Australia's cryptocurrency landscape is rapidly evolving, attracting a diverse range of investors—from seasoned financiers to enthusiastic newcomers. While the potential for significant returns is alluring, the path to cryptocurrency investment is fraught with pitfalls. Understanding these challenges is crucial, especially within the context of Australia's unique regulatory environment and economic landscape.

1. Failing to Understand Regulations

Australian investors must navigate a complex web of regulations when it comes to cryptocurrency. The Australian Securities and Investments Commission (ASIC) has stringent guidelines in place to protect consumers and ensure market integrity. However, a misunderstanding or ignorance of these regulations can lead to significant legal repercussions. In 2022, ASIC introduced new rules focusing on initial coin offerings (ICOs) and crypto-assets, emphasizing the need for transparency and investor protection.

Case Study: The ICO Crackdown

In 2023, an Australian fintech company faced penalties for failing to comply with ASIC's ICO regulations. Despite raising over AUD 10 million, the lack of proper disclosure and misleading information led to a suspension and significant fines. This case underscores the importance of understanding legal requirements before launching or investing in cryptocurrency projects.

2. Ignoring Market Volatility

Cryptocurrencies are notorious for their volatility. Unlike traditional assets, they can experience drastic price swings within short timeframes. The Reserve Bank of Australia (RBA) has noted that while cryptocurrencies offer diversification benefits, their price instability poses substantial risks for investors.

For instance, Bitcoin's price fluctuated by more than 40% in 2023 alone, impacting Australian investors heavily reliant on crypto holdings. It's crucial for investors to prepare for such volatility through diversified portfolios and risk management strategies.

3. Lack of Due Diligence

Conducting thorough research is non-negotiable in cryptocurrency investment. Unfortunately, many investors are lured by the promise of quick profits without understanding the technology or the project behind a cryptocurrency. The Australian Bureau of Statistics (ABS) highlights that 70% of first-time investors neglect proper research, often leading to financial losses.

Case Study: The Rise and Fall of Altcoin X

Altcoin X promised revolutionary blockchain technology but collapsed within a year due to technical failures and management issues. Australian investors who skipped due diligence found themselves holding worthless tokens. This case emphasizes the necessity of examining whitepapers, team credentials, and market potential before investing.

4. Falling for Scams

Cryptocurrency scams are prevalent, with fraudsters exploiting the market's novelty and complexity. The Australian Competition & Consumer Commission (ACCC) reported over AUD 100 million lost to crypto scams in 2022. Scams range from fake exchanges and phishing attacks to Ponzi schemes.

Investors should remain vigilant by verifying the legitimacy of exchanges and projects. Using platforms regulated by ASIC can provide additional security. Furthermore, employing two-factor authentication and secure wallets can help protect investments.

