In the ever-evolving financial landscape of Australia, stories of young investors achieving millionaire status have captured the public's imagination. One such story is that of a 25-year-old Australian who harnessed the power of the stock market to amass a fortune. This journey is not just about wealth accumulation—it's a profound lesson in strategic investment, financial literacy, and the potential of the Australian stock market.

The Australian Economic Landscape: A Fertile Ground for Investment

Australia's economy, characterized by robust growth and resilience, provides a fertile ground for stock market investments. The Reserve Bank of Australia (RBA) notes that the nation has enjoyed a steady GDP growth rate of approximately 2.5% over the past decade. This economic stability, coupled with a well-regulated financial system, offers a conducive environment for investments.

According to the Australian Securities and Investments Commission (ASIC), young investors are increasingly participating in the stock market. A recent survey indicates that 30% of new investors in Australia are under the age of 30. This shift is driven by improved access to financial information, digital trading platforms, and a growing interest in financial independence.

Case Study: The Journey of a Young Millionaire

Meet Alex, a 25-year-old from Melbourne, whose journey to becoming a millionaire began with a modest investment in the Australian Securities Exchange (ASX). Alex's story is one of strategic planning, continuous learning, and leveraging the unique opportunities presented by the Australian market.

Problem: Alex started with a common problem faced by many young Australians: limited capital and a lack of financial literacy. Initial investments in a few low-cost stocks resulted in minimal gains, prompting a need for a strategic overhaul.

Action: Determined to succeed, Alex enrolled in online courses on financial markets, subscribed to investment newsletters, and engaged with communities on platforms like Reddit's ASXbets. This knowledge allowed Alex to diversify investments across sectors like technology, energy, and healthcare, focusing on stocks with strong growth potential.

Result: Over three years, Alex's portfolio grew significantly. Key investments included shares in emerging tech companies like Afterpay, which saw a 150% increase in value before being acquired. By the age of 25, Alex's portfolio was valued at over AUD 1 million.

Takeaway: Alex's case demonstrates the power of education, diversification, and strategic investment in achieving financial milestones. Young Australians can replicate this success by staying informed and leveraging the dynamic opportunities within the ASX.

Understanding Market Trends and Economic Factors

The Australian stock market is influenced by various economic factors and market trends. Understanding these can significantly enhance an investor’s ability to make informed decisions. According to the Australian Bureau of Statistics (ABS), sectors such as technology, renewable energy, and healthcare have shown robust growth, driven by innovation and government incentives.

The RBA's monetary policies also play a crucial role in shaping the investment landscape. For instance, low-interest rates have encouraged borrowing and investment, leading to increased market activity. This environment benefits young investors who can leverage low-cost capital to maximize their investment portfolios.

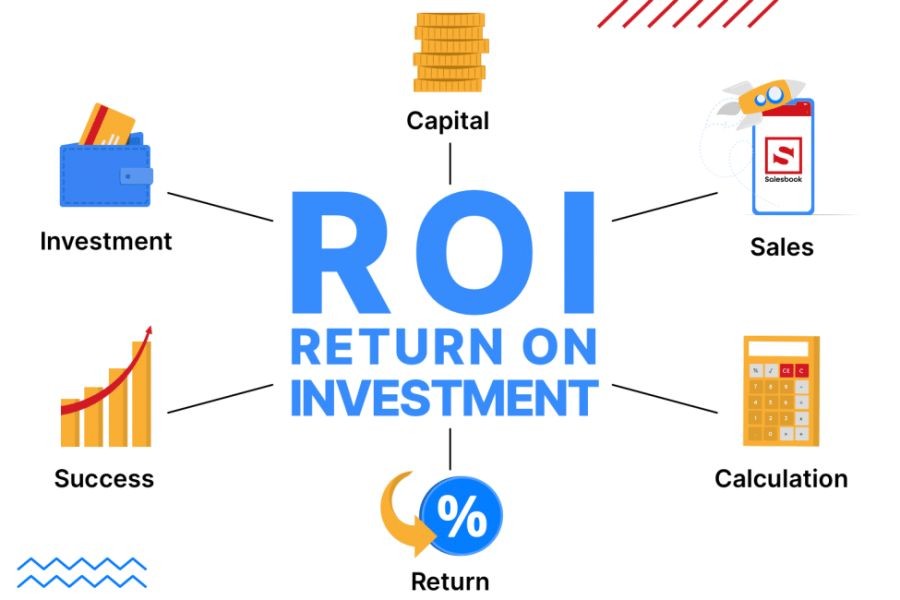

Risk vs. Reward: Strategies for Young Investors

Investing in stocks inherently involves risks, but with the right strategies, the rewards can be substantial. Here’s how young investors like Alex navigate the complexities of the stock market:

- Diversification: Spreading investments across different sectors minimizes risk and allows for potential growth in various areas.

- Research and Education: Staying informed about market trends, economic policies, and company performance is crucial. Utilizing resources from ASIC and financial institutions can provide valuable insights.

- Long-term Perspective: While short-term gains can be enticing, a long-term investment strategy often yields better returns, as evidenced by historical data from the ASX.

- Risk Management: Setting stop-loss orders and regularly reviewing portfolios can help manage potential losses and capitalize on profitable opportunities.

Regulatory Insights: Navigating the Australian Investment Landscape

Investors must navigate a regulatory environment designed to protect and empower them. The Australian Competition & Consumer Commission (ACCC) and the Australian Prudential Regulation Authority (APRA) play pivotal roles in maintaining market integrity. Understanding these regulations can help investors make compliant and informed decisions.

