For the astute property investor, the cost of capital is the bedrock of every deal. We scrutinise loan-to-value ratios, calculate serviceability, and forecast cash flows with precision. Yet, a more profound, often overlooked force shapes our investment landscape: the structural relationship between Australia's major banks and the monetary policy set by the Reserve Bank of Australia. While the term "manipulation" implies clandestine conspiracy, the reality is a sophisticated, legally permissible form of margin management that systematically prioritises bank profitability, often at the expense of the indebted consumer and investor. Understanding this mechanism is not about uncovering a secret, but about recognising a powerful market dynamic that directly impacts your portfolio's leverage and long-term viability.

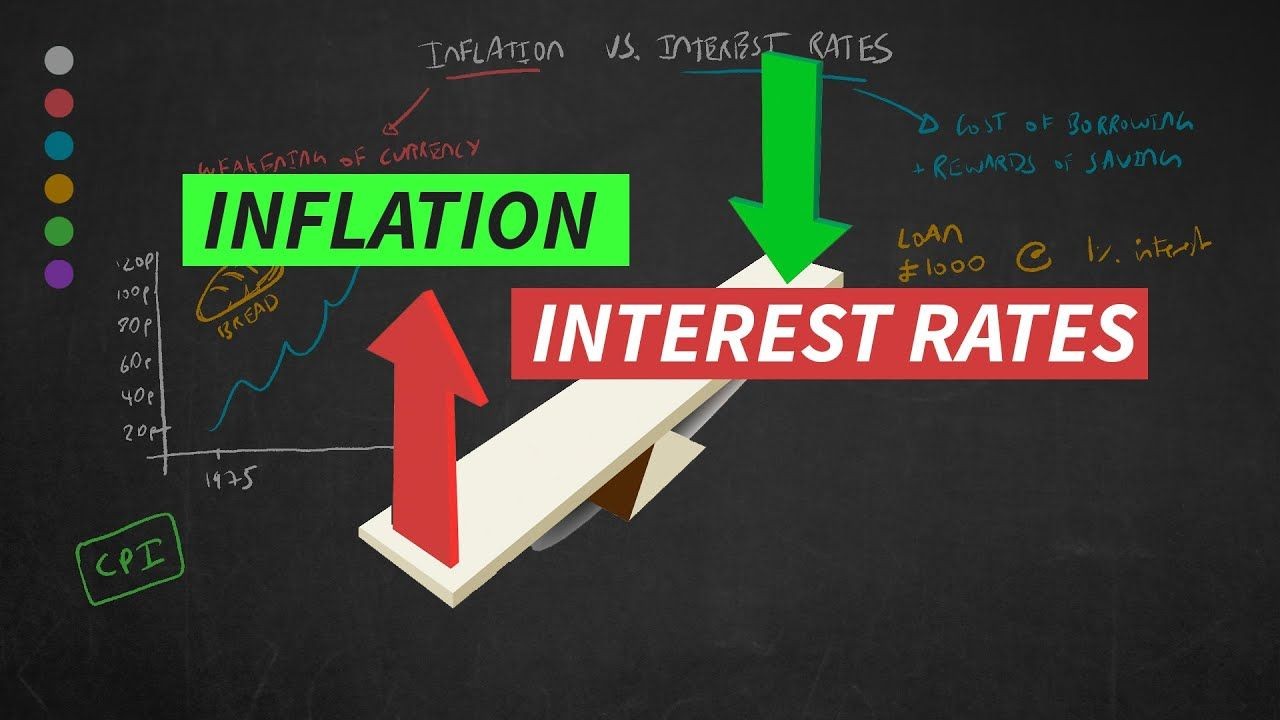

The Mechanics of Margin Management: More Than Just the Cash Rate

The common perception is that the RBA's cash rate target is the sole determinant of mortgage rates. This is a dangerous oversimplification. In practice, the banks engage in a calculated exercise of margin management, where the spread between their funding costs and the rate they charge you is actively adjusted. When the RBA cuts rates, banks are often swift to pass on a portion, but rarely the full amount, especially for existing customers. Conversely, when the RBA hikes, the full increase is typically applied immediately, and often exceeded.

