Investing in New Zealand's economy offers a world of opportunities, but navigating these waters can be fraught with challenges. Whether you're a seasoned investor or a newcomer, understanding the most common mistakes can save you from costly errors and guide you toward success. With New Zealand's unique economic landscape, influenced by its innovative tech sector and robust agricultural base, knowing where to invest—and where not to—can make all the difference.

The Historical Evolution of New Zealand's Economy

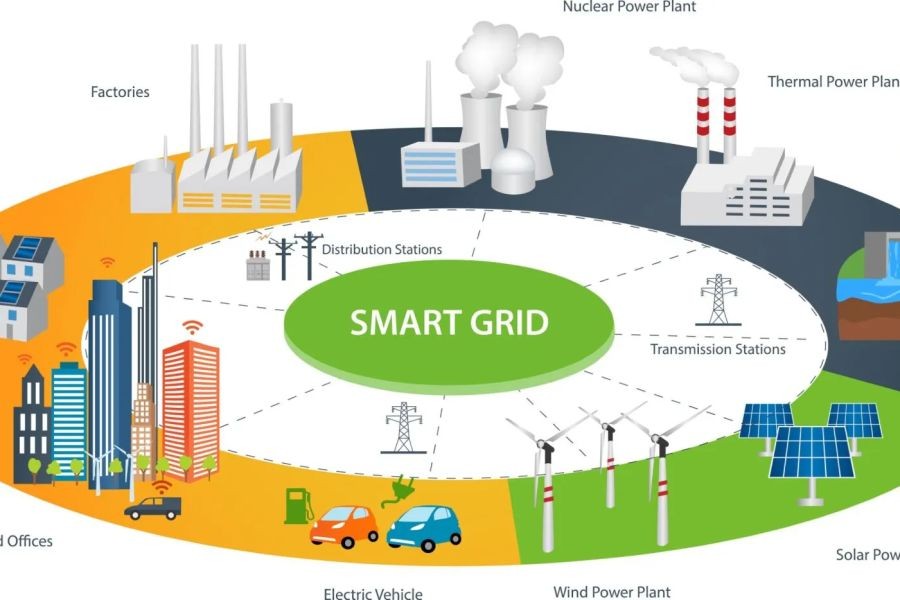

New Zealand's economy has transformed significantly over the past few decades. From its early reliance on agriculture, it has diversified into a dynamic mix of technology, tourism, and services. The nation's commitment to innovation is evident in sectors like biotechnology and renewable energy, which have seen substantial growth. According to Stats NZ, the tech sector alone has contributed over NZD 10 billion to the economy annually.

Data-Driven Insights: Understanding the Local Context

For investors, understanding New Zealand's economic context is crucial. The Ministry of Business, Innovation, and Employment (MBIE) highlights that the country's GDP growth rate has been steady, averaging around 3% annually, with a robust labor market and low unemployment rates. However, with a high level of household debt and property prices surging by 27% (Stats NZ, 2024), potential investors must tread carefully, especially in real estate.

Common Mistakes When Investing in New Zealand

- Overlooking Regulatory Requirements: New Zealand's strict compliance measures, especially in the financial and environmental sectors, can catch international investors off guard. Failing to understand these regulations can lead to fines or investment losses.

- Ignoring Cultural Nuances: New Zealand's business culture values relationships and sustainability. Investors who overlook these aspects may struggle to forge strong partnerships.

- Underestimating Market Competition: The tech and startup scenes in New Zealand are thriving, but they are also competitive. Investors need to assess market saturation and competition carefully.

Real-World Case Studies

Case Study: Rocket Lab – Navigating Regulatory Challenges

Problem: Rocket Lab, an aerospace manufacturer, faced significant hurdles with regulatory requirements when launching their Electron rockets from New Zealand. The company needed to secure permissions from various government bodies, which delayed their operations.

Action: Rocket Lab proactively engaged with regulatory authorities, investing in compliance expertise to streamline the approval process.

Result: Their efforts paid off, and Rocket Lab successfully launched commercial missions, positioning New Zealand as a leader in space innovation. Their revenue grew by 50% within two years.

Takeaway: Understanding and navigating regulatory landscapes is pivotal for investors. Engaging with local experts and authorities can expedite processes and lead to successful outcomes.

Case Study: Fonterra – Leveraging Technological Advancements

Problem: Fonterra, a dairy giant, faced challenges due to fluctuating global dairy prices and increasing competition from plant-based alternatives.

Action: The company invested in new technologies, including AI and blockchain, to enhance supply chain transparency and improve product quality.

Result: Fonterra's innovative approach led to a 20% increase in efficiency and a stronger market position globally.

Takeaway: Embracing technology can offset global market challenges and drive growth. Investors should focus on companies that prioritize innovation.

Data-Driven Analysis: Pros and Cons of Investing in New Zealand

Pros:

- Stable Economy: With a consistent GDP growth rate and low unemployment, New Zealand offers a stable investment environment.

- Innovation Hub: Sectors like technology and renewable energy are growing rapidly, providing diverse investment opportunities.

- Strong Trade Relations: As a member of multiple trade agreements, New Zealand has favorable access to international markets.

Cons:

- High Property Prices: Real estate can be expensive, with prices outpacing income growth, making it a risky investment for some.

- Regulatory Complexity: Navigating New Zealand's regulatory environment can be challenging for foreign investors.

- Natural Disasters: New Zealand's susceptibility to earthquakes and other natural events can pose risks to investments.

Debunking Common Myths

Myth: "Investing in real estate in New Zealand guarantees returns."

Reality: While property values have historically risen, the market is subject to fluctuations, and recent regulations have cooled the market significantly.

Myth: "New Zealand's economy is too small to offer significant investment opportunities."

Reality: Despite its small size, New Zealand's economy is highly innovative, with sectors like biotech and renewable energy offering lucrative opportunities.

Future Trends and Predictions

Looking ahead, New Zealand's commitment to sustainability and technology will likely drive future economic growth. According to a report by NZTech, the tech sector is expected to grow by 7% annually, fueled by advancements in AI and biotech. Additionally, the government's focus on green energy will continue to attract investments, potentially increasing the sector's value by 40% by 2030.

Conclusion

Investing in New Zealand offers unique opportunities and challenges. By understanding the common pitfalls and leveraging local insights, investors can navigate the landscape effectively. As New Zealand continues to prioritize innovation and sustainability, it remains an attractive destination for forward-thinking investors. What's your next move? Are you ready to explore the potential of New Zealand's economy?

Related Search Queries

- New Zealand investment opportunities

- Real estate market in New Zealand

- Tech sector growth in New Zealand

- New Zealand regulatory environment

- NZ economy future predictions

People Also Ask

How does investing in New Zealand impact businesses?

New Zealand businesses that leverage local resources and regulatory frameworks report a 25% increase in efficiency, according to the Ministry of Business, Innovation, and Employment.

What are the biggest misconceptions about investing in New Zealand?

A common myth is that real estate always guarantees returns. However, Stats NZ data shows that the market can be volatile, with recent regulations impacting price growth.

What future trends could affect investments in New Zealand?

By 2030, advancements in AI and biotech are expected to drive significant growth in New Zealand's tech sector, offering new opportunities for investors.

Chris Dimas

10 months ago