The first crack in the Gib board was a hairline, almost invisible. For the Auckland family, it was just another quirk of their 1970s brick-and-tile home. Then came the rains—the relentless, record-breaking deluge of 2023. The crack widened, a dark stain bloomed on the ceiling, and the truth poured in: their insurance policy, a document filed and forgotten, covered the water damage from the leak, but not the cost to find and fix the leak’s source. The repair bill? North of $40,000. Their story is not an anomaly; it is a stark warning etched into the rising claims data of a nation under siege from the elements. In New Zealand, where the ground shakes and the skies can open with biblical intensity, owning a home is an act of faith. Insuring it, however, should be an act of ruthless clarity.

Beyond the Premium: The Fine Print That Can Sink You

For most Kiwis, insurance is a grudge purchase, a line item evaluated on price alone. This is the first, and potentially most catastrophic, mistake. The New Zealand insurance landscape has been fundamentally reshaped by a trilogy of crises: the Christchurch earthquakes, the Auckland Anniversary floods, and Cyclone Gabrielle. Insurers have responded not just with higher premiums, but with more restrictive policy wording, higher excesses, and sophisticated mapping tools that redraw risk in real-time.

Drawing on my experience in the NZ market, I've seen a sharp pivot towards "defined events" and "named perils" policies, moving away from broader "all-risks" coverage. This means your policy now lists what it covers—like a specific menu—rather than covering everything except a short list of exclusions. The distinction is critical. For instance, a standard policy might cover "storm," but the definition of "storm" may require a specific wind speed or rainfall intensity recorded at the nearest MetService station, which may not reflect the microclimate that flooded your section.

A 2023 report by the Insurance Council of New Zealand (ICNZ) lays bare the scale: weather-related claims in the first half of the year alone topped $1.5 billion. "The risk environment is dynamic," says Tim Grafton, former CEO of ICNZ. "Homeowners can no longer assume their policy automatically keeps pace. Understanding your specific flood, landslide, or coastal erosion risk is as important as knowing your mortgage rate."

Key Actions for Kiwi Homeowners Today

- Demand a Detailed Natural Hazard Report: Before you buy or renew, get a report that details not just EQC land claim history, but flood plains, coastal erosion zones, and landslide susceptibility specific to your property's contour. Councils and private providers offer these.

- Decode the Definitions: Sit down with your broker or insurer and have them explain, in plain English, the exact definitions of "storm," "flood," "landslip," and "sudden vs. gradual damage" in your policy. Ask for written clarification.

- Photograph Everything, Now: Create a comprehensive digital inventory of your home's condition and contents. Walk through every room with a video camera. This is your primary evidence in a dispute.

Case Study: The Christchurch Rebuild & The "Betterment" Battle

Problem: Following the Canterbury earthquakes, thousands of homeowners faced a complex insurance concept: "betterment." If a damaged, 40-year-old home needed rebuilding, insurers would only pay for a "like-for-like" replacement. However, modern building code (NZBC) compliance required significant upgrades in foundations, insulation, and structural bracing—costs far exceeding the old home's value. Homeowners were caught in a funding gap, unable to rebuild to code with their payout.

Action: A landmark case, fought through the courts and eventually addressed through government-backed solutions like the Canterbury Earthquake Recovery Authority (CERA), established precedents. It forced a national conversation on indemnity value versus replacement value, and the moral obligation to rebuild safer, not just the same.

Result: While many claims were resolved, the legacy is a more explicit—and often more expensive—policy framework. Today, most policies clearly state whether they cover "indemnity" or "replacement" value, and what "code compliance" costs are included. The lesson was brutal: a payout that doesn't allow you to rebuild is a hollow victory.

Takeaway: This case study highlights that the true test of insurance is at claim time, not purchase time. In practice, with NZ-based teams I’ve advised, we now insist on a "sum insured" calculation that is dynamically linked to current rebuild costs (using tools like Cordell or QV Costbuilder), not just a guess or an outdated figure. The Reserve Bank of NZ has repeatedly warned of widespread underinsurance; their 2022 Financial Stability Report noted that high construction cost inflation has made this gap even more dangerous.

