For any economic strategist, the central bank is not a distant institution but a primary actor on the stage of national prosperity. Its decisions ripple through exchange rates, influence investment climates, and ultimately shape the financial reality for every business and household. In New Zealand, the Reserve Bank of New Zealand (RBNZ) operates with a uniquely transparent and often debated mandate, making a nuanced understanding of its role not just academic, but a critical component of strategic foresight. This analysis moves beyond textbook definitions to dissect the RBNZ's evolving function, the contentious debates surrounding its policy toolkit, and the practical implications for navigating the Kiwi economy.

The Dual Mandate Debate: Price Stability vs. Maximum Employment

The core philosophical debate in modern central banking, intensely relevant to New Zealand, centres on the mandate. Should a central bank focus solely on inflation, or should it explicitly target employment as well? The RBNZ's journey provides a compelling case study in this global tension.

For decades, the RBNZ was a global pioneer in single-minded inflation targeting. The Reserve Bank of New Zealand Act 1989 famously made price stability the sole objective, a model lauded for taming the high inflation of the 1970s and 80s. This "inflation first" orthodoxy held that low, stable inflation was the best contribution a central bank could make to sustainable employment and growth. However, the post-Global Financial Crisis era, marked by persistently low inflation and wage growth despite low unemployment, challenged this view. In 2018, the government amended the RBNZ's mandate to include supporting "maximum sustainable employment" (MSE) alongside price stability.

This shift from a single to a dual mandate sparked vigorous debate. Proponents argue it modernises the bank's approach, recognising that monetary policy can and should be used to mitigate employment crises, as seen during the COVID-19 pandemic. Critics, however, warn of mission creep and reduced clarity. They contend that managing two potentially conflicting targets—cooling an overheating economy to fight inflation may raise unemployment—could muddy policy signals and reduce the bank's accountability.

Key actions for Kiwi strategists: Monitor the RBNZ's Monetary Policy Statements (MPS) not just for OCR forecasts, but for its analysis of the labour market. The bank now explicitly publishes its assessment of "maximum sustainable employment." From consulting with local businesses in New Zealand, I've observed that sectors with tight labour markets, like technology and construction, are often more sensitive to subtle shifts in the RBNZ's language regarding wage pressure and capacity constraints than others.

Pros & Cons of the Expanded RBNZ Mandate

Evaluating the amended mandate requires a balanced view of its operational implications.

✅ Pros:

- Holistic Economic Management: Formally acknowledges the interconnectedness of inflation and employment, allowing for a more flexible response to economic shocks that affect both, such as a terms-of-trade boom or a pandemic.

- Enhanced Social License: Aligns the central bank's goals more directly with public wellbeing, as employment is a tangible outcome for most citizens compared to an abstract inflation figure.

- Forward-Looking Flexibility: In practice, with NZ-based teams I’ve advised, the dual mandate has encouraged deeper scenario analysis, considering a wider range of labour market indicators beyond the headline unemployment rate, such as underutilisation and wage growth by sector.

❌ Cons:

- Reduced Policy Clarity: Creates potential for perceived conflicts, making it harder for markets and businesses to anticipate policy reactions, potentially increasing volatility.

- Measurement Challenges: "Maximum sustainable employment" is an unobservable variable, estimated with significant uncertainty, unlike a clear inflation band (1-3%). This can lead to disputes over whether the bank is prioritising one objective over the other.

- Risk of Overreach: Could pressure the bank to maintain accommodative policy for too long to boost employment, risking an inflation overshoot that is later more painful to correct—a concern highlighted during the 2021-2023 inflation surge.

