In recent years, New Zealand's retail landscape has undergone a significant transformation, reflecting global trends while imbibing local nuances. Kiwi retailers, known for their adaptability and innovation, are increasingly straddling the line between budget-friendly and luxury product lines. This shift is not merely a response to consumer demand but a strategic maneuver to capture a broader market segment. As New Zealand's economy continues to evolve, understanding this dichotomy is crucial for real estate experts, investors, and business strategists alike.

Future Forecast & Trends

New Zealand's retail sector is poised for dynamic shifts. According to Stats NZ, the retail trade sales volume increased by 1.4% in the first quarter of 2023, driven by both high-end and budget-conscious consumers. This dual demand has prompted retailers to diversify their offerings, creating a more inclusive market space.

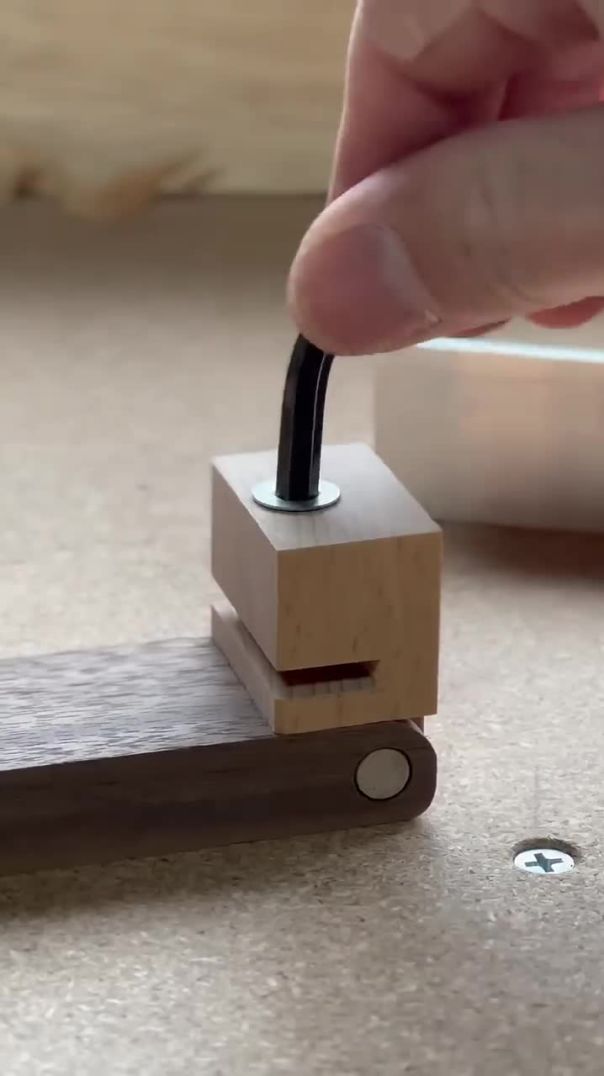

A key trend is the rise of omnichannel retailing, integrating physical stores with digital platforms. This approach caters to varying consumer preferences, offering low-cost essentials online while providing in-store experiences for luxury items. As the Reserve Bank of New Zealand projects a moderate GDP growth of 2.5% in 2024, retailers are likely to invest more in technology and customer experience to enhance their competitive edge.

Contrasting Views: Budget-Friendly vs. Luxury Lines

The debate between budget-friendly and luxury product lines is nuanced. On one side, budget-friendly products attract a broader audience, especially in economically uncertain times. These products offer value for money, catering to cost-conscious consumers—a growing demographic in New Zealand, where the cost of living has been a significant concern.

Conversely, luxury products appeal to a niche market that prioritizes quality, exclusivity, and brand prestige. This segment, although smaller, is willing to spend significantly more, contributing to higher profit margins. Luxury retailers often leverage storytelling and personalized services to create a compelling brand narrative, which resonates well with affluent consumers seeking unique experiences.

