Amidst the breathtaking landscapes of New Zealand, a pressing question looms for many aspiring homeowners: Is the New Zealand property market too expensive for first-time buyers? With property prices soaring and affordability seemingly slipping out of reach, the dream of homeownership may feel more like a distant fantasy for many Kiwis. A closer look at the data reveals a complex picture, influenced by both local and global factors, calling for a strategic approach to navigating this challenging market.

The Current State of New Zealand’s Property Market

New Zealand's property market has been a topic of intense discussion, especially following the surge in prices during the pandemic. According to Stats NZ, the average house price has increased by over 25% in the last five years, a figure that has left many first-time buyers scrambling. The Reserve Bank of New Zealand reports that in 2023, the median house price in Auckland alone reached NZD 1.2 million, a significant barrier for new buyers.

Understanding the Demand Surge

The demand for housing in New Zealand has been driven by a combination of low interest rates, population growth, and historically high levels of migration. The government’s recent initiatives to curb foreign investment, although aimed at stabilizing prices, have had mixed results. Local buyers still face stiff competition and limited supply, pushing prices further up.

Are There Hidden Opportunities?

Despite the challenges, opportunities exist for strategic buyers. Regional areas such as Waikato and Otago have shown more moderate price increases, offering potential value for those willing to look beyond the main urban centers. According to property experts, these regions could see increased demand as remote work becomes more accepted, allowing more flexibility in choosing a home location.

Case Study: A Strategic Approach to Home Buying in New Zealand

Consider the story of Emma and Liam, a couple from Wellington who recently purchased their first home. Facing daunting prices in the city, they opted for a strategic approach by investing in a property in the nearby Kapiti Coast. This decision not only allowed them to secure a more affordable home but also provided an opportunity for future capital growth as infrastructure and amenities in the area improve.

Problem: Emma and Liam were priced out of Wellington’s market.

Action: They explored regional areas and leveraged government first-home buyer grants.

Result: They purchased a home 20% below Wellington's median price with significant growth potential.

Takeaway: Regional areas can offer affordability and growth opportunities for first-time buyers.

Data-Driven Analysis: Affordability Challenges

Affordability remains the core issue. The Ministry of Business, Innovation and Employment (MBIE) notes that housing affordability, measured by the house price-to-income ratio, is at an all-time high, making it increasingly difficult for average-income earners to enter the market. A household earning the median income would need over nine years’ worth of total income to afford a typical home, assuming no other expenses.

