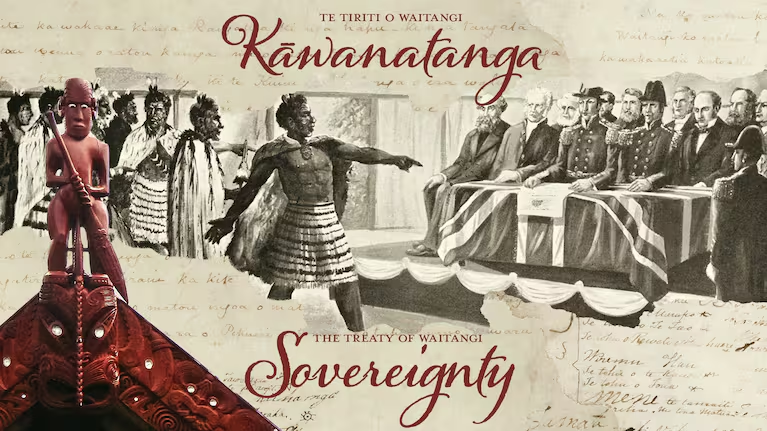

To understand the modern New Zealand economy is to grapple with a foundational document signed in 1840. The Treaty of Waitangi is not a relic of history; it is a living, breathing, and often contentious framework that directly shapes fiscal policy, corporate governance, investment risk, and market opportunities. For financial advisors and investors, ignoring its implications is a profound strategic error. This analysis moves beyond the cultural narrative to dissect how the Treaty’s principles—partnership, participation, and protection—manifest as tangible economic forces, creating unique liabilities and unlocking unprecedented value for those who comprehend them.

The Treaty as an Economic Framework: Beyond Redress, Towards Redefinition

The post-1975 era of Treaty settlements, facilitated by the Waitangi Tribunal, is often viewed through the lens of historical grievance. This is a critical misreading. Financially, it represents one of the largest, most deliberate, and strategically significant wealth transfers in New Zealand's history. The Crown has settled claims with an approximate total value of $2.24 billion in financial and commercial redress, as of recent Treasury summaries. However, the real economic weight lies in the return of culturally significant land and commercial assets, which are often undervalued in pure balance-sheet terms.

From consulting with local businesses in New Zealand, I've observed a direct correlation between regional settlement finalizations and subsequent economic activity. The establishment of post-settlement governance entities (PSGEs) like Ngāi Tahu Holdings Corporation or Waikato-Tainui's Te Ohu Kaimoana has created a new class of institutional investor with dual mandates: commercial return and intergenerational cultural advancement. These are not passive funds; they are active, long-term strategic players with investment horizons spanning centuries, not quarters. Their portfolio decisions increasingly influence sectors like fisheries, agriculture, forestry, and renewable energy.

Key Actions for Kiwi Investors and Advisors

- Analyze Regional Settlement Maps: Track where major settlements have occurred. These regions often see increased capital flow, infrastructure development, and joint venture opportunities.

- Understand PSGE Mandates: When evaluating companies or projects, assess their alignment or partnerships with local iwi economic arms. This can de-risk investments and unlock social license.

- Look Beyond Direct Redress: The true economic impact is amplified through leveraged investments. Ngāi Tahu's growth from a $170 million settlement to an asset base exceeding $2 billion is a masterclass in strategic compounding.

The Corporate Imperative: Treaty Principles as ESG on Steroids

Globally, ESG (Environmental, Social, and Governance) investing is a trend. In New Zealand, the "T" for Treaty is the non-negotiable cornerstone of authentic social license. For companies operating on land or with resources subject to historical claims, Treaty compliance is a material financial risk. The controversy surrounding water rights, the foreshore and seabed, and spectrum allocation are not political side-shows; they are direct threats to asset valuation and operational continuity.

Drawing on my experience in the NZ market, I advise clients that a company's Treaty competency is a leading indicator of its governance maturity and long-term resilience. A firm that engages meaningfully with Māori as partners, not stakeholders, secures a competitive moat. Conversely, those that pay lip service or ignore obligations face reputational damage, regulatory hurdles, and activist shareholder pressure that can crater value overnight. The New Zealand Stock Exchange (NZX) now expects listed entities to report on their Māori engagement and cultural impact, effectively hardwiring Treaty considerations into disclosure requirements.

