In the dynamic landscape of New Zealand real estate, the debate between managing properties as a DIY landlord versus hiring a professional property manager is both significant and timely. With property investment being a key component of financial strategies for many Kiwis, understanding the nuances of each approach is essential for investors looking to maximize returns and minimize stress.

Case Study: DIY Landlord Success in Auckland

Meet Sarah, a savvy investor based in Auckland. In 2022, she decided to manage her two rental properties herself, aiming to increase her profit margins by saving on management fees. Sarah meticulously researched tenancy laws, market trends, and maintenance schedules. Her proactive approach, including regular communication with tenants and swift resolution of issues, resulted in a high occupancy rate and tenant satisfaction.

Result: Within a year, Sarah increased her rental income by 20% and saved approximately NZD 5,000 in management fees. Her success underscores the potential advantages of the DIY approach when executed with diligence and expertise.

Case Study: Leveraging Professional Management in Wellington

In contrast, consider John, a Wellington-based investor with a diverse property portfolio. Overwhelmed by the complexities of managing multiple properties, John opted for a professional property management service. His chosen firm, renowned for its expertise, handled tenant screening, maintenance coordination, and legal compliance.

Result: John's properties maintained a 95% occupancy rate, and he reported a 15% increase in overall rental income due to strategic rent adjustments and reduced vacancy periods. The expertise of the property management firm enabled John to focus on expanding his portfolio rather than day-to-day operational challenges.

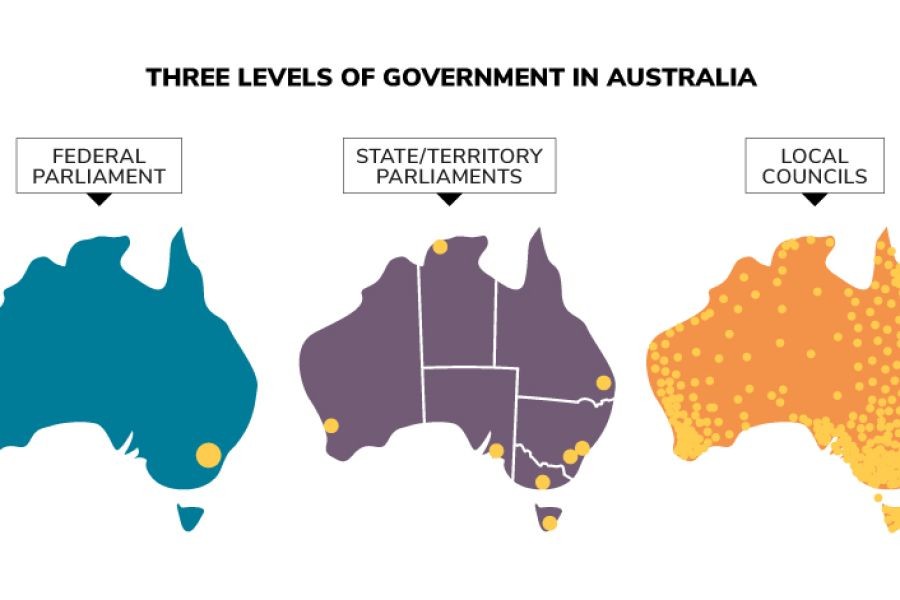

Data-Driven Insights: The New Zealand Context

According to Statistics NZ, the median rent in New Zealand increased by 5% in 2023, underscoring the potential for rental income growth. However, the Ministry of Business, Innovation and Employment (MBIE) highlights that compliance with the Healthy Homes Standards is a critical challenge, with over 30% of rental properties requiring upgrades.

In this context, the decision between DIY management and professional services hinges on investor capacity to navigate regulatory requirements, market dynamics, and tenant relationships.

