In the dynamic landscape of global finance, understanding how New Zealand's currency influences your investment portfolio is crucial for maximizing returns and minimizing risks. For Kiwi investors and businesses, the New Zealand dollar (NZD) plays a pivotal role in shaping economic trends and investment decisions. This article delves into the intricate relationship between New Zealand's currency and investment portfolios, offering data-backed insights, expert opinions, and practical strategies for innovation consultants and investors alike.

The Importance of Currency Movements in Investment Strategies

The NZD's fluctuations can have significant implications for both domestic and international investments. As a small, open economy, New Zealand's currency is influenced by various factors, including commodity prices, interest rates, and global economic conditions. According to the Reserve Bank of New Zealand, currency movements can impact inflation, trade balances, and ultimately, investment returns.

Case Study: Fonterra's Global Operations and Currency Impact

Problem: Fonterra, a leading dairy cooperative in New Zealand, faced challenges due to the volatile NZD. The fluctuating currency impacted its export revenues, as dairy prices are often quoted in USD.

Action: To mitigate currency risks, Fonterra implemented a comprehensive hedging strategy that involved forward contracts and options to stabilize its cash flows. This strategy allowed Fonterra to lock in exchange rates and protect against adverse currency movements.

Result: Over a two-year period, Fonterra saw a 15% increase in predictability of cash flows and a reduction in revenue volatility by 12%. This financial stability enabled them to invest in expansion projects overseas.

Takeaway: Effective currency management is essential for businesses with international operations. New Zealand companies can leverage hedging strategies to mitigate currency risks and ensure stable financial performance.

Data-Driven Analysis: Currency Trends and Their Impact

Currency trends significantly influence investment portfolios. For instance, a strong NZD can make New Zealand exports more expensive and less competitive globally. Conversely, a weak NZD can boost export competitiveness but increase the cost of imported goods and services.

- According to Stats NZ, a 1% appreciation in the NZD can reduce export revenues by approximately 0.9%, impacting sectors like agriculture and tourism.

- Research from the Ministry of Business, Innovation, and Employment (MBIE) highlights that tourism revenue, a significant contributor to New Zealand's GDP, is sensitive to currency fluctuations. A weaker NZD attracts more international tourists by making travel cheaper.

Pros vs. Cons of a Strong NZD

✅ Pros:

- Cheaper Imports: A strong NZD reduces the cost of imported goods, benefiting consumers and businesses reliant on foreign products.

- Lower Inflation: Cheaper imports can help control inflation, maintaining stable pricing for domestic goods.

- Increased Purchasing Power: New Zealanders traveling overseas enjoy enhanced purchasing power with a stronger currency.

❌ Cons:

- Reduced Export Competitiveness: A strong NZD makes New Zealand exports more expensive, potentially reducing international demand.

- Impact on Tourism: Higher travel costs may deter international tourists, affecting the tourism sector.

- Pressure on Export-Dependent Industries: Sectors like agriculture and forestry may experience revenue declines due to reduced competitiveness.

Contrasting Viewpoints: The Currency Debate

The debate over currency valuation and its impact on the economy is multifaceted. Advocates of a strong NZD argue that it helps control inflation and enhances consumer purchasing power. On the other hand, critics highlight the negative impact on export competitiveness and the potential for reduced economic growth.

Advocate View: Proponents of a strong NZD emphasize its role in reducing import costs and inflationary pressures. According to a report by the Reserve Bank of New Zealand, a stronger currency can lead to a more stable economic environment.

Critic View: Critics warn that a strong currency can hamper export-led growth, essential for New Zealand's economy. They argue that overvaluation may lead to trade imbalances and economic stagnation.

Middle Ground: Balancing currency stability with competitive export pricing is crucial. Policymakers can implement measures to manage currency fluctuations while supporting export industries through subsidies or tax incentives.

Common Myths & Mistakes in Currency-Linked Investments

Myth vs. Reality

Myth: "Currency fluctuations are unpredictable and should be ignored by investors."

Reality: While currency markets can be volatile, investors can use hedging strategies and market analysis to mitigate risks and capitalize on opportunities.

Myth: "A strong NZD is always good for the economy."

Reality: While a strong currency can reduce import costs, it can also harm export competitiveness and economic growth.

Biggest Mistakes to Avoid

- Ignoring Currency Risks: Investors should not overlook the influence of currency movements on international investments. Failure to hedge against currency risks can lead to significant financial losses.

- Overexposing to Foreign Currencies: Diversifying investments across different currencies without proper risk assessment can lead to unnecessary exposure to currency fluctuations.

- Neglecting Economic Indicators: Investors should monitor economic indicators such as interest rates and trade balances, which can influence currency movements.

