Improving your credit score in Australia within six months isn't just a financial aspiration—it's a necessity for those looking to secure better loan terms, lower interest rates, and improved financial flexibility. While the journey may seem daunting, understanding key strategies can make it achievable. In this article, we'll explore actionable steps, backed by data and expert insights, to help you enhance your credit health efficiently.

Understanding the Importance of a Good Credit Score

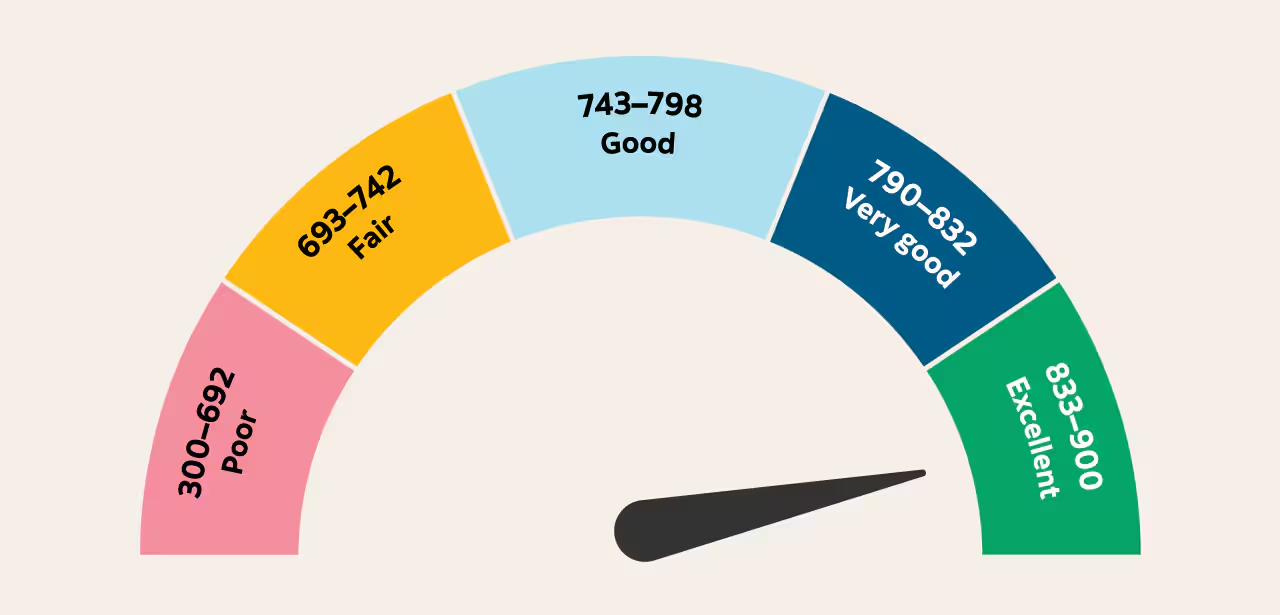

A credit score is a numerical representation of your creditworthiness. In Australia, scores typically range from 0 to 1200, with a higher score indicating better creditworthiness. The Australian Bureau of Statistics (ABS) reports that individuals with a score above 750 are considered excellent, providing access to better financial products.

A good credit score is crucial for obtaining loans, mortgages, or even securing rental properties. According to the Reserve Bank of Australia (RBA), those with higher credit scores can save up to 0.75% on interest rates compared to those with lower scores, translating into significant savings over time.

Steps to Improve Your Credit Score in Six Months

1. Check Your Credit Report Regularly

Start by obtaining a copy of your credit report from any of the main credit reporting agencies in Australia—Equifax, Experian, or illion. Reviewing your report allows you to identify errors or discrepancies that may be negatively impacting your score. According to the Australian Competition & Consumer Commission (ACCC), 20% of Australians find inaccuracies in their credit reports, which when corrected, can improve their scores substantially.

2. Pay Your Bills on Time

Payment history is one of the most significant factors affecting your credit score. Consistently paying bills on time, including credit cards, utilities, and loans, demonstrates reliability. ASIC highlights that late payments can remain on your credit report for up to two years, so prioritizing timely payments is crucial.

3. Reduce Outstanding Debt

High levels of debt relative to your credit limits can adversely affect your credit score. The Australian Securities and Investments Commission (ASIC) suggests focusing on paying down credit card balances and other debts. A balanced debt-to-credit ratio should not exceed 30% of your credit limit to maintain a healthy score.

4. Limit Credit Applications

Every credit application you make results in a hard inquiry on your credit report, which can reduce your score. Instead, focus on managing existing credit responsibly. The RBA notes that frequent credit inquiries can lower your score by up to 10%.

Common Myths about Credit Scores

Despite widespread information, several myths about credit scores persist in Australia.

Myth: "Checking your own credit score will lower it."Reality: Self-checks are considered soft inquiries and do not affect your score. Regularly checking can help you stay informed and proactive.

Myth: "Closing old accounts will improve your score."Reality: Older accounts contribute to a longer credit history, which can positively impact your score. Closing them may inadvertently reduce your credit history length.

Myth: "Using a credit repair company is the only way to fix your score."Reality: Many issues can be resolved independently by disputing inaccuracies directly with credit bureaus.

Case Study: Successful Credit Score Improvement

Meet Sarah, a Sydney-based nurse who improved her credit score from 620 to 780 in just six months. Sarah started by obtaining her credit report and identifying errors that were subsequently corrected. She focused on paying off her credit card debt, reducing her debt ratio to below 30%. Additionally, Sarah set up automatic payments for her bills, ensuring timely payments. As a result, Sarah secured a home loan with a favorable interest rate, saving her thousands over the loan's term.

Future Trends in Credit Scoring

By 2025, the introduction of alternative data sources, such as rental and utility payments, could reshape credit scoring in Australia, according to a report by Deloitte. This shift aims to provide a more comprehensive view of an individual's financial behavior, potentially benefiting those with limited credit histories.

Final Takeaways

- Check your credit report regularly for accuracy.

- Pay bills on time to maintain a positive payment history.

- Reduce outstanding debt to improve your debt-to-credit ratio.

- Limit new credit applications to avoid unnecessary inquiries.

- Stay informed about upcoming trends that may impact credit scoring.

Conclusion

Improving your credit score in Australia is entirely achievable with disciplined financial habits and informed strategies. By understanding the factors that influence your score and taking proactive steps to manage your credit, you can enhance your financial standing within six months. Have you tried any of these strategies? Share your experiences and insights below!

People Also Ask

How does improving your credit score benefit you in Australia?Improving your credit score can lead to better loan terms and lower interest rates, saving you money in the long run.

What are the biggest misconceptions about credit scores?One common myth is that checking your own credit score will lower it. However, self-checks do not affect your score.

What upcoming changes in Australia could affect credit scoring?By 2025, the inclusion of alternative data, like rental payments, could provide a more comprehensive view of financial behavior, benefiting those with limited credit histories.

Related Search Queries

- How to check your credit score in Australia

- Factors affecting credit score

- Steps to improve credit score quickly

- Impact of credit score on home loans

- Credit score myths debunked

- Alternative data in credit scoring

- Best credit cards for building credit in Australia

- Credit score range in Australia

- How to dispute credit report errors

- Long-term benefits of a good credit score