For example, ASIC’s regulatory framework ensures transparency and fairness in trading practices. Young investors are encouraged to familiarize themselves with these regulations to avoid pitfalls and make ethical investment choices.

Common Myths and Mistakes in Stock Investment

Despite the potential for success, several myths and mistakes can hinder an investor’s journey. Here are a few misconceptions debunked:

Myth: "Investing in stocks is a guaranteed way to make money."

Reality: While stocks can offer high returns, they also come with risks. Thorough research and strategic planning are essential for success.

Myth: "Only wealthy individuals can invest in the stock market."

Reality: With the advent of digital trading platforms, investing is accessible to individuals with varying capital levels.

Myth: "Timing the market is crucial for success."

Reality: Trying to time the market often leads to losses. A disciplined, long-term investment approach is more effective.

Future Trends and Predictions in the Australian Stock Market

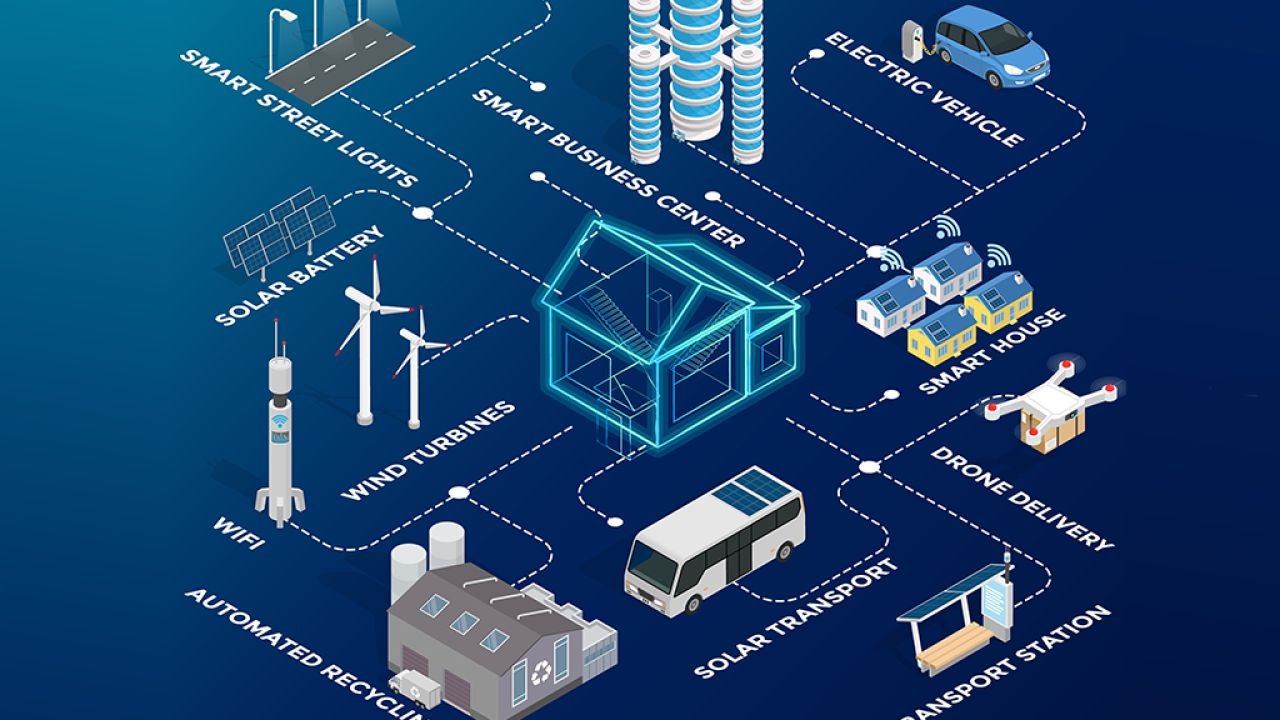

Looking ahead, several trends are set to shape the Australian stock market. According to a report by Deloitte, sectors like technology and renewable energy will continue to drive growth, supported by government policies and global demand for sustainable solutions.

Additionally, the integration of artificial intelligence and machine learning in financial services will enhance investment strategies, offering personalized and data-driven insights for investors. By 2028, it is predicted that 40% of Australian investors will utilize AI tools for portfolio management, according to McKinsey & Company.

Conclusion: Embracing Opportunities and Learning from Success

Alex’s journey from a novice investor to a millionaire underscores the potential of the Australian stock market for young investors. By embracing education, strategic planning, and regulatory insights, young Australians can navigate the complexities of stock investments and achieve financial success.

As the market continues to evolve, staying informed and adaptable will be crucial. Whether you’re a seasoned investor or just starting, the opportunities within the Australian stock market are vast and promising. What strategies have worked for you in your investment journey? Share your insights and join the conversation.

People Also Ask

- How does investing in stocks impact young Australians? Investing in stocks offers young Australians opportunities for wealth accumulation, with many achieving significant financial milestones through informed and strategic investments.

- What are the biggest misconceptions about stock investment? A common myth is that only the wealthy can invest in stocks. However, digital platforms have made stock investment accessible to individuals with varying capital levels.

- What future trends should investors in Australia watch? Investors should watch for growth in technology and renewable energy sectors, supported by government policies and global sustainability demands.

Related Search Queries

- How to invest in the Australian stock market

- Top Australian stocks for young investors

- Stock market trends in Australia 2024

- Australian stock market investment strategies

- Regulatory insights for Australian investors

- Future of stock investments in Australia

- Common myths about stock investment

- Case studies of successful Australian investors

- Impact of AI on the Australian stock market

- Risk management in stock investments

kathlene95e371

10 months ago