In the evolving landscape of global economies, Australia's startup ecosystem is poised for transformative growth as we approach 2030. With the country’s robust economic policies, cutting-edge technology, and dynamic market trends, the implications for financial advisors and investors are profound. Understanding these shifts is crucial for anyone looking to capitalize on the opportunities that lie ahead.

Key Drivers of Australia's Startup Ecosystem

Several factors are driving the evolution of Australia's startup ecosystem. At the forefront is the Australian government's commitment to fostering innovation through supportive policies and initiatives. According to the Australian Treasury, initiatives such as the Research and Development Tax Incentive and the Entrepreneurs' Programme have been instrumental in bolstering innovation and entrepreneurship across the country.

Economic Factors and Trends

The Reserve Bank of Australia (RBA) has reported steady economic growth, with GDP expected to increase by 2.5% annually through the decade. This economic stability provides a fertile ground for startups to thrive, offering a conducive environment for innovation and investment. Furthermore, Australia's strategic focus on digital transformation is set to enhance productivity and efficiency across various sectors.

Technological Advancements: AI and Beyond

Artificial intelligence (AI) is a significant catalyst in the transformation of startups. The adoption of AI technologies is expected to increase significantly, with businesses leveraging AI for everything from customer service to data analysis. According to Deloitte, companies that integrate AI into their operations could see productivity gains of up to 40% by 2030.

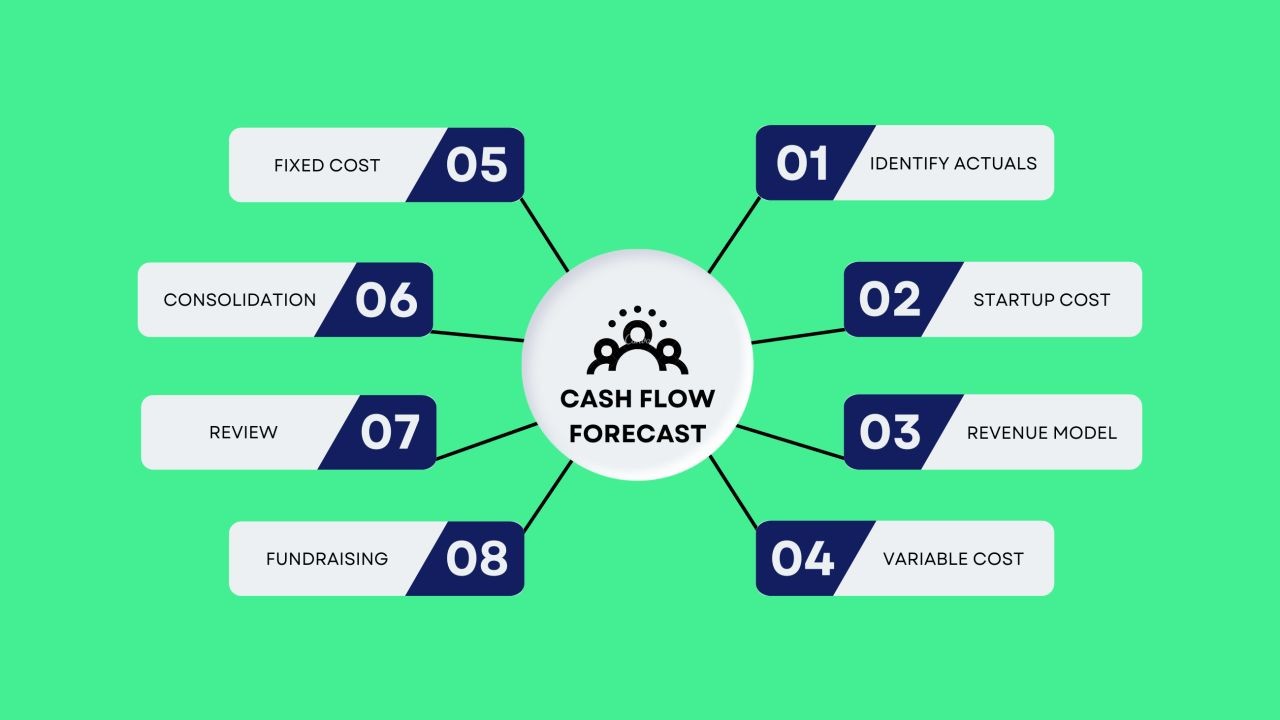

Funding and Investment Opportunities

venture capital investment in Australia is on the rise. Startmate and Blackbird Ventures are among the key players fueling this growth. In 2022, venture capital investment in Australian startups reached AUD 10 billion, a record high, indicating strong investor confidence in the market. These funds are crucial in helping startups scale and compete on a global stage.

