For the tax specialist, property is rarely just bricks and mortar; it is a complex asset class where value is intrinsically tied to legal permissions. A client's investment thesis, whether for capital growth, yield, or development, can be rendered obsolete overnight by a single line in a district plan. The most sophisticated depreciation schedule or tax structure is meaningless if the underlying asset cannot be used for its intended, and most profitable, purpose. In New Zealand's rapidly evolving urban landscape, understanding zoning and planning rules is not a peripheral concern for conveyancers—it is a core component of risk assessment and strategic financial advice.

The Foundational Framework: RMA, District Plans, and Zones

New Zealand's planning system is governed by the Resource Management Act 1991 (RMA), a piece of legislation currently undergoing a significant transition to a new dual-system under the Natural and Built Environment Act (NBEA) and the Spatial Planning Act. For now, the RMA remains the operative law. Its primary mechanism is the district plan, developed by each city or district council. Think of the district plan as the rulebook for land use within that territory.

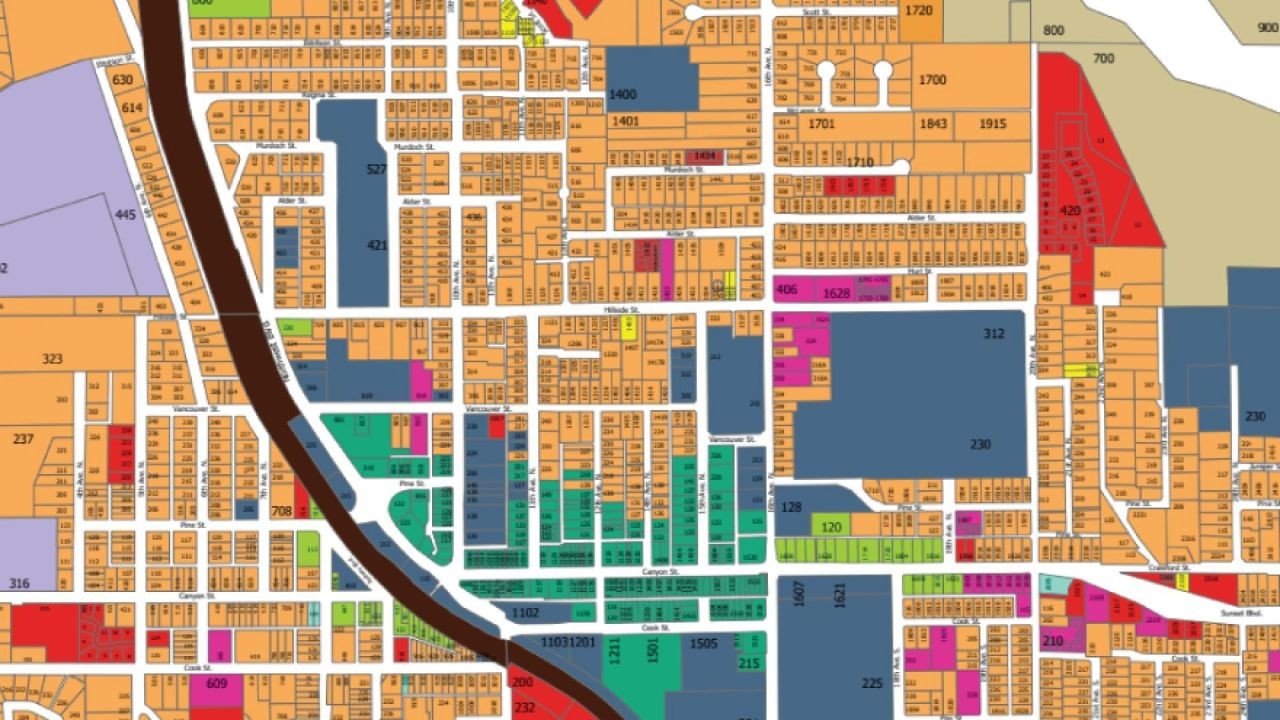

Within these plans, land is categorised into zones—Residential, Commercial, Industrial, Rural, etc.—each with a set of "permitted activities." These are uses allowed "as of right," requiring no resource consent. However, the devil is in the detail. "Residential" is not monolithic. Drawing on my experience supporting Kiwi companies, I've seen investors caught out by the subtle but critical differences between Single House, Mixed Housing Suburban, and Mixed Housing Urban zones in Auckland's Unitary Plan, each with vastly different density allowances and development potential.

