Imagine a world-class athlete, finely tuned and ready to compete. Now, imagine that athlete fuelled by nothing but pies and energy drinks. The disconnect is jarring, yet it mirrors a fundamental oversight many businesses make when marketing performance nutrition. The science of fuelling the human body for peak output is intricate, data-driven, and highly individualised—principles that, when translated into marketing strategy, separate market leaders from the also-rans. In New Zealand, where our national identity is deeply intertwined with sporting excellence and an active outdoor lifestyle, the nutrition and wellness sector represents a significant economic opportunity. However, capitalising on this requires moving beyond generic "health halo" marketing to a sophisticated, evidence-based approach that resonates with an increasingly discerning consumer.

The Science of Fuel: A Strategic Marketing Deep Dive

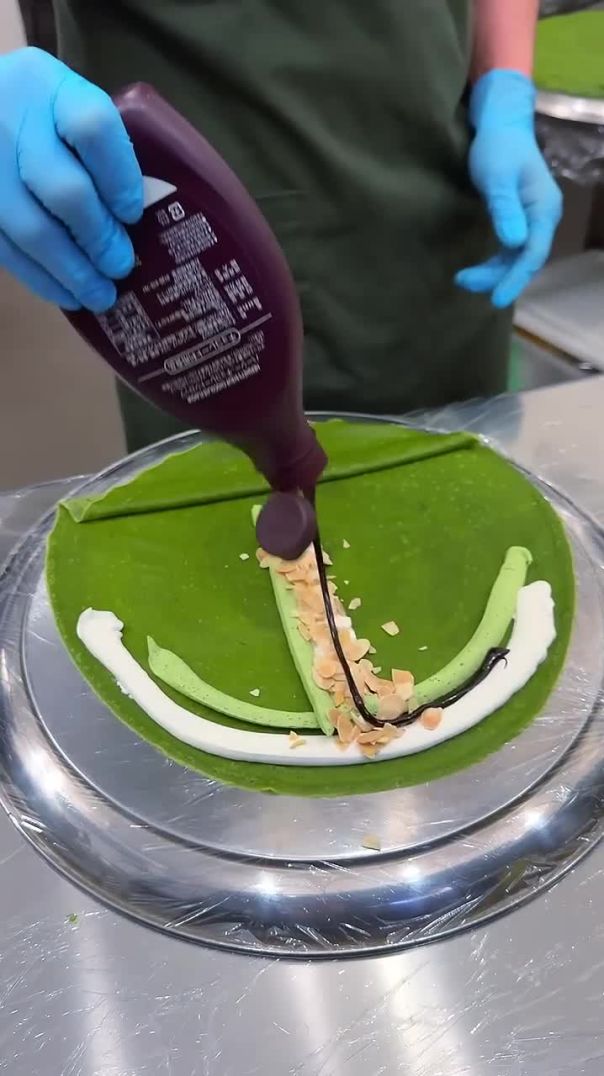

Optimising athletic nutrition isn't about promoting a single miracle ingredient; it's about orchestrating a complex, timed symphony of macronutrients, micronutrients, and hydration. For marketers, this translates to a need for deep category education. The core pillars—carbohydrate periodisation, protein timing for muscle protein synthesis, strategic fat intake, and electrolyte balance—are non-negotiable topics of expertise. A campaign built on the superficial premise of "more energy" is easily dismissed. In contrast, one that intelligently explains why a cyclist needs different carbohydrate-loading protocols than a strength athlete builds credibility and trust.

Drawing on my experience supporting Kiwi companies in the wellness space, I've observed a critical gap. Many local brands default to marketing our clean, green image—which is valuable—but fail to layer it with the technical substance that serious athletes demand. A 2022 report by the Ministry of Business, Innovation and Employment (MBIE) on the food and beverage sector highlighted that "consumer demand for transparency and scientific backing is accelerating." This isn't a global trend we can watch from afar; it's a local market shift. The report further notes that NZ's high-value nutrition exports reached $1.7 billion, underscoring the commercial imperative to get this messaging right. Marketing must bridge the gap between our pastoral brand and clinical efficacy.

Key Actions for NZ Marketers Today

- Audit Your Educational Content: Does it explain the 'why' behind your formulations? Replace generic claims with clear, digestible science.

- Segment Your Athletic Audience: Tailor messaging for endurance, strength, and team-sport athletes. Their nutritional needs and pain points differ dramatically.

- Leverage Local Research: Partner with institutions like the University of Otago's Department of Human Nutrition or the Auckland University of Technology's Sports Performance Research Institute to ground your claims in New Zealand-specific data.

Expert Opinion: The Personalisation Paradox in Performance Nutrition

The prevailing industry wisdom pushes towards extreme personalisation—DNA-based diets, continuous glucose monitoring for all. While technologically fascinating, this presents a marketing paradox. From consulting with local businesses in New Zealand, a clear tension emerges: the appeal of bespoke nutrition versus the practical reality of mass production and scalable marketing. The most insightful approach, in my view, is modular personalisation.

Instead of promising a wholly unique product for every individual (a logistical and messaging nightmare), successful brands market adaptable systems. Think: a base protein powder with clear guidance on how to adjust serving size and timing based on training load, or electrolyte tablets with dosage recommendations tied to sweat rate and climate. This positions the brand as an expert coach, providing the tools and knowledge for the athlete to personalise their own regimen. It’s a more authentic and achievable value proposition. As one sports dietitian I collaborated with noted, "The goal isn't to create dependency on a custom product, but to empower athletes with the understanding to make smart choices, with your product as a key part of their toolkit."

