Imagine stepping into a world where budgeting apps, designed ostensibly to help you save, are subtly engineered to keep you spending. This paradoxical scenario is not just a figment of imagination but a reality that many Australians encounter daily. Budgeting apps, with their sleek interfaces and user-friendly designs, promise financial discipline. However, a deeper dive reveals a critical flaw: these apps often encourage spending rather than saving. As Australia battles economic uncertainties, understanding the underlying motives of these platforms becomes imperative for consumers and policymakers alike.

The Illusion of Control: How Budgeting Apps Mislead Users

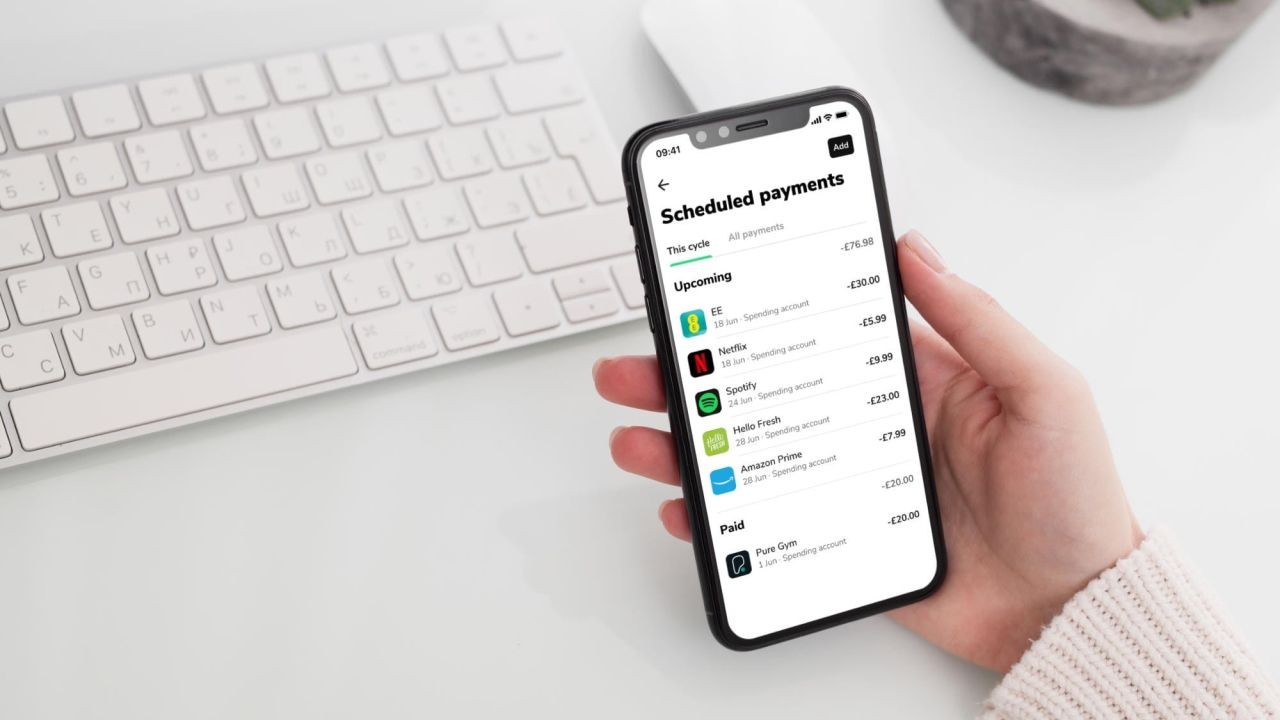

Budgeting apps have become ubiquitous, with millions of Australians relying on them for financial management. According to a report by the Australian Bureau of Statistics (ABS), over 50% of millennials use digital financial tools to track expenses. Yet, these tools often come with inherent design features that promote consumerism.

Dr. Michelle Preston, a financial behavior expert at the University of Sydney, notes, "Budgeting apps are designed to make spending seem less impactful. By gamifying personal finance, they create an illusion of control while subtly encouraging users to spend more." The gamification element, while making financial management engaging, often disguises the real cost of transactions.

The Future Outlook for Aussie Industries

Budgeting apps are marketed as tools for financial control, discipline, and empowerment. Millions of Australians now rely on them to track expenses, manage subscriptions, and plan for the future. Yet a growing body of behavioural research and industry analysis suggests a more uncomfortable truth: many budgeting apps are not designed to reduce spending, but to optimise engagement and transactions.

