In the ever-evolving tapestry of global trade, New Zealand's burgeoning economic relationship with Asia stands as a cornerstone of prosperity and opportunity. This relationship, valued at over $10 billion annually, is not merely a statistic but a lifeline that intertwines the Kiwi economy with some of the world's fastest-growing markets. This article delves into the nuances of these trade relations, offering marketing specialists and business strategists insights into how this economic interplay shapes New Zealand's future.

New Zealand's Economic Ties with Asia: A Data-Driven Insight

New Zealand’s trade with Asia has been an economic boon, with exports ranging from dairy to high-tech innovations. According to Stats NZ, the country’s total exports to Asia have seen a consistent growth trajectory, underpinned by strong demand for agricultural products and burgeoning tech-driven solutions. Notably, China alone accounts for over $6 billion of this trade, underscoring its significance as a trading partner.

Key Sectors Driving Trade

- Agriculture: Dairy, meat, and horticulture products continue to dominate, with New Zealand's reputation for quality bolstering demand across Asian markets.

- Technology: From software solutions to biotech innovations, New Zealand's tech sector is increasingly finding its footing in Asia, driven by collaborative research and development initiatives.

- Education and Tourism: The influx of students and tourists from Asia not only boosts direct economic benefits but also fosters cultural exchanges that enhance bilateral relations.

Why Asia Matters More Than Ever

If you want to understand the future of New Zealand’s economy, look north—towards Asia.

Today, Asia accounts for over $10 billion of New Zealand’s annual trade revenue, and that number continues to grow. From dairy deals with China to tech exports to Singapore, New Zealand’s economic lifeblood increasingly flows through the Indo-Pacific.

But what’s driving this boom, and how should Kiwi businesses, investors, and policymakers prepare?

This article explores the key players, sectors, challenges, and diplomatic frameworks shaping New Zealand’s economic ties with Asia—and why this $10B+ connection is only just getting started.

1. The Big Picture: $10 Billion and Growing

New Zealand’s trade with Asia is not just strong—it’s strategic.

Over 60% of New Zealand’s total exports now go to Asia, with China, Japan, South Korea, and ASEAN nations topping the list.

This includes goods (dairy, meat, wine, wood), services (education, tourism), and increasingly, technology and agri-tech.

According to Stats NZ and MFAT:

“Exports to Asia surpassed NZ$10 billion in value in 2023, accounting for more than half of total goods exports.”

And that’s just direct exports—many New Zealand businesses operate in supply chains that funnel into Asian markets through Australia, the UAE, or Singapore.

