarding Australia's Adventure Sports Industry

Insurance scams are not destroying Australia’s adventure sports scene, but they are distorting it. The cost is borne not by insurers alone, but by operators, regions, and participants who lose access to safe, well-run experiences.

What makes this moment different is that solutions are emerging from within the ecosystem. Australian startups are reframing insurance as something that reflects reality rather than fights it.

If they succeed, the outcome will not be a risk-free adventure culture. It will be a more honest one, where responsibility is shared, data replaces assumption, and insurance once again supports participation instead of quietly suffocating it.

In a country built on outdoor challenge, that shift may prove essential.

Insurance scams pose a significant threat not only to the financial viability of adventure sports businesses but also to their reputation and customer trust. By understanding the dynamics of these scams and implementing robust preventive measures, businesses can protect themselves and contribute to the integrity of the industry.

As the adventure sports sector continues to grow, remaining vigilant and proactive in fraud prevention will be crucial. By fostering a culture of transparency and collaboration, Australia can ensure that its adventure sports scene remains both thrilling and secure.

Final Takeaways

- Insurance scams in adventure sports can take the form of false claims, exaggerated injuries, and ghost policies, impacting both businesses and participants.

- Implementing rigorous verification processes and investing in surveillance can help deter fraudulent claims.

- Collaboration with insurers and adherence to APRA guidelines are critical in minimizing fraud risk.

- Future trends indicate increased use of AI and machine learning for fraud detection, enhancing industry resilience.

Call to Action

To stay informed about the latest trends and preventive measures in the adventure sports industry, subscribe to our newsletter. Share your thoughts on how businesses can better protect themselves from insurance scams in the comments below!

People Also Ask (FAQ)

- How do insurance scams impact businesses in Australia's adventure sports industry? Insurance scams lead to increased premiums and financial losses, affecting business viability and consumer trust.

- What are the biggest misconceptions about insurance scams? Many believe that scams only target large businesses and that insurers are solely responsible for prevention, which is not the case.

- What strategies can businesses use to prevent insurance scams? Businesses should implement verification processes, invest in surveillance, and collaborate with insurers for effective fraud prevention.

Related Search Queries

- Insurance fraud in adventure sports Australia

- How to prevent insurance scams in sports

- Adventure sports insurance policies Australia

- Impact of insurance fraud on Australian businesses

- Future trends in fraud detection technology

- APRA guidelines on insurance fraud

For the full context and strategies on The Insurance Scams That Plague Australia’s Adventure Sports Scene – (And How Aussie Startups Are Capitalising), see our main guide: Telehealth Video Marketing Australia.