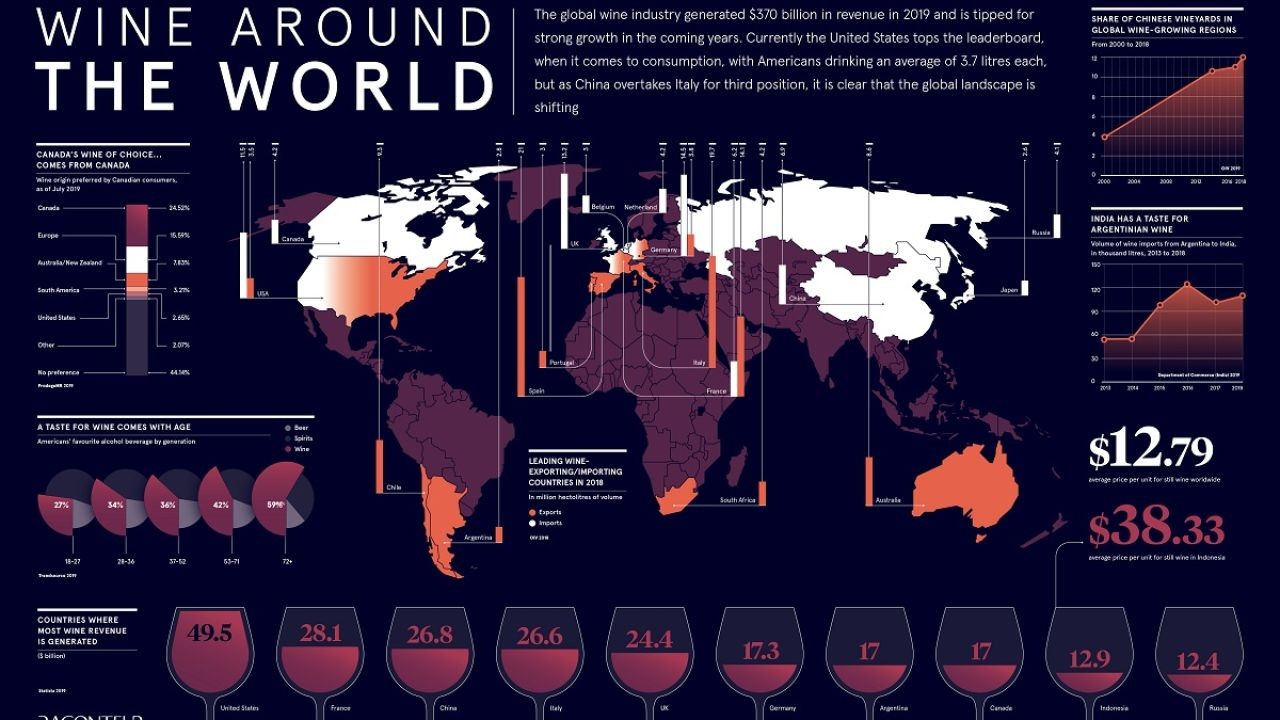

The global wine market is not merely evolving; it is undergoing a fundamental structural shift. For decades, the industry operated on a model of predictable consumption in established markets, with prestige defined by a handful of Old World regions. Today, that model is fracturing under the weight of changing consumer demographics, climate volatility, and a digital-first commerce landscape. For Australia, a nation whose wine exports were valued at $1.9 billion in the 2023-24 financial year according to Wine Australia, these shifts represent both an existential challenge and a profound opportunity for reinvention. The question is no longer if the market will change, but how Australian producers and exporters will strategically adapt to secure their place in the new world order.

The Core Drivers Reshaping Global Demand

Understanding the new landscape requires moving beyond vintage reports and examining the macroeconomic and social currents redirecting the flow of wine worldwide.

Consumer Behaviour: The Rise of the 'Why' Purchase

Globally, and acutely in key markets like the US and UK, consumption is moving from habitual to intentional. Health-consciousness, particularly among Millennials and Gen Z, is driving demand for lower-alcohol, lower-sugar, and organic options. This isn't a fringe trend; it's a recalibration of value. Furthermore, storytelling and provenance are paramount. Consumers increasingly buy into a narrative—sustainability credentials, regenerative farming practices, or a compelling founder's journey—as much as the liquid in the bottle. From my work with Australian SMEs, those who have pivoted their messaging from technical tasting notes to authentic stories about family, place, and environmental stewardship are seeing stronger engagement and price resilience in crowded export markets.

