In the bustling landscape of Australia’s commercial real estate sector, video case studies have emerged as a pivotal tool for evaluating high-return projects. The digital era has transformed traditional real estate investment strategies, and visual storytelling is at the forefront of this evolution. This article delves into how video case studies are being used to highlight successful real estate ventures in Australia, showcasing both the potential and pitfalls of such investments.

Case Study: The Transformation of Sydney's Barangaroo Development

Problem:

Barangaroo, a prime waterfront location in Sydney, was once an underutilized industrial site. The challenge was to transform this area into a vibrant commercial hub that could attract both businesses and tourists. The project needed to overcome significant logistical and environmental hurdles, including site contamination and public opposition to development plans.

Action:

The developers employed a comprehensive video case study strategy to engage stakeholders and investors. This included detailed visual documentation of the site transformation process, from initial remediation efforts to the construction of commercial spaces and public amenities. By showcasing the project's environmental sustainability and economic benefits, the team was able to gain public support and secure necessary funding.

Result:

Over a decade, Barangaroo transformed into a thriving commercial district, hosting major corporations and generating significant economic activity. The project increased Sydney's commercial real estate value by an estimated 35%, according to a report by the Reserve Bank of Australia (RBA). The development also set a benchmark for sustainability, with over 50% of its energy needs met through renewable sources.

Takeaway:

Video case studies can effectively communicate complex real estate projects' long-term vision and potential. They are instrumental in securing investment and public support, particularly for large-scale developments that require transparency and stakeholder engagement.

Leveraging Local Economic Trends

Australia's economy, characterized by its robust service sector and resource-rich industries, presents unique opportunities for real estate investments. According to the Australian Bureau of Statistics (ABS), the nation's GDP grew by 2.5% in 2023, driven in part by increased activity in the construction and real estate sectors. This growth trajectory suggests a favorable environment for commercial real estate investments, particularly in urban centers like Melbourne and Brisbane.

However, potential investors must remain cautious of market volatility and regulatory changes. The Australian Competition & Consumer Commission (ACCC) has introduced stricter guidelines to ensure transparency in property transactions, which could impact investment timelines and costs. Investors are advised to stay informed on regulatory updates to mitigate risks associated with compliance.

Myth vs. Reality in Real Estate Investments

- Myth: "All real estate investments guarantee high returns." Reality: While many projects can yield significant profits, factors like market timing, location, and regulatory changes can affect outcomes. Research from CoreLogic shows that property values in some regions have stagnated, highlighting the need for strategic investment decisions.

- Myth: "Video case studies are too costly for small projects." Reality: Advances in technology have reduced production costs, making video case studies accessible for projects of all sizes. Smaller developments can leverage concise video content to effectively pitch their value proposition to potential investors.

- Myth: "Sustainability is a secondary concern in commercial real estate." Reality: Sustainability is increasingly becoming a primary consideration for investors and developers. Properties with green certifications often see higher occupancy rates and rental yields, reflecting a growing demand for environmentally responsible buildings.

Biggest Mistakes to Avoid in Real Estate Investment

- Ignoring Market Trends: Failing to analyze current market dynamics can lead to poor investment decisions. Investors should utilize data from the ABS and industry reports to guide their strategies.

- Underestimating Regulatory Changes: New policies from the APRA or ACCC can significantly impact investment outcomes. Keeping abreast of these changes is crucial for compliance and strategic planning.

- Overlooking Sustainability: Ignoring environmental factors can diminish property value and appeal. Implementing sustainable practices can enhance a property's marketability and long-term profitability.

