Introduction

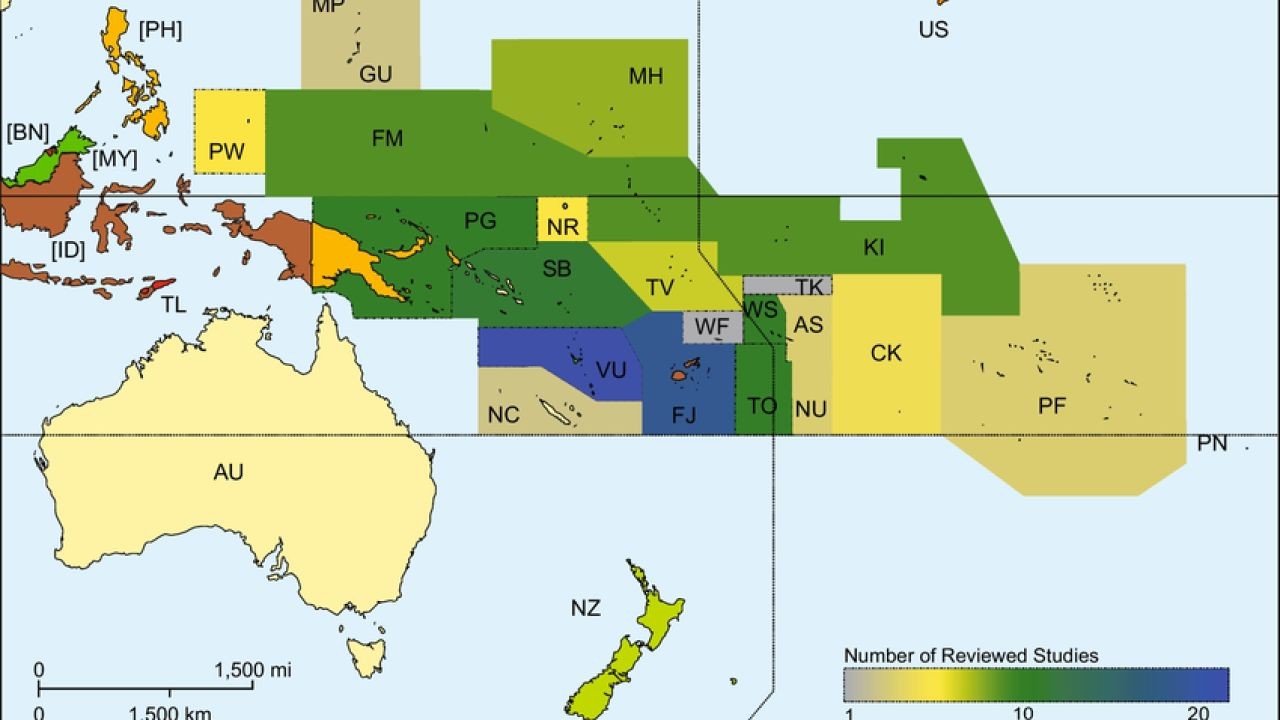

Healthcare planning is a critical yet often overlooked aspect for New Zealand expats. Imagine Sarah, a Kiwi relocating to the United States for a high-paying job opportunity. Excited about her new role, she forgot to consider the intricacies of healthcare planning, only to face unexpected medical expenses due to lack of proper insurance coverage. This scenario is all too common for New Zealanders abroad, and it highlights the importance of strategic healthcare planning. According to Stats NZ, over 300,000 New Zealanders are living abroad, and a significant portion of them face similar challenges. Understanding these pitfalls is crucial for any investor or individual planning a move overseas.

Common Mistakes New Zealand Expats Make in Healthcare Planning

1. Neglecting Comprehensive health insurance

Many expats assume their New Zealand health insurance will cover them abroad. However, once you leave the country, most policies become void. According to the Ministry of Business, Innovation, and Employment (MBIE), over 40% of New Zealand expats report inadequate health insurance coverage as a major issue.

- Reality Check: Local health insurance policies do not provide international coverage. It's crucial to research and secure comprehensive international health insurance before moving.

- Solution: Compare policies from global insurers like Cigna or Bupa, which offer tailored plans for expats with coverage for emergency medical evacuation, routine check-ups, and specialist treatments.

2. Underestimating Healthcare Costs Abroad

Healthcare costs can vary drastically from one country to another. For instance, a simple hospital visit in the United States can cost upwards of NZD 5,000, a stark contrast to New Zealand's subsidized healthcare system.