Case Study: Meridian Energy & Te Uku Wind Farm – A Blueprint for Partnership

Problem: In the mid-2000s, Meridian Energy planned the 64-turbine Te Uku wind farm in Waikato. The project risked significant delays and opposition due to lack of local support and unresolved historical grievances with Tainui iwi. Traditional "consultation" was insufficient; it was perceived as the Crown (via a state-owned enterprise) once again imposing on whenua.

Action: Meridian moved beyond transactional consultation to a genuine partnership model. They negotiated directly with Tainui, resulting in a groundbreaking agreement where the iwi became a strategic partner and equity shareholder in the project. This included not just a financial stake but also roles in environmental management and cultural monitoring.

Result: The project was completed on schedule with strong local support. For Tainui, it provided a long-term revenue stream and active involvement in sustainable energy. For Meridian, it de-risked a major capital project, enhanced its social license, and created a replicable model for future developments. The partnership turned a potential liability into a strategic asset, demonstrating that honoring Treaty principles can directly accelerate and profitably enable major infrastructure.

Takeaway: This case proves that early, equitable partnership with Māori is not a cost but a critical path to project execution and value creation. For investors, it underscores the need to scrutinize a company's partnership track record in its due diligence.

The Great Debate: Partnership vs. Separatism – An Economic Crossroads

Here lies the most contentious and financially relevant fault line. One perspective advocates for full economic integration and partnership, where Māori innovation and capital drive growth for all New Zealand. The opposing view fears a slide towards separatism—a parallel economy with different rules, creating complexity and deterring foreign investment.

✅ The Advocate Perspective: The Innovation & Growth Engine

Proponents argue that Māori economic development is a net positive for GDP. Stats NZ data shows the Māori economy was estimated at over $70 billion in 2020. Māori are younger, more entrepreneurial, and have a growing appetite for tech and sustainable industries. Their unique world-view (te ao Māori) integrates long-term environmental stewardship, which aligns perfectly with global demand for ESG and sustainable finance. By fostering this engine, New Zealand can develop niche, high-value exports and intellectual property rooted in unique cultural capital. From observing trends across Kiwi businesses, the most dynamic startups often integrate Māori knowledge (mātauranga Māori) in areas like agri-tech, environmental science, and health.

❌ The Critic Perspective: Complexity and Investment Risk

Critics contend that expanding Treaty interpretations create legal uncertainty. They point to debates over "co-governance" of natural resources, such as the Three Waters reforms, as introducing opaque decision-making that complicates infrastructure investment. The fear is that New Zealand becomes a "harder to do business" jurisdiction if every project requires navigating a dual governance system. This perspective warns that excessive focus on redress could divert capital from productivity-enhancing investments into transactional settlements, potentially crowding out other public spending.

⚖️ The Middle Ground: Clarity Through Contract

The pragmatic financial solution lies not in political rhetoric, but in contract law and clear frameworks. The future is not "separatism" but sophisticated, legally-defined partnerships. The Crown-Iwi relationship at its best operates like a joint venture agreement. The challenge for policymakers is to create transparent, consistent frameworks for such partnerships—especially in resource management—that provide the certainty global capital demands. The updated Resource Management Act reforms are a critical test case here.

Future Forecast: The Financial Landscape of 2030

By 2030, the Treaty's influence will be further institutionalized within New Zealand's financial architecture. We will see:

- Māori Bonds (Pūtea Ture): Sovereign-style bonds issued by major PSGEs to fund iwi-specific infrastructure and social projects, attracting ESG-focused international capital.

- Treaty Audits: Standardized due diligence reports assessing a company's Treaty-related risks and partnerships, demanded by institutional investors and lenders as part of credit ratings.

- Data Sovereignty as an Asset Class: As per Te Mana Raraunga (Māori Data Sovereignty Network), control over Māori data will become a key commercial and cultural asset, influencing sectors from health tech to genetic research.

- Mainstreaming of Māori Finance Concepts: Principles like kaitiakitanga (guardianship) will be formally integrated into investment fund mandates and corporate law, moving beyond vague ESG statements to measurable obligations.

Based on my work with NZ SMEs entering global supply chains, those who can authentically articulate their Treaty-based partnerships and sustainability practices will command premium pricing and preferential access.