Expert Opinion & Thought Leadership

Industry experts suggest that the key to success lies in balancing these contrasting elements. Kiwi retailers are encouraged to adopt a hybrid model, offering budget-friendly products to maintain volume sales while integrating luxury lines to enhance brand prestige and profitability. This strategy not only diversifies revenue streams but also mitigates risks associated with economic fluctuations.

In a recent analysis by the Ministry of Business, Innovation and Employment (MBIE), retailers that successfully implement this dual strategy see a 30% increase in customer retention rates. The report emphasizes the importance of data analytics in understanding consumer behavior, enabling retailers to tailor their offerings effectively.

Case Study: Farmers - Navigating Dual Retail Strategies

Problem: Farmers, a leading New Zealand department store, faced challenges in appealing to diverse consumer segments. While their budget-friendly range was popular, there was untapped potential in the luxury market.

Action: To address this, Farmers introduced a tiered product strategy, expanding its luxury offerings while maintaining a strong budget line. The store also enhanced its online presence, offering exclusive luxury items through its e-commerce platform, supported by targeted marketing campaigns.

Result: Within a year, Farmers reported a 20% increase in overall sales, with a notable 15% rise in luxury product sales. The integration of digital and physical retail strategies led to a 25% increase in online traffic and a 10% improvement in in-store customer footfall.

Takeaway: Farmers' success underscores the value of a balanced approach in retail. By catering to both budget-conscious and luxury-seeking consumers, retailers can optimize market reach and profitability. This case study highlights the potential for Kiwi retailers to adapt and thrive in a competitive landscape.

Pros and Cons of Dual Retail Strategies

Pros:

- Diverse Revenue Streams: Offers financial stability by catering to multiple consumer segments.

- Increased Market Reach: Attracts a wider audience, enhancing brand recognition and loyalty.

- Flexibility: Allows retailers to pivot based on market trends and consumer preferences.

- Higher Profit Margins: Luxury products typically yield higher margins, boosting profitability.

Cons:

- Complex Inventory Management: Balancing diverse product lines can complicate logistics and supply chain management.

- Brand Identity Challenges: Maintaining a coherent brand image across different market segments can be challenging.

- Resource Intensive: Requires significant investment in marketing, technology, and staff training.

- Risk of Alienation: Potential to alienate core consumers if the focus shifts too heavily towards one segment.

Common Myths & Mistakes

Myth: "Luxury products are recession-proof." Reality: While luxury items often perform well, economic downturns can affect even affluent consumers, reducing luxury spending.

Myth: "Budget products lack quality." Reality: Many budget-friendly products offer excellent quality, as manufacturers increasingly focus on value-added features.

Myth: "Online sales cannibalize in-store purchases." Reality: Omnichannel strategies show that online and in-store sales can complement each other, enhancing overall customer experience.

Conclusion

In conclusion, Kiwi retailers showcasing both budget-friendly and luxury product lines are strategically positioned to capture diverse market segments. By understanding consumer behavior and leveraging technology, these retailers can navigate the complexities of modern retailing. As New Zealand's economy continues to grow, those who balance affordability with exclusivity will likely lead the market. What approach do you think will dominate New Zealand's retail sector in the coming years? Share your thoughts below!

People Also Ask (FAQ)

How does showcasing budget-friendly and luxury product lines impact New Zealand retailers?Retailers benefit by diversifying their customer base, enhancing brand loyalty, and increasing profit margins, according to MBIE reports.

What are common misconceptions about dual retail strategies?A common myth is that luxury products are recession-proof. However, economic downturns can affect even affluent consumers, reducing luxury spending.

What are the best strategies for implementing dual retail strategies?Experts recommend starting with market analysis, followed by integrating omnichannel approaches, and ensuring consistent brand messaging across segments.

Related Search Queries

- New Zealand retail trends 2023

- Luxury retail strategies NZ

- Budget-friendly shopping in New Zealand

- Omnichannel retailing examples

- Consumer behavior in New Zealand

For the full context and strategies on Kiwi Retailers Showcasing Budget-Friendly vs Luxury Product Lines, see our main guide: Advanced Retail Video Marketing Insights Nz.

Lay Wine's

2 months ago