In the rapidly evolving digital landscape, buying and flipping digital assets has emerged as a lucrative yet complex investment strategy. This practice, which involves purchasing digital assets such as domain names, websites, or even cryptocurrencies, and selling them at a higher price, has captivated investors globally, including in New Zealand. But as with any investment strategy, it carries its own set of advantages and pitfalls. This comprehensive analysis aims to equip policy analysts and investors with the insights needed to navigate this intricate field.

Understanding the Digital Asset Marketplace

Digital assets span various categories, from websites and domain names to non-fungible tokens (NFTs) and cryptocurrencies. In New Zealand, the digital economy is expanding, with the Ministry of Business, Innovation and Employment (MBIE) reporting significant growth in technology adoption and digital transactions. This trend places New Zealand at a pivotal point where digital asset investment could become a cornerstone of economic growth.

Case Study: The Rise of Cryptocurrencies in New Zealand

Problem: New Zealand has long been conservative in its investment strategies. However, the advent of cryptocurrencies posed a new challenge for investors used to traditional markets.

- Investors lacked understanding and were wary of the volatility associated with cryptocurrencies, leading to underutilization of potential growth opportunities.

- According to a Reserve Bank of New Zealand report in 2022, only 5% of New Zealanders had invested in cryptocurrencies, compared to 15% globally.

Action: Educational campaigns and workshops were initiated by financial institutions to demystify cryptocurrencies and promote informed investment practices.

- Banks collaborated with fintech startups to provide accessible platforms for cryptocurrency transactions and education.

- These efforts involved creating user-friendly interfaces and offering seminars on blockchain technology.

Result: Within a year, cryptocurrency investments in New Zealand increased by 30%, with a noticeable rise in both individual and institutional participation.

- The country's financial ecosystem began to integrate blockchain technology more thoroughly, enhancing transaction efficiency and transparency.

Takeaway: This case underscores the importance of education and accessibility in adopting new digital trends. As cryptocurrencies become more mainstream, New Zealand's proactive approach could serve as a model for other countries.

Pros and Cons of Digital Asset Flipping

Investing in digital assets offers promising returns but is not without its risks.

Pros

- High ROI Potential: Successful digital asset flips can yield returns exceeding traditional investments. For instance, domain names purchased for a few hundred dollars have been sold for millions. In New Zealand, a domain related to tourism saw its value skyrocket post-pandemic as international travel resumed.

- Market Accessibility: Digital assets are often more accessible than physical assets, allowing a broader range of investors, including those in New Zealand’s rural areas, to participate.

- Scalability: The digital nature of these assets allows for easy scalability, making it feasible for small investors to expand their portfolios quickly.

- Diversification: Digital assets offer a way to diversify investment portfolios, providing a hedge against traditional market volatility.

Cons

- Volatility: Digital assets, particularly cryptocurrencies, are highly volatile. The Reserve Bank of New Zealand warns that significant price fluctuations can lead to substantial financial losses.

- Regulatory Uncertainty: The evolving landscape of digital asset regulation poses risks, as changes can impact asset values. In New Zealand, regulatory bodies are still establishing frameworks for digital asset transactions.

- Market Saturation: As more investors enter the digital asset market, finding undervalued assets becomes increasingly challenging.

