The intersection of property and technology is no longer a niche trend; it is fundamentally restructuring the New Zealand real estate landscape. For tax specialists, this evolution presents a complex new frontier of compliance, advisory, and strategic planning. PropTech is not merely about digital listings; it encompasses blockchain-based transactions, AI-driven valuation models, automated property management, and sophisticated data analytics platforms. These innovations are streamlining processes, but they are also creating novel asset classes, altering income recognition points, and introducing unprecedented data trails for tax authorities. Understanding this shift is no longer optional for practitioners advising property investors, developers, or tech startups—it is critical to providing relevant, forward-looking counsel.

Case Study: The Tokenisation of a Wellington Commercial Asset

To grasp the tangible tax implications, consider a real-world application gaining traction: property tokenisation. This process involves digitising a real estate asset into blockchain-based tokens, representing fractional ownership.

Problem: Liquidity and Access Barriers

A syndicate owning a premium Wellington office building faced a common dilemma. While the asset performed well, the investment was illiquid. Exiting or adjusting the portfolio required selling the entire building, a lengthy and costly process. Furthermore, the high capital requirement barred smaller, sophisticated investors. The traditional structure limited flexibility and access, a scenario familiar to many New Zealand property holders.

Action: Implementing a Security Token Offering (STO)

The syndicate engaged a PropTech firm to structure a Security Token Offering (STO). The building's ownership was transferred to a special purpose vehicle (SPV), and digital tokens representing shares in the SPV were issued on a regulated blockchain platform. Each token conferred a proportional right to rental income and capital gains. Smart contracts were programmed to automate distribution of net income to token holders' digital wallets.

Result: Unlocking Value and Creating Complexity

The STO successfully fractionalised the NZD $25 million asset into 10,000 tokens, democratising access. Trading commenced on a secondary market, providing liquidity previously unavailable. However, this innovation triggered a cascade of tax considerations:

- Income Character: Are token distributions dividends, interest, or rental income? Inland Revenue's view on the substance of the cash flow is paramount.

- Trading vs. Holding: Is a token holder engaged in a taxable activity (trading) if they actively buy and sell on a secondary market, or are they merely a passive investor?

- Withholding Tax Obligations: If a token holder is non-resident, does the smart contract's automated distribution mechanism create a non-resident withholding tax (NRWT) obligation for the SPV, and how is it complied with?

- Bright-line & Land Transfer Tax: Does the transfer of a token representing an interest in land constitute a "transfer" for bright-line test or land transfer tax purposes? Current legislation is ambiguous.

Drawing on my experience supporting Kiwi companies in digital asset ventures, the primary takeaway is that the technology outpaces regulation. The legal and tax framework for tokenised assets in New Zealand remains a grey area, heavily reliant on Inland Revenue's evolving interpretation of existing laws. Proactive engagement with tax advisors during the structuring phase is not just prudent—it is essential to mitigate future disputes.

A Step-by-Step Guide to Tax Due Diligence for PropTech Investments

For tax specialists evaluating PropTech opportunities—whether for a client investing in a platform or a startup developing one—a structured due diligence framework is vital.

Step 1: Deconstruct the Revenue Model

Identify every revenue stream. Is it a transaction fee, subscription (SaaS), data licensing, or a share of capital gains? For example, a platform facilitating flatmate matching may charge a listing fee (likely GST-inclusive) and a premium subscription for landlords. Each stream has different GST, income recognition, and potential PE (Permanent Establishment) implications if the platform operates cross-border.

Step 2: Map the Data Flow and Tax Jurisdiction

PropTech is data-centric. Determine where user data is collected, stored, and processed. If a NZ-based PropTech uses cloud servers in Australia or the US to host tenant application data, this raises questions about economic substance, transfer pricing for internal services, and potential foreign tax obligations. Based on my work with NZ SMEs in the tech sector, many underestimate the tax footprint created by global cloud infrastructure.

Step 3: Analyse the Asset Classification

Is the core technology a revenue-generating asset eligible for depreciation? Software development costs may be capitalised and depreciated. However, costs related to developing a proprietary algorithm for property valuation might be treated differently. The distinction between deductible R&D (potentially eligible for the R&D Tax Incentive) and capital expenditure is a critical judgement.

Step 4: Scrutinise User Tax Reporting Obligations

A key selling point for many PropTech platforms is automated tax reporting for users (e.g., generating annual rental income statements). You must assess the accuracy and completeness of these reports. Does the platform correctly account for apportioned expenses, capital improvements, and bright-line dates? Relying on an automated report without understanding its logic is a significant risk for your client.

Step 5: Review Compliance with Emerging Standards

Stay abreast of guidance from Inland Revenue and other bodies. For instance, the OECD's crypto-asset reporting framework (CARF) will soon influence how digital asset transactions, including property tokens, are reported globally. New Zealand is likely to adopt these standards, meaning platforms may have new due diligence and reporting obligations.

Pros and Cons: The PropTech Tax Landscape

✅ Pros: Enhanced Efficiency and Transparency

- Automated Record-Keeping: Digital trails from PropTech platforms can simplify evidence gathering for deductions, cost base calculations, and bright-line compliance.

- Real-Time Data: Access to live market data aids in accurate valuations for estate planning, gifting, or transfer pricing.

- Reduced Compliance Errors: Integrated tools can minimise manual entry mistakes in tax returns for property investors.

❌ Cons: Novel Risks and Regulatory Lag

- Interpretative Uncertainty: As seen in the tokenisation case, existing tax law often doesn't neatly fit new business models, leading to uncertainty and potential disputes.

