Purchasing a property in New Zealand as a foreign investor can be a rewarding yet complex journey, offering both significant opportunities and challenges. This guide delves into the intricacies of investing in Kiwi real estate, providing you with a step-by-step roadmap to navigate the process successfully. As we explore this topic, we'll draw on data from Stats NZ and insights from industry experts to ensure you are well-informed about the local market dynamics and regulatory environment.

Understanding New Zealand's Property Market

New Zealand's property market has long been a magnet for foreign investors due to its stable economy and stunning natural landscapes. However, recent changes in government policies and economic trends have reshaped the landscape. According to Stats NZ, the median house price in New Zealand rose by 27% in 2024, prompting concerns about affordability and accessibility. Foreign investors must now navigate a more regulated market, requiring a keen understanding of local conditions and potential pitfalls.

Step 1: Researching Property Types and Locations

Before diving into the property market, it's crucial to identify the type of property you wish to invest in. New Zealand offers a diverse range of options, from residential homes and commercial spaces to rural farmland and lifestyle properties. Each category has its own set of regulations and market dynamics.

- Residential Properties: Ideal for buy-to-let investments, especially in urban centers like Auckland and Wellington.

- Commercial Properties: Offers higher returns but requires a thorough understanding of lease agreements and tenant management.

- Rural and Lifestyle Properties: These are less regulated but come with unique challenges such as land use restrictions.

Location is another critical factor. Cities like Auckland, Christchurch, and Wellington are popular for their robust infrastructure and economic activity, but regional areas can offer more affordable options with potential for growth.

Step 2: Navigating Legal and Regulatory Requirements

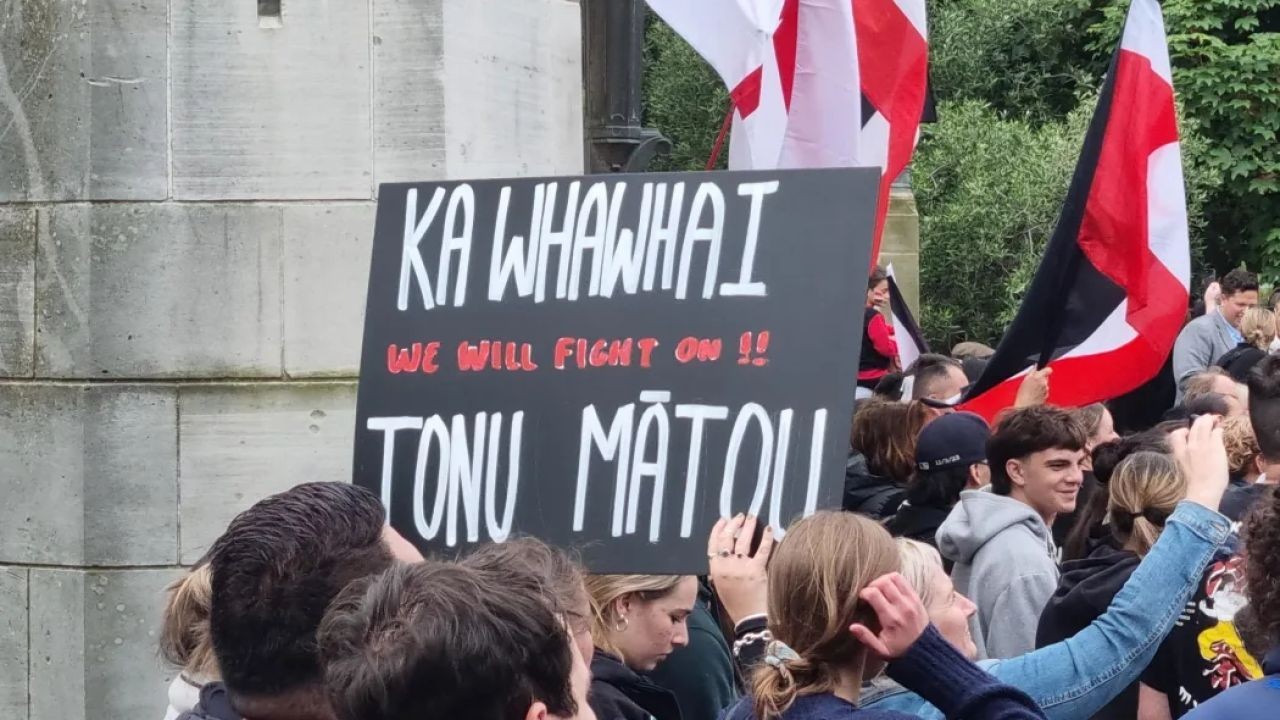

Foreign investors in New Zealand face specific legal and regulatory hurdles. The Overseas Investment Act 2005 governs the acquisition of sensitive land by foreigners, requiring approval from the Overseas Investment Office (OIO) for certain transactions. In 2021, the government introduced amendments tightening restrictions on foreign ownership, particularly concerning residential properties.