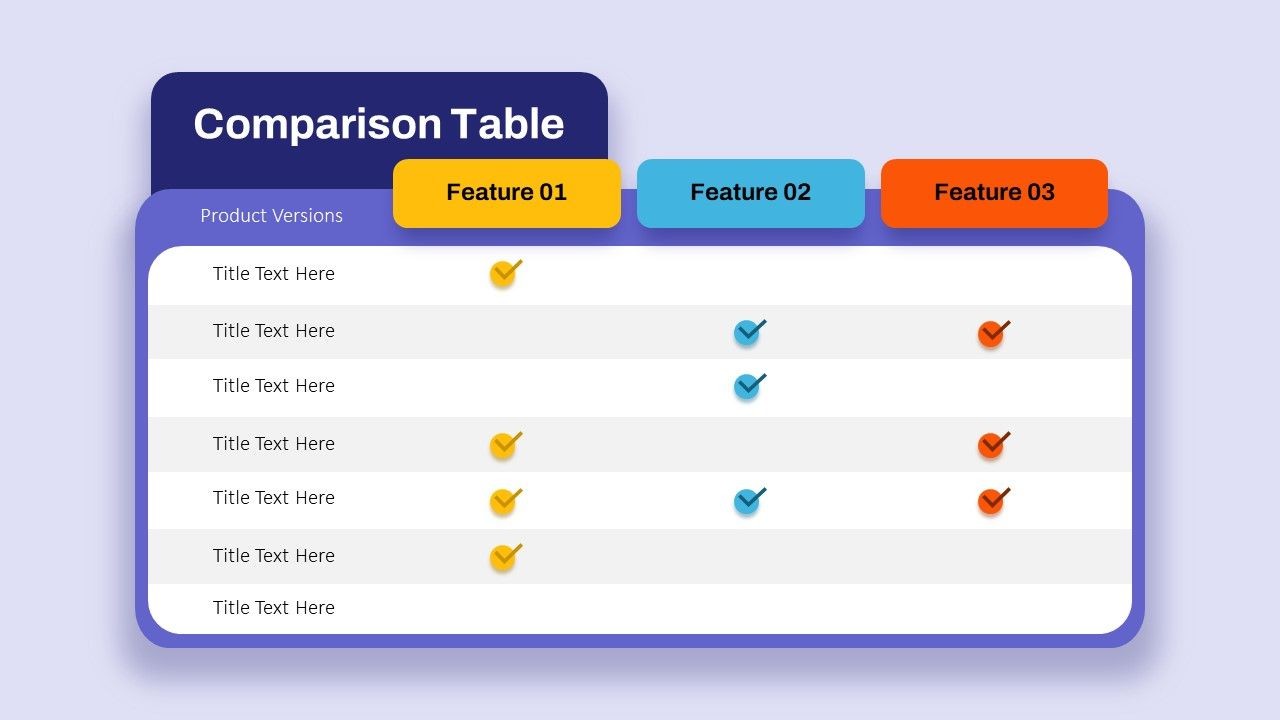

Pros and Cons: DIY Landlord vs. Property Manager

Pros of DIY Landlord:

- Cost Savings: Avoid management fees, increasing profit margins.

- Control: Direct involvement in tenant selection and property maintenance.

- Flexibility: Ability to implement personalized strategies for property management.

Cons of DIY Landlord:

- Time-Consuming: Requires significant time investment for effective management.

- Legal Risks: Potential for costly mistakes due to non-compliance with regulations.

- Stress: Managing tenant issues and maintenance can be overwhelming.

Pros of Property Manager:

- Expertise: Professional handling of tenant relations and legal compliance.

- Efficiency: Streamlined processes for maintenance and rent collection.

- Market Knowledge: Access to market insights for optimal pricing strategies.

Cons of Property Manager:

- Cost: Management fees can reduce overall rental income.

- Less Control: Limited involvement in day-to-day operations.

- Dependency: Reliance on a third party for property success.

Common Myths & Mistakes

Myth: "DIY landlords always save money."

Reality: While avoiding management fees can save money, unexpected legal costs and vacancy periods can offset these savings. (Source: NZ Property Investors’ Federation)

Myth: "Property managers guarantee higher profits."

Reality: Success depends on choosing the right property manager with market expertise and a proven track record.

Future Trends in NZ Real Estate Management

Looking ahead, the integration of technology in property management is set to revolutionize the industry. By 2028, it is projected that over 50% of property management tasks in New Zealand will be automated, enhancing efficiency and reducing human error (Source: NZTech Report 2024).

Additionally, the emphasis on sustainable housing practices is expected to influence property management strategies, aligning with government policies aimed at reducing carbon footprints and improving energy efficiency.

Conclusion

In the debate between DIY landlords and property managers, the right choice depends on individual investor goals, capacity, and property portfolio size. For those seeking control and cost savings, the DIY approach may be advantageous, provided they are prepared for the challenges involved. Conversely, leveraging professional management can offer peace of mind and optimized returns, especially for larger portfolios.

As the New Zealand real estate market continues to evolve, staying informed and adaptable will be key to success. Whether choosing to manage properties independently or through professionals, understanding the local context and future trends will empower investors to make strategic decisions.

Final Takeaway: Evaluate your investment strategy, considering both short-term gains and long-term sustainability. Engage with industry experts, and continuously update your knowledge to navigate the complexities of property management effectively.

What's your take? Share your insights and experiences in the comments below!

People Also Ask (FAQ)

How does property management impact rental income in New Zealand?Professional property management can increase rental income by optimizing rent pricing and reducing vacancy rates, according to the NZ Property Investors’ Federation.

What are the biggest misconceptions about DIY landlords in NZ?A common myth is that DIY landlords always save money. However, research shows that unexpected costs and legal risks can negate these savings.

Related Search Queries

- DIY property management tips NZ

- Benefits of hiring a property manager

- New Zealand rental market trends 2024

- Property investment strategies NZ

- Healthy Homes Standards compliance

Queens Mini Bus Hire Sydney

10 months ago