Economic and Logistic Pressures

Inflationary pressures have squeezed disposable income, making mid-tier wine a fiercely competitive battleground. Concurrently, supply chain disruptions and soaring freight costs, which impacted Australian exporters significantly post-pandemic, have forced a rethink of logistics. The economic partnership agreements with the UK and India are positive, but their benefits are partially offset by these global headwinds. Drawing on my experience in the Australian market, forward-thinking exporters are now exploring regional consolidation hubs and investing in direct-to-consumer (DTC) channels to improve margin control and reduce dependency on volatile freight markets.

The Climate Imperative

Climate change is no longer a future risk but a present-day operational variable. Increased frequency of heatwaves, bushfires (and associated smoke taint risk), and shifting rainfall patterns are directly impacting yield and quality consistency in regions from the Barossa to Margaret River. This necessitates significant investment in climate-adaptation strategies, from vine genetics to water management. The 2020 bushfire season, which caused an estimated $40 million in grape losses, was a stark wake-up call. Adaptation is now a line item in any credible business plan.

Where Most Australian Brands Go Wrong

In observing trends across Australian businesses, several strategic missteps are common when responding to these global shifts.

- Over-Reliance on Legacy Markets: While China's import tariffs were a specific shock, the broader error is dependency on any single market. Many producers remain overly exposed to traditional routes, failing to diversify into emerging opportunities in Southeast Asia or the Americas.

- Commoditisation of Premium Offerings: In a bid for volume, there's a tendency to discount premium labels during surplus vintages. This erodes brand equity and trains consumers to wait for promotions, making it incredibly difficult to regain price positioning.

- Treating DTC as an Afterthought: Many wineries view their cellar door and website as separate from their export strategy. In practice, with Australia-based teams I’ve advised, the most resilient businesses are those with an integrated omni-channel approach, using DTC data from domestic sales to understand consumer preferences that inform export product development and marketing.

- Under-Investing in Digital Storytelling: A brochure-style website is insufficient. The modern buyer’s journey starts with a search engine or social media. Australian producers must create rich, search-optimised content that conveys their unique narrative and values to a global online audience.

Strategic Advantages and Actionable Pathways for Australia

Despite the challenges, Australia possesses distinct competitive advantages: diverse terroirs, advanced viticultural technology, and a reputation for consistent quality. The task is to leverage these within the new paradigm.

1. Double Down on Authentic Sustainability

"Sustainable" is a term at risk of becoming meaningless. Australian producers must move beyond basic certification to communicate tangible, verifiable actions. This includes:

- Regenerative Agriculture: Showcasing soil health initiatives, biodiversity projects, and carbon sequestration efforts. This resonates powerfully with the narrative-driven consumer.

- Circular Economy Practices: Highlighting innovations in lightweight packaging, recycled materials, and water re-use. Based on my work with Australian SMEs, those who quantify their environmental impact (e.g., "this bottle uses 30% less glass") see stronger cut-through in markets like Scandinavia and the UK.

- Actionable Insight: Conduct a full lifecycle audit of your product's environmental impact. Use this data not just for internal improvement, but as the core of your marketing narrative for key export markets. Create a dedicated "Our Impact" page on your website with transparent metrics.

2. Master the Omni-Channel Export Model

The future of export is hybrid, blending traditional distribution with agile DTC e-commerce.

- Market-Specific E-Commerce: Don't just ship internationally from a .com.au site. Consider localised platforms, partnerships with specialist online retailers in target countries, or leveraging global marketplaces with wine programs. This solves for logistics, currency, and local marketing.

- Data-Driven Market Entry: Use tools like Wine Australia's Export Market Guide alongside e-commerce analytics to identify niches. For instance, data might reveal growing demand for Australian Nero d'Avola in the US, allowing a producer to enter with a targeted digital campaign rather than a generic "Australian wine" push.

- Actionable Insight: For your next target export market, pilot a "digital-first" entry. Partner with a local influencer or sommelier for a virtual tasting, sell limited allocations via a dedicated landing page, and use the customer data and engagement generated to negotiate with traditional distributors from a position of proven demand.

3. Innovate Beyond the Grape

The non-alcoholic and alternative wine category is growing at over 7% annually (IWSR 2024). Australia is well-placed to lead in quality-driven products in this space, using its technical expertise to create sophisticated alcohol-removed wines and other fermented beverages. This isn't a dilution of brand equity but an expansion of addressable market.