Key Actions for the Advising Professional

- Obtain the Planning Map and Rules: Never rely on a property's current use or a sales agent's verbal assurance. Immediately access the council's online GIS mapping system to confirm the exact zoning and review the corresponding chapter of the district plan.

- Identify "Controlled," "Restricted Discretionary," and "Discretionary" Activities: These are uses that require a resource consent. The council's discretion, and thus the risk and cost to your client, increases through these categories.

- Check for Overlays: Special Character Areas, Historic Heritage, Significant Natural Areas, or Flood Plains can impose additional, costly constraints even within a favourable zone.

The High-Stakes Game of Development and Financial Modelling

For development clients, zoning dictates the fundamental financial model. Key planning metrics include Floor Area Ratio (FAR), height in relation to boundary (HIRB) rules, yard setbacks, and minimum dwelling sizes. A shift from a 50% to a 60% FAR on a 1000sqm site can mean the difference between 500sqm and 600sqm of gross floor area—a 20% increase in potential revenue. Based on my work with NZ SMEs in the construction sector, I have observed that the single largest cause of feasibility study failure is not construction cost inflation, but an optimistic misreading of these development controls.

Consider this data-driven insight: Statistics NZ's Building Consents Issued: March 2024 report shows a national trend towards higher-density housing. In Auckland, consents for townhouses, flats, and units comprised over 60% of all new dwellings consented in the year to March 2024. This is a direct outcome of zoning changes in the Auckland Unitary Plan, redirecting capital into specific typologies. A tax advisor must understand this to advise on the correct tax treatment (e.g., intention on acquisition, GST registration, bright-line test) for clients operating in this space.

Case Study: The Subdivision That Wasn't

Problem: A client purchased a 1.2-hectare lifestyle block on Auckland's periphery with the explicit intention of a future two-lot subdivision, a strategy discussed as a key part of their retirement planning. Their due diligence focused on title and LIM report building issues but accepted a generic agent's comment that "these blocks often subdivide."

Action: Upon engaging our firm for broader asset planning, we immediately reviewed the Auckland Unitary Plan. The property was zoned Rural – Countryside Living, which had a minimum lot size of 1 hectare. However, a site-specific overlay for "Significant Ecological Area" (SEA) covered 40% of the land, rendering that portion unusable for building platforms or wastewater disposal.

Result: The net "developable" area fell below the 1-hectare threshold for even one additional lot. A resource consent application would have been a "non-complying activity," a category with a very low success rate. The client's development equity was effectively locked in, fundamentally altering the asset's risk profile and liquidity.

Takeaway: The financial model for any land-based investment must be stress-tested against the worst-case planning scenario, not the aspirational one. A desktop feasibility study by a planning consultant (costing ~$2,000-$5,000) is a prudent due diligence expense that can prevent a seven-figure capital misallocation.

Debunking Common Myths in Property Zoning

Myth 1: "If my neighbour did it, I can do it too." Reality: Planning rules are not static. That neighbour's consent may have been granted under a previous district plan with more lenient rules. Councils cannot grant consents that contravene the current plan, a principle known as "planning by precedent." In practice, with NZ-based teams I've advised, we've seen clients denied consent for a second dwelling where a nearby property had one, simply because the rules changed in the intervening five years.

Myth 2: "The council will help me find the best use for my land." Reality: The council's role is regulatory, not advisory. Planners assess applications against the rules; they will not guide you to the most profitable or viable option. It is the applicant's responsibility to propose a scheme that complies. From consulting with local businesses in New Zealand, I find the most successful developers engage planning consultants early to navigate the rules creatively, rather than expecting council staff to be collaborators.

Myth 3: "Zoning is only important for developers, not buy-and-hold investors." Reality: Zoning dictates not only what you can do, but what can be built next door. A long-term hold of a character home in a "Single House" zone carries different risk (protection of amenity) versus one in a "Terrace Housing and Apartment Buildings" zone (potential for high-density overlooking). Future value is heavily influenced by the development potential of both the subject property and its surroundings.

The Evolving Landscape: RMA Reform and Intensification

The government's resource management reform signals a profound shift. The new system, centred on the National Planning Framework (NPF), aims for greater national consistency. For tax and financial advisors, the critical trend is the explicit policy drive towards intensification. The Medium Density Residential Standards (MDRS), now incorporated into many plans, allow for three homes of up to three storeys on most residential sites in major cities without resource consent.

