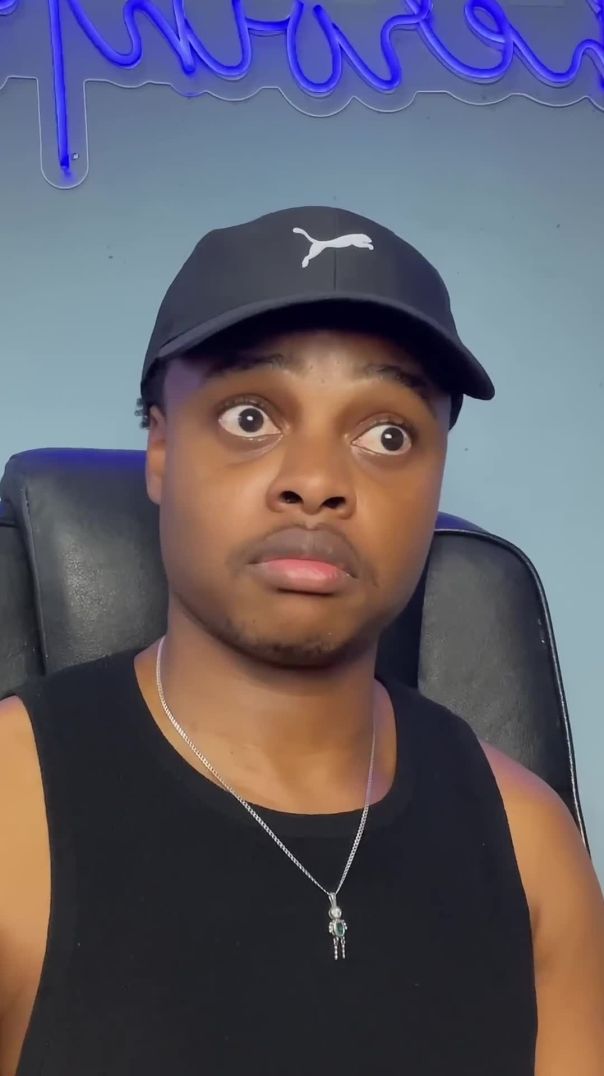

0 Views· 29 June 2022

Cathie Wood Explains Why Ark Invest Keeps Crashing

Interested in seeing my full portfolio with explanations along with buy and sell alerts? Join my research platform here: https://www.patreon.com/casgains

My Second Channel:

https://www.youtube.com/channe....l/UCPkDot_lMk7HB_c68

Twitter: https://twitter.com/casgains

Instagram: https://www.instagram.com/casgainsacademy/

Get up to 5 FREE Stocks by opening a brokerage account with moomoo: https://j.moomoo.com/0098br

Join Interactive Brokers here: https://www.interactivebrokers.com/mkt/?src=casgainsy&url=%2Fen%2Findex.php%3Ff%3D1338

Contact for business inquiries only: casgainsacademy@gmail.com

Ark Invest is experiencing the worst downturn in the company’s history. Ark’s flagship ETF is down roughly 40% in the past year while the S&P 500 is up almost 25%. That’s a frightening gap for Ark investors. The reason for this underperformance ultimately ties down to the macroeconomy. If these factors are not reversed or at least resolved, Ark Invest will continue to crash even more. This video will explain what those factors are and what Cathie Wood herself has to say about Ark Invest’s downturn.

The Federal Reserve has totally failed on all accounts in regards to saving America’s economy. After Fed chair Jerome Powell printed exorbitant sums of money during the pandemic, equities and consumer prices accelerated to all time highs. Now the Federal Reserve is doing the exact opposite of that. The Fed is now quickly retracing its previous decisions and will soon pull out money from the economy. By mid-March, the Fed estimates that it will no longer be purchasing bonds, also known as quantitative easing. Starting from there, the Fed will be reducing its balance sheet by selling bonds and raising interest rates. In simpler terms, the Fed turned on the money printer in 2020 and 2021, but now in 2022, the Fed will be using a vacuum to suck back a significant amount of that money. This will almost certainly negatively impact the economy in the short term, which is already being priced into the current valuations. This is because when the Fed sells bonds, bond yields must increase. Increasing interest rates are problematic for innovative companies because innovative companies need to constantly borrow money to continue growing. Higher interest rates mean that the cost of borrowing is more expensive, which would be detrimental to innovative companies. Bond yields recently increased and investors only expect these yields to increase even more. Because of that, Ark Invest related stocks are continuing to crash week after week. So the question is: when will this turmoil stop so that innovation will rebound? The answer centers around inflation. If the Fed’s retraction leads inflation to quickly decelerate, it’s extremely likely that the Fed will revert back to quantitative easing, which is when the Fed purchases bonds. On the flip side, if inflation continues to accelerate to new highs, the Fed will have to either stick to its existing game plan or be even more aggressive with its retraction. So in simple terms, if inflation cools down, then the money printer will likely turn back on, which would benefit Ark Invest. On the contrary, if inflation heats up, the money vacuum will stay, leading Ark to crash even more. Cathie Wood believes that the first scenario will happen for a variety of reasons, but first I want to address her explanation as to why Ark is crashing so much. Algorithmic traders have been pricing in the second scenario that we talked about, which is that inflation is going to continue to stay at elevated levels. Many investors assume that algorithmic traders make market prices more efficient, but the complete opposite actually happens. During the beginning of the pandemic, algorithmic traders were focused on shorting companies that were burning money and also had a low cash cushion. These algorithms broadly work, but not for certain sectors. For instance, genomics stocks fit those characteristics and were therefore punished heavily. However, any logical human being would know that genomics companies were going to be part of the solution to the pandemic. This led genomics stocks to rally a month after being initially punished.

Now Cathie believes we’re in exactly the same situation but with almost all innovative stocks. Algorithms are punishing stocks that are deemed as riskier and are rotating into value because of inflation fears and rising interest rates. Some of these characteristics include high valuation multiples, miniscule profits, declining revenue growth, and low cash cushions. Two of Ark’s highest conviction stocks that follow these characteristics are Zoom and Teladoc. Both of these stocks are getting absolutely destroyed, as they are both down roughly 70% from their highs. Teladoc is Ark’s second largest position and Zoom is Ark’s fourth largest position. Investors liken these two stocks to tech companies during the dot-com bubble, but Cathie thinks they are totally wrong.

0 Comments