This asymmetry is a key profit lever. Data from the RBA itself illustrates this. Following the cutting cycle that began in 2019, the average spread between the standard variable mortgage rate and the bank's funding costs widened significantly. Banks cited "higher risks" and "regulatory requirements" – valid in part due to APRA's lending standards – but the net effect was a bolstering of net interest margins during a period of record-low rates. From my experience consulting with Australian SMEs and investors, this environment created a dual challenge: while debt was cheaper, the banks' retained margin and tightened credit criteria meant accessing optimal finance became a more nuanced battle, favouring those with impeccable financials and substantial equity.

Case Study: The 2020-2022 Fixed Rate Mortgage Phenomenon

Problem: In 2020-2021, Australian banks, led by the major four, engaged in an aggressive fixed-rate mortgage war, offering sub-2% rates for terms of 2-4 years. This was a strategic move to lock in a high volume of customers at historically low rates, using cheap funding from the RBA's Term Funding Facility. The goal was market share growth and securing future revenue streams.

Action: Banks heavily marketed these fixed rates, with a significant proportion of new loans—peaking at nearly 46% of all new housing loans in mid-2021 (RBA data)—being written on fixed terms. This created a time-bomb scenario for household budgets, as borrowers were shielded from the initial rate hikes but faced a severe "payment shock" upon expiry.

Result: As the RBA's tightening cycle commenced in May 2022, variable rates soared. Borrowers rolling off fixed rates faced increases of 3-4% or more in their repayments. The banks, having locked in these customers, now benefited from repricing this large cohort at much higher variable rates. The ACCC, in its mortgage pricing inquiry, noted the banks' "focus on managing profit margins" throughout this cycle. The takeaway for investors is profound: banks' product strategies are designed to manage their own interest rate risk and profitability over the long term, not to provide perpetual relief to borrowers.

Assumptions That Don’t Hold Up

Several comforting myths persist about bank behaviour and interest rates. Let's correct them with a property investor's lens.

Myth: "All banks compete fiercely, so I always get the best rate." Reality: While competition exists, it is often focused on acquiring new customers via "honeymoon" rates. The loyalty penalty is real. The ACCC has repeatedly found that existing customers, especially those not actively seeking a refinance, pay significantly more. For an investor with multiple properties, this passive approach can mean tens of thousands in lost equity over a decade.

Myth: "The RBA sets my mortgage rate." Reality: The RBA sets the price of short-term money in the interbank market. Your mortgage rate is determined by the bank's cost of funds (including deposits and wholesale markets), its risk assessment, its desired profit margin, and competitive positioning. The RBA's move is a signal, not a command.

Myth: "Big bank profits are solely from responsible lending and efficiency." Reality: A core driver is structural margin management. In its 2023 report, APRA data showed the major banks' net interest margin had expanded from its COVID lows, contributing directly to record profits even as household financial stress increased. This is not malfeasance; it is a rational, shareholder-focused business model that investors must account for in their own models.

The Strategic Investor's Defence: Actionable Insights

Knowledge of this system is not an invitation to cynicism, but a call to strategic action. Here is how a sophisticated Australian property investor should respond.

- Treat Your Debt as a Dynamic Portfolio: Just as you manage a property portfolio, actively manage your debt portfolio. Schedule an annual review of every loan. Use the threat of refinancing as a negotiation tool. Based on my work with Australian SMEs and investors, those who proactively engage with their lenders or brokers secure, on average, 30-50 basis points better ongoing rates than passive borrowers.

- Decouple from the Standard Variable Rate (SVR): The SVR is the bank's most profitable product. Insist on a professional package or discounted variable rate. For investment loans, consider principal and interest loans that often carry lower rates than interest-only, and offset the repayment difference via a linked offset account.