- Increased Audit Scrutiny: The digital footprint left by PropTech platforms provides Inland Revenue with a powerful audit trail. Inconsistencies between platform data and filed returns will be easier to detect.

- Complexity in Characterisation: Determining whether an activity conducted via a platform constitutes a taxable trading venture (e.g., frequent short-term rental hosting) becomes more nuanced but also more visible to authorities.

Common Myths and Costly Mistakes

Myth: "Using a PropTech platform absolves me from tax compliance responsibilities." Reality: The platform is a tool, not a tax advisor. You remain solely responsible for the accuracy of information submitted to Inland Revenue. A 2023 report by the NZ Property Investors Federation highlighted that many landlords incorrectly assume automated income summaries are fully tax-compliant without reviewing expense categorisations.

Myth: "Digital assets like property tokens are a tax-free grey area." Reality: Inland Revenue applies substance-over-form principles. The economic reality of receiving income and capital gains from an underlying property will almost certainly be taxable, regardless of the digital wrapper. Assuming otherwise invites penalties and interest.

Costly Mistake: Neglecting GST on PropTech services. Many PropTech startups operate online and serve global customers, leading to confusion about GST registration thresholds and the place of supply rules. A common error is not charging GST to NZ-based customers for digital services, creating a significant liability. The solution is to conduct a thorough GST analysis at inception, considering the GST on remote services rules.

The Future of PropTech and Tax in New Zealand

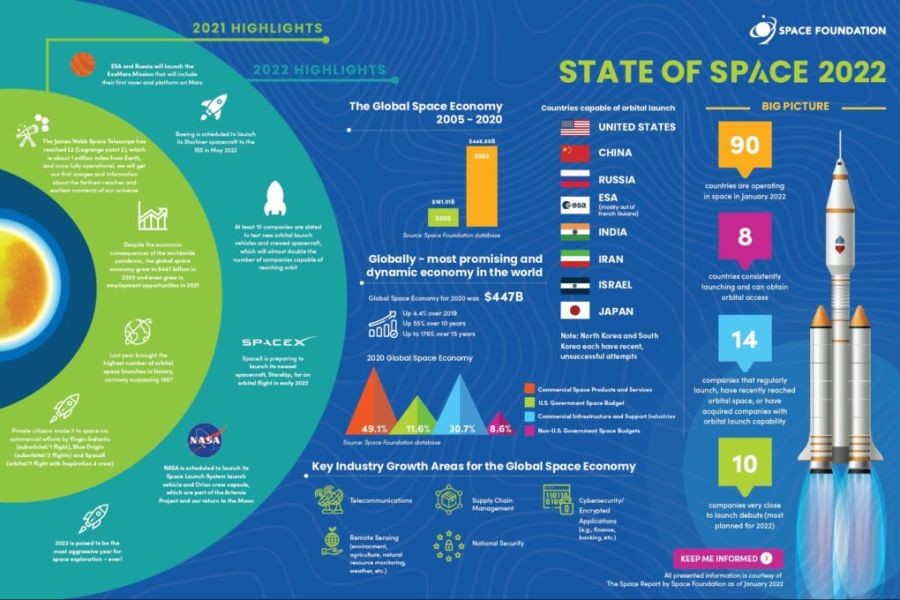

The trajectory points toward deeper integration and regulatory catch-up. We can anticipate Inland Revenue developing specific guidance on tokenised property and the tax treatment of transactions facilitated by AI. Furthermore, data-sharing agreements between PropTech platforms and government agencies are plausible, akin to the current sharing of bank interest information. This would pre-fill more data in tax returns but also increase the speed and accuracy of compliance audits.

From observing trends across Kiwi businesses, the PropTech firms that will thrive are those that build tax compliance into their product architecture from the start, consulting with specialists to navigate the evolving landscape. For tax practitioners, continuous education in blockchain, AI, and data analytics is becoming as fundamental as understanding trust law or depreciation schedules.

Final Takeaways for the Tax Specialist

- Substance Over Form: Always analyse the economic substance of a PropTech transaction, not just its digital presentation.

- Proactive Engagement: Advise clients to involve you during the structuring phase of any PropTech investment or venture, not during tax return preparation.

- Data as a Double-Edged Sword: Leverage the data from PropTech for client efficiency but be acutely aware it provides the same power to Inland Revenue.

- Continuous Learning is Non-Negotiable: The field is evolving rapidly. Dedicate time to understanding the underlying technologies to provide credible advice.

People Also Ask

How is Inland Revenue responding to PropTech trends? Inland Revenue is actively monitoring developments, particularly in digital assets. While formal guidance is limited, they apply existing income tax, GST, and bright-line rules to new models, emphasizing the economic reality of transactions. Specific rulings are expected as the market matures.

What is the biggest tax risk for a NZ PropTech startup? Misunderstanding GST obligations for digital services is a common and costly pitfall. Startups often incorrectly assume they fall under the NZD $60,000 threshold when serving global markets, not realizing that rules for "remote services" can create liability from the first sale to a NZ resident.

Can PropTech data be used directly for a tax return? It can form the basis, but it requires careful review. Automated reports may not correctly classify capital vs. revenue expenses, account for private use portions, or apply bright-line rules correctly. Professional verification is essential.

Related Search Queries

- Property tokenisation tax NZ

- Inland Revenue PropTech guidance

- GST on digital real estate platforms

- Tax treatment of Airbnb income NZ

- Bright-line test and PropTech

- R&D tax incentive PropTech New Zealand

- blockchain property tax implications

- Automated rental income reporting tax compliance

For the full context and strategies on Property Technology in NZ: How PropTech is Changing Real Estate, see our main guide: Real Estate Video Campaigns Boost Listings Nz.