This creates a unique portfolio analysis opportunity. Having worked with multiple NZ startups and property investors, I now advise a systematic review of existing holdings. A standalone property in a central suburb, previously valued as a single dwelling, may now have an "as of right" development potential that isn't reflected in its current capital value but significantly impacts its future earnings potential and associated tax obligations (e.g., potential reclassification from capital to revenue account upon development).

Pros and Cons of the Intensification Push

✅ Pros:

- Unlocks Latent Value: Provides a clear, permitted development pathway for existing landowners, potentially boosting asset values and housing supply.

- Streamlines Process: Reduces consenting costs and timeframes for compliant developments, improving project feasibility and ROI.

- Aligns with Infrastructure: Concentrates growth in areas already serviced by transport and utilities, a more fiscally sustainable model.

❌ Cons:

- Amenity Risk: Can lead to overcrowding, loss of sunlight, and parking pressures, potentially degrading the liveability that attracts tenants and buyers.

- Two-Tier Market: May disproportionately benefit larger, corporate developers with economies of scale over smaller "mum and dad" investors.

- Infrastructure Lag: Stormwater, wastewater, and transport networks in older suburbs may be overwhelmed by rapid, as-of-right intensification, leading to future council levies or downgrades.

Strategic Integration for the Tax Specialist: A Step-by-Step Guide

Your role transcends compliance; it involves proactive value protection and creation. Here is a practical framework to integrate planning due diligence into your advisory practice.

- Incorporate a Planning Questionnaire: At the outset of any client engagement involving property, ask: What is the current zoning? Are you aware of any development constraints or special features on the title? What is your intended hold period and use for this asset?

- Order a Professional Planning Report: For any acquisition over a threshold value (e.g., $1.5M) or with a stated development intent, recommend and review a report from a registered planning consultant. This should be as standard as a builder's report.

- Model Multiple Scenarios: Work with the client's planner and accountant to model the after-tax feasibility under different consenting pathways (permitted vs. discretionary) and different end uses (hold as-is, renovate, subdivide, develop).

- Monitor Plan Changes: Councils periodically notify changes to their district plans. Subscribe to updates for areas where your clients have concentrated holdings. A proposed plan change from "Business - Mixed Use" to "Residential - High Density" can dramatically alter an asset's value trajectory.

- Advise on Entity Structure Early: The planning outcome (buy-and-hold vs. develop-and-sell) must inform the legal and ownership structure from day one to optimise tax outcomes and manage liability.

Final Takeaway and Call to Action

In New Zealand's constrained property market, value is increasingly a function of permissible use rather than mere location. For the tax specialist, this elevates zoning from a technical footnote to a central strategic variable. The most effective advisors will be those who can synthesise the language of district plans with the principles of financial and tax modelling, identifying both the latent value and the hidden pitfalls within a title.

Your immediate action is to conduct a planning audit on your top five client property holdings. Cross-reference the current zoning against the client's stated long-term goals. You may uncover a strategic misalignment or, more positively, an untapped opportunity that redefines the asset's role in their portfolio. The intersection of planning law and tax strategy is where truly sophisticated, value-added advice is delivered.

People Also Ask (PAA)

How do I find out the zoning for a specific property in New Zealand? Visit your local city or district council website and use their online GIS mapping tool (often called "Property Search" or "Maps"). Enter the address to see the zoning and links to the relevant district plan rules. Always call the council's duty planner to confirm your interpretation.

What is the difference between a LIM report and a zoning report? A LIM (Land Information Memorandum) from the council provides recorded information on the property, including consents, rates, and hazards. A zoning or planning report, typically from a private consultant, interprets the district plan rules in the context of your specific proposal, assessing feasibility and consent pathways.

Can zoning rules change after I buy a property? Yes. District plans are reviewed and changed periodically. A rule change can either enhance or diminish your development rights. There is generally no compensation for a loss of value due to a zoning change, making ongoing monitoring essential for significant holdings.

Related Search Queries

- Auckland Unitary Plan zoning map

- Resource consent cost NZ 2024

- Medium Density Residential Standards explained

- How to object to a district plan change NZ

- RMA vs Natural and Built Environment Act

- Planning consultant fees New Zealand

- What is a non-complying activity?

- Check for heritage overlay on my property

- Subdivision feasibility study cost NZ

- Council GIS mapping [City Name]

For the full context and strategies on Understanding Property Zoning and Planning Rules in NZ, see our main guide: Future Education Support Videos Nz.