This design reality is quietly shaping Australian consumer behaviour and influencing the future direction of multiple industries, from fintech to retail and banking.

The Business Model Behind Budgeting Apps

To understand why budgeting apps often fail to reduce spending, it’s necessary to look at how they make money. Most popular apps operate on freemium models, affiliate commissions, data insights, or partnerships with financial institutions and retailers. Their revenue depends not on users spending less, but on users staying active, clicking offers, and integrating more financial products.

This creates a fundamental misalignment between user goals and platform incentives. While users want clarity and restraint, platforms benefit from engagement loops that keep money flowing through visible, trackable channels.

How App Design Influences Spending Behaviour

Budgeting apps rely heavily on behavioural design principles. Visual dashboards, spending summaries, and “safe-to-spend” indicators often normalise discretionary purchases rather than challenge them. When an app tells a user they are “within budget,” it can psychologically license further spending, even when saving would be the wiser choice.

In Australia, where digital banking integration is advanced and frictionless payments are the norm, this effect is amplified. The ease of tracking spending does not automatically translate into reduced consumption. In many cases, it simply reframes spending as controlled, even when overall outflows remain high.

Why Australians Feel Financially Aware but Still Stretched

Australia has one of the highest household debt levels among developed nations. Despite widespread access to budgeting tools, many Australians report ongoing financial stress. This contradiction highlights the difference between awareness and behaviour change.

Budgeting apps excel at showing where money goes, but they rarely address why spending happens. Emotional triggers, lifestyle inflation, social pressure, and housing costs are structural issues that apps are poorly equipped to confront. Instead of encouraging meaningful restraint, many platforms focus on categorisation, visual feedback, and convenience.

This can create a false sense of financial control without delivering long-term improvement.

The Role of Consumer Data and Embedded Commerce

Another critical factor is data monetisation. Budgeting apps collect highly valuable insights into consumer behaviour. This data is often used to personalise offers, recommend financial products, or promote spending opportunities aligned with user habits.

In Australia’s rapidly growing fintech ecosystem, budgeting apps increasingly function as gateways to loans, buy-now-pay-later services, credit cards, and investment platforms. While these tools can be useful, they also keep users financially active rather than financially conservative.

The result is an ecosystem that rewards movement of money, not minimisation of it.

How This Is Shaping Australian Industries

The design of budgeting apps is influencing broader industry behaviour. Retailers benefit from consumers who feel informed but not restricted. Financial institutions gain deeper behavioural data and more targeted cross-selling opportunities. Fintech companies position themselves as wellness tools while participating in transactional growth.

At the same time, industries focused on financial advice, mental wellbeing, and long-term planning are responding to growing dissatisfaction. Australians are increasingly seeking human guidance, values-based financial planning, and tools that prioritise outcomes over engagement metrics.

This tension is reshaping how financial products are marketed and regulated in Australia.

The Shift Toward Ethical and Outcome-Driven Finance

There are signs of change. Some Australian startups and financial institutions are beginning to design tools that prioritise savings automation, friction for discretionary spending, and long-term goal reinforcement. These models challenge the assumption that more engagement is always better.

Regulatory scrutiny is also increasing. As consumer awareness grows, there is pressure for greater transparency around incentives, data use, and behavioural design. Australians are becoming more critical of tools that claim to support wellbeing while subtly encouraging consumption.

What the Future Holds for Budgeting and Finance in Australia

The future of budgeting in Australia is likely to move beyond passive tracking toward intentional financial design. Tools that help Australians spend less will need to accept lower transactional engagement in exchange for trust and long-term value.

Industries that adapt to this shift may build deeper loyalty, while those that rely on perpetual spending cycles may face reputational and regulatory challenges. As Australians reassess their relationship with money amid cost-of-living pressures, the demand for genuinely supportive financial tools is growing.

Case Study: The Rise of Afterpay

Australia's Afterpay, a leading buy-now-pay-later (BNPL) service, exemplifies this trend. Initially launched as a budgeting tool to help manage expenses, Afterpay quickly evolved into a spending facilitator. By offering easy installment options, it encourages users to purchase items they may not afford upfront.

In 2023, a study by IBISWorld revealed that Afterpay's user base grew by 35% annually, with many users admitting to increased impulse purchases. The convenience of deferred payments creates a false sense of financial security, leading to higher overall spending.

Pros and Cons: A Critical Evaluation

Pros:

- Convenience: Budgeting apps provide an easy way to track expenses and manage finances on-the-go.