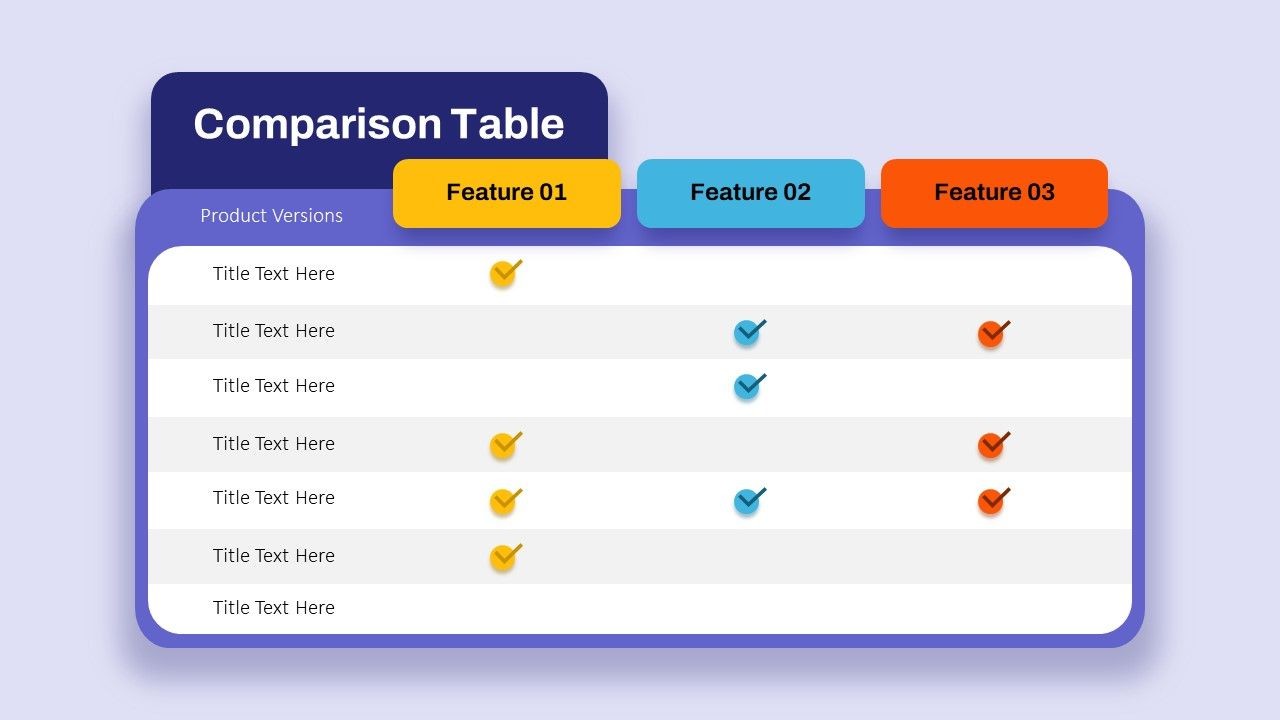

Balancing Costs and Benefits: A Pros vs. Cons Analysis

Pros:

- Potential for Capital Gains: Historical trends suggest that property in New Zealand appreciates over time.

- Government Support: First-home buyer schemes and grants are available to eligible buyers.

- Sense of Ownership: Purchasing a home provides stability and a sense of belonging.

Cons:

- High Entry Costs: Deposits and transaction costs are significant barriers.

- Market Volatility: Economic fluctuations can impact property values.

- Ongoing Maintenance: Owning a home comes with additional responsibilities and costs.

Common Myths & Mistakes in the NZ Property Market

Myth vs. Reality

- Myth: "Property prices always go up." Reality: While long-term growth is likely, short-term fluctuations can lead to price drops.

- Myth: "It's better to buy in the city." Reality: Regional areas can offer more affordable options with growth potential.

- Myth: "You need a 20% deposit to buy a house." Reality: Various loans and government schemes allow for lower deposit requirements.

Costly Mistakes to Avoid

Many first-time buyers make the mistake of not researching thoroughly before purchasing. According to a 2024 study by the NZ Property Investors’ Federation, 67% of first-time buyers regretted their purchase due to unforeseen costs.

Solution: Utilize resources such as Sorted.org.nz for budgeting tools and seek advice from certified financial advisors to ensure informed decision-making.

Future Trends & Predictions in the New Zealand Property Market

Looking ahead, the property market in New Zealand could see significant changes. As per a Deloitte report, AI and digital real estate platforms are predicted to streamline the buying process, making it more accessible to first-time buyers. Moreover, sustainable housing solutions are expected to gain traction, aligning with New Zealand's environmental goals.

By 2028, it is anticipated that 40% of property transactions will be conducted online, reducing costs and increasing transparency for buyers. This shift could be a game-changer for new entrants to the market.

Final Takeaways & Actionable Insights

- While the market presents challenges, strategic regional investments can offer affordability and growth.

- Utilize government grants and schemes to ease financial burdens.

- Stay informed about market trends and leverage digital tools for purchasing.

As the New Zealand property market evolves, first-time buyers must remain adaptable and informed. Whether it’s exploring regional opportunities or leveraging digital innovations, the key lies in strategic planning and execution.

Conclusion

The New Zealand property market, while challenging, is not insurmountable. With the right approach and informed choices, first-time buyers can navigate this complex landscape successfully. Ready to explore your options? Dive into the resources available and start your journey towards homeownership today!

People Also Ask (FAQ)

- How does the property market impact first-time buyers in New Zealand? The high property prices create affordability challenges, but government schemes can assist first-time buyers in entering the market.

- What are the biggest misconceptions about buying property in New Zealand? One common myth is that you need a 20% deposit, but various loans and grants offer lower deposit options.

- What are the best strategies for buying property as a first-time buyer? Experts recommend researching regional markets and leveraging government grants for affordability.

- What upcoming changes could affect the New Zealand property market? By 2028, online transactions will likely dominate, offering more transparency and lower costs.

- Who benefits the most from the current property market in New Zealand? Strategic buyers who explore regional markets and use digital tools stand to benefit most in today’s market.

Related Search Queries

- First-time home buyer grants NZ

- New Zealand property market trends

- Best places to buy property in NZ

- Regional property prices in New Zealand

- NZ housing affordability 2024

- Government schemes for first-time buyers NZ

- How to buy a house in New Zealand

- Property investment strategies NZ

- New Zealand house price forecast

- Impact of interest rates on NZ property market