- Understand the True Cost of Fixed Rates: Fixed rates are a risk-management tool, not a cost-saving tool. Use them strategically to lock in a portion of your debt during a rising rate cycle to ensure cash flow certainty, but be prepared for the expiry cliff. Model your worst-case scenario repayment after the fixed term ends.

- Leverage Broker Expertise & Market Scrutiny: A quality mortgage broker has visibility across lenders and can identify not just the best initial rate, but the lender with a history of fair post-settlement pricing. Furthermore, the increased scrutiny from the ACCC and ASIC on mortgage pricing has made banks more sensitive to public perception—use this to your advantage in negotiations.

The Future of Debt: Regulatory Winds and Investor Implications

The landscape is shifting. The "loyalty penalty" is firmly in the crosshairs of regulators. We can expect continued pressure from the ACCC for banks to automatically offer existing customers competitive rates. Furthermore, the rise of sophisticated fintech and non-bank lenders, while not immune to funding cost pressures, provides a crucial competitive wedge. Drawing on my experience in the Australian market, the most significant trend for investors will be the increased granularity of risk-based pricing. Banks will use open banking data to price loans with even more precision, meaning your financial behaviour across all accounts will directly impact your offered rate. The imperative for impeccable financial management has never been greater.

Pros and Cons of the Current Bank-Debt Dynamic

Pros:

- System Stability: Profitable, well-capitalised banks (guided by APRA) provide a stable lending environment, crucial for long-term investment planning.

- Product Innovation: Competition, though imperfect, drives product features like offset accounts and flexible repayments that savvy investors can exploit.

- Predictable Responses: Banks' margin-focused behaviour is, to a degree, predictable, allowing astute investors to model rate scenarios more accurately.

Cons:

- The Loyalty Tax: Passive investors systematically pay more, eroding portfolio returns.

- Asymmetric Rate Movements: The tendency for hikes to be passed on fully and cuts partially increases the long-term cost of capital.

- Complexity & Opaqueness: The myriad of rates, fees, and conditions makes true cost comparison difficult, leading to suboptimal financial decisions.

Final Takeaway & Call to Action

The relationship between big banks and borrowers is not a partnership of equals; it is a commercial negotiation where one side holds vastly more information and power. As a property investment specialist, your greatest leverage is your own expertise and proactive stance. Do not outsource the management of your largest expense—your debt.

Your immediate action point: In the next seven days, gather the latest statements for every investment loan. Note the current rate, compare it to the advertised new customer rate from that lender, and then benchmark it against three competitors. This 60-minute exercise will either give you peace of mind or reveal a tangible opportunity to improve your cash flow and equity accumulation. The banks' strategy is to manage their margins. Your strategy must be to relentlessly manage yours.

People Also Ask

Do banks have to pass on RBA rate changes? No, they are under no legal obligation. While political pressure is intense, banks base decisions on commercial factors like funding costs, competitive posture, and profit margins. The pass-through is rarely 100% in either direction.

What is the biggest mistake property investors make with mortgage rates? The single biggest error is "set and forget." Accepting the standard variable rate and never reviewing the loan post-settlement guarantees you will pay a significant loyalty premium over the life of a 30-year loan, potentially amounting to hundreds of thousands in lost wealth.

How will open banking affect mortgage rates in Australia? Open banking will enable hyper-personalised risk pricing. Investors with exemplary financial behaviour—high income, solid savings history, diversified assets—will access the absolute best rates. Those with volatile finances may face higher costs, making holistic financial management a critical part of investment strategy.

Related Search Queries

- bank mortgage margin Australia 2024

- RBA cash rate vs mortgage rate history

- how to negotiate a better home loan rate Australia

- ACCC mortgage pricing inquiry findings

- fixed rate mortgage cliff 2024 2025

- best investment loan rates Australia

- non-bank lenders vs major banks Australia

- APRA lending standards impact on investors

- how to calculate true cost of a mortgage

- refinancing investment property tax implications Australia

For the full context and strategies on How Big Banks Manipulate Interest Rates to Keep Aussies in Debt – How It Could Redefine Aussie Innovation, see our main guide: Australian Legal Regulatory Services.