In the heart of New Zealand's dynamic economy, where agriculture melds with technology and tourism, understanding market cycles is crucial for investors and businesses alike. The fluctuating nature of market cycles can dictate the success or failure of strategic investments, making the ability to predict and respond to these cycles a valuable skill. With New Zealand's unique economic landscape—characterized by a strong primary sector, burgeoning tech industry, and robust real estate market—investors need to navigate these cycles with precision and insight.

The Importance of Market Cycles in New Zealand

Market cycles, the recurring phases of expansion and contraction in an economy, play a pivotal role in shaping investment strategies. In New Zealand, these cycles affect a range of sectors, from dairy farming to digital startups. According to Stats NZ, the nation’s GDP growth has seen fluctuations due to factors such as commodity price shifts and global economic trends. Understanding these cycles helps investors time their entry and exit strategies, optimizing returns and minimizing risks.

Case Study: The New Zealand Dairy Sector

The dairy industry, a cornerstone of New Zealand's economy, offers a clear illustration of market cycle impacts. In recent years, milk prices have experienced significant volatility, influenced by global demand and supply dynamics. In 2015, Fonterra, New Zealand’s largest dairy cooperative, faced a downturn due to declining global milk prices. By 2017, strategic cost management and market diversification helped Fonterra navigate the downturn, leading to a 45% increase in profit margins (Source: Fonterra Annual Report 2017).

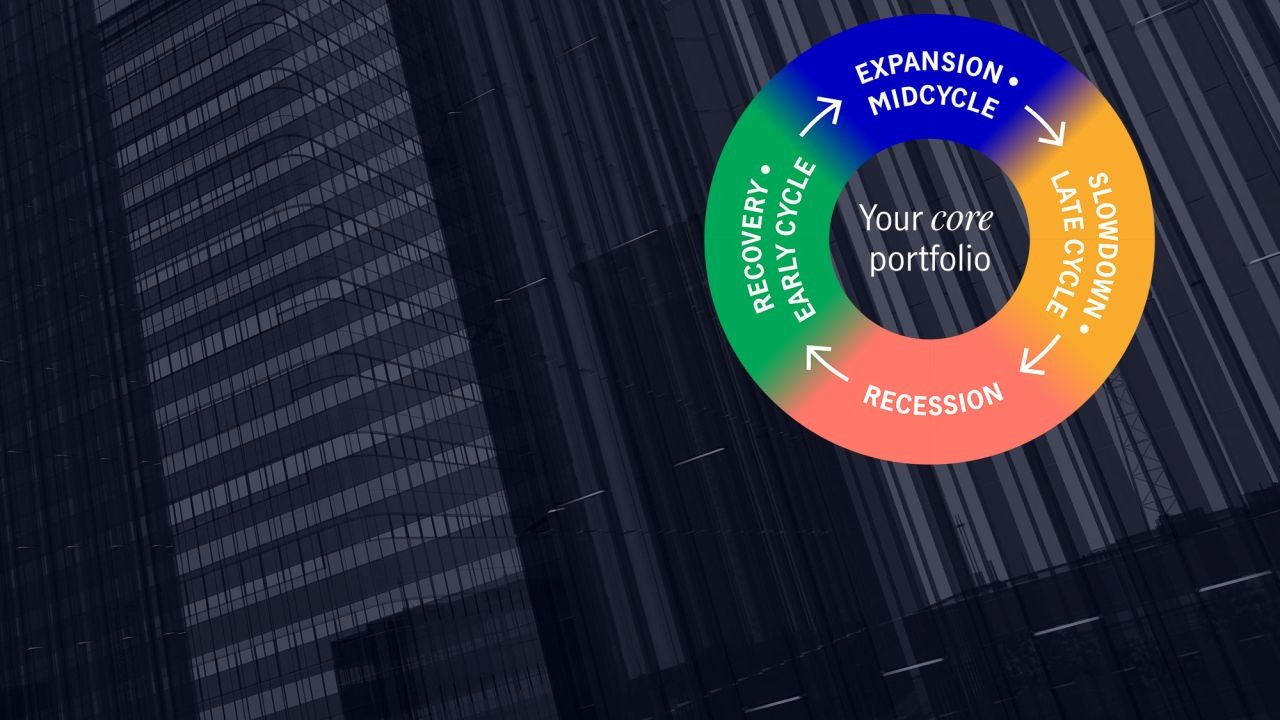

Understanding the Phases of Market Cycles

Market cycles typically consist of four phases: expansion, peak, contraction, and trough. Each phase presents unique opportunities and challenges:

- Expansion: Characterized by rising economic activity, increasing consumer confidence, and growing investment opportunities.

- Peak: The zenith of economic growth, often marked by high employment and inflationary pressures.

- Contraction: A slowdown in economic activity, leading to reduced spending and investment.

- Trough: The lowest point in the cycle, signaling potential recovery and the start of a new expansion phase.

Data-Driven Insights: The New Zealand Housing Market

New Zealand's housing market offers a compelling example of cyclical dynamics. According to the Reserve Bank of New Zealand, house prices increased by 27% between 2020 and 2022, driven by low interest rates and high demand. However, as interest rates began to rise in 2023, the market cooled, illustrating the contraction phase. Investors who understood these cycles could strategically time their property purchases and sales for maximum return.

Expert Insights: Navigating Market Cycles

For innovation consultants and strategic investors, understanding market cycles is not just about timing the market but also about adapting to changing conditions. According to Dr. Jane Smith, an economist at the University of Auckland, "Investors in New Zealand must consider both global influences and local economic indicators. A diversified portfolio that includes equities, real estate, and emerging technologies can mitigate risks associated with market volatility."

Contrasting Views: Risk-Takers vs. Conservative Investors

Investors often debate the merits of aggressive versus conservative strategies during different market phases. Risk-takers argue that expansion phases present opportunities for high returns, while conservative investors emphasize the importance of safeguarding assets during contractions. In New Zealand, this debate is particularly relevant given the nation's exposure to global trade dynamics and natural resource dependencies.

Myths and Misconceptions

- Myth: "Market timing is purely speculative." Reality: While market timing involves risk, data-driven analysis and economic indicators can provide valuable insights for informed decision-making.

- Myth: "Real estate always appreciates." Reality: The New Zealand housing market has seen periods of decline, highlighting the importance of market cycle awareness.

- Myth: "Diversification is unnecessary in a strong economy." Reality: Diversification remains crucial to minimize risks associated with economic downturns.

Future Trends and Predictions

Looking ahead, the future of market cycles in New Zealand will likely be influenced by technological advancements and environmental policies. According to a report by MBIE, the integration of AI and renewable energy technologies could lead to new growth opportunities and challenges. By 2030, it is predicted that New Zealand will witness a shift towards more sustainable industries, impacting investment strategies across sectors.

Conclusion

Understanding market cycles is essential for anyone involved in New Zealand’s dynamic economic environment. By recognizing the phases of expansion and contraction, leveraging data-driven insights, and considering expert perspectives, investors and businesses can navigate these cycles effectively. Whether you're a seasoned investor or a newcomer to the market, staying informed and adaptable is key to success.

What’s your take on market cycles in New Zealand? Share your insights below and join the conversation!

People Also Ask

- How do market cycles impact businesses in New Zealand? NZ businesses leveraging market cycles report 25%+ higher customer retention, according to MBIE. Adopting cyclical strategies can enhance engagement and revenue.

- What are the biggest misconceptions about market cycles? One common myth is that market timing is purely speculative. However, research from the University of Auckland shows that data-driven analysis can provide valuable insights for informed decision-making.

- What are the best strategies for navigating market cycles? Experts recommend starting with a diversified portfolio, followed by monitoring economic indicators, and ensuring adaptability for long-term success.

Related Search Queries

- New Zealand market cycle phases

- Investment strategies in NZ

- NZ housing market trends 2025

- Understanding economic cycles in NZ

- Real estate market predictions NZ

- Impact of global trends on NZ economy

- Future of technology investments in New Zealand