- Automation: Automatic categorization of expenses saves time and aids in financial analysis.

- Insightful Analytics: Apps offer detailed insights into spending habits, helping users identify areas to cut back.

Cons:

- Encouragement of Spending: Features like rewards and gamification can lead to increased spending rather than saving.

- Privacy Concerns: Many apps require access to personal financial data, raising privacy and security issues.

- Subscription Costs: Premium features often come with subscription fees, adding to user expenses.

Regulatory Insights: ACCC's Role in Consumer Protection

As the Australian Competition & Consumer Commission (ACCC) steps up its oversight of digital financial platforms, questions arise about the ethical implications of budgeting apps. The ACCC has expressed concerns over the transparency of BNPL services, highlighting the need for clearer disclosure of fees and charges.

In 2022, the ACCC launched a review into digital financial services, focusing on their impact on consumer behavior. The findings revealed that many platforms, while offering budgeting tools, prioritize revenue generation through increased user transactions.

Comparative Analysis: Global Trends and Australian Context

Globally, the trend of budgeting apps doubling as spending tools is not unique to Australia. In the United States, apps like Mint and YNAB have faced criticism for similar reasons. However, Australia presents a unique case with its high adoption rate of digital payment systems.

According to the Reserve Bank of Australia (RBA), digital payments accounted for 80% of transactions in 2023, a significant increase from previous years. This shift towards cashless transactions has made digital budgeting tools more attractive, yet also more prone to misuse for facilitating spending.

Case Study: Pocketbook’s Journey

Pocketbook, an Australian budgeting app, initially gained popularity for its simplistic design and effective budgeting features. However, as competition rose, it introduced features that encouraged spending through partner promotions and discounts.

Despite these changes, Pocketbook managed to retain its user base by offering transparency in its operations. By clearly communicating its partnerships and ensuring users understood the implications of promotional offers, it maintained trust and credibility.

Common Myths and Mistakes

Myth vs. Reality

- Myth: "Budgeting apps always help you save money." Reality: Many apps are designed to increase user engagement through spending incentives, often leading to higher expenditures.

- Myth: "All budgeting apps protect your financial data." Reality: Not all apps have stringent security measures, and some may share data with third parties for marketing purposes.

- Myth: "Gamification in budgeting apps is harmless." Reality: Gamification can lead to addictive spending behaviors, making it harder to stick to a budget.

Biggest Mistakes to Avoid

- Over-reliance on Automation: While automation helps in managing finances, it can lead to complacency. Users should regularly review their financial status manually.

- Ignoring Subscription Fees: Many budgeting apps charge subscription fees that can add up over time, negating any savings achieved.

- Neglecting Privacy Settings: Users often overlook privacy settings, which can result in data being shared without their consent.

Future Trends and Predictions

As digital finance continues to evolve, the role of budgeting apps in consumer spending will become more pronounced. By 2026, it is predicted that AI-driven financial tools will dominate the market, offering personalized budgeting advice based on real-time data analysis. This could revolutionize how Australians manage their finances, provided these tools prioritize consumer interests over profit.

Furthermore, regulatory interventions are expected to increase, with the ACCC likely to impose stricter guidelines on digital financial platforms. This will ensure greater transparency and protect consumers from deceptive practices.

Conclusion

In a world where financial management tools are supposed to aid in saving, the reality is often a complex web of incentives designed to encourage spending. As Australians navigate this landscape, awareness and critical evaluation of these tools become paramount. By understanding the motives behind budgeting apps and leveraging them wisely, consumers can reclaim control over their finances.

What’s your take on the role of budgeting apps in financial management? Share your insights and experiences below!

People Also Ask (FAQ)

- How do budgeting apps encourage spending? Many budgeting apps use gamification and reward systems that make spending more appealing, often leading to increased expenditures.

- Are budgeting apps safe to use in Australia? While many apps are secure, users should be cautious about data privacy and choose apps that clearly outline their security measures.

- What are the best strategies for effective budgeting? Experts recommend setting clear financial goals, regularly reviewing expenses, and using budgeting tools that prioritize saving over spending.

Related Search Queries

- Best budgeting apps in Australia

- How do budgeting apps make money?

- Are budgeting apps worth it?

- Why budgeting apps fail

- Impact of digital payments in Australia

For the full context and strategies on Why Most Budgeting Apps Are Designed to Keep You Spending – The Future Outlook for Aussie Industries, see our main guide: Rail Public Transport Videos Australia.