In New Zealand's dynamic real estate market, deciding whether to buy or rent property is a critical question faced by many. This decision not only impacts individual financial stability but also influences broader economic trends. Recent data from Stats NZ highlights a 27% rise in property prices over the past year, exacerbating affordability concerns. This article explores the pros and cons of buying versus renting property in New Zealand, offering strategic insights for business consultants and investors.

The New Zealand Real Estate Landscape

New Zealand's real estate market has witnessed significant shifts, driven by economic factors and policy changes. The Reserve Bank of New Zealand's tight monetary policies have influenced mortgage rates, affecting purchasing decisions. Furthermore, the government's recent initiatives on housing affordability aim to stabilize the market, making it crucial for investors to understand the local context.

The Pros and Cons of Buying Property

Pros:

- Equity Building: Homeownership allows individuals to build equity over time, providing a sense of financial security.

- Capital Growth: With property prices rising, owning real estate can lead to substantial capital gains, particularly in high-demand areas like Auckland and Wellington.

- Stability: Owning a home offers stability and the freedom to make modifications, which is appealing to families seeking long-term residence.

Cons:

- High Initial Costs: The upfront costs of buying a property, including deposits and legal fees, can be prohibitive for many.

- Market Volatility: Property values can fluctuate, posing a risk to homeowners seeking to sell during downturns.

- Maintenance Responsibilities: Homeowners are responsible for maintenance and repairs, adding to the overall cost of ownership.

The Pros and Cons of Renting Property

Pros:

- Flexibility: Renting offers mobility, allowing individuals to relocate without the burden of selling a property.

- Lower Short-Term Costs: Renting typically requires less upfront financial commitment compared to buying.

- Reduced Maintenance Concerns: Tenants are generally not responsible for property maintenance, reducing ongoing expenses.

Cons:

- Limited Control: Renters have limited control over property modifications and may face rent increases.

- Lack of Equity: Unlike homeowners, renters do not build equity, potentially impacting long-term financial goals.

- Instability: Tenants may face uncertainty if landlords decide to sell or repurpose the property.

Case Study: Auckland's Property Market

Problem: In recent years, Auckland has experienced a property boom, resulting in soaring prices and reduced affordability. Many residents found themselves priced out of the market, leading to increased demand for rental properties.

Action: To address this, the Auckland Council implemented policies to increase housing supply, including rezoning areas for higher-density development.

Result: These measures led to a 20% increase in housing supply within two years, stabilizing rental prices and providing more options for potential buyers.

Takeaway: Strategic urban planning and policy interventions can effectively address housing market challenges, offering valuable lessons for other regions in New Zealand.

Expert Insights: Local and Global Perspectives

According to a report by the Ministry of Business, Innovation and Employment (MBIE), the housing supply in New Zealand needs to increase by 25% over the next decade to meet demand. This highlights the critical need for strategic planning and investment in the real estate sector.

Globally, countries like Canada have implemented similar strategies to address housing affordability, offering insights that New Zealand can adapt. For instance, Canada's focus on affordable housing projects and rent control measures has shown positive results, suggesting potential pathways for Kiwi policymakers.

Debunking Common Myths

- Myth: Buying property is always a better investment than renting.

- Reality: While owning property can lead to capital gains, renting may offer more financial flexibility and lower risk in volatile markets.

- Myth: Renting is throwing money away.

- Reality: Renting can provide financial stability and flexibility, especially for those not ready to commit to long-term ownership.