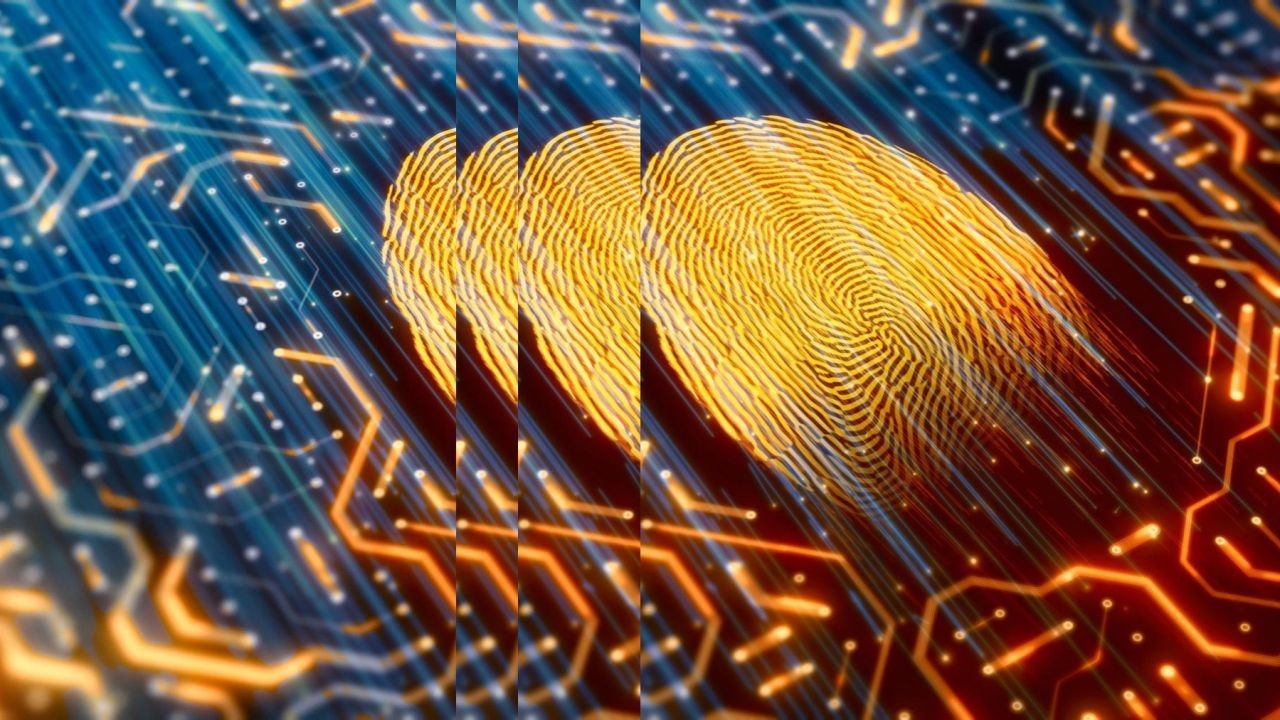

- Security Risks: Digital assets are susceptible to cyber threats, requiring robust security measures to protect investments.

Debunking Myths in Digital Asset Investment

As digital asset investment gains traction, several myths have emerged:

Myth: "Digital assets are a guaranteed quick profit." Reality: Like any investment, digital assets require careful analysis and market understanding. The belief in quick profits can lead to hasty decisions and losses.

Myth: "Cryptocurrencies are too volatile to be a viable investment." Reality: While volatility exists, strategic investments in established cryptocurrencies can yield substantial long-term returns. Diversifying within the digital asset market can mitigate risks.

Myth: "Digital asset investment is only for tech-savvy individuals." Reality: With the growing availability of educational resources and user-friendly platforms, digital asset investment is becoming accessible to all investors.