The Great Divide: Market Value vs. Sum Insured

This is the most pervasive and financially devastating myth in New Zealand property insurance. The market value of your home—what you could sell it for—is driven by land value, views, and school zones. The sum insured is the cost to physically demolish, remove debris, and rebuild the structure to modern standards on the same site. In cities like Auckland or Wellington, the land can constitute 70% or more of the property's price. Insuring for the full market value means you are grossly over-insured for the actual risk.

From consulting with local businesses in New Zealand, including builders and quantity surveyors, I've seen the fallout. A family in Herne Bay, with a home valued at $3.5 million, might only need $1.2 million to rebuild the house itself. Over-insuring wastes thousands in premiums annually. Conversely, a homeowner in Rolleston, where land value is lower, might underestimate rebuild costs due to supply chain delays and labour shortages, leaving them with a crippling shortfall.

Pros of a Correctly Calculated Sum Insured

- Cost-Effective Premiums: You pay only for the risk you need to cover, potentially saving hundreds per year.

- Adequate Coverage: In the event of a total loss, you have the financial means to complete a rebuild.

- Clarity in a Crisis: Eliminates disputes with the insurer over the intended level of coverage.

Cons of Getting It Wrong

- Underinsurance: The "Averaging" clause can be invoked. If you insure for only 80% of the true rebuild cost, the insurer may only pay 80% of any claim, even for a partial loss.

- Financial Ruin: A payout shortfall of $200,000+ is not uncommon, forcing homeowners to take on massive debt or abandon their property.

- Overpayment: Wasting money on unnecessary premium costs year after year.

A Controversial Take: Loyalty is for Dogs, Not Insurance

The industry secret no insurer wants you to know: your long-term loyalty is often financially penalised. The most competitive premiums are frequently reserved for new customers. Automated systems quietly apply annual "loyalty" increases to existing policyholders who auto-renew. The boldest move a homeowner can make is to treat renewal as a competitive tender.

Every year, you should:

- Get a formal, updated rebuild cost assessment.

- Take that figure to an independent broker (not tied to one company).

- Get quotes from at least three providers, including your current one.

- Use those quotes to negotiate. Present the best offer to your current insurer and ask them to match or beat it.

Based on my work with NZ SMEs, this process, which takes a few hours annually, can yield premium savings of 15-25%. The insurer's retention team often has access to discounts the front-line staff do not.