Future Trends and Predictions

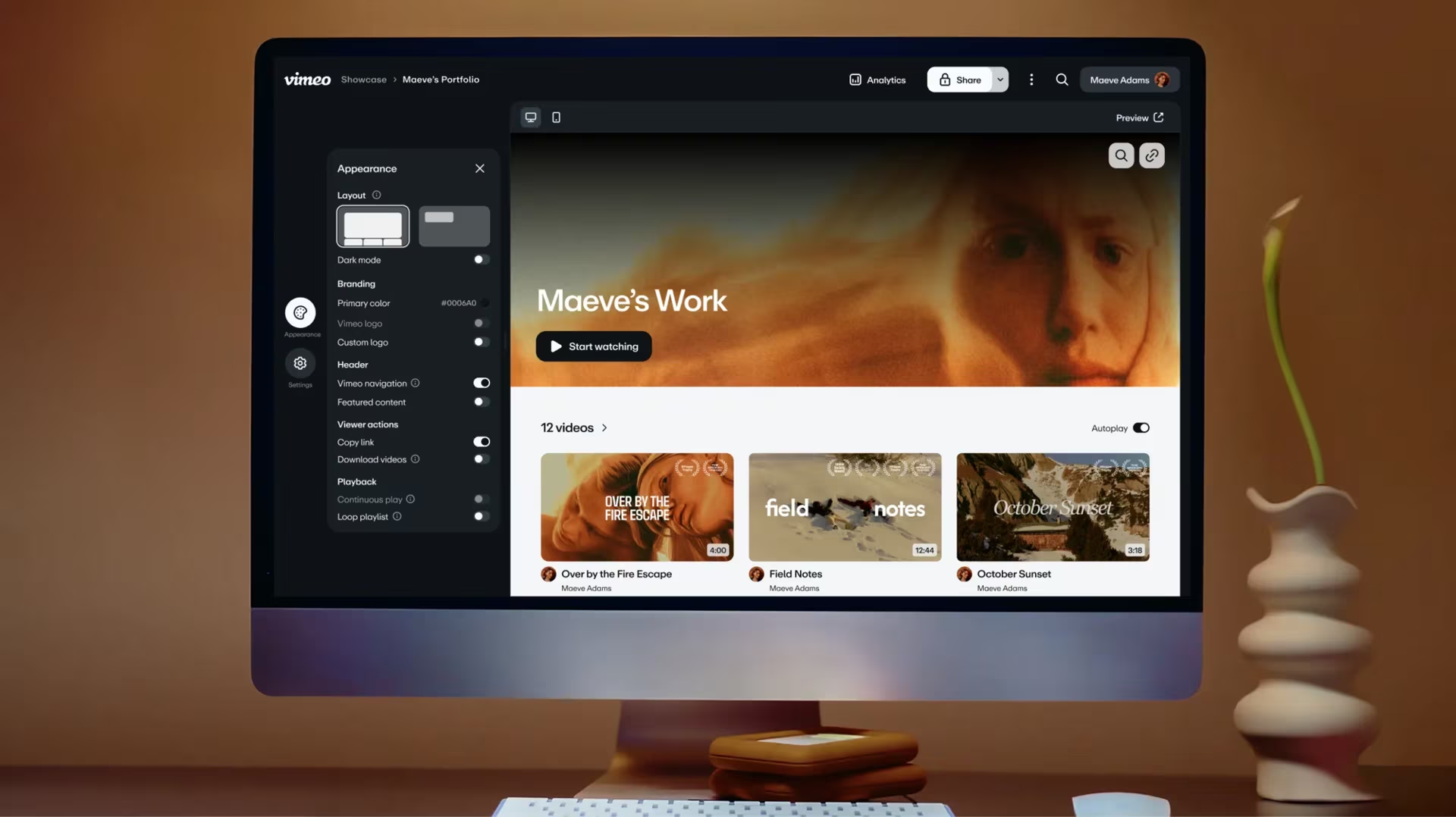

The future of New Zealand's property market will likely be shaped by technological advancements and policy changes. By 2028, it is projected that 40% of property transactions will involve digital platforms, streamlining the buying and renting process. Additionally, emerging trends like co-living and sustainable housing are expected to gain traction, providing new opportunities for investors and developers.

Conclusion

Deciding whether to buy or rent property in New Zealand requires careful consideration of individual circumstances and market conditions. Strategic insights and data-driven analysis can guide informed decision-making, ensuring long-term financial stability. As the real estate landscape evolves, staying informed about policy changes and market trends will be crucial for investors and business consultants alike.

People Also Ask

- What are the biggest misconceptions about renting property? One common myth is that renting is a waste of money. However, renting can offer financial flexibility and lower risk, especially in volatile markets.

- How does the New Zealand property market impact businesses? The property market affects businesses by influencing employee relocation costs and office space affordability, impacting overall operational expenses.

Related Search Queries

- New Zealand property investment strategies

- Buying vs. renting in Auckland

- Housing affordability in NZ

- Real estate trends in New Zealand 2025

- Impact of NZ housing policies on investment

DottyMosie

29 days ago