Let's cut through the hype. As a business owner who has navigated everything from volatile commodity prices to shifting consumer trends, I assess opportunities through a lens of risk management, regulatory reality, and long-term viability. The question of cryptocurrency as a 'safe' investment in New Zealand isn't about getting rich quick; it's about understanding if it fits within a prudent, diversified strategy for a Kiwi entrepreneur. The answer is nuanced, deeply personal, and hinges on separating technological potential from investment speculation.

The rise of cryptocurrency interest in New Zealand

Over the last five years, cryptocurrency adoption in New Zealand has grown rapidly. Exchanges like Easy Crypto and independent trading platforms have made buying, selling, and storing digital assets more accessible. Young professionals, tech-savvy investors, and those seeking portfolio diversification are among the most active participants.

Several factors drive this interest. High-profile price surges abroad create a sense of urgency to participate, while low yields in traditional savings and fixed-income products make crypto appear attractive as an alternative. Additionally, the decentralised nature of cryptocurrencies resonates with Kiwis who value autonomy over financial decisions. However, this enthusiasm often obscures the significant risks associated with market volatility and regulatory gaps.

Volatility: the double-edged sword

One of the defining characteristics of cryptocurrencies is extreme price volatility. Even within a single day, values can swing by double-digit percentages. While volatility creates opportunities for short-term gains, it also exposes investors to rapid and substantial losses.

For New Zealand investors, volatility is compounded by relatively limited local market infrastructure. Unlike larger international markets, liquidity on Kiwi-focused exchanges can be lower, leading to larger spreads and potential difficulties executing large trades without impacting price. These structural factors make crypto less predictable and increase the likelihood of unexpected financial outcomes.

Regulatory uncertainty in New Zealand

New Zealand has made progress in regulating aspects of cryptocurrency, particularly in anti-money laundering and exchange compliance. The Financial Markets Authority (FMA) monitors crypto platforms, while the Reserve Bank of New Zealand evaluates systemic risks associated with digital assets.

Yet, regulatory clarity is still evolving. Unlike bank deposits or KiwiSaver investments, cryptocurrencies are generally not covered by government guarantees or insurance schemes. Investors bear full responsibility for security, storage, and potential loss. Regulatory gaps also mean that fraudulent or unlicensed operators can occasionally emerge, leaving investors exposed to scams without formal recourse.

Additionally, taxation of crypto gains is a nuanced issue. Income from trading is considered taxable in New Zealand, but the treatment of long-term holdings or complex decentralized finance transactions can be confusing, increasing the risk of unintentional non-compliance.

Security risks and storage considerations

Cryptocurrency relies on digital wallets and private keys. Loss or theft of these keys can result in permanent asset loss. New Zealand investors who store crypto on exchanges rather than in secure offline wallets may face exposure to hacking incidents. Global precedents, such as exchange failures or phishing attacks, demonstrate that even reputable platforms are not immune to breaches.

Investor education is critical. Knowing how to secure wallets, enable two-factor authentication, and verify platform credentials can dramatically reduce risk. However, this technical requirement introduces an additional layer of complexity not present in traditional asset classes.

The New Zealand Landscape: Regulation vs. The Wild West

Unlike the unregulated frontier of a decade ago, New Zealand has established a clear, if cautious, framework. The Financial Markets Authority (FMA) classifies most cryptocurrencies as "financial products" if offered to retail investors. This brings them under the Financial Markets Conduct Act, requiring licensing for exchanges and adherence to fair dealing and disclosure obligations. In practice, this means platforms like Easy Crypto NZ and Dasset must operate with greater transparency.

However, a critical distinction exists. The FMA regulates the service providers, not the underlying crypto assets themselves. There is no government guarantee, no depositor protection scheme like the NZ Deposit Takers Act, and no Reserve Bank of New Zealand (RBNZ) backstop. The RBNZ has been explicit in its stance, stating in a 2021 Financial Stability Report that crypto assets "pose limited direct risks to financial stability" but highlighting their volatility and speculative nature as risks to investors. This creates a unique environment: a regulated gatekeeper for a largely unregulated asset class.

Key Actions for Kiwi Investors

Before considering a single dollar, your first stop must be the FMA's financial service providers register. Verify that any platform you use is licensed. This is your primary layer of consumer protection. Secondly, understand that New Zealand's anti-money laundering (AML) rules apply, meaning you'll need to complete full identity verification. From consulting with local businesses in New Zealand, I've seen savvy operators treat this regulatory scrutiny as a positive filter, separating serious platforms from offshore fly-by-night operations.