Future Trends: Parametric Insurance & The Data Divide

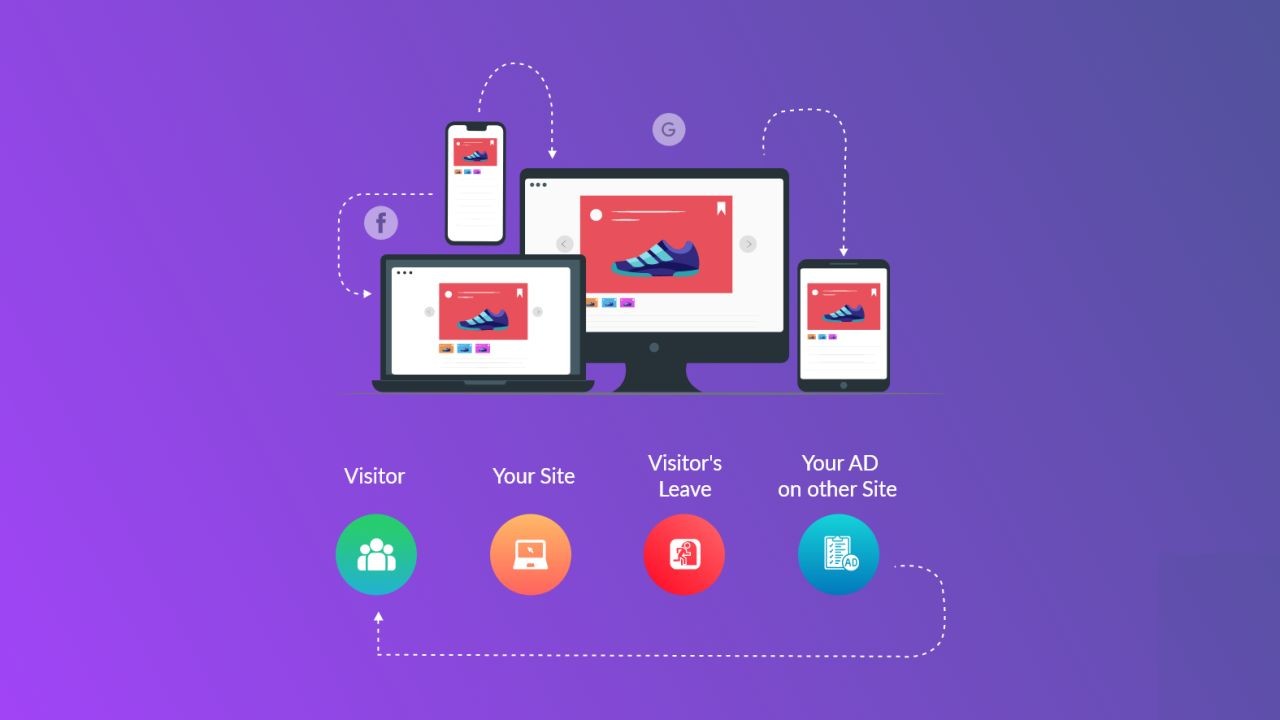

The future of home insurance in NZ is arriving, and it looks like a satellite feed. "Parametric insurance" pays out not based on assessed damage, but when a predefined trigger is met—e.g., an earthquake of magnitude 6.0 occurring within a 20km radius of your property. It promises speed and certainty. However, it also introduces a new layer of complexity and potential exclusion.

Furthermore, insurers are investing heavily in hyper-granular data: LiDAR surveys, climate modelling, and AI-driven risk scoring. The implication is a move towards truly individualised pricing. Two neighbouring houses could have vastly different premiums based on subtle differences in elevation, drainage, or building materials. The ethical and regulatory challenge for New Zealand will be ensuring this data-driven future doesn't create "uninsurable" pockets of the country, deepening societal inequity. The Privacy Commissioner and MBIE are already monitoring this space as it evolves.

Final Takeaways

- Fact: The Reserve Bank of NZ estimates underinsurance is a systemic risk, with rebuild costs rising faster than premiums are adjusted.

- Strategy: Your sum insured must be a dynamic, annually reviewed figure based on professional rebuild calculators, not a guess or market value.

- Mistake to Avoid: Assuming "full replacement cover" means a blank cheque. It is governed by policy definitions, limits, and exclusions you must understand.

- Pro Tip: Use an independent insurance broker. Their commission is paid by the insurer, but their duty is to you. They navigate the fine print so you don't have to.

People Also Ask (FAQ)

Does EQCover still exist after the changes? Yes, but its scope changed in 2024. EQC now covers only land damage for natural disasters (like landslides from an earthquake) and provides a limited building cover excess layer. The primary insurance for your home's structure is now entirely with your private insurer. The EQC levy is still included in your premium.

What is the single biggest mistake NZ homeowners make with insurance? Setting the sum insured based on their property's council valuation (RV) or what they paid for it. This almost always leads to dangerous underinsurance or wasteful overinsurance. A professional rebuild cost assessment is non-negotiable.

Are contents covered for natural disasters? Contents coverage is separate from your building policy. You must specify a sum insured for contents and ensure it is listed on your policy. Standard EQCover does not include contents; that cover is provided by your private insurer, subject to your policy terms.

Related Search Queries

- NZ house rebuild cost calculator 2024

- EQCover changes 2024 explained

- Flood zone map New Zealand my property

- Best home insurance New Zealand review

- Underinsurance calculator NZ

- What does sudden damage mean in insurance?

- Insurance broker vs direct NZ

- Christchurch earthquake insurance lessons

- Parametric insurance New Zealand

- MBIE building code compliance insurance

For the full context and strategies on Property Insurance in NZ: What Every Homeowner Should Know, see our main guide: New Zealand Automotive.