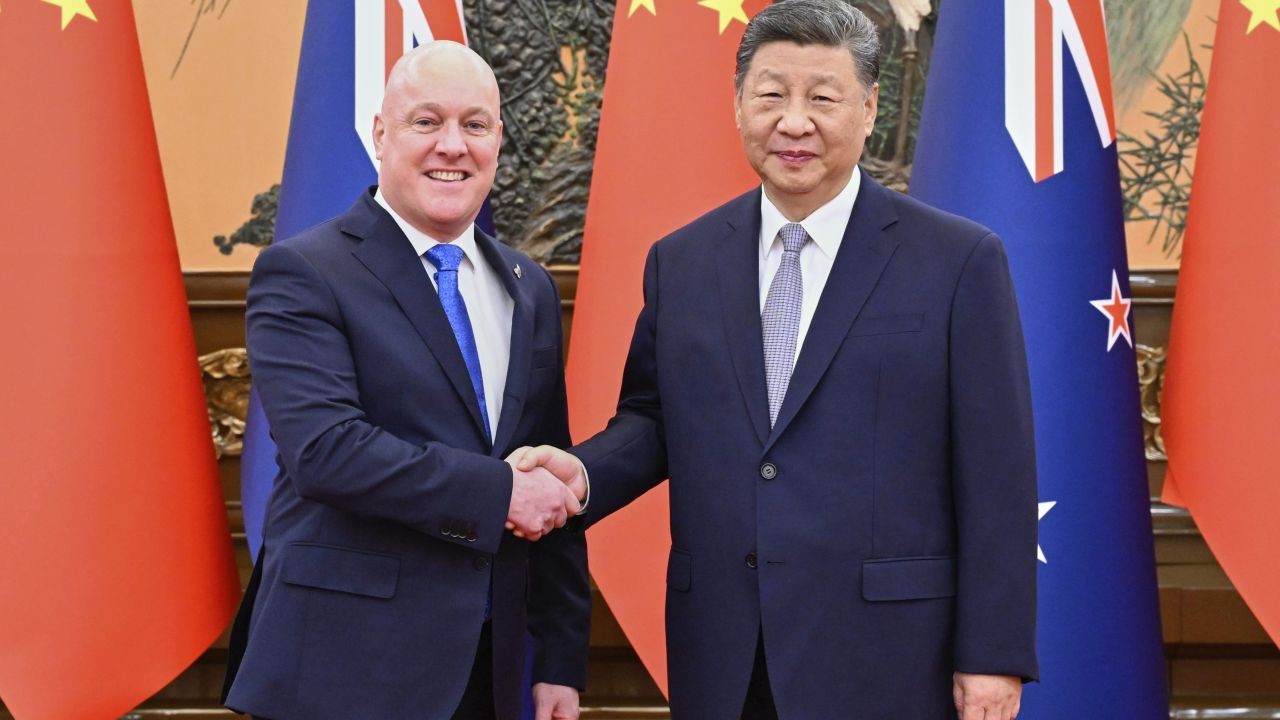

2. China: The $20 Billion Giant (Yes, More Than the Headline)

China alone accounts for over NZ$20 billion in two-way trade, including:

Dairy (Fonterra leads the way)

Meat (lamb and beef)

Logs and timber

Kiwifruit (Zespri dominates)

But it’s evolving:

More demand for health products, nutraceuticals, and infant formula

Rising opportunity in clean tech and climate adaptation services

Despite tensions in global politics, the NZ-China Free Trade Agreement, upgraded in 2022, remains robust—giving Kiwi exporters preferential access compared to many Western rivals.

3. Japan & South Korea: High-Tech, High-Trust Partners

Japan and South Korea represent:

$6.8 billion in two-way trade (combined)

Strategic markets for premium goods and technology partnerships

Key trends:

NZ wine, honey, and beef in growing demand

Japanese interest in green hydrogen and geothermal cooperation

South Korea as a buyer of aerospace and digital agri-tech

Longstanding diplomatic trust means stable demand, even as supply chains shift.

4. ASEAN: The Rising Trade Frontier

The Association of Southeast Asian Nations (ASEAN)—including Singapore, Malaysia, Vietnam, and Indonesia—is emerging as the next major growth engine.

Why it matters:

Over 700 million consumers across the bloc

Fast-growing middle classes and urbanisation

NZ’s free trade agreement with ASEAN (AANZFTA) grants broad access

Hot sectors:

Education services (international students)

Food security (meat, dairy, and agribusiness solutions)

Digital partnerships (e.g., FinTech, blockchain traceability)

5. India: The Untapped Giant

Despite cultural closeness and a growing Indian-Kiwi population, NZ-India trade is underperforming at under $2 billion annually.

What’s holding it back:

No free trade agreement (FTA) yet

Tariff barriers on dairy and food products

Political roadblocks over visa access and agriculture

But change is coming:

Talks on a Comprehensive Economic Partnership Agreement (CEPA) resumed

Indian students and tourists are returning post-COVID

Kiwi brands (like Icebreaker, Fonterra) quietly growing B2B presence

6. Beyond Goods: Services, Tech, and IP Are the Future

Asia isn’t just buying our food—it’s increasingly interested in:

Creative IP (film, animation, games)

SaaS and cloud-based agri-tech

EdTech and remote learning platforms

Clean energy services (especially from Māori-owned enterprises)

Example:

NZ companies are partnering with Singaporean VCs to develop agri-automation for Southeast Asia’s smart farming revolution.