Case Study: Taylors Wines – Leveraging Data and DTC for Resilience

Problem: Taylors (known as Wakefield in Europe), a major family-owned Clare Valley producer, faced the dual challenge of global market volatility and the need to build deeper direct relationships with consumers beyond its cellar door. Like many, its export model was heavily wholesale-dependent, insulating it from end-customer insights.

Action: The company invested significantly in a sophisticated CRM and e-commerce platform, unifying data from its cellar door, wine club, and website. It launched targeted, content-rich digital campaigns in key export markets like the US, focusing on its family story and multi-generational sustainability projects (e.g., its biodiversity wetlands). Crucially, it used this DTC channel to offer exclusive, small-batch wines and experiences directly to international consumers.

Result: This strategy delivered measurable outcomes:

- Substantial growth in its high-margin DTC channel, providing a buffer against wholesale margin pressures.

- Valuable first-party data on export consumer preferences, informing blend development and marketing messaging.

- Enhanced brand loyalty, with international wine club members acting as advocates in their home markets.

Takeaway: Taylors demonstrates that a proactive DTC and data strategy is not just for small boutiques. It provides critical market intelligence, improves margins, and builds brand equity, making a large exporter more agile and resilient in the face of global shifts. Australian businesses of all sizes can emulate this by starting to collect and centralise customer data, no matter how small the initial sample.

The Future of Australian Wine on the Global Stage

The next five years will see a clear bifurcation. Producers who cling to the bulk/commodity model or undifferentiated mid-tier offerings will face intense pressure. Conversely, those who act as authentic storytellers, agile digital merchants, and sustainable innovators will capture disproportionate value. We will see:

- Hyper-Local to Hyper-Global: Wineries will use digital platforms to sell limited editions from a single barrel or vineyard block directly to a global audience of collectors, bypassing traditional layers.

- Regulation as a Catalyst: Stricter EU and UK sustainability labelling laws will become a competitive advantage for prepared Australian exporters with verified credentials.

- Tech-Enabled Terroir: Widespread use of AI and sensors for precision viticulture will improve climate adaptation, with the story of that technology becoming part of the brand appeal for quality-focused buyers.

People Also Ask (PAA)

How is climate change specifically affecting Australian wine regions? Beyond heat and drought, increased bushfire risk brings smoke taint, threatening entire vintages. Changing seasonal patterns also disrupt flowering and harvest timing, challenging traditional winemaking practices and requiring significant investment in irrigation and canopy management technologies.

What is the biggest opportunity for Australian wine in Asia beyond China? Southeast Asia, particularly Thailand, Vietnam, and Malaysia, presents a major growth opportunity driven by a growing middle class and economic integration via agreements like CPTPP. Success requires tailored strategies focusing on lighter styles, education, and digital engagement suited to each market's unique platforms.

Is direct-to-consumer (DTC) export logistically feasible for small Australian wineries? Yes, through partnerships. Specialist third-party logistics providers now offer temperature-controlled international shipping, customs clearance, and compliance services. Collaboratives where several wineries share export costs and marketing resources can also make DTC export viable and cost-effective for smaller producers.

Final Takeaway & Call to Action

The global wine market's shift is a demand for greater transparency, authenticity, and agility. Australia's response must be equally multidimensional. It is no longer enough to make excellent wine. You must craft an irresistible narrative, deliver it through seamless digital and physical experiences, and prove your commitment to the future of your land. The time for incremental adjustment has passed. The mandate is for strategic transformation.

Your first move? Audit your business against the three pillars of the new era: Story (is your sustainability and provenance narrative compelling and verified?), Channel (is your DTC and digital export capability developed?), and Product (are you innovating to meet future demand?). Identify your single largest gap and commit to a measurable action to close it within this quarter. The future market belongs to the decisive.

Related Search Queries: Australian wine export trends 2024, impact of climate change on viticulture, direct to consumer wine shipping, sustainable wine certification Australia, wine e-commerce platforms, alternative wine market growth, Australian wine in Southeast Asia, wine branding and storytelling, smoke taint risk management, wine industry digital transformation.

For the full context and strategies on How Global Wine Markets Are Shifting – And What It Means for Australia – Why It’s Hot Right Now in Australian Media, see our main guide: Performing Arts Videos Australia.