The Evolving Toolkit: From OCR to LSAP and Beyond

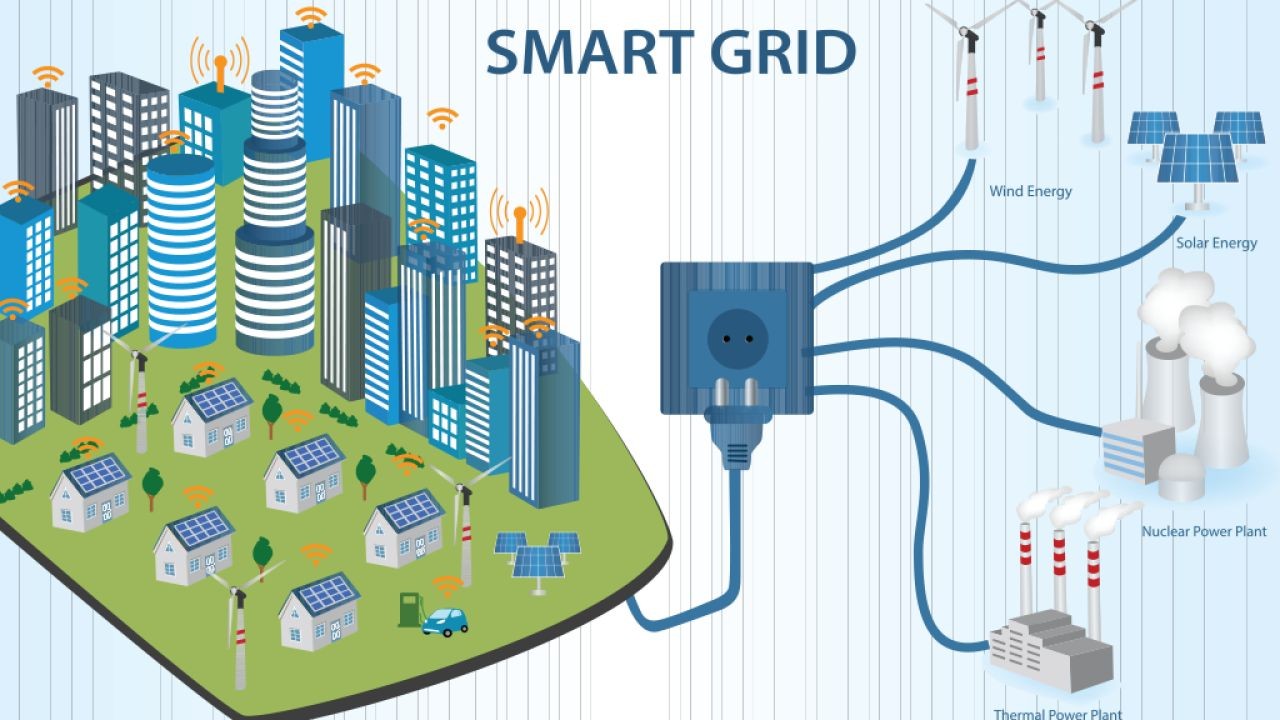

The RBNZ's policy instruments have dramatically expanded, moving far beyond the traditional lever of the Official Cash Rate (OCR). This evolution reflects lessons from global crises and directly impacts asset prices and financial stability in New Zealand.

The Global Financial Crisis and the COVID-19 pandemic forced central banks worldwide to innovate. The RBNZ introduced Large Scale Asset Purchases (LSAP), or quantitative easing (QE), in 2020, purchasing billions in government bonds to lower long-term interest rates and signal sustained support. It also implemented a Funding for Lending Programme (FLP), providing cheap funding to banks to encourage lending. These tools were effective in providing liquidity and stabilising markets during acute crises. However, their prolonged use and unwinding present new challenges. The LSAP programme, which peaked at nearly $100 billion, has led to significant financial losses for the RBNZ as interest rates rose—losses that are ultimately borne by the Crown.

Drawing on my experience in the NZ market, the introduction of these tools has altered the transmission mechanism of monetary policy. For instance, the FLP had a direct effect on lowering mortgage rates, fuelling housing market demand in a way a simple OCR cut may not have. This unintended consequence forced the RBNZ to later implement macroprudential tools like loan-to-value ratio (LVR) restrictions, blurring the lines between monetary and financial stability policy.

Case Study: The RBNZ's Response to COVID-19 – A Test of Fire for Unconventional Tools

Problem: In March 2020, the New Zealand economy faced an unprecedented sudden stop due to the COVID-19 pandemic. Forecasts predicted a severe recession and deflationary spiral. The OCR was rapidly cut to 0.25%, but with little room left for conventional easing, the RBNZ risked losing its ability to stimulate the economy.

Action: The Bank deployed a suite of unconventional tools for the first time:

- It committed to keeping the OCR at 0.25% for at least 12 months (forward guidance).

- It launched a Large Scale Asset Purchase (LSAP) programme of up to $100 billion in government bonds.

- It later introduced a Funding for Lending Programme (FLP) to lower bank funding costs.

Result: The combined policy package was largely successful in its immediate aims:

✅ Financial market functioning was restored, with bond yields stabilising.

✅ Borrowing costs fell sharply; the average two-year fixed mortgage rate dropped from around 3.5% in early 2020 to below 2.5% in 2021.

✅ Inflation and employment rebounded much faster than anticipated, with unemployment falling to a record low of 3.2% in late 2021 (Stats NZ).

Takeaway: This case study demonstrates the power of an expanded toolkit in a crisis but also reveals the lagged challenges. The ultra-low rates and liquidity contributed to a 40%+ surge in house prices (RBNZ data), exacerbating wealth inequality and financial stability concerns. For strategists, the lesson is clear: central bank actions can have powerful and sometimes unintended cross-market effects. Monitoring the RBNZ now requires understanding the interplay between its monetary tools and its macroprudential (financial stability) levers.

Historical Evolution: From Financial Repression to Independent Inflation Targeter

Understanding the RBNZ's current posture is impossible without context. Its history is a movement from a controlled, subordinate institution to a globally influential, independent authority.

Prior to 1989, the RBNZ was not independent. Monetary policy was often subordinated to the government's fiscal needs, a practice known as financial repression. This contributed to the high and volatile inflation that plagued New Zealand in the 1970s and 80s, peaking at over 17% in 1980. The landmark Reserve Bank of New Zealand Act 1989 was a revolutionary change. It granted the Bank operational independence to pursue an inflation target set through a Policy Targets Agreement (PTA) with the Minister of Finance. This model of transparent, goal-dependent independence was exported worldwide.

The subsequent three decades were defined by the "Great Moderation"—a period of stable growth and low inflation. However, the 2008 GFC and the 2020 pandemic were seismic events that forced evolution. The Bank's role expanded into financial stability supervision, and its toolkit grew, as discussed. Today, it stands at another inflection point, grappling with the post-pandemic inflation surge and reviewing its monetary policy remit. Based on my work with NZ SMEs, this historical perspective is crucial. Many business owners who lived through the high-inflation era maintain a deeply ingrained inflation vigilance, which colours their interpretation of current RBNZ policy and their own long-term pricing strategies.

Common Myths and Strategic Misconceptions

Several persistent myths can cloud strategic analysis of the RBNZ's role.

- Myth: The RBNZ sets mortgage and deposit rates directly. Reality: It sets the OCR, which is the wholesale interest rate for overnight borrowing between banks. Retail banks then set their own rates based on the OCR, their funding costs (including international markets), competitive pressures, and risk margins. The link is strong but not absolute.

- Myth: The RBNZ's primary goal is to ensure a low NZD to help exporters. Reality: While the exchange rate is a key transmission channel, the RBNZ does not target a specific level. Its focus is on inflation and employment. A lower OCR may weaken the NZD, but that is a side effect, not the objective. The Treasury's 2021 Long-Term Fiscal Statement highlights that long-term export competitiveness depends more on productivity than transient exchange rate moves.

- Myth: Central bank independence means the RBNZ is completely free from government influence. Reality: Independence is operational, not goal-setting. The government sets the high-level policy targets (via the PTA and Remit) and appoints the Governor and Board. The Bank must also regularly explain its decisions to Parliament and the public, creating a system of constrained independence with democratic accountability.

The Future of the RBNZ: Climate, Digital Currency, and a New Policy Framework

The next decade will see the RBNZ's role evolve in response to three transformative trends.

First, climate change is becoming a core consideration. The RBNZ now stress-tests the financial system against climate scenarios and has incorporated climate-related risks into its prudential supervision. It is debating whether and how climate change should factor into its monetary policy decisions, given its long-term impact on economic potential and inflation.

Second, the digital currency revolution is on the horizon. The RBNZ is actively researching Central Bank Digital Currencies (CBDCs). A digital New Zealand dollar could reshape the payments system, financial inclusion, and the very transmission of monetary policy. Having worked with multiple NZ startups in fintech, the potential for a CBDC to enable programmable payments and streamline settlement is a topic of intense strategic planning.

Third, the policy framework itself is under review. The post-pandemic inflation surge has sparked debate about whether the 1-3% inflation target band remains fit for purpose. Some argue for a higher average target, while others suggest incorporating asset prices into the mandate. The outcome of this review will define the RBNZ's core mission for the next generation.

Final Takeaways for the Economic Strategist

- Monitor the Narrative: The RBNZ's published communications—MPS, Financial Stability Reports, and speeches—are as important as the OCR decision itself. The "forward guidance" and assessment of trade-offs between its dual mandates provide critical strategic signals.

- Think in Systems: Do not analyse monetary policy in isolation. Its effects are mediated through the housing market, banking sector health, and global commodity prices. Use tools like the RBNZ's sectoral factor model to understand inflation drivers.

- Plan for Regime Change: The tools and frameworks used in the last decade (QE, FLP) may not be the tools of the next. Scenario planning should include the potential for new instruments, such as a CBDC or more active use of macroprudential policy for cyclical management.

- Engage with the Process: The RBNZ conducts frequent consultations on policy changes. Submitting evidence-based perspectives from your industry is a practical way to inform policy that affects your strategic environment.

People Also Ask (PAA)

How does the RBNZ's policy directly impact a small business in New Zealand? It affects borrowing costs for expansion, influences customer demand through employment and wage channels, and impacts the cost of imported inputs via the exchange rate. A rate hike cycle can cool consumer spending and tighten credit conditions simultaneously.

What is the difference between the RBNZ's monetary policy and financial stability roles? Monetary policy manages aggregate demand (inflation/employment) using tools like the OCR. Financial stability policy safeguards the banking system from systemic risks, using tools like LVR restrictions and capital requirements. The two are increasingly interconnected.

Why has the RBNZ been recording large financial losses recently? These stem from its Large Scale Asset Purchase (LSAP) programme. The RBNZ bought bonds when yields were low; as it sold them or they matured amid higher yields, it realised losses. This is an accounting outcome of its crisis-response measures and does not impair its ability to conduct policy.

Related Search Queries

- RBNZ OCR forecast 2024 2025

- Reserve Bank of New Zealand dual mandate explained

- Impact of RBNZ monetary policy on NZD exchange rate

- RBNZ financial stability report housing market

- History of inflation targeting in New Zealand

- RBNZ climate change strategy

- Digital currency New Zealand RBNZ

- How does the Official Cash Rate work

- RBNZ Policy Targets Agreement current

- New Zealand quantitative easing LSAP programme

For the full context and strategies on How to Understand the Role of the Reserve Bank in Economic Policy – Key Mistakes Kiwis Should Avoid, see our main guide: Why Kiwi Creators Leaving Youtube For Vidude.