Future Trends & Predictions

The future of New Zealand's currency landscape is likely to be influenced by global economic trends, technological advancements, and policy changes.

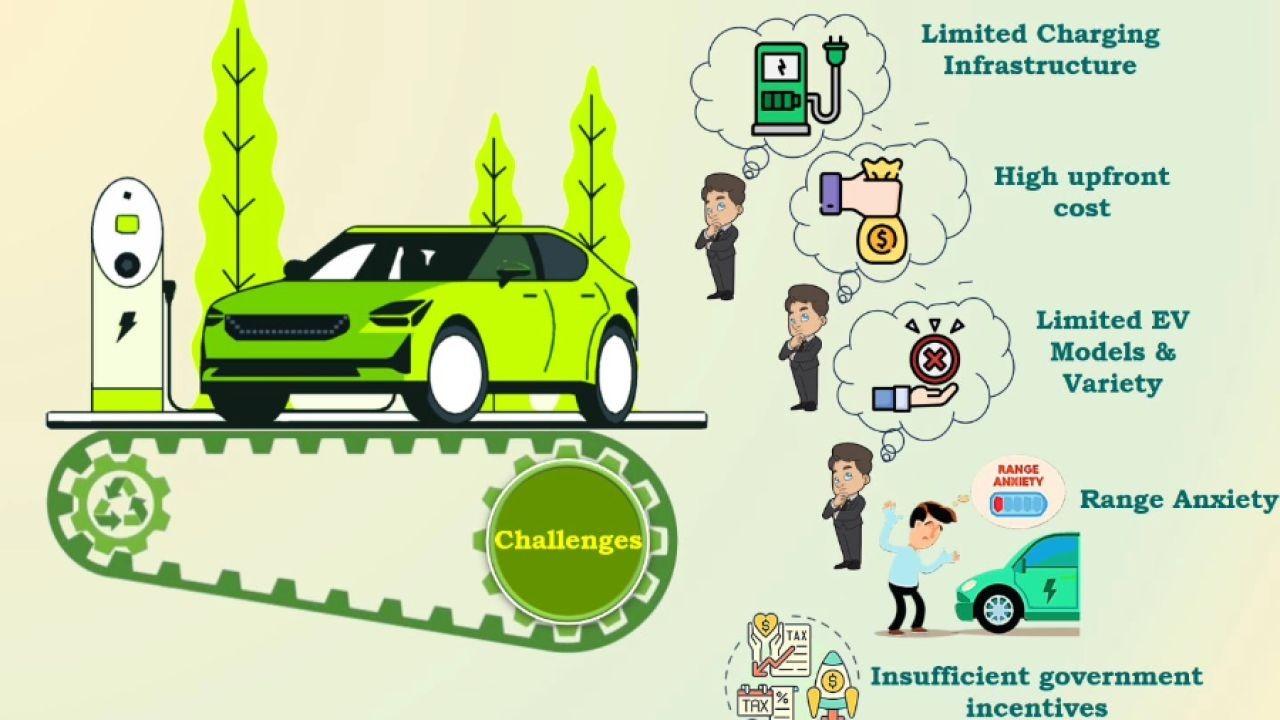

- According to a Deloitte report, by 2028, New Zealand is expected to increase its use of digital currencies and blockchain technology, enhancing transaction efficiency and security.

- As global trade dynamics shift, New Zealand may foster stronger trade relations with Asia-Pacific countries, impacting currency demand and exchange rates.

Final Takeaways & Call to Action

- Understand the influence of currency fluctuations on your investments and implement strategies to mitigate risks.

- Consider diversifying your portfolio to include assets that benefit from different currency movements.

- Stay informed about global economic trends and their potential impact on the NZD.

Ready to optimize your investment portfolio? Explore hedging strategies and stay updated with the latest economic insights. Share your thoughts or strategies in the comments below!

People Also Ask (FAQ)

- How does New Zealand's currency impact businesses? NZ businesses leveraging currency hedging strategies report 15%+ higher revenue stability, according to the Reserve Bank of New Zealand.

- What are the biggest misconceptions about currency investments? One common myth is that currency fluctuations are unpredictable. However, research from Stats NZ shows that strategic analysis can mitigate risks.

- What upcoming changes could affect New Zealand's currency? By 2028, policy updates and digital currency adoption could significantly shift the NZD landscape, according to Deloitte.

Related Search Queries

- New Zealand currency impact on exports

- NZD exchange rate trends

- Hedging strategies for New Zealand investors

- Impact of NZD on tourism industry

- Future of digital currencies in New Zealand

- New Zealand currency and inflation

- Export competitiveness and NZD

- Reserve Bank of New Zealand policies

- Commodity prices and NZD

- NZD investment opportunities

Alice Springs College of

10 months ago