Case Studies: Success Stories in the Australian Startup Scene

To illustrate the potential of the Australian startup ecosystem, let's examine some success stories that showcase innovation and strategic growth.

Case Study: Canva – Revolutionizing Design

Problem: Canva, an Australian graphic design platform, aimed to democratize design by making it accessible to everyone, regardless of design expertise.

Action: Canva developed a user-friendly interface powered by AI, allowing users to create professional-quality designs easily.

Result: Canva now boasts over 60 million monthly active users, with a valuation exceeding AUD 40 billion. The platform's success underscores the importance of user-centric design and innovation.

Takeaway: Canva's journey highlights the potential of leveraging technology to solve real-world problems, a strategy that can be replicated across various industries.

Case Study: Afterpay – Transforming Payment Solutions

Problem: Afterpay identified a gap in the payment industry, where consumers sought flexible payment options without incurring credit card debt.

Action: The company introduced a buy-now-pay-later (BNPL) solution that allowed consumers to make purchases and pay in installments.

Result: Afterpay's innovative model quickly gained popularity, with the company expanding to international markets and securing a multi-billion-dollar acquisition by Square.

Takeaway: The success of Afterpay emphasizes the value of identifying consumer needs and creating tailored financial solutions.

Regulatory Insights and Challenges

The regulatory landscape in Australia plays a crucial role in shaping the startup ecosystem. The Australian Competition & Consumer Commission (ACCC) and the Australian Securities and Investments Commission (ASIC) provide oversight to ensure fair competition and investor protection. Compliance with these regulations is essential for startups to build trust and credibility in the market.

Opportunities and Risks

While the startup ecosystem offers immense opportunities, it is not without risks. Financial advisors must weigh the potential returns against the inherent risks of investing in early-stage companies. Startups often face challenges such as market volatility, regulatory compliance, and the need for sustainable business models.

Future Trends: What to Expect by 2030

Looking ahead, several trends are set to shape the future of Australia's startup ecosystem.

Increased Focus on Sustainability

Sustainability will be a key driver of innovation. Startups that prioritize eco-friendly solutions and sustainable business practices are likely to gain a competitive advantage. The Australian government's commitment to achieving net-zero emissions by 2050 will further propel this trend.

Rise of Decentralized Finance (DeFi)

Decentralized finance (DeFi) is poised to revolutionize the financial industry by offering more transparent and efficient financial services. As blockchain technology matures, its adoption in Australia is expected to grow, providing new opportunities for startups to innovate in the financial sector.

Digital Health Innovations

The healthcare industry is ripe for disruption, with digital health solutions playing a pivotal role. Startups focused on telehealth, AI-driven diagnostics, and personalized medicine will be at the forefront of this transformation, addressing the growing demand for accessible and efficient healthcare services.

Common Myths and Mistakes in the Startup Ecosystem

As the ecosystem evolves, it's crucial to debunk common myths and avoid costly mistakes.

Myth: "Startups are Always Risky Investments"

Reality: While startups carry inherent risks, strategic investment in sectors with high growth potential can yield significant returns. Diversification and due diligence are key to mitigating risks.

Myth: "Innovation Only Happens in Tech"

Reality: Innovation is not limited to technology. Industries such as agriculture, healthcare, and finance are experiencing significant breakthroughs, driven by startups addressing unique challenges.

Biggest Mistakes to Avoid

- Neglecting Market Research: A thorough understanding of market trends and consumer needs is essential for startup success.

- Overlooking Regulatory Compliance: Non-compliance can lead to legal challenges and damage a startup's reputation.

- Lack of Sustainable Business Models: Startups must focus on long-term sustainability rather than short-term gains.

Conclusion: Embracing the Future of Australia's Startup Ecosystem

As we look toward 2030, the Australian startup ecosystem presents a wealth of opportunities for investors and entrepreneurs alike. By understanding the key drivers, challenges, and emerging trends, financial advisors can strategically position themselves to capitalize on the growth potential of this dynamic landscape.

People Also Ask (FAQ)

- How does the Australian startup ecosystem impact businesses?Australian startups are driving innovation, creating jobs, and contributing to economic growth. Successful startups often spur further investment and development in their respective industries.

- What are the biggest misconceptions about startups?One common myth is that startups are always risky investments. However, with proper strategy and due diligence, they can offer substantial returns.

- What upcoming changes could affect Australian startups?Increased focus on sustainability and the rise of decentralized finance are set to impact the startup ecosystem, offering new opportunities for growth and innovation.

- Who benefits the most from Australia's startup ecosystem?Investors, entrepreneurs, and consumers all stand to benefit from the dynamic growth and innovation within Australia's startup ecosystem.

Related Search Queries

- Australian startup trends 2030

- Investment opportunities in Australia

- Emerging technologies in Australia

- Future of AI in Australia

- Sustainable business practices in startups