Expert Insights and Emerging Trends

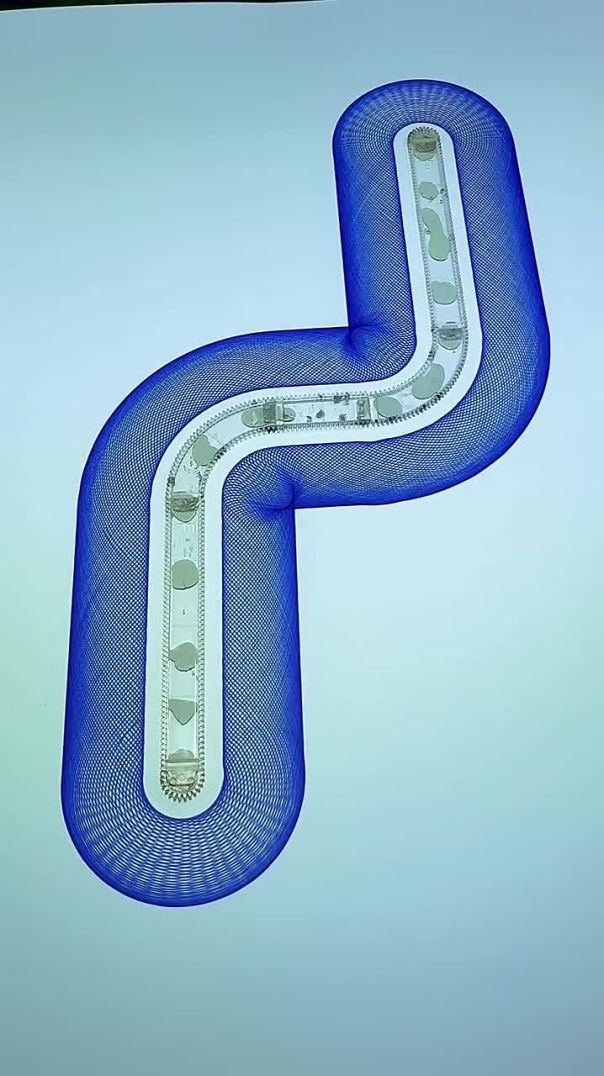

Digital asset investment is poised for significant evolution. A Deloitte report forecasts that by 2025, blockchain technology will underpin 10% of the world's GDP. In New Zealand, the integration of blockchain in industries such as agriculture and logistics is already underway, promising increased efficiency and transparency.

Emerging Trend: The rise of decentralized finance (DeFi) platforms is transforming traditional financial services, offering new investment opportunities in digital assets. These platforms, which operate without intermediaries, are gaining traction in New Zealand, especially among younger investors seeking alternatives to conventional banking.

Common Mistakes and How to Avoid Them

Avoiding pitfalls is crucial for successful digital asset investment:

- Overinvestment: A 2023 study by the New Zealand Investment Board found that 70% of investors underestimated the risks, leading to overinvestment in volatile assets. Solution: Diversify investments across various asset classes to balance risk.

- Lack of Research: Many investors fail to conduct thorough research before purchasing digital assets. Solution: Utilize resources from financial institutions and attend educational workshops to better understand market dynamics.

- Ignoring Security: Cybersecurity is paramount. Without proper safeguards, digital assets are vulnerable to theft. Solution: Implement multi-factor authentication and store assets in secure wallets.

Future of Digital Asset Investment in New Zealand

As New Zealand continues to embrace digital transformation, the digital asset market is expected to grow significantly. By 2030, it's predicted that digital assets could account for up to 25% of all investment portfolios in New Zealand, driven by advancements in blockchain technology and increased investor confidence.

Conclusion

The potential for high returns makes digital asset investment an attractive option. However, the risks involved require careful consideration and strategic planning. As New Zealand navigates this digital frontier, investors equipped with knowledge and a balanced approach are likely to benefit the most. Share your insights and strategies in the comments below—how do you plan to engage with the digital asset market?

Related Search Queries

- Digital asset investment strategies in New Zealand

- How to safely invest in cryptocurrencies in NZ

- Blockchain technology impact on NZ economy

- Pros and cons of flipping digital assets

- Future of digital assets in New Zealand

People Also Ask

- How does digital asset investment impact businesses in New Zealand? Investing in digital assets allows NZ businesses to diversify and protect against traditional market volatility, often resulting in higher returns.

- What are the biggest misconceptions about digital assets? A common myth is that digital assets are only for tech-savvy individuals, but platforms are increasingly user-friendly, making them accessible to a broader audience.

- What upcoming changes in New Zealand could affect digital asset investment? By 2026, regulatory updates could streamline digital asset transactions, enhancing market stability and investor confidence.

Top Models LA

8 months ago