Common Myths and Costly Mistakes

Myth 1: "The Treaty is a social issue, separate from finance and economics." Reality: It is a primary determinant of resource access, regulatory approval, social license, and now, governance reporting standards (NZX). Ignoring it is a direct threat to portfolio performance.

Myth 2: "Treaty settlements are a drain on the taxpayer and the economy." Reality: Settlements transfer dormant Crown assets to entities with a proven track record of aggressive, innovative commercial development. The subsequent investment and job creation generate taxable activity that likely outweighs the initial redress value. It is a restructuring of capital, not a loss.

Myth 3: "Only businesses in primary industries need to worry about Treaty issues." Reality: Every sector is impacted. Tech firms use spectrum (a contested resource). Tourism operators rely on cultural IP and land. Fintechs must navigate data sovereignty. The principles of partnership are universally applicable.

❌ Biggest Mistakes for NZ Businesses and Investors to Avoid

- Treating Engagement as a Box-Ticking Exercise: Superficial consultation is easily identified and can cause irreparable damage. The mistake is viewing it as a cost of compliance rather than an opportunity for value creation.

- Underestimating the Speed of Change: Assuming Treaty perspectives are static is dangerous. The economic and political influence of Māori is accelerating. Investment theses from five years ago may already be obsolete.

- Failing to Build Internal Competency: Outsourcing all "Māori issues" to a single advisor or department creates strategic blind spots. Treaty literacy must be embedded at the board and executive leadership levels.

Final Takeaways: The Advisor's Mandate

- Fact: The Māori economy is a >$70 billion force, growing faster than the national average, and is fundamentally reshaping key sectors.

- Strategy: Incorporate a "Treaty Impact Assessment" into your standard investment due diligence and financial planning reviews for clients with business or concentrated asset exposure.

- Mistake to Avoid: Allowing clients to dismiss Treaty dynamics as political noise. This is a direct source of financial risk and alpha.

- Pro Tip: Develop relationships with the economic development arms of major iwi and PSGEs. They are becoming pivotal deal-makers, joint-venture partners, and sources of unique investment opportunities.

Conclusion: The Indivisible Future

The path for New Zealand's economic prosperity is inextricably linked to the fulfilment of its founding covenant. For the financial community, this is not a question of ideology but of calculus. The Treaty of Waitangi has moved from the marae onto the balance sheet. It dictates where capital can flow, how projects are governed, and which companies will thrive in the coming decade. The advisors and investors who develop the fluency to navigate this landscape will identify the risks others miss and unlock the opportunities others cannot see. The question is no longer if the Treaty matters to your portfolio, but how profoundly you understand its implications.

People Also Ask (PAA)

How does the Treaty of Waitangi impact foreign investment in New Zealand? It creates a unique layer of due diligence. Foreign investors must assess Treaty-related risks around resource use and social license. Successful investors often partner with iwi entities, turning a potential hurdle into a local alliance that facilitates smoother operations and community support.

What is a "post-settlement governance entity" (PSGE) and why is it important for business? A PSGE is the legal entity (often a trust or company) that manages the assets from a Treaty settlement. They are major commercial players in their regions, involved in sectors like agriculture, fishing, and property. Partnering with a PSGE can provide local knowledge, cultural authority, and long-term capital for joint ventures.

Are there specific investment funds focused on the Māori economy? Yes, the landscape is developing. There are dedicated funds managed by entities like Māori Trustee and some mainstream fund managers offer ESG funds with a strong Treaty alignment focus. Direct investment often occurs through partnerships with iwi-owned businesses or ventures in sectors where Māori have strategic interests.

Related Search Queries

- Māori economy GDP New Zealand 2024

- Waitangi Tribunal settlement process financial value

- Iwi investment portfolio examples New Zealand

- Treaty of Waitangi business partnership examples

- ESG investing New Zealand Treaty principles

- How to invest in Māori businesses

- Three Waters reform co-governance economic impact

- NZX Māori engagement reporting requirements

- Post-settlement governance entity list NZ

- Te Ao Māori business strategy

For the full context and strategies on Case Study: How the Treaty of Waitangi Has Shaped Modern New Zealand – (And What It Means for Kiwi Businesses), see our main guide: How Kiwi Retailers Drive Sales Vidude Video Campaigns.