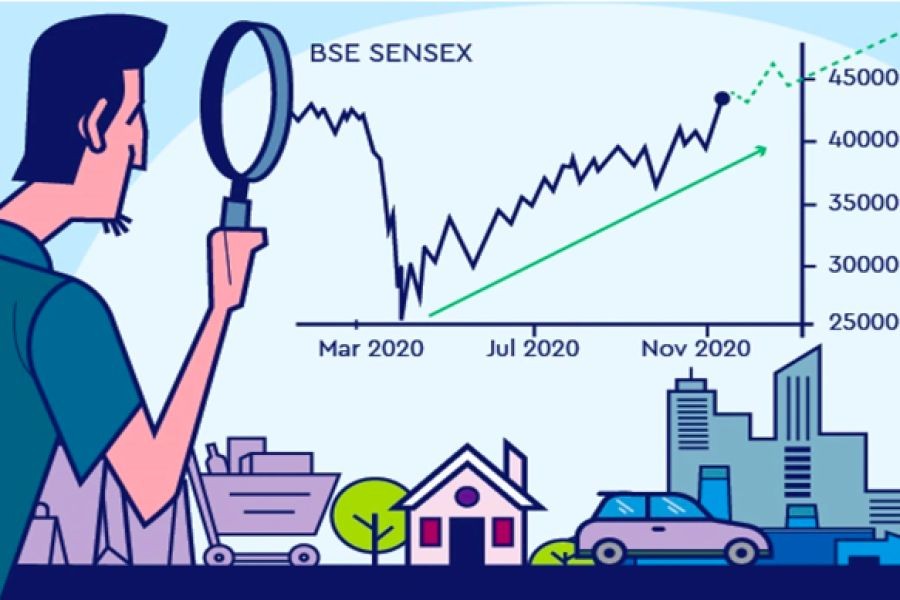

A Data-Driven Reality Check: Volatility is the Norm

Let's move past anecdotes and look at cold, hard numbers. "Safe" in investment parlance often correlates with stability and predictability. Cryptocurrency is the antithesis. Consider Bitcoin, often viewed as the 'blue-chip' of crypto. In 2021, it reached an all-time high near NZ$100,000. By late 2022, it had plummeted to around NZ$23,000—a drop of over 75%. While it has recovered since, such swings are endemic to the asset class.

A 2023 study by the University of Auckland Business School analysed the correlation between crypto and traditional NZ asset classes. It found that while crypto returns are extraordinarily high at times, their volatility is an order of magnitude greater than the NZX 50 or residential property. For a business owner, this is a crucial insight. Having worked with multiple NZ startups that held treasury assets in crypto, I've witnessed first-hand how such volatility can jeopardise cash flow planning. An asset that can lose 30% of its value in a week is not a 'safe' store of value for short-term obligations.

Case Study: The Allure and The Agony – A Cautionary Tale

Case Study: The NZ Tech Startup & The Treasury Experiment

Problem: A promising Auckland-based SaaS startup, post a successful Series A raise, found itself with a significant cash reserve in 2020. Influenced by prevailing narratives, a faction of leadership argued that holding a portion (15%) in Ethereum was a savvy way to outpace low-interest rates and inflation. The goal was enhanced treasury returns.

Action: Against more conservative advice, the company allocated NZ$300,000 into Ethereum via a licensed NZ exchange. The initial months were positive, with the holding appreciating to nearly NZ$450,000.

Result: The 2022 "crypto winter" hit. As the market collapsed, their Ethereum holding shrunk to approximately NZ$95,000. This paper loss triggered a crisis of confidence. More critically, a planned expansion into Australia required capital precisely when their crypto reserve was decimated. They were forced to delay hiring and scale back marketing, losing crucial momentum. They eventually sold at a steep loss to fund operations.

Takeaway: This isn't a story of a scam, but of profound asset-liability mismatch. The volatile crypto asset was utterly unsuitable for the company's medium-term, predictable capital needs. Drawing on my experience in the NZ market, the lesson is that business capital reserved for operational execution should be in stable, liquid assets. Speculative plays belong, if anywhere, in a ring-fenced portion of capital the business can afford to lose entirely.

The Strategic Pros and Cons for a Kiwi Business Owner

Evaluating this requires a balanced ledger. Let's move beyond generic lists to specifics relevant to our context.

✅ Potential Advantages (The Pros)

- diversification Beyond Traditional Correlations: As the Auckland Uni research noted, crypto can sometimes move independently of NZ shares and property. A small, calculated allocation might provide non-correlated returns in a diversified portfolio.

- Exposure to blockchain Innovation: Investing is a belief in underlying utility. For businesses in tech, logistics, or finance, holding crypto can be a strategic hedge or learning tool related to blockchain's disruptive potential.

- High-Risk, High-Reward Potential: No one denies the astronomical returns seen in specific cycles. For capital explicitly earmarked for high-risk speculation, it presents an option.

- Streamlined Cross-Border Transactions: Some NZ import/export businesses use stablecoins (like USDC) for faster, lower-cost settlement with international suppliers, though this is more utility than investment.

❌ Significant Risks & Drawbacks (The Cons)

- Extreme Volatility: As established, this is the paramount risk. It undermines its function as a reliable store of value.