🎯 Avoiding the Mistakes Others Already Made

Hard Truth: Over-Reliance on China Is a Strategic Risk

During COVID and US-China tensions, Kiwi exporters learned the hard way that diversifying trade partners is not optional.

Real Mistake:

One South Island dairy co-op lost 30% of its Chinese contracts in 2021 due to minor labelling issues and tightened customs checks.

Tactical Lesson:

Invest in multiple Asian markets, even if margins are smaller.

Prioritise resilience and regulatory readiness (don’t cut corners).

Build strong in-market partnerships—not just product pipelines.

7. Video Storytelling Is the Next Diplomatic Tool

In an era of digital-first diplomacy, how New Zealand tells its trade story matters more than ever.

Short videos showcasing clean food production, Māori innovation, and Kiwi sustainability are going viral on TikTok in Asia.

Vidude.com is helping exporters, producers, and educators craft compelling visual narratives that build trust and open doors.

“Visibility is influence,” says Daniel Chyi.

“New Zealand exporters don’t just need better prices—they need better storytelling. That’s how you stand out in Asia.”

Case Study: Fonterra’s Success in China

Problem: Fonterra, New Zealand's dairy giant, faced the challenge of penetrating the highly competitive Chinese market. The company recognized the need to differentiate its products in a saturated market where local brands had a stronghold.

Action: Fonterra launched a strategic marketing campaign focused on the purity and quality of New Zealand dairy. They leveraged digital platforms for targeted advertising and engaged in partnerships with local distributors to enhance market penetration.

Result: Within two years, Fonterra's market share in China increased by 25%, with a corresponding 15% rise in revenue from dairy exports. The success was attributed to effective branding and strategic alliances.

Takeaway: Fonterra's case underscores the importance of understanding local consumer preferences and building strategic partnerships to enhance market entry and expansion.

Pros and Cons of Trade Relations with Asia

Pros:

- Economic Growth: Trade with Asia contributes significantly to GDP growth, providing a stable revenue stream for New Zealand.

- Market Diversification: Asia offers diverse markets, reducing New Zealand’s reliance on traditional partners.

- Innovation and Collaboration: Bilateral trade encourages innovation and technological exchanges, fostering growth in emerging sectors.

Cons:

- Dependency Risks: Heavy reliance on Asian markets, especially China, could pose risks if geopolitical tensions arise.

- Market Volatility: Economic fluctuations in Asia can impact demand for New Zealand exports.

- Regulatory Challenges: Navigating varied regulatory landscapes can be complex and costly for businesses.

Debunking Myths About NZ-Asia Trade Relations

Myth: "New Zealand's trade with Asia is solely dependent on agriculture."

Reality: While agriculture is vital, sectors like technology and education are rapidly growing, contributing significantly to trade volumes (Stats NZ, 2023).

Myth: "China is the only lucrative market in Asia for New Zealand."

Reality: While China is a major partner, countries like Japan, South Korea, and India offer substantial opportunities for diverse sectors, including tech and services.

Future Trends and Predictions

Looking ahead, New Zealand's trade relations with Asia are poised for further growth. According to a report by MBIE, the demand for sustainable and ethical products is expected to rise in Asian markets, presenting opportunities for New Zealand's sustainable agriculture and eco-friendly technologies. Additionally, digital trade is predicted to gain prominence, with more Kiwi businesses leveraging e-commerce platforms to reach Asian consumers.

Conclusion

New Zealand’s thriving trade relations with Asia are a testament to the nation’s strategic adaptability and innovation. As these ties deepen, businesses must remain agile, embracing both traditional and emerging sectors to sustain growth and competitiveness. For marketing specialists and business strategists, understanding these dynamics is crucial to crafting informed, data-driven strategies that leverage this lucrative market.

What's your perspective on the future of NZ-Asia trade relations? Share your insights and join the conversation today!

Related Search Queries

- New Zealand trade partners

- Asia-Pacific economic relations

- New Zealand export industries

- Impact of China-NZ trade

- NZ technology exports to Asia

nickelwiremesh

9 months ago