1 Views· 29 June 2022

The first 1,000 people to use this link or signup with code CASGAINSACADEMY will get a 1 month free trial of Skillshare: https://skl.sh/casgainsacademy02221

We're hiring! Interested in conducting financial research for Casgains Academy? Apply via Upwork here: https://www.upwork.com/jobs/~0137988d0556b8871b

My Second Channel:

https://www.youtube.com/channe....l/UCPkDot_lMk7HB_c68

Twitter: https://twitter.com/casgains

Contact for business inquiries only: casgainsacademy@gmail.com

Chamath Palihapitiya recently expressed several strong opinions about the Russia - Ukraine war. Chamath is a billionaire venture capitalist famous for his early role in Facebook, where he helped bring the platform to grow to nearly 1 billion users by the time he left. He believes the war is different from conventional war and its impact on investors, pension funds, and cryptocurrencies will be immense. This video will go into detail on how this war will drastically affect the economic outlook for investors worldwide.

Economic sanctions are the withdrawal of conventional trade and financial partnerships between two bodies. Sanctions can be broad, such as the long-standing US trade embargo against Cuba, or they can be specific, outlawing transactions with specific businesses, groups, or individuals. This can include trade restrictions, travel bans, asset freezes, and arms embargoes. Since the 9/11 terrorist attacks, targeted sanctions have been used more widely across the world, to minimize the suffering of innocent civilians.

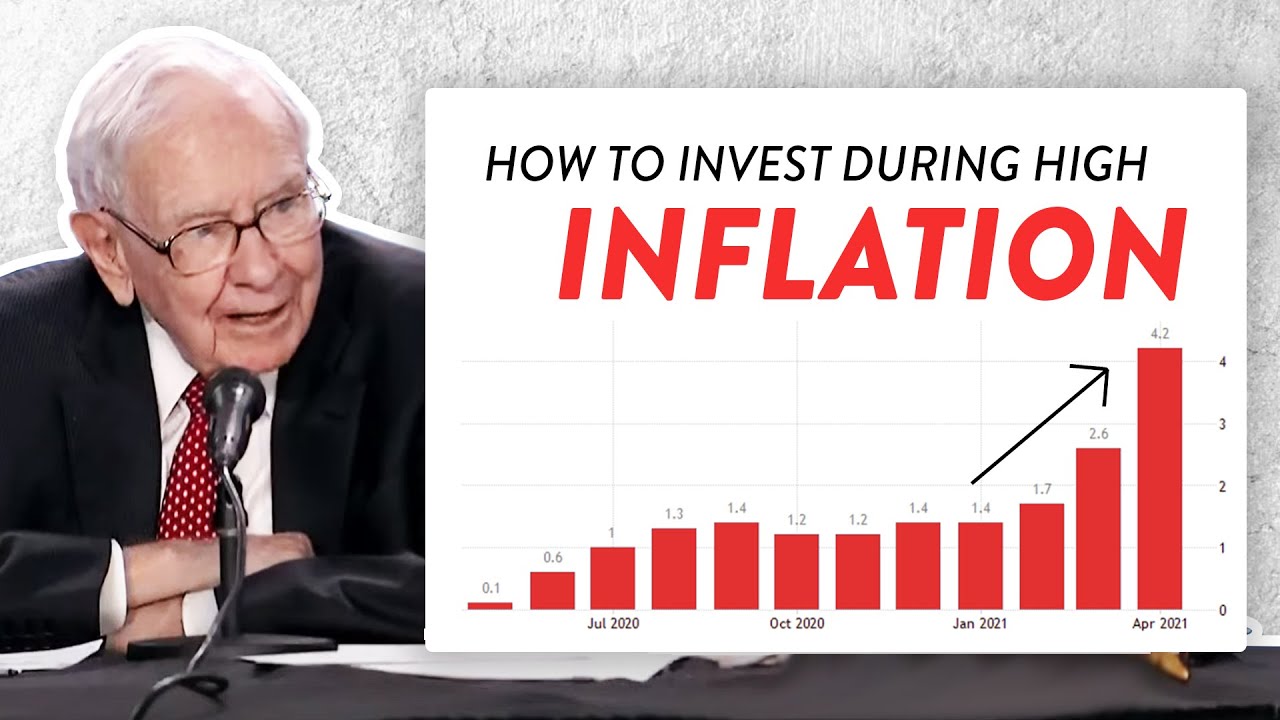

Over the past couple of weeks, the United States unveiled a sanctions package aimed at Russia's Central Bank. The European Union also followed suit. These sanctions will prevent Russia’s central bank from converting 643 billion dollars worth of assets that are held in US dollars and euros into their national currency, rubles. The measure also prevents Russia from accessing the National Wealth Fund, which is its emergency sovereign wealth fund.

Furthermore, the United States and the European Union have announced that all Russian banks except for energy-related ones will be cut off from SWIFT. SWIFT is the largest global network where international payments are initiated. Cutting Russian banks out of SWIFT is one of the most severe economic actions that could be taken. The US and the EU had previously taken a cautious approach to sanction Russia. Trade ties between Russia and the EU made policymakers reluctant to impose stringent measures on Russia. However, in this fast-moving war, it now seems possible for a complete ban on SWIFT transactions for Russian banks to occur.

Due to the severity of the sanctions imposed upon Russia, many are concerned that President Putin doesn't have a way of exiting from the invasion without losing face. This means that he could lash out unpredictably when he feels there are no other options. Because of this, it may be beneficial for the US and its allies to 'off-ramp' which gives a way for Putin to de-escalate the war. This is also known as a detente, which means that the West can come to an agreement with Russia and end the war. But first, the sanctions must be implemented to force Putin to de-escalate the war. In Chamath’s opinion, this would be the desired end game:

Measures to restrict Russia's energy exports are currently not in place, because there are concerns such sanctions would cause the EU economies to crash. As a result, the economic impact of the currently announced sanctions will be minimal outside of Russia and Western companies with exposure to Russia. The conflict's economic impact will be felt most painfully in Ukraine and Russia, both of which will experience severe recessions this year. The EU has and will continue to face energy, supply-chain, and trade shocks.

Another impact is on the already contentious global transition to renewable energy. Tesla's mission statement is to accelerate the world's transition to sustainable energy. However, due to the Ukraine war, Elon Musk felt compelled to tweet on March 5th: “Hate to say it, but we need to increase oil & gas output immediately. Extraordinary times demand extraordinary measures. Obviously this would negatively affect Tesla, but sustainable energy solutions simply cannot react instantaneously to make up for Russia oil & gas exports. Elon explained his thoughts further by saying that “increased oil & gas production in the short term is critical or people around the world will be placed under great duress. This is not a question of money, it is a question of having enough energy to power civilization”.

This is a surprising but logical statement that illustrates how Russia’s invasion will have knock-on effects for the global economy and will dominate the discussion on energy solutions.

![This was the Investment Opportunity of a Lifetime! Flipping to Max Set #17 [OSRS]](https://i.ytimg.com/vi/rY2qkvrd3ZQ/maxresdefault.jpg)

0 Comments