- Regulatory Uncertainty: While NZ has rules today, they can change. The OECD's Crypto-Asset Reporting Framework (CARF), which NZ has committed to, will bring enhanced tax transparency but also complexity.

- No Fundamental Valuation Anchor: Unlike a company with earnings or a property with rental yield, valuing most cryptocurrencies lacks traditional metrics. Price is driven almost entirely by sentiment and market dynamics.

- Operational Security Risks: You are your own bank. Loss of private keys, exchange hacks, or simple user error can lead to irreversible loss of funds. This is a profound responsibility.

- Limited Real-World Integration in NZ: Despite growth, daily use of crypto for purchasing goods and services in the NZ economy remains minimal, limiting its current utility value.

Debunking Common Crypto Myths in the NZ Context

Myth 1: "It's a hedge against inflation like gold." Reality: While Bitcoin is dubbed 'digital gold,' its 2022 performance disproved this. During a period of rising inflation, both traditional equities and crypto fell sharply. A true inflation hedge should preserve value; crypto's volatility makes it an unreliable one. The RBNZ's inflation-fighting tools are interest rates, not crypto cycles.

Myth 2: "The licensed exchanges in NZ mean my investment is safe." Reality: Licensing means the exchange operates fairly and has AML controls. It does not insure your crypto holdings against a platform hack or a collapse in the value of the asset itself. Your Ethereum on a licensed exchange is not protected like your NZD in a registered bank.

Myth 3: "It's too complex for the average business owner." Reality: The mechanics of buying via a user-friendly NZ exchange are straightforward. The complexity lies in the understanding—the technology, the risk profile, and the tax implications (IRD treats crypto as property, subject to capital gains). If you don't understand it, that's not a barrier to entry; it's the primary reason to avoid it.

A Contrarian, Pragmatic Take: The "Why Bother?" Argument

Here's a perspective seldom voiced in crypto circles: for most NZ business owners, the opportunity cost is too high. The mental bandwidth and risk capital required to engage meaningfully and safely with crypto are immense. That same energy and capital, invested in upskilling your team, refining your marketing funnel, or improving customer experience, will almost certainly yield a higher, more predictable, and less stressful return on investment.

Based on my work with NZ SMEs, the most successful operators master their core business first. They build wealth through business equity, prudent property investment, and diversified traditional funds. They don't gamble operational capital on speculative assets. If you have mastered all other aspects of your business and personal wealth and have true discretionary capital, then—and only then—does speculative allocation become a question worth pondering.

Future Trends & The NZ Horizon

The future in NZ will be defined by increasing institutionalisation and regulatory clarity. We will see more licensed custodial services, potentially crypto-based ETFs (following overseas trends), and tighter integration of blockchain for specific business processes, like supply chain provenance for our export sectors. The RBNZ's exploration of a Central Bank Digital Currency (CBDC) is the most significant local development to watch. A digital NZD could co-exist with, or even marginalise, volatile cryptocurrencies for everyday transactions.

My prediction is that by 2030, crypto as a speculative retail investment will remain a niche, high-risk activity. However, the underlying blockchain technology will become quietly embedded in business infrastructure, particularly in areas vital to NZ's economy: verifying the origin of Manuka honey, tracking sustainable forestry products, and streamlining agricultural export documentation.

Practical steps for responsible crypto investing in New Zealand

Kiwis considering cryptocurrency investment should approach it with the same diligence as any other financial asset. Conducting research, limiting allocation to what one can afford to lose, and prioritising reputable platforms are fundamental steps. Diversifying across multiple assets, keeping clear records for tax purposes, and using secure storage methods are additional protective measures.

Engaging professional financial advice can also help. Advisors familiar with New Zealand’s tax framework, regulatory landscape, and market conditions can provide guidance tailored to individual risk profiles, helping investors avoid common mistakes.

Looking ahead: cryptocurrency in New Zealand’s financial future

Over the next three to five years, cryptocurrency adoption in New Zealand is likely to continue evolving. Regulatory frameworks are expected to become more robust, exchanges more secure, and institutional participation more pronounced. These developments may reduce some risks and increase transparency, but they will not eliminate volatility or the need for careful due diligence.

For Kiwis, the key takeaway is clear: cryptocurrency is not inherently safe, and its suitability depends on personal risk tolerance, financial knowledge, and long-term planning. While the asset class offers exciting opportunities, treating it as a speculative gamble without understanding the nuances can lead to significant financial consequences.

Ultimately, the truth about cryptocurrency in New Zealand is that it presents both opportunity and risk in equal measure. Informed, disciplined, and cautious participation is the only way to navigate this complex market while protecting one’s financial future.

For the full context and strategies on Is Cryptocurrency Really a Safe Investment in NZ? The Truth – What No One Is Talking About in NZ, see our main guide: Vidude For Hospitality Driving Bookings Local Engagement.