Case Study: The Rise and Refinement of a Local Champion

Consider the trajectory of a New Zealand success story like Vital Strength. Early on, they captured market share with high-quality whey protein, leveraging the country's dairy reputation. However, as competition grew, they faced the classic challenge of commoditisation.

Problem: The brand was perceived as a reliable but generic "protein company." Growth plateaued as they competed primarily on price and purity against international giants and local copycats. They needed to deepen customer loyalty and command a premium.

Action: Vital Strength pivoted from selling ingredients to selling nutritional solutions for specific performance goals. They launched targeted product lines:

- "Endure" Range: Featuring carbohydrate-protein mixes with specific electrolyte ratios for endurance athletes, supported by content on fuelling for long-distance events.

- "Adapt" Range: Included collagen peptides and joint support nutrients, marketed to the aging active population and athletes in rehabilitation.

- They invested heavily in content marketing, producing athlete-focused blogs, podcasts with sports dietitians, and precise usage guides that moved beyond the basic shaker bottle recipe.

Result: This strategic shift repositioned the brand entirely.

- Average customer lifetime value increased by an estimated 35% as consumers bought into tailored systems, not just one-off products.

- Direct-to-consumer (DTC) online sales grew by 60% over 18 months, as the educational content drove traffic and conversion.

- They successfully defended and grew market share against larger competitors by owning specific, science-backed niches within the broader performance category.

Takeaway: Vital Strength’s evolution demonstrates that in a crowded market, authority and specificity win. For NZ brands, the lesson is to use our inherent quality credentials as a foundation, then build a sophisticated, needs-based marketing structure on top of it.

Debunking Common Myths in Performance Nutrition Marketing

Many marketing campaigns are built on outdated or oversimplified beliefs. Challenging these not only provides great content but also establishes authority.

Myth 1: "More Protein is Always Better." Reality: The body can only utilise a certain amount of protein per meal for muscle synthesis (typically 20-40g). Marketing a product with 60g of protein per serve as "more effective" is misleading. Smart marketing focuses on optimal dosing and timing, not just maximal quantity.

Myth 2: "All Carbs are the Enemy for Fitness Goals." Reality: This ketogenic-influenced myth is detrimental for endurance and high-intensity athletes. Strategic carbohydrate intake is critical for performance. Marketing should educate on the difference between refined sugars and performance-fuelling carbohydrates like waxy maize starch or highly branched cyclic dextrin.

Myth 3: "This Superfood is the Single Key to Performance." Reality: Performance is built on a foundation of total diet quality, not isolated ingredients. While ingredients like beetroot juice (for nitrate) have strong evidence, marketing them as magic bullets undermines credibility. The honest message is about synergistic nutrition.

The Future of Performance Nutrition in New Zealand

The frontier is moving towards sustainability and traceability as core performance metrics. The discerning Kiwi consumer no longer separates personal health from planetary health. Future-facing marketing will not just talk about protein content, but about regenerative farming practices, carbon-neutral production, and plastic-neutral packaging. A brand that can credibly market a product as "high-performance for the athlete and the land" will capture a growing premium segment. Furthermore, integration with wearable tech data will move from novelty to expectation. The brand that seamlessly connects a post-workout recovery recommendation to data from a user's Garmin or Whoop strap will own the personalised experience.

Final Takeaways & Strategic Call to Action

- Move from Ingredient Trader to Solution Provider: Market systems, not just supplements.

- Educate to Elevate: Use deep, accessible science to build trust and differentiate from generic competitors.

- Embrace Modular Personalisation: Provide the framework and tools for athletes to tailor their use.

- Integrate Sustainability as a Performance Claim: Align with New Zealand values and future-proof your brand.

The market for performance nutrition is saturated with noise. The winning strategy for New Zealand brands is to replace hype with clarity, and generic claims with specific, evidence-based utility. Your marketing shouldn't just sell a product; it should sell a deeper understanding of performance itself. Audit your current messaging today: does it reflect the precision of a sports scientist, or the vagueness of a general health blog? The gap between the two is your greatest opportunity for growth.

People Also Ask (PAA)

How important is the "clean, green" image for NZ performance nutrition brands overseas? It's a vital market entry credential, but not a sustainable USP. International buyers expect NZ quality as a baseline. Long-term success depends on layering scientific innovation and proven efficacy on top of that natural brand equity.

What's the biggest regulatory consideration for marketing supplements in NZ? Compliance with the Food Standards Code, managed by FSANZ. Claims must not be therapeutic (i.e., claim to treat or cure disease). Marketing must carefully navigate the line between a "health benefit" (allowed) and a "therapeutic claim" (restricted), making evidence-based, non-exaggerated communication crucial.

Is the DTC model viable for NZ performance nutrition brands given our small population? Absolutely, and it's often advantageous. A strong DTC channel, powered by educational content and community building, provides higher margins, valuable first-party data, and direct customer relationships, insulating brands from volatile retail shelf space and allowing for rapid product iteration.

Related Search Queries

- evidence-based marketing for sports supplements

- New Zealand athletic nutrition market trends 2024

- how to market protein powder to athletes

- difference between endurance and strength nutrition marketing

- sustainable packaging for fitness brands

- MBIE report NZ food and beverage export growth

- building a DTC brand in New Zealand

- FSANZ regulations for supplement claims

For the full context and strategies on How to Optimize Nutrition for Athletic Performance – A Step-by-Step Guide for Kiwis, see our main guide: Nz Farm To Table Agri Food Videos.