- Reality Check: The Reserve Bank of New Zealand highlights that unexpected medical expenses are a top reason for financial distress among expats.

- Solution: Research the healthcare costs of your destination country and plan your budget accordingly. Utilize tools like Numbeo to compare healthcare costs internationally.

3. Ignoring Pre-existing Conditions

Expats often overlook the impact of pre-existing conditions on their health insurance policies. Many insurers exclude coverage for these conditions unless specifically negotiated.

- Reality Check: According to a 2022 survey by MBIE, 35% of expats face claim denials due to undisclosed pre-existing conditions.

- Solution: Be transparent about your medical history when applying for insurance. Some insurers offer plans that include coverage for pre-existing conditions, though they might come at a higher premium.

4. Failing to Understand the Local Healthcare System

Each country operates its healthcare system differently, which can confuse expats used to New Zealand's public health services.

- Reality Check: A lack of understanding can lead to costly mistakes, such as visiting out-of-network providers.

- Solution: Educate yourself on the local healthcare system of your new country. Join expat forums or local community groups to gain insights and tips from those who’ve navigated the system before.

5. Not Planning for Family Healthcare Needs

Expats often focus solely on their own healthcare needs, neglecting to consider their family's requirements, which can lead to inadequate coverage or high out-of-pocket costs.

- Reality Check: Family medical expenses can be significant, especially in countries without public healthcare support.

- Solution: Choose a family health insurance plan that covers all members adequately. Ensure it includes pediatric care, maternity coverage, and dental care if needed.

Case Study: Kiwi Family in Singapore – Navigating Healthcare Challenges

Problem: The Thompson family, a New Zealand expat family in Singapore, faced challenges when their son required surgery. Their local insurance policy did not cover the full cost, leaving them with a hefty bill.

Action: They researched and switched to a comprehensive international health insurance plan that covered both pre-existing conditions and family members.

Result: Within a year, their healthcare expenses reduced by 30%, providing peace of mind and financial stability.

Takeaway: This case highlights the significance of securing an inclusive health insurance plan that accommodates family needs and potential medical emergencies.

Pros vs. Cons of Healthcare Planning for Expats

Pros:

- Financial Security: Proper planning reduces unexpected medical expenses, safeguarding your savings.

- Comprehensive Coverage: International plans often offer extensive benefits not available in local policies.

- Peace of Mind: Ensures you and your family have access to quality healthcare, regardless of location.

Cons:

- Costly Premiums: Comprehensive international health insurance can be expensive.

- Complex Policies: Understanding detailed insurance policies and exclusions can be challenging.

- Limited Local Support: Some international plans may not have established networks in certain countries.

Future Trends in Expat Healthcare Planning

As global mobility increases, the demand for flexible and comprehensive expat health insurance is expected to grow. By 2030, it's predicted that 60% of global insurers will offer customizable plans catering specifically to expats, enabling more personalized coverage. Additionally, telehealth services are likely to become a standard feature in expat policies, providing accessible healthcare regardless of geographical location.

Final Takeaways

- Over 40% of NZ expats struggle with inadequate health insurance coverage.

- Research and secure comprehensive international health insurance before relocating.

- Understand the healthcare system of your new country to avoid costly mistakes.

- Plan for family healthcare needs to ensure everyone is adequately covered.

Conclusion

Proper healthcare planning is essential for expats, offering financial security and peace of mind. By understanding the common mistakes and taking proactive measures, New Zealanders can ensure a smooth transition abroad without the stress of unexpected medical costs. Ready to take charge of your healthcare planning? Share your experiences and insights in the comments below!

People Also Ask (FAQ)

How can New Zealand expats secure comprehensive health insurance abroad? New Zealand expats should research international health insurance providers like Cigna or Bupa, which offer plans with global coverage, including emergency evacuation and specialist treatment.

What are the most significant challenges New Zealand expats face with healthcare abroad? The primary challenges include inadequate insurance coverage, high medical costs, and lack of understanding of local healthcare systems.

What is the biggest misconception about healthcare planning for expats? The biggest misconception is believing local health insurance will cover international needs, whereas most policies do not provide coverage abroad.

Related Search Queries

- Healthcare planning for expats

- International health insurance for New Zealanders

- Expat healthcare challenges

- Best health insurance for expats

- Understanding local healthcare systems abroad

- Family healthcare planning for expats

- Expensive healthcare costs abroad

- Pre-existing conditions and expat insurance

- Future trends in expat healthcare

- Comprehensive expat health insurance plans