It's essential to consult with a local legal expert to ensure compliance with these regulations. Additionally, understanding tax implications, such as the Bright-line Test for property sales, is crucial for avoiding potential financial pitfalls.

Case Study: Successful Foreign Investment

Let's examine a real-world example of successful foreign investment in New Zealand. A Singapore-based investment group recently acquired a commercial property in Auckland's central business district. Facing initial challenges due to the OIO's stringent approval process, the group worked closely with local advisors to navigate legal requirements. Their strategic focus on high-demand areas and long-term leases resulted in a 15% increase in rental income within the first year.

Takeaway: This case study underscores the importance of strategic planning, local expertise, and compliance with New Zealand's regulatory framework when investing in the property market.

Step 3: Financing Your Investment

Securing financing is a crucial step in the property acquisition process. New Zealand's financial institutions offer various mortgage options to foreign investors, though the requirements may differ from those for local buyers. It's advisable to engage with a financial advisor familiar with the New Zealand market to explore the best financing options.

According to the Reserve Bank of New Zealand, leveraging local financing solutions not only helps manage currency risk but also provides access to competitive interest rates. Consider pre-approval for a mortgage to streamline the purchasing process and strengthen your negotiating position.

Pros and Cons of Investing in New Zealand Property

✅ Pros:

- High Demand: New Zealand's population growth and urbanization create sustained demand for housing.

- Stable Economy: The country's resilient economy offers a reliable investment climate.

- Natural Appeal: Scenic landscapes and a high quality of life attract both residents and tourists.

❌ Cons:

- Regulatory Hurdles: Stringent laws can complicate the investment process for foreigners.

- High Entry Costs: Rising property prices can be a barrier for some investors.

- Market Volatility: Economic shifts can impact property values and rental yields.

Common Myths & Mistakes

Investing in New Zealand property comes with its share of misconceptions and potential errors. Let's debunk some common myths:

- Myth: "All foreign investors are barred from buying property." Reality: While restrictions exist, strategic investments are still possible with proper planning and compliance.

- Myth: "Property prices will always rise." Reality: While New Zealand has seen price growth, market fluctuations can occur, necessitating careful market analysis.

- Myth: "You don't need local expertise." Reality: Engaging local advisors is crucial for navigating regulatory and market complexities.

Biggest Mistakes to Avoid

- Failing to research local market conditions, leading to overpayment or poor investment choices.

- Overlooking legal requirements, resulting in costly compliance issues.

- Ignoring financial planning, leading to cash flow problems or inability to service debt.

For example, a 2024 study from the NZ Property Investors’ Federation found that 62% of first-time foreign investors underestimated the impact of local taxes, highlighting the need for thorough financial analysis.

Future Trends & Predictions

Looking ahead, the New Zealand property market is poised for several transformative trends. As the government continues to tackle housing affordability, policy shifts may open new opportunities for foreign investors. The integration of technology in property management and virtual tours is expected to enhance investment processes and accessibility.

By 2028, it's predicted that 40% of property transactions will incorporate blockchain technology for secure, transparent dealings (Source: Deloitte Real Estate Report 2024). This shift could redefine investment strategies and streamline regulatory compliance.

Conclusion & Call to Action

Investing in New Zealand's property market as a foreign investor offers a wealth of opportunities, provided you navigate the regulatory landscape and market dynamics with care. By leveraging local expertise and strategic planning, you can capitalize on this vibrant market. Are you ready to embark on your investment journey? Share your thoughts or experiences in the comments below!

Related Search Queries

- How to invest in New Zealand property market

- New Zealand property investment opportunities 2024

- Overseas Investment Act New Zealand 2025

- Best locations for property investment in NZ

- New Zealand property market trends 2025

People Also Ask (FAQ)

- How does New Zealand's property market impact foreign investors? NZ's robust economy and rising property prices create lucrative opportunities, but regulatory hurdles require strategic planning.

- What are the biggest misconceptions about investing in NZ property? A common myth is that all foreign investment is banned, yet strategic opportunities exist with proper compliance.

- What are the best strategies for financing NZ property investments? Engaging a financial advisor to explore local mortgage options is crucial for managing currency risk effectively.

- What upcoming changes in New Zealand could affect property investments? Policy shifts addressing housing affordability may open new investment opportunities by 2028.

- Who benefits the most from investing in NZ property? Investors seeking stable returns and regulatory compliance, especially in urban centers, stand to gain significantly.

Cross Dock Miami

10 months ago