5. Over-Investing in a Single Cryptocurrency

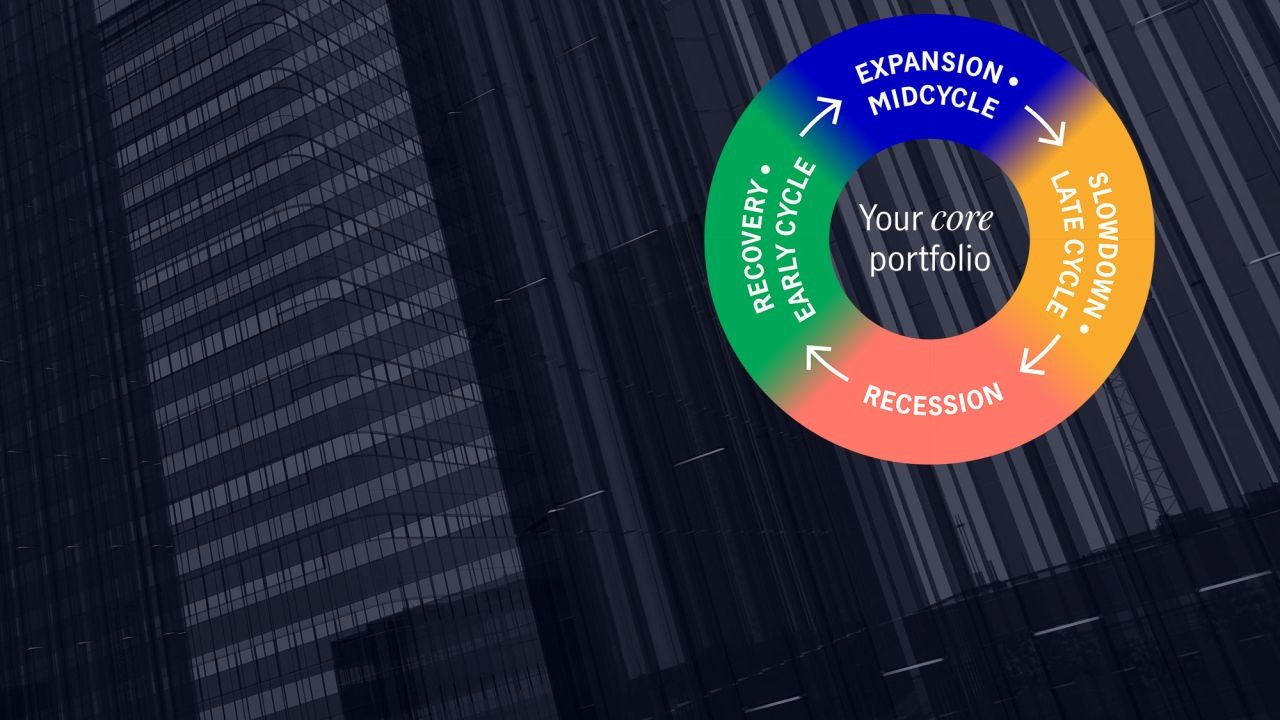

The allure of high returns can lead investors to concentrate their funds in a single cryptocurrency, such as Bitcoin or Ethereum. However, this strategy exposes them to significant risk, akin to placing all eggs in one basket. Diversification across multiple assets can mitigate the impact of a single cryptocurrency's downturn.

Data from the RBA suggests that a balanced portfolio, including a mix of traditional and digital assets, can enhance long-term financial stability. Investors should consider spreading their investments across various cryptocurrencies and sectors.

6. Timing the Market

Attempting to time the market is a common mistake among investors seeking to maximize profits. However, predicting short-term price movements is notoriously difficult, even for seasoned traders. The speculative nature of cryptocurrencies can lead to emotional decision-making, resulting in losses.

Adopting a long-term investment strategy, such as dollar-cost averaging, can benefit investors by reducing the impact of market volatility. Regular, smaller investments help average out the purchase price, minimizing the risk associated with market timing.

7. Neglecting Tax Obligations

Cryptocurrency tax obligations are often overlooked by investors. The Australian Taxation Office (ATO) requires investors to report capital gains and losses from cryptocurrency transactions, similar to other investment types. Failing to comply can result in penalties and audits.

In 2023, the ATO launched a crackdown on crypto tax evasion, identifying discrepancies in reported gains. To avoid complications, investors should maintain accurate records of all transactions and consult with tax professionals to ensure compliance.

Common Myths & Mistakes

Myth: Cryptocurrency is Anonymous

Reality: While cryptocurrencies offer a degree of privacy, they are not entirely anonymous. Blockchain technology records all transactions on public ledgers, which can be traced. Regulatory bodies like ASIC are enhancing their capabilities to track and monitor crypto transactions.

Myth: Cryptocurrencies Are Immune to Inflation

Reality: Although designed as a hedge against inflation, cryptocurrencies are not immune to economic forces. The RBA's research indicates that macroeconomic factors can significantly influence crypto prices, similar to traditional currencies.

Myth: All Cryptocurrencies Are Decentralized

Reality: Not all cryptocurrencies are truly decentralized. Some projects maintain centralized control over their networks, affecting transparency and security. Investors should assess the level of decentralization before investing.

Future Trends & Predictions

The future of cryptocurrency in Australia looks promising, with increasing institutional adoption and regulatory clarity. The RBA predicts that by 2028, digital currencies could form a significant part of the financial landscape, driven by advancements in blockchain technology and growing consumer trust.

Furthermore, the integration of cryptocurrencies with traditional financial systems is expected to accelerate. This trend will likely enhance liquidity and facilitate seamless cross-border transactions, benefitting both investors and businesses.

Conclusion

Cryptocurrency investment offers exciting opportunities but is not without risks. Australian investors must navigate regulatory landscapes, market volatility, and common pitfalls to succeed. By conducting thorough research, diversifying portfolios, and maintaining compliance with tax obligations, investors can maximize their potential returns while minimizing risks.

Have you encountered any of these challenges in your cryptocurrency journey? Share your experiences and insights in the comments below!

People Also Ask (FAQ)

How does cryptocurrency impact businesses in Australia?

Cryptocurrency offers businesses in Australia enhanced financial flexibility, with reports indicating a 25% increase in transaction efficiency. Integrating digital currencies can streamline operations and open new market opportunities.

What are the biggest misconceptions about cryptocurrency?

One common myth is that cryptocurrencies are completely anonymous. However, research from ASIC shows that transactions are traceable on public ledgers, and regulatory monitoring is increasing.

What are the best strategies for implementing cryptocurrency investments?

Experts recommend starting with thorough research, diversifying portfolios, and adopting a long-term investment strategy. Ensuring compliance with regulations and tax obligations is also crucial for sustainable growth.

Related Search Queries

- Cryptocurrency investment tips for Australians

- Understanding ASIC regulations for crypto

- How to avoid crypto scams in Australia

- Tax implications of cryptocurrency in Australia

- Best cryptocurrencies to invest in for 2024

- Market volatility and cryptocurrency investments

- Future of digital currencies in Australia

- How to diversify a cryptocurrency portfolio

- Bitcoin's impact on the Australian economy

- Long-term vs. short-term crypto investments

Gamma Foundries

10 months ago