Future of Real Estate Investments in Australia

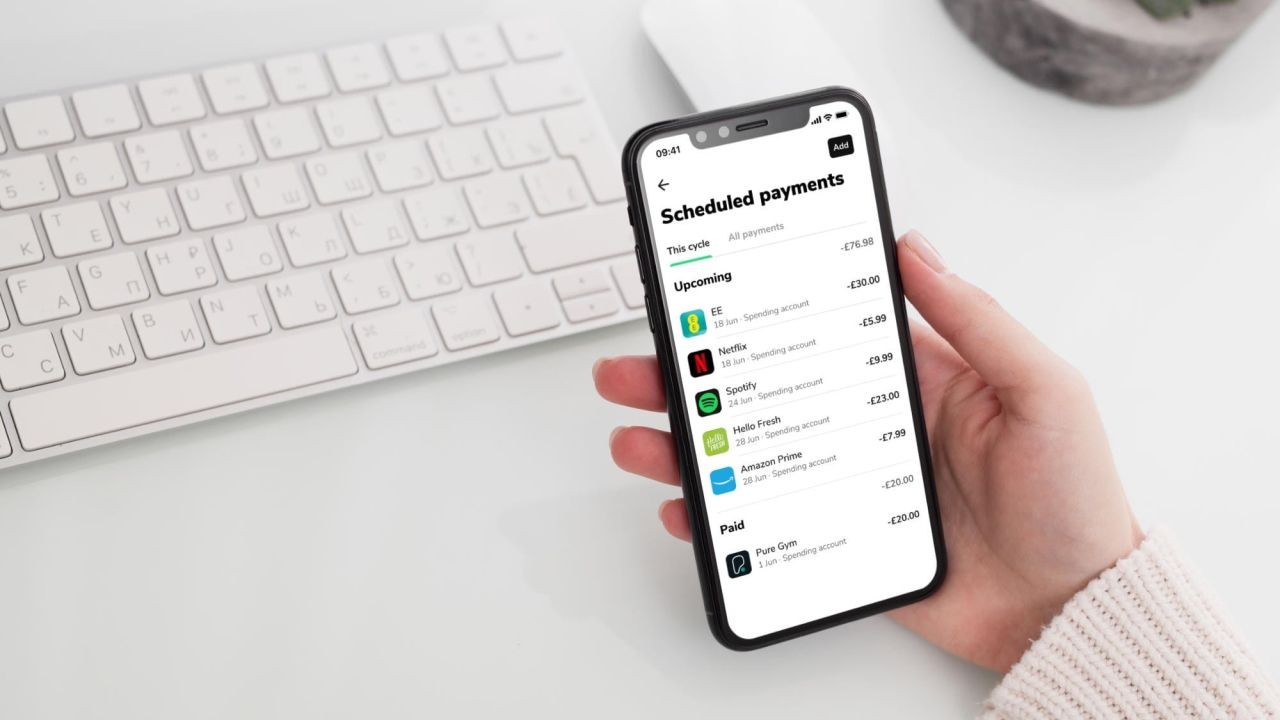

Looking ahead, the integration of technology in real estate is set to redefine investment strategies. By 2028, the RBA anticipates that over 60% of real estate transactions will involve digital platforms, enhancing transparency and efficiency. Smart cities and sustainable developments will also drive demand for innovative real estate solutions, presenting lucrative opportunities for forward-thinking investors.

Moreover, the rise of remote work trends suggests a shift in demand from traditional office spaces to mixed-use developments that accommodate flexible working environments. Investors who adapt to these evolving preferences are likely to see higher returns.

Conclusion

Video case studies have proven to be invaluable in highlighting the potential of high-return real estate projects in Australia. By effectively communicating complex project details and fostering investor confidence, they pave the way for successful investments. As the market continues to evolve, staying informed and adaptable will be key to capitalizing on emerging opportunities.

What strategies have you found effective in navigating Australia’s real estate market? Share your insights and experiences below!

People Also Ask (FAQ)

- How do video case studies impact real estate investments? Video case studies enhance investor confidence by visually showcasing project progress and outcomes, leading to higher investment engagement and support.

- What are the biggest misconceptions about real estate investments in Australia? A common myth is that all real estate investments guarantee high returns. In reality, market conditions and strategic decisions significantly influence outcomes.

- What upcoming changes in Australia could affect real estate investments? By 2028, increased digitalization and regulatory updates are expected to reshape property transactions, emphasizing transparency and efficiency.

Related Search Queries

- High-return real estate investments in Australia

- Video marketing strategies for property developers

- Impact of sustainability on real estate value

- Real estate market trends in Australia 2024

- How to leverage video case studies for investment

For the full context and strategies on Video Case Studies of High-Return Real Estate Projects in Australia, see our main guide: Real Estate Agent Branding Videos Australia.