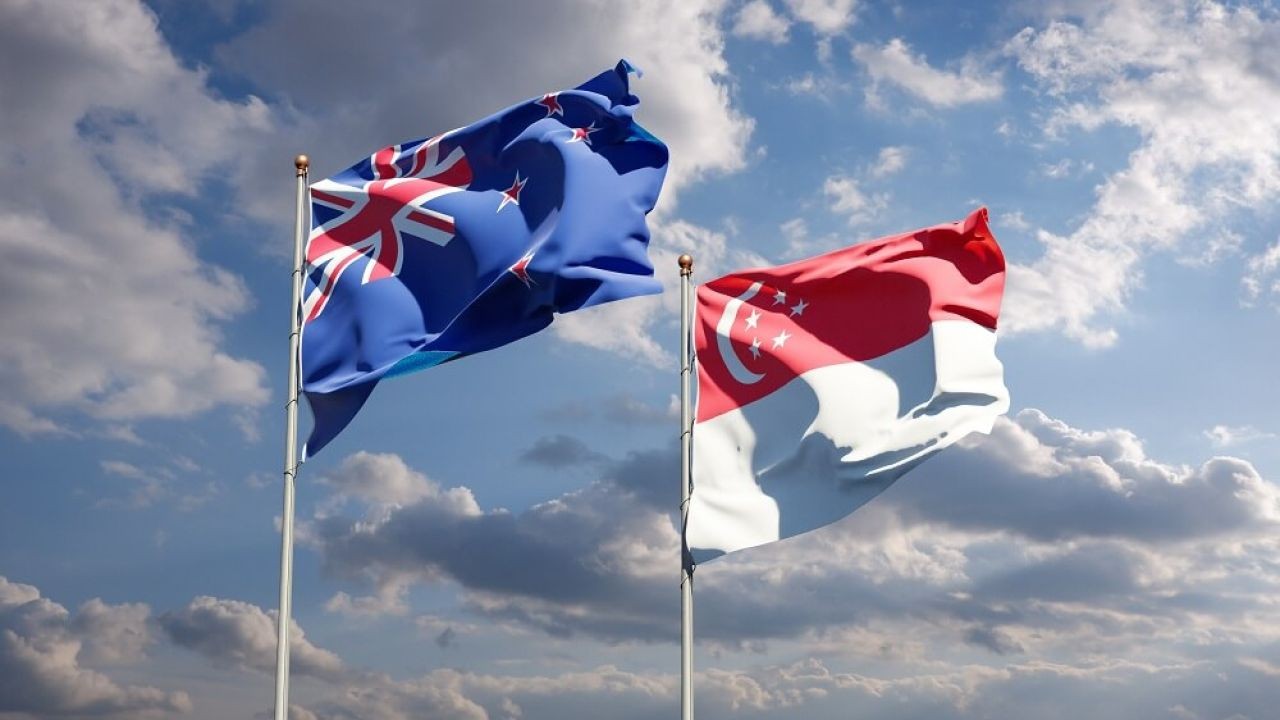

In the global race to become the leading tech hub, New Zealand and Singapore stand as prominent contenders, each offering unique advantages and challenges for startups. As a financial advisor, understanding these dynamics is crucial, not just for advising clients but also for identifying potential investment opportunities and risks in these regions. But how do these two tech ecosystems compare, and what implications do they have for the Kiwi economy?

Behind-the-Scenes Insights: New Zealand's Tech Landscape

New Zealand's tech industry has been gaining momentum, contributing significantly to the nation's economy. According to the Ministry of Business, Innovation, and Employment (MBIE), the tech sector accounts for around 8% of New Zealand's GDP, with ICT exports reaching NZD 8.7 billion in 2022. This growth is driven by a supportive government, robust infrastructure, and a burgeoning startup culture.

However, challenges remain. New Zealand's geographical isolation can be a double-edged sword. While it provides a unique testbed for innovation, it also poses logistical challenges for startups aiming for global expansion. Moreover, the talent pool, while skilled, is relatively small, which can hinder rapid scaling.

Innovation Breakdown: Singapore's Tech Ecosystem

Singapore, on the other hand, is a global powerhouse, consistently ranking high in ease of doing business and innovation indices. With a strategic location, world-class infrastructure, and a pro-business regulatory environment, Singapore attracts tech startups from around the world.

The city-state's government actively supports tech innovation through initiatives like the Smart Nation program and robust funding schemes. These efforts have cultivated a vibrant ecosystem, making Singapore a hub for fintech, AI, and biotech innovations. However, the high cost of living and intense competition are notable downsides for startups.

Case Study: Xero – A Kiwi Success Story

Xero, a New Zealand-founded company, exemplifies how Kiwi startups can thrive globally. Initially struggling with market penetration, Xero leveraged New Zealand's supportive tech policies and focused on innovation within cloud accounting.

Problem: Xero faced the challenge of scaling its operations and gaining international recognition.

- Limited local market size hindered growth potential.

- Competition from established global players was intense.

Action: The company prioritized product innovation and strategic partnerships.

- Focused on user-friendly design and seamless cloud integration.

- Secured partnerships with major banks and tech firms globally.

Result: Xero's approach paid off significantly:

- Revenue increased by 29% annually, reaching NZD 848.8 million in 2023.

- Global subscriber base expanded to over 3 million.

Takeaway: New Zealand startups can achieve global success by leveraging local support and focusing on niche innovation.

Pros and Cons: New Zealand vs. Singapore for Startups

Pros of New Zealand

- Supportive Government Policies: Initiatives like Callaghan Innovation provide grants and resources.

- Innovative Testbed: Ideal for piloting new technologies due to its smaller market size.

- High Quality of Life: Attracts talent with its appealing lifestyle and work-life balance.

Cons of New Zealand

- Geographic Isolation: Limits quick access to larger markets.

- Limited Talent Pool: Can hinder rapid scaling.

- Market Size: Small domestic market can restrict growth potential.

Pros of Singapore

- Strategic Location: Gateway to Asian markets with excellent connectivity.

- Robust Infrastructure: World-class facilities and digital infrastructure.

- Pro-Business Environment: Favorable tax policies and regulatory support.

Cons of Singapore

- High Cost of Living: Increases operational expenses.

- Intense Competition: Saturated market with many players vying for attention.

- Resource Constraints: Limited space and natural resources.

Common Myths & Mistakes

Myths in Tech Hubs

Myth: "New Zealand's isolation is a major deterrent for startups."

Reality: While isolation presents challenges, it also fosters a unique environment for innovation and problem-solving, as demonstrated by companies like Rocket Lab.

Myth: "Singapore is only suitable for fintech startups."

Reality: While fintech thrives, Singapore's ecosystem supports diverse sectors, including biotech and AI, with substantial government backing.

Mistakes to Avoid

- Overlooking Local Regulations: Both regions have specific compliance requirements. Engage local experts to navigate these effectively.

- Underestimating Cultural Differences: Tailor products and marketing strategies to align with local consumer preferences.

- Lack of Long-Term Planning: Focus on sustainable growth strategies rather than short-term gains.

Controversial Take: Singapore's Dominance Challenged?

While Singapore is often seen as the de facto leader in tech innovation, some experts argue that its high costs and competitive market might drive startups to seek more affordable and less saturated alternatives like New Zealand. As remote work becomes more prevalent, New Zealand's appeal as a tech hub could grow, offering a unique balance of innovation and lifestyle.

Future Trends & Predictions

Looking ahead, New Zealand is poised to enhance its tech landscape with increased government investment in digital infrastructure and innovation hubs. By 2028, it is predicted that New Zealand's tech exports will surpass NZD 10 billion, driven by advancements in AI and sustainable technology sectors (Source: NZTech).

Conversely, Singapore will likely continue its aggressive push in AI and smart city technologies, potentially leading to new regulatory frameworks that other regions, including New Zealand, might adopt to remain competitive.

Final Takeaways

- New Zealand's tech sector offers unique opportunities for niche innovation and sustainable growth.

- Singapore provides a dynamic environment for scaling and accessing Asian markets, albeit at a higher operational cost.

- Both regions offer distinct advantages that can be leveraged depending on startup goals and market strategies.

As a financial advisor, it's crucial to guide clients in evaluating these factors to align with their business objectives. Ready to explore opportunities in these tech hubs? Let’s discuss how to position your investments for maximum impact.

People Also Ask (FAQ)

- How does New Zealand's tech industry impact its economy? The tech sector contributes 8% to New Zealand's GDP, with ICT exports reaching NZD 8.7 billion, showcasing its economic significance.

- What are the biggest misconceptions about Singapore's tech ecosystem? A common myth is that Singapore is only fintech-focused, whereas it supports diverse sectors, including biotech and AI.

- What are the best strategies for startups in New Zealand? Focus on leveraging government support, tapping into niche markets, and fostering innovation to thrive in New Zealand's tech landscape.

- What upcoming changes in Singapore could affect startups? Policy updates in AI and smart city technologies are expected, influencing how startups operate in Singapore.

- Who benefits the most from New Zealand's tech environment? Startups focusing on sustainable and niche innovations benefit most, leveraging government support and a quality lifestyle.

Related Search Queries

- New Zealand tech startup opportunities

- Singapore vs. New Zealand tech hub comparison

- Best countries for tech startups 2024

- New Zealand tech industry growth

- Singapore fintech ecosystem overview

- Tech investment opportunities in New Zealand

- Challenges for startups in Singapore

- New Zealand government support for tech startups

- Future of tech hubs in Asia-